The Gambler's Fallacy

Has anybody applied The Gambler's Fallacy to trading?

Briefly what this says is "The gambler's fallacy is a logical fallacy involving the mistaken belief that past events will affect future events when dealing with random activities..." etc.

The idea is that the dice or roulette wheel does not have a memory. So if red came up 10 times in a row on the roulette table then the chance of it coming up red the next time is not affected by the previous results.

I am interested to know how this applies to trading.

Briefly what this says is "The gambler's fallacy is a logical fallacy involving the mistaken belief that past events will affect future events when dealing with random activities..." etc.

The idea is that the dice or roulette wheel does not have a memory. So if red came up 10 times in a row on the roulette table then the chance of it coming up red the next time is not affected by the previous results.

I am interested to know how this applies to trading.

quote:

Originally posted by elite trader

Okay, here is another probability question:

Suppose you have 3 doors and behind one of those is a hidden treasure.

You pick door A and someone opens door B for you and reveals that there is no treasure behind door B. You are now given a chance to change your selection before the final door opening. Do you stick with your original choice (door A) or do you switch to door C?

What is your decision? And why did you decide that?

the decision is simple you stick to your decision, door A. If your wrong you will know, If your wright you will know the Key word here Is knowing

Why I decided this way? the minute you change your decision you will never stick to any other decision again because you gave yourself permission to do so.

quote:

Originally posted by inventor

the decision is simple you stick to your decision, door A. If your wrong you will know, If your wright you will know the Key word here Is knowing

Why I decided this way? the minute you change your decision you will never stick to any other decision again because you gave yourself permission to do so.

From a mental and psychological point of view I can see and understand your point and think that there is merit in it when applied to the art of trading.

However, in this particular puzzle, as super trader points out, there is more information being introduced to the puzzle later in the game when you are being given the option to change your mind.

Based on probabilities I believe that you would be better off changing your choice of door. Let me try and work through the probability logic and see if I can get it right.

At the first choice you select door A. Each door has the same probability of 1/3 of hiding the treasure. So your probability of selecting the correct door is 1/3. This is easy.

Okay, now let's look at it from a different angle. You do in fact want to select either door B or door C but you cannot decide which one. So what you do is decide to select both of them giving yourself a 2/3 chance of winning them. The way that you do this is to (1) initially select door A, (2) allow one of the other two doors to be opened, (3) switch your choice to the other door.

This way you have given yourself a 2/3 probability of chance of winning.

Just in case someone missed the explanation let me restate it in terms of you wanting to select door A as the winning door. In this situation you would select either door B or C. Let's say you initially select door C. Someone else will open either door A or B allowing you to switch to the other. Again your probability moves up to 2/3 instead of 1/3.

quote:

Originally posted by inventor

the decision is simple you stick to your decision, door A. If your wrong you will know, If your wright you will know the Key word here Is knowing

Why I decided this way? the minute you change your decision you will never stick to any other decision again because you gave yourself permission to do so.

I think that day trading explained this the best that I have ever heard by reversing the logic but I also agree with your approach to sticking to your first choice when the odds have not changed.

Reversing the logic makes this problem much easier to understand. I have not look at it from this angle before. The problem is also usually stated in terms of the Monty Hall Dilemma and behind one door is a car and behind the other two are goats.

Hello .. I am new to this forum. i would like to add some thoughts for trading decisions. Comparing a decision to trade a certain direction is not in the same arena as making a choice to pick a dead object behind a door. The dead one is incapable of change and a trade can always change due to the intelligent forces behind it.

quote:

Originally posted by shenhill

Hello .. I am new to this forum. i would like to add some thoughts for trading decisions. Comparing a decision to trade a certain direction is not in the same arena as making a choice to pick a dead object behind a door. The dead one is incapable of change and a trade can always change due to the intelligent forces behind it.

Hi shenhill,

Welcome to the forum!

I agree with your reasoning but the puzzle with the objects behind the door is indeed one with change in it. In this puzzle it is not the dead objects behind the door that we need to focus on but the new information that has been introduced into the puzzle.

So when we are trading we are always getting new information and we need to analyze and assess that information and that new information will influence our trading decision. You are 100% correct about that.

In this puzzle though, just like in trading, we have new information introduced when one of the doors is opened and we discover that there is no prize behind it.

At the beginning of the puzzle we do not know what is behind any of the 3 doors.

At stage 2 in the puzzle we know what is behind 1 of the doors so we have new information which should influence our decision just like in trading.

Daytrader thanks .. My statements were a setup up to probe for a response. Strong forces in the market will probe for a response and set you up with a choice.

Which choice they want you to take or what you should take you will never know. Then they may change their mind if they do not get the follow thru response they wanted even if you made a good choice..

Unless you are the stronger force you are always behind the cue stick and will be forced in a direction you have to adjust to.

Which choice they want you to take or what you should take you will never know. Then they may change their mind if they do not get the follow thru response they wanted even if you made a good choice..

Unless you are the stronger force you are always behind the cue stick and will be forced in a direction you have to adjust to.

Well not necessarily.

Firstly you will always know the choice that you should have taken after the action is complete - this assumes that you seek to maximize profits and not losses.

Secondly, being behind the cue stick (I have never heard that expression before) is not a bad thing because it allows you to anticipate or go with the stronger force.

Thirdly and finally, there are very few truly strong forces in the market if measured singly. What I mean by this is that the forces that we see in liquid markets is not the result of one individual or organisation moving the market but a collective force of many participants who are oblivious and unaware of each others' intentions.

Firstly you will always know the choice that you should have taken after the action is complete - this assumes that you seek to maximize profits and not losses.

Secondly, being behind the cue stick (I have never heard that expression before) is not a bad thing because it allows you to anticipate or go with the stronger force.

Thirdly and finally, there are very few truly strong forces in the market if measured singly. What I mean by this is that the forces that we see in liquid markets is not the result of one individual or organisation moving the market but a collective force of many participants who are oblivious and unaware of each others' intentions.

On the point of the collective force ,this is the srtonger force I am talking about. There are layers of buyers or sellers in each wealth range and they do get layers of information not prevee to the other layers. This creates a dominio effect as the higher layers react first, then the others follow. But what happens is the lower end seems to ignore the fact they are following and must be more nimble as there view ahead is blocked by those ahead of them.

Likewise the dog wags his tail, the tail does not wag the dog.

Likewise the dog wags his tail, the tail does not wag the dog.

I agree with your (good) description of traders in wealth and information layers. The upper layers will receive time sensitive information first but not always react in the same direction. If you listen to the squawk box in the pit you hear the very large and one would assume intelligent money managers (the likes of Goldmans and Merrill) coming in with large orders on opposite sides.

Take Fed Day as an example. There days when the market trades sideways in the morning (almost all fed days are like this) the rate announcement is made and then the market bounces around on heavey volume but goes nowhere. The upper layers with all the volume and information have been trading against each other.

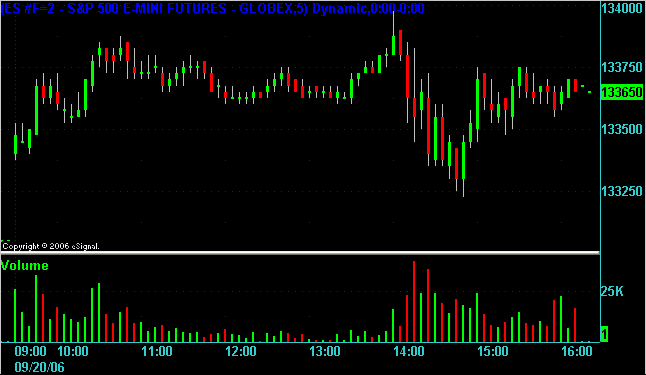

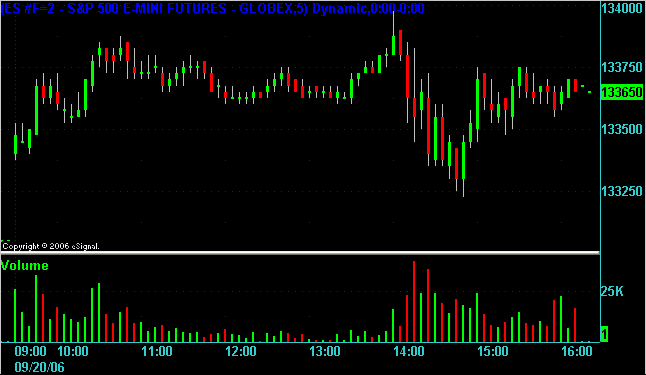

Here is an example of a Fed Day that was like that:

Take Fed Day as an example. There days when the market trades sideways in the morning (almost all fed days are like this) the rate announcement is made and then the market bounces around on heavey volume but goes nowhere. The upper layers with all the volume and information have been trading against each other.

Here is an example of a Fed Day that was like that:

UrbanSound, you and I are saying the same thing. Simply using price bars you cannot predict the next bar. The predictability of future bars is in the patterns. Such patterns include S/R, Fibs and such. It is the formation that gives predictive value because from that you are able to see what other traders are thinking and hoping for.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.