Your favorite entry bars?

I thought I'd start a thread to share any ideas about specific entry bar techniques that people use. Although I prefer to average in this is one that I like the best. It is not new nor will I take credit for it as Lee Gettes, Haggerty, Kent Calhoun, Joe Ross and others have already done that...

For these entries to work you are looking for a support or resistance zone to be entered ( not discussed here)and then wait for the setup bars.

If you suspect a swing high is forming then you are looking for the following:

1) A down close bar

2) Followed within 5-6 bars an up close bar ( I like the 3 and 5 minute)

3) You enter on the break of the up bars low by one tick.

4) Your initial stop should be one tick above the up bars high.

Think about this: It will take an outside vertical bar to stop you out or a poor close after your entry.

I have a friend who used the 10 minute bars back in 1998 and he knew the probabilities of an outside bar forming on that time frame...just something to think about.

5) At a minimum your target should be at least what you are risking and then get your stop to break even on multiples but that's been written about before. Here is an example of a swing high..

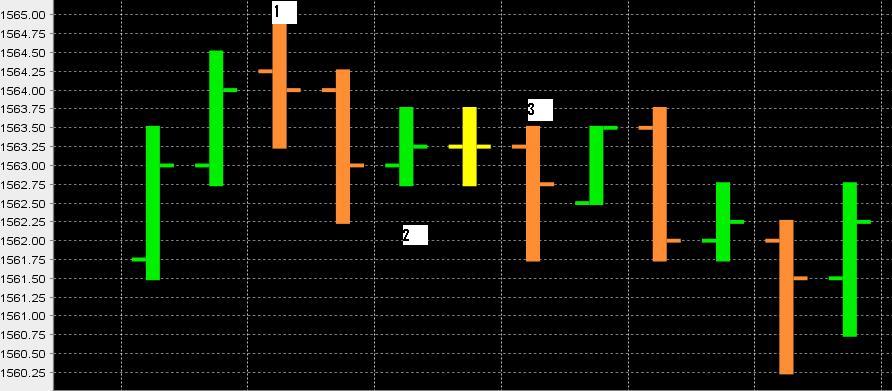

Where just coming off the plus 4 - 5.5 number on a gap up opening..these examples aren't perfect...

Bar labeled one gives us the down close, bar labeled #2 gives us the up close ( also an inside bar), bar #3 is the entry bar..

Here is an example of a swing low setup..you are looking for the following:

1) an up close bar,

2) a down close bar within 5 -6 bars

3) Entry on a break of the Down close bars high by one tick

Bar 1 gives us our up close, bar 2 gives us our down close, we need to wait until the bar labeled # 3 for entry above bar #2's high.

For those who like indicators you will probably find some nice divergent trade and use this as a filter

Hope this is useful....It's kind of like the classic 1-2-3 pattern with some filtering and setup bars defined. Dome will watch retracement levels to coincide with these entries.

Bruce

For these entries to work you are looking for a support or resistance zone to be entered ( not discussed here)and then wait for the setup bars.

If you suspect a swing high is forming then you are looking for the following:

1) A down close bar

2) Followed within 5-6 bars an up close bar ( I like the 3 and 5 minute)

3) You enter on the break of the up bars low by one tick.

4) Your initial stop should be one tick above the up bars high.

Think about this: It will take an outside vertical bar to stop you out or a poor close after your entry.

I have a friend who used the 10 minute bars back in 1998 and he knew the probabilities of an outside bar forming on that time frame...just something to think about.

5) At a minimum your target should be at least what you are risking and then get your stop to break even on multiples but that's been written about before. Here is an example of a swing high..

Where just coming off the plus 4 - 5.5 number on a gap up opening..these examples aren't perfect...

Bar labeled one gives us the down close, bar labeled #2 gives us the up close ( also an inside bar), bar #3 is the entry bar..

Here is an example of a swing low setup..you are looking for the following:

1) an up close bar,

2) a down close bar within 5 -6 bars

3) Entry on a break of the Down close bars high by one tick

Bar 1 gives us our up close, bar 2 gives us our down close, we need to wait until the bar labeled # 3 for entry above bar #2's high.

For those who like indicators you will probably find some nice divergent trade and use this as a filter

Hope this is useful....It's kind of like the classic 1-2-3 pattern with some filtering and setup bars defined. Dome will watch retracement levels to coincide with these entries.

Bruce

Sorry you are confused. These entries need to come at support or resistance points that YOU have determined in advance. If you are expecting a bottom to form you want to see:

1) An impulse up move

2) a retest of the low

3) and then a resumption of the initial impulse move up

these relate to the same steps as numbers 1-3 in the setup...

1) An impulse up move

2) a retest of the low

3) and then a resumption of the initial impulse move up

these relate to the same steps as numbers 1-3 in the setup...

quote:

Originally posted by pakeez

BrucwM

Thanks for your response. Though I am confused at the moment with your clarification, It may take some time for me to understand your logic of the setup.

BruceM,

Thanks, now I understand your pattern concept formation. My brain chip has not been updated to keep with computer chip and hence it is slow in grasping the concept.

Thanks, now I understand your pattern concept formation. My brain chip has not been updated to keep with computer chip and hence it is slow in grasping the concept.

deleted by mod

Hi Bruce,

There is a free trading room www.tradingontherocks.com, this guy uses something similar to what you explain, He only tries to go with the trend, it is really good strategy. Since I start using this technique my trading has improved a lot. Here is the link to the web site; the room is open from 6:30 to 9:00 am Chicago time. Whenever you have a chance look at it.

The room is in Spanish but if you ask something in English the guy will answer in English

http://www.tradingontherock.com/Enlace.php

Roberto

There is a free trading room www.tradingontherocks.com, this guy uses something similar to what you explain, He only tries to go with the trend, it is really good strategy. Since I start using this technique my trading has improved a lot. Here is the link to the web site; the room is open from 6:30 to 9:00 am Chicago time. Whenever you have a chance look at it.

The room is in Spanish but if you ask something in English the guy will answer in English

http://www.tradingontherock.com/Enlace.php

Roberto

Going by this concept 1090.50 will be a good short

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.