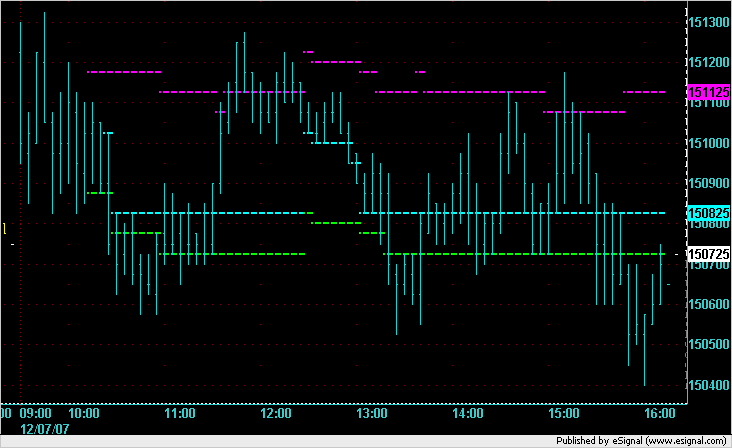

Friday -12-07-2007

Overnight range not taken out yet...sell day in force so far..with prices at 1508 we are close to midpoint ( 1515 to 1501)...seems like the hour breakdown may work today so thoughts are to downside for the 1501 retest ( overnight low)

looks like the market is content to build a value area this morning

The ER and NQ are each forming pretty tight triangles, a breakout of which might trigger some activity.

The ER and NQ are each forming pretty tight triangles, a breakout of which might trigger some activity.

my concern is that 1505 as once it gets broken they like to test it and so far it seems market is holding above...I'm short from 1508.25..with the 1505 as first target,.....

for the sake of your short position I hope the market chooses to break these triangles to the downside.

it might be interesting if the triangle breaks to the downside first and then reverses sharply higher off support and the market makes a run for the highs.... just speculation at this point until the volume picks up the pace.

it might be interesting if the triangle breaks to the downside first and then reverses sharply higher off support and the market makes a run for the highs.... just speculation at this point until the volume picks up the pace.

thanks DT..triples sit now at 1507 on downside so that will keep my bias...we get into the 1511 area and I may need to bail and re-enter after noon time pop up...if it happens

Took a long in the ER2 here on this initial push up

adding in at 1510.75..now 07.50 needs to be first target..obviously new highs will be a concern

scalped out for a +1.20

market stalling at resistance...might see a reversal if sellers step in here

new highs in Dow but not S&P...this is where one can start justifying a position which can be a big mistake...

for a reversal we will need to see a lower high on the next attempt to the upside ($tick > 500)

my guess is they will sweep resistance and flush any buy stops sitting up there first however

my guess is they will sweep resistance and flush any buy stops sitting up there first however

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.