Wednesday 12-05-2007

... post em if ya got em

Exited all NQ short for +5.25

another lesson here is counter trend trading we need to use reasonable or realistic profit targets... use smaller size and try to hit singles and doubles, not home runs. This perspective or strategy is based on probability. In a counter-trend trade setup the market is much more likely to continue the trend than reverse it.

seems like this 86 area is the sell zone but I have no signal..interesting when single prints trade back through the area a third .....in case of the ES we had the single prints that originally formed on the upsdide, then we traded back through them all on downside and now we just traded back through them again on upside.....this a cool spot

Very well said PT...you and DT have a flair for putting your ideas into words...I'm like a third grader...lol.... feel free to "clean up" anything I post to make it more "useable" for the average reader...

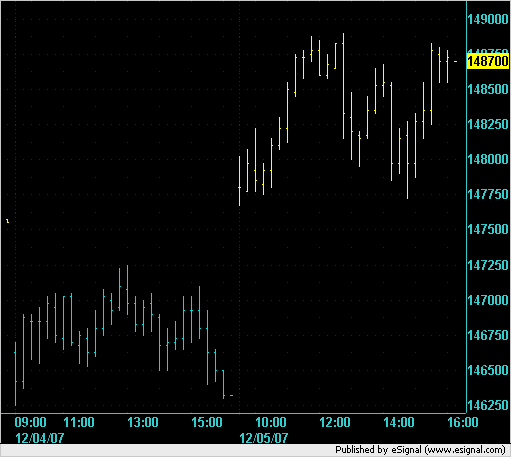

I sure wish I could say I took that 1486 short but just couldn't find a signal....I'll post a chart later as I don't see that concept mentioned too often.....The Dow seemed to be trying to lead that last drive up as the futures where well above the single prints...

I find most will use 1.5 to 2.5 emin S&P points as a filter on those market profile trades...

I think it would be good for any of us to summarize our key trade concepts at the end of the day or whenever so those who are looking to learn something from don't need to scroll throught all the posts..or perhaps they should work for it....

Good trading Pt

I sure wish I could say I took that 1486 short but just couldn't find a signal....I'll post a chart later as I don't see that concept mentioned too often.....The Dow seemed to be trying to lead that last drive up as the futures where well above the single prints...

I find most will use 1.5 to 2.5 emin S&P points as a filter on those market profile trades...

I think it would be good for any of us to summarize our key trade concepts at the end of the day or whenever so those who are looking to learn something from don't need to scroll throught all the posts..or perhaps they should work for it....

Good trading Pt

quote:

Originally posted by pt_emini

another lesson here is counter trend trading we need to use reasonable or realistic profit targets... use smaller size and try to hit singles and doubles, not home runs. This perspective or strategy is based on probability. In a counter-trend trade setup the market is much more likely to continue the trend than reverse it.

thinking the market needs to build a new value area here in this 86 to 77 range

yeah im not really sure the best way to do this... I think just posting trades without much explanation is probably not of much lasting value... posting thoughts or ideas on the fly in an intra-day trading journal style seemed like an idea that might be of benefit... but with just two of us posting we are up to 6 pages... lol

Excellent commentary today gentlemen. All I can say is that I'm very pleased that I wasn't here to try and short that gap as I would have been chewed up and spit out.

thanks DT

yesterday's session was not an easy read, but we figured it out reasonably well along the way. I think this is where the journal idea does help, bouncing ideas around and sharing what we are seeing develop.

the opening trend up ran a little further in price and time than either Bruce or I expected, and it took a couple of tries on both our parts to get onboard the expected price retracement (or reactive phase) back down.

we did one thing right, and that is we kept a reasonable price target for the retracement and exited for a nice profit near price support.

lastly my expectation for a trading range (value area) to form in the afternoon did turn out to be correct.

in my view yesterday is a good example of grinding out some hard earned profits in less than ideal market conditions.

yesterday's session was not an easy read, but we figured it out reasonably well along the way. I think this is where the journal idea does help, bouncing ideas around and sharing what we are seeing develop.

the opening trend up ran a little further in price and time than either Bruce or I expected, and it took a couple of tries on both our parts to get onboard the expected price retracement (or reactive phase) back down.

we did one thing right, and that is we kept a reasonable price target for the retracement and exited for a nice profit near price support.

lastly my expectation for a trading range (value area) to form in the afternoon did turn out to be correct.

in my view yesterday is a good example of grinding out some hard earned profits in less than ideal market conditions.

I agree - you guys did a great job of a difficult situation and turned a profit at the same time.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.