Thursday 12-13-07

Thoughts go towards the Monday Tuesday range possible break to downside...down in 68 area as per December futures....overnight low at 71 so far...would prefer lower trade first to get long once real time market opens...not looking to sell a break of Mon- tueday range as that may be a trap.. 86 - 87 area critical in ESZ7 on upside....buying a break of hour lows will be a possible long entry...

summary : got my long goggles on this morning

summary : got my long goggles on this morning

futures are rolling over to the march contract

I made a mistake on Mon-Tuesday range break as it happened yesterday..I'll still be trading December in early trade if I can get a signal to get long...thanks PT

NQ 2100 looks like natural support (march contract)

ES 1480-82 (march)

ER2 is already trading below sup so 760 level could be a target

ES 1480-82 (march)

ER2 is already trading below sup so 760 level could be a target

up trendline seems to be holding, or trying to hold, possible long entry setup

edit - trendline broke to the downside

edit - trendline broke to the downside

testing support levels

support feels like it might try and hold... noticing a mini-triangle in the ES right on support

trying a long here in the NQ

ER2 has a double bottom in place... now just need to break all these downtrend lines that have been formed and see the ER2 start making some higher lows

ER2 back at lows... a real lack of buying interest in that market this morning for some reason

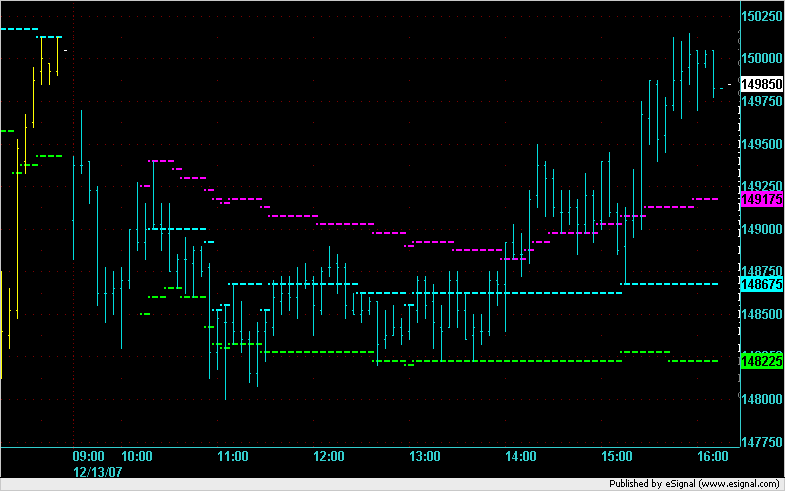

Today's market in graphic. Both days that you see on the chart are the H8 (March 2008) contract. The symbol on the chart is ES H8.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.