Pitbull Three Strategy

Here is a strategy which I did not originate. Perhaps some of you have seen or heard about various forms of this. It was taught to me by a self proclaimed “old Timer” who I happened to meet about 5-7 years ago in a commodity site chat room. This was before Paltalk and Hotcomm was popular. I present it here mostly as it was taught to me for free. I “watched” him trade this for about 9 months in real time. It was designed for the big S&P contract so I have modified it slightly for the emini. The man who taught this was gruff, sometimes abusive ( especially when the future vendor Kingfish came in the room) but always answered questions…

Originally I thought he was going to turn out like the Army Sargent played by Lou Gosset Jr. in “Officer and a gentleman” but this mentor just disappeared and I never found him again. Perhaps he started his own service and markets this but I haven’t seen it. His idea on stops was the following….”You can either take the loss and try again or trade your way out”. He always tried to trade his way out and would sometimes lose on trend days… as it is a counter – trend strategy……a few other things….he would call in for the official opening range…( it is not the one minute high or low as some think but we can use that for exits)..I am using the opening price on the emini to set the levels . He would trade up to 50 contracts if he needed to so he was at times adding to a “losing trade” as some might say……he always took a 1.5 point profit target…….he didn’t alter this….I’ll think of other things as we go. He also thought that if the rumors where true and the floor traders where moving to screen trading then this strategy would become less effective…….it is only traded in the first hour and he only broke this rule if he was trying to “trade out”…..keep in mind this was designed when volatility was higher and 5 minute bar could have a range of 5 points…unlike today's markets……I think the levels are most important and although I don’t snap them on my own personal charts I have them written down on paper after the opening….He believed that at 10:30 EST you should close your business up and end for the day…unless he was trying to recover... ok enough of the history

ok first we take the opening price and add and subtract the following numbers

The strategy tends to capitalize on the floors ability to push the market in one direction to sucker in the public for it to then only snap back towards the opening range…I have noticed that it works best when the market is pushed to an extreme of either an overnight high or low or the previous days high or low…so we can relate this to an “open-test-reject” as per Market profile concepts……

+- 2.5

+- 4.0

+-5.5

+-8.0

This sets up our WINDOW of trade entry points….For today Friday January 5th I have the opening price at 1424 so the downside numbers would be 1421.50, 1420, 1418.50 and 1416..and here are the rules.

1) If we open and drop down to the minus 2.5 number then rally to the open you buy

2) If we open and drop down to the minus 4 you then buy at the minus 2.5 on the way back up

3) If we drop down to the minus 5.5 you buy the minus 4 number

4) If we drop to the minus 8 you buy the minus 5.5

This is all reversed for the upside.

Anything beyond a plus or minus 8 meant the market was too risky too initiate from down or up from the opening so he avoided it…in general he believed that the further out into the WINDOW you went then the riskier it became…so buying a minus 2.5 after a hit on minus 4 is a safer trade then buying a minus 4 number after a minus 5.5…He didn’t use stops but his target was always 1.5 off the window number ..not your fill price...

You would stop trading if the markets dropped 2.5 points below the opening and then traded 2.5 above the opening…..this would be called a COMPLETED WINDOW RUN and the floor was done doing it’s business…you would be finished also…just one or two good trades a day……for now think about how you can incorporate the Pitbull One and II thread ideas into this……did you see the singles band with the first and second one minute bar today

The Market opens at 1424 and drops down to slightly below the minus 2.5 number at 1421.50…since we didn’t trade back to the opening at 1424 there is no long trade…..The market then drops further and goes to the minus 4 number at 1420 so we are a buyer at 1421.50……which is the minus 2.5…If you use stops then this trade would not have hit 1.5 points of profit and you lose if you are using stops….The market drops further to the minus 5.5 number to the tick at 1418.50..so you are a buyer at the minus 4 which is 1420….this achieves it’s target and rallies up to test the band..see pitbull thread II at the first and second one minute bars…not shown on this chart. ok...this is a lot so I will work on trying to clarify what needs to be clear…the second long was better because we had Tick divergence to support the trade…may seem complicated but it’s not..I’ll highlight the important stuff…..and ask questions...it helps me too to get this stuff in words

Bruce

Originally I thought he was going to turn out like the Army Sargent played by Lou Gosset Jr. in “Officer and a gentleman” but this mentor just disappeared and I never found him again. Perhaps he started his own service and markets this but I haven’t seen it. His idea on stops was the following….”You can either take the loss and try again or trade your way out”. He always tried to trade his way out and would sometimes lose on trend days… as it is a counter – trend strategy……a few other things….he would call in for the official opening range…( it is not the one minute high or low as some think but we can use that for exits)..I am using the opening price on the emini to set the levels . He would trade up to 50 contracts if he needed to so he was at times adding to a “losing trade” as some might say……he always took a 1.5 point profit target…….he didn’t alter this….I’ll think of other things as we go. He also thought that if the rumors where true and the floor traders where moving to screen trading then this strategy would become less effective…….it is only traded in the first hour and he only broke this rule if he was trying to “trade out”…..keep in mind this was designed when volatility was higher and 5 minute bar could have a range of 5 points…unlike today's markets……I think the levels are most important and although I don’t snap them on my own personal charts I have them written down on paper after the opening….He believed that at 10:30 EST you should close your business up and end for the day…unless he was trying to recover... ok enough of the history

ok first we take the opening price and add and subtract the following numbers

The strategy tends to capitalize on the floors ability to push the market in one direction to sucker in the public for it to then only snap back towards the opening range…I have noticed that it works best when the market is pushed to an extreme of either an overnight high or low or the previous days high or low…so we can relate this to an “open-test-reject” as per Market profile concepts……

+- 2.5

+- 4.0

+-5.5

+-8.0

This sets up our WINDOW of trade entry points….For today Friday January 5th I have the opening price at 1424 so the downside numbers would be 1421.50, 1420, 1418.50 and 1416..and here are the rules.

1) If we open and drop down to the minus 2.5 number then rally to the open you buy

2) If we open and drop down to the minus 4 you then buy at the minus 2.5 on the way back up

3) If we drop down to the minus 5.5 you buy the minus 4 number

4) If we drop to the minus 8 you buy the minus 5.5

This is all reversed for the upside.

Anything beyond a plus or minus 8 meant the market was too risky too initiate from down or up from the opening so he avoided it…in general he believed that the further out into the WINDOW you went then the riskier it became…so buying a minus 2.5 after a hit on minus 4 is a safer trade then buying a minus 4 number after a minus 5.5…He didn’t use stops but his target was always 1.5 off the window number ..not your fill price...

You would stop trading if the markets dropped 2.5 points below the opening and then traded 2.5 above the opening…..this would be called a COMPLETED WINDOW RUN and the floor was done doing it’s business…you would be finished also…just one or two good trades a day……for now think about how you can incorporate the Pitbull One and II thread ideas into this……did you see the singles band with the first and second one minute bar today

The Market opens at 1424 and drops down to slightly below the minus 2.5 number at 1421.50…since we didn’t trade back to the opening at 1424 there is no long trade…..The market then drops further and goes to the minus 4 number at 1420 so we are a buyer at 1421.50……which is the minus 2.5…If you use stops then this trade would not have hit 1.5 points of profit and you lose if you are using stops….The market drops further to the minus 5.5 number to the tick at 1418.50..so you are a buyer at the minus 4 which is 1420….this achieves it’s target and rallies up to test the band..see pitbull thread II at the first and second one minute bars…not shown on this chart. ok...this is a lot so I will work on trying to clarify what needs to be clear…the second long was better because we had Tick divergence to support the trade…may seem complicated but it’s not..I’ll highlight the important stuff…..and ask questions...it helps me too to get this stuff in words

Bruce

I'm more concerned with the general levels and not a precise price as I don't trade the original setups too often. I use IB data and just go with the first hash mark on my chart....

Originally the mentor who taught me this would phone into the floor to get the official opening range and add the numbers to the high of that and subtract it from the lows.... we can use the first one minute bar but we still may have data discrepencies...sorry I can't be more help

Originally the mentor who taught me this would phone into the floor to get the official opening range and add the numbers to the high of that and subtract it from the lows.... we can use the first one minute bar but we still may have data discrepencies...sorry I can't be more help

"5 minute bar once we entered the plus 4 - 5.5 zone.......so if price action is your thing that that is a good trade entry....you simply want to see price get below the lows of the highest vertical bars on your chart"

Bruce when you say that in the key zones let the price get below the low of the highest 5 min bar or above the high of the lowest 5 min. bar are we looking for a close above or below or are we looking for a spike or a close which ever occures first.

Bruce when you say that in the key zones let the price get below the low of the highest 5 min bar or above the high of the lowest 5 min. bar are we looking for a close above or below or are we looking for a spike or a close which ever occures first.

just a trade below or above.....it could be any time frame you are comfortable with too....doesn't have to be a 5 minute......lets say you go short below the low of the higest 5 minute bar on your screen, you may want to make sure you get a good close in order to hold the trade.........so in this case you may want to see a close below the low of the previous bar too or else you may want to exit...I'll have to post some charts as my explainations just plain suck sometimes......

What is cool about these entries is that it will take an OVB ( outside vertical bar) on your time frame to stop you out before the close of the bar....more to come

What is cool about these entries is that it will take an OVB ( outside vertical bar) on your time frame to stop you out before the close of the bar....more to come

Thanks Bruce, shall look forward to your post

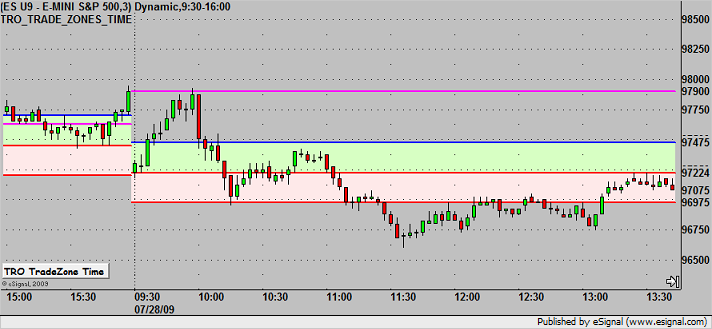

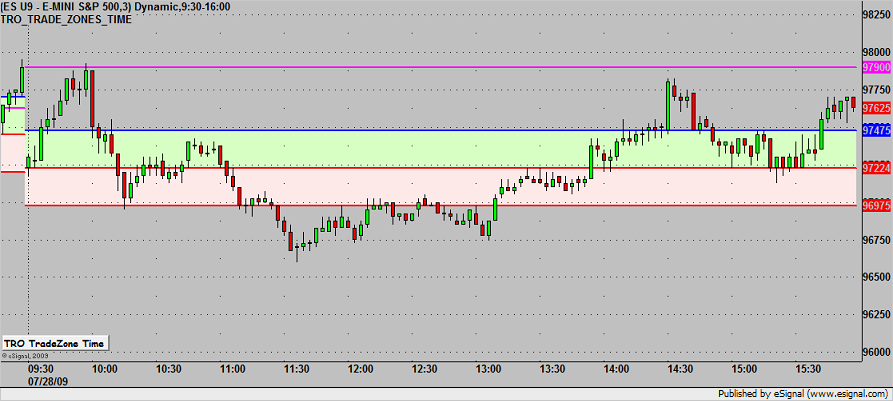

Thank you Bruce for the great post & the generous number of details & info on how & when this setup works the best. "confluence of numbers" for example make a lot of sense when filtering trades. I've been observing this for a few months, & it does work! I found a lil indicator on www.kreslik.com it automatically puts the pink line at the prior days close, the red line is the 9:30 open, the colored range above & below the open are adjustable, this is a 3 min with a 2.5 colored range above & below the 9:30 open. This is by no means an advertisment for TRO who posted here a while back, but putting this study on my Esignal charts helps me with this system & my gap fade system, plus it puts the #s there automatically so there's less math & less to watch at the open. This thread & Joe's mini IB thread are 2 of the best "simple" systems I've ever found that actually work. Thank you Bruce M & Ch Joe

Here's a better chart with the open,prior close, & which ever opening range one prefers, the numbers are right scale & that makes it easier & quicker for me trading the open.

And just when I got used to counting the numbers in my head....lol thanks for the add on staylor

thanks for the feedback....that's nice to have the lines snapped automatically......I've noticed on some days when we see gap trades fail they actually make it back to the settlement price but not the actually closing price...just an FYI..

These days in summer trade I've been using the 5 minute range to target the overnight highs and lows, the previous days highs and lows and the other probabilities..including the pitbull numbers like the plus and minus 4..... also trying to fade at the pitbull numbers...I was getting tired of having to watch the market move until we hit a good zone.............just throwing that out there...combining the 5 minute range with the probabilities and targets is just amazing most days.

As a good example and this is not bragging...On monday we opened lower and I avoided taking the 5 minute sell signals because we had key numbers down in the 73 area and we had a gap above and we were closer to the previous days high and the previous weeks high............both great probabilities to get run out....so I knew to avoid the sells.....

On the flip side of that I had a great long this morning but missed the fade at the plus 5.5 because I was thinking that they would run out yesterdays high first....that's what thinking gets you some days...hopefully this gives some insight into how I'm currently combining the methods... an additional filter which seems to help is the high volume areas from the overnight as support or resistance..I give credit to Dr. Brett for clueing me into that..

I like the automation ..some days there seems to be too many numbers

These days in summer trade I've been using the 5 minute range to target the overnight highs and lows, the previous days highs and lows and the other probabilities..including the pitbull numbers like the plus and minus 4..... also trying to fade at the pitbull numbers...I was getting tired of having to watch the market move until we hit a good zone.............just throwing that out there...combining the 5 minute range with the probabilities and targets is just amazing most days.

As a good example and this is not bragging...On monday we opened lower and I avoided taking the 5 minute sell signals because we had key numbers down in the 73 area and we had a gap above and we were closer to the previous days high and the previous weeks high............both great probabilities to get run out....so I knew to avoid the sells.....

On the flip side of that I had a great long this morning but missed the fade at the plus 5.5 because I was thinking that they would run out yesterdays high first....that's what thinking gets you some days...hopefully this gives some insight into how I'm currently combining the methods... an additional filter which seems to help is the high volume areas from the overnight as support or resistance..I give credit to Dr. Brett for clueing me into that..

I like the automation ..some days there seems to be too many numbers

Is there a time limit to the numbers (2.5,4,5.5,8) being hit?

20mins, 30mins, ?!?!?!

If I missed this nugget of info, I apologize.

Thanks for any help.

piper

20mins, 30mins, ?!?!?!

If I missed this nugget of info, I apologize.

Thanks for any help.

piper

I prefer these lines in the first 90 minutes.....then comes the lunch hour and after that we are more likely to try and trend so fading moves becomes more difficult and not advised

Originally posted by BruceM

big mike...is this one of bitmans ideas u r using on weeklies

http://community.livevol.com/index.php/articles.html/_/options-trading/spx-weekly-credit-spread-strategy-r3205

Yes it is.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.