Advanced Trading Workshop (ATW)

jackj: "Could you say here what your thoughts were on Simmons..."

-------------------------------------------------------------

Um, not to be peculiar or anything, but I think I just did.

Can't really be much more descriptive than that without using words like "satan-spawn" or "cannibal" etc.

If that stuff works for you bro, then party on. But if it's working for you, it'd be nice to have you post how and what is working, being as specific as possible and showing chart(s) prior to or at trade entry. I mention that only because you said you like the Jerry-stuff and have been interacting with him at some level for a time.

Peace Love and Wild Monkey Flips,

MM

-------------------------------------------------------------

Um, not to be peculiar or anything, but I think I just did.

Can't really be much more descriptive than that without using words like "satan-spawn" or "cannibal" etc.

If that stuff works for you bro, then party on. But if it's working for you, it'd be nice to have you post how and what is working, being as specific as possible and showing chart(s) prior to or at trade entry. I mention that only because you said you like the Jerry-stuff and have been interacting with him at some level for a time.

Peace Love and Wild Monkey Flips,

MM

LOL... And not to be peculiar, either, but unfortunately (though they are very funny), satan-spawn, cannibal, and even charlatan aren't very helpful in understanding WHY he's those things. The charlatan means he's misrepresenting who he is, but still not as helpful as I was hoping for. I wasn't trying to take up your challenge to go head-to-head with you, defending him. I haven't traded with him, so I can't provide specific trades, nor even vouch for his trading. That's why I'm asking. I only did a trial to their room, and hence watched his analysis of the markets. I was considering signing up, though, so sought out others' opinions. So "that stuff" that I'm into - that I liked of his - for me refers to his analysis of the markets, which indeed, I find very good. Now, it is longer-term timeframes. I don't get to see him intraday trade. It just seems like he has a good breadth of knowledge, particularly of cycles, but also of other more basic technical analysis stuff.

Obviously you had a bad experience (to say the LEAST!), but he does both swing and day trading, and so I was wondering which it was, if only one. And whether it was his analysis, which I find very good, that is so bad, or his trading. Perhaps he's good at the big picture but not the small? And for how long? Someone could say someone was terrible, but only traded with him a for a week, and that wouldn't mean near as much as if he had traded for months with him. Again, any specifics would be more helpful.

I don't know you, so I'm not trying to question your character, or even judgment. But as I don't know you, perhaps you got screwed by him in some other non-trading venture, or he screwed your wife and you're just getting back at him for that?

The reason I was asking was bec. I haven't seen anything questionable from him, outside of the fact that it's a paid service. And while I understand that some don't like them, and indeed many are worthless (and perhaps his is, too), I don't think they inherently are bad or indicative of someone being a scammmer. Hence, my question asking for more specifics. Not even along the lines of what you're asking of me, i.e. specific trades. I was just wondering whether you were day or swing trading with him? Whether it was his analysis that isn't as good as I'm thinking it is, or if it's his actual trading? Was it re: swing trades or day trades? For how long? Any specifics, more than what you had provided in this thread. You referenced posting on another thread/topic earlier, so I figured it maybe had more specifics. But it's not archived, so I was hoping that you'd provide those details here.

Thanks again for any and all feedback.

Obviously you had a bad experience (to say the LEAST!), but he does both swing and day trading, and so I was wondering which it was, if only one. And whether it was his analysis, which I find very good, that is so bad, or his trading. Perhaps he's good at the big picture but not the small? And for how long? Someone could say someone was terrible, but only traded with him a for a week, and that wouldn't mean near as much as if he had traded for months with him. Again, any specifics would be more helpful.

I don't know you, so I'm not trying to question your character, or even judgment. But as I don't know you, perhaps you got screwed by him in some other non-trading venture, or he screwed your wife and you're just getting back at him for that?

The reason I was asking was bec. I haven't seen anything questionable from him, outside of the fact that it's a paid service. And while I understand that some don't like them, and indeed many are worthless (and perhaps his is, too), I don't think they inherently are bad or indicative of someone being a scammmer. Hence, my question asking for more specifics. Not even along the lines of what you're asking of me, i.e. specific trades. I was just wondering whether you were day or swing trading with him? Whether it was his analysis that isn't as good as I'm thinking it is, or if it's his actual trading? Was it re: swing trades or day trades? For how long? Any specifics, more than what you had provided in this thread. You referenced posting on another thread/topic earlier, so I figured it maybe had more specifics. But it's not archived, so I was hoping that you'd provide those details here.

Thanks again for any and all feedback.

I don't know you, so I'm not trying to question your character, or even judgment. But as I don't know you, perhaps you got screwed by him in some other non-trading venture, or he screwed your wife and you're just getting back at him for that?

Ouch! You hit the nail on the head ... except he did all 3 of my wives -- unforgivable!

Obviously you had a bad experience (to say the LEAST!)

It's not a bad experience thing. I'm just extremely familiar with the people and their teachings in the VENDOR environment ... including ATW and Simmons.

The reason I was asking was bec. I haven't seen anything questionable from him, outside of the fact that it's a paid service.

Yeppers, it's a paid service ... a VENDOR. And in this environment, it is rampant with "satan-spawn" types. Therefore, when you inquired about him/ATW, I simply provided inside the mypivots community, my informed opinion of the "stuff."

You referenced posting on another thread/topic earlier, so I figured it maybe had more specifics. But it's not archived, so I was hoping that you'd provide those details here.

Give Guy a holler to find out if that info is still available and how to access it.

As I mentioned before in my prior post, if you find his info (long or short term) good/useful to you, then simply incorporate that into your own analysis.

You are familiar enough with his approach as you intimated with: So "that stuff" that I'm into - that I liked of his - for me refers to his analysis of the markets, which indeed, I find very good. Now, it is longer-term timeframes. I don't get to see him intraday trade. It just seems like he has a good breadth of knowledge, particularly of cycles, but also of other more basic technical analysis stuff.

At this point, I'd suggest that you invite others besides me to comment with their knowledge and/or experience of what you find to be "very good."

I trust that this is helpful and that he (satan-spawn) does not attempt to screw your wife or wives

And since he's a vendor and you initiated a post and spoke of his (satan-spawn's) info (referenced above) as "very good" ... I'd encourage you to share what is "very good."

The onus in this environment is upon the vendor and/or the person who initiates a post where they describe a vendor (big fee for service) as "very good."

I look forward to your posts of what you've found to be just that and how it's affected your trading.

Peace Love Flowers and Monkey Flip-flops to Ya Bro,

MM

Ouch! You hit the nail on the head ... except he did all 3 of my wives -- unforgivable!

Obviously you had a bad experience (to say the LEAST!)

It's not a bad experience thing. I'm just extremely familiar with the people and their teachings in the VENDOR environment ... including ATW and Simmons.

The reason I was asking was bec. I haven't seen anything questionable from him, outside of the fact that it's a paid service.

Yeppers, it's a paid service ... a VENDOR. And in this environment, it is rampant with "satan-spawn" types. Therefore, when you inquired about him/ATW, I simply provided inside the mypivots community, my informed opinion of the "stuff."

You referenced posting on another thread/topic earlier, so I figured it maybe had more specifics. But it's not archived, so I was hoping that you'd provide those details here.

Give Guy a holler to find out if that info is still available and how to access it.

As I mentioned before in my prior post, if you find his info (long or short term) good/useful to you, then simply incorporate that into your own analysis.

You are familiar enough with his approach as you intimated with: So "that stuff" that I'm into - that I liked of his - for me refers to his analysis of the markets, which indeed, I find very good. Now, it is longer-term timeframes. I don't get to see him intraday trade. It just seems like he has a good breadth of knowledge, particularly of cycles, but also of other more basic technical analysis stuff.

At this point, I'd suggest that you invite others besides me to comment with their knowledge and/or experience of what you find to be "very good."

I trust that this is helpful and that he (satan-spawn) does not attempt to screw your wife or wives

And since he's a vendor and you initiated a post and spoke of his (satan-spawn's) info (referenced above) as "very good" ... I'd encourage you to share what is "very good."

The onus in this environment is upon the vendor and/or the person who initiates a post where they describe a vendor (big fee for service) as "very good."

I look forward to your posts of what you've found to be just that and how it's affected your trading.

Peace Love Flowers and Monkey Flip-flops to Ya Bro,

MM

Sorry, couldn't help myself with the "satan-spawn" thingy referenced in several posts ... but here is the majestic ATW

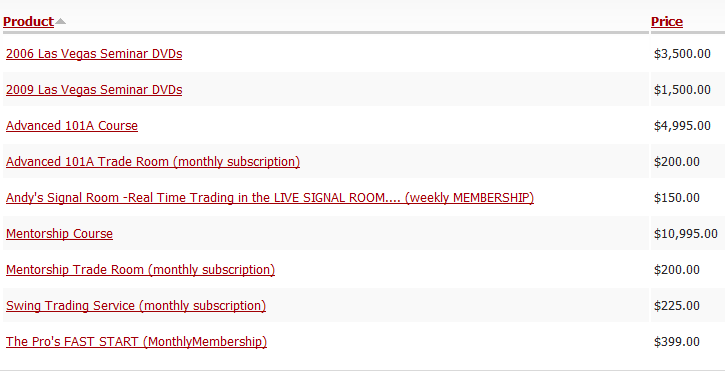

And here's how folks like these (VENDORS) pay for their kiddo's college tuition.

Yeah, it's just my irreverent sense of humor on the first pic, but the second doesn't charge $666 for any of the offered courses ... which surprises me!

And here's how folks like these (VENDORS) pay for their kiddo's college tuition.

Yeah, it's just my irreverent sense of humor on the first pic, but the second doesn't charge $666 for any of the offered courses ... which surprises me!

Nice artwork, MM! Looks like someone at some of the concerts I take my son to. Thanks for clarifying that it isn't specifically Simmons; from your JFK comment I took it to mean that you had specific dealings with him. As I said (I think?), many/most of the vendors have a good dollop of b.s. in them, but I've been around enough and I think use good critical thinking skills, enough to sniff them out (and often piss them off with my questions in webinars). That happened last week after a friend invited me in; he heard about that later from Michael Lydick, the host :) But that irritation at legitimate questions just confirms my questions/suspicions of them.

I can't say, quantifiably, how Simmons has helped my trading. I've been mainly studying, with a couple of forays into live, the last few years, and just now have gone live again, very cautiously. I'm just speaking from what I see in his presentations. Rather than try to summarize it, and have people take my word for it, I'd encourage (if anyone's interested) people to judge for themselves, just looking at a couple of free webinars he has posted at traderkingdom.

One is indeed a part pitch for his swing-trading service, but that's just the first :14 or so. After that he demonstrates some of his analysis, including cycle systems, and I'll let other judge. I have a decent grounding in technical analysis (as well as b.s. detecting), but maybe it isn't as good as I think and I'm just being fooled. I'd be interested in others' feedback.

The other video is he demonstrating a couple of tools he uses. He readily acknowledges that they're nothing new or special. What he refers to as a DPTL is overlapping horizontal S/R lines based on price action highs and lows. And his DAlt's are measured moves. He also uses some fib stuff. But one thing I'm impressed with is that he readily shares how he does much of it for free. This video was one of four he did, and the other three one can watch (along with many, many other videos) with a free 30 day trial to their room. That's what I did. And I'm not here to promote them; merely pointing out why I think he isn't a run-of-the-mill vendor. Not many (any?) do 30 day trials, during which they show you a ton of what they use and how.

Anyway, that's my .02. If anyone's interested, they can sign up at the traderkingdom website for free to watch his videos. He also used to post his shorter daily ones on youtube, search for: atwdaytrader

His two videos are to the right on this page:

http://www.traderkingdom.com/experts/89-jerry-simmons

I can't say, quantifiably, how Simmons has helped my trading. I've been mainly studying, with a couple of forays into live, the last few years, and just now have gone live again, very cautiously. I'm just speaking from what I see in his presentations. Rather than try to summarize it, and have people take my word for it, I'd encourage (if anyone's interested) people to judge for themselves, just looking at a couple of free webinars he has posted at traderkingdom.

One is indeed a part pitch for his swing-trading service, but that's just the first :14 or so. After that he demonstrates some of his analysis, including cycle systems, and I'll let other judge. I have a decent grounding in technical analysis (as well as b.s. detecting), but maybe it isn't as good as I think and I'm just being fooled. I'd be interested in others' feedback.

The other video is he demonstrating a couple of tools he uses. He readily acknowledges that they're nothing new or special. What he refers to as a DPTL is overlapping horizontal S/R lines based on price action highs and lows. And his DAlt's are measured moves. He also uses some fib stuff. But one thing I'm impressed with is that he readily shares how he does much of it for free. This video was one of four he did, and the other three one can watch (along with many, many other videos) with a free 30 day trial to their room. That's what I did. And I'm not here to promote them; merely pointing out why I think he isn't a run-of-the-mill vendor. Not many (any?) do 30 day trials, during which they show you a ton of what they use and how.

Anyway, that's my .02. If anyone's interested, they can sign up at the traderkingdom website for free to watch his videos. He also used to post his shorter daily ones on youtube, search for: atwdaytrader

His two videos are to the right on this page:

http://www.traderkingdom.com/experts/89-jerry-simmons

Hey Jackie-J, other than a couple of 1-time posters on this 2-page thread, I'm reading descriptions of primarily negative experiences with this vendor and its method/trainers/service/promoters. And along with my .02 cents added, it seems at this point you're more interested in getting other folks interested in participating than finding out what people think who have actual, first-hand knowledge about them and their methods.

Your initial post was to me. I couldn't find the earlier post of yours, MonkeyMeat. Could you say here what your thoughts were on Simmons, bec. I've been impressed with his analysis of the markets (mainly longer-term). Thanks.

I reread the thread and your initial post has morphed into a "soft" promotion of ATW where you've gone on to describe more detailed knowledge of their "stuff," and are encouraging folks to go check it all out. You've even mapped it out describing where/how to find all the "good" information and even a link.

You asked my thoughts on that vendor fellow that charges a fortune where you've already gotten enough feedback for most semi-reasonable folks to break out in a case of hives. Then you follow up with this kind of chatter:

But one thing I'm impressedwith is that he readily shares how he does much of it for free. This video was one of four he did, and the other three one can watch (along with many, many other videos) with a free 30 day trial to their room. That's what I did. And I'm not here to promote them

(ummmm ... ya just did ... promote them, that is)

I'm just speaking from what I see in his presentations. Rather than try to summarize it, and have people take my word for it, I'd encourage (if anyone's interested) people to judge for themselves, just looking at a couple of free webinars he has posted at traderkingdom.

(line sheep up nose to tail, smile and pat their heads, point toward open door to slaughter house)

Do you know what a shillpen is? Probably not because it's a new indicator that just popped into my head. It's the pen with which a shill spills "ink" subtly or overtly to promote a vendor. And it's pegging in oversold territory now. Some of its component measurements relate to length of posts, asking what/why someone thinks about a vendor ... then following up with your own praise for them in subsequent posts, certain verbiage used (ex. impressed, the real deal, etc.) among other things.

Btw, you write and communicate an awful lot like Jerry!

For anyone else out there who hasn't broken out in hives yet, here's some more comments/reviews to chew on:

http://traderopinions.com/indicators/advanced-trading-workshop-aka/

http://www.trade2win.com/boards/commercial-systems/36565-advanced-traders-workshop.html

Your initial post was to me. I couldn't find the earlier post of yours, MonkeyMeat. Could you say here what your thoughts were on Simmons, bec. I've been impressed with his analysis of the markets (mainly longer-term). Thanks.

I reread the thread and your initial post has morphed into a "soft" promotion of ATW where you've gone on to describe more detailed knowledge of their "stuff," and are encouraging folks to go check it all out. You've even mapped it out describing where/how to find all the "good" information and even a link.

You asked my thoughts on that vendor fellow that charges a fortune where you've already gotten enough feedback for most semi-reasonable folks to break out in a case of hives. Then you follow up with this kind of chatter:

But one thing I'm impressedwith is that he readily shares how he does much of it for free. This video was one of four he did, and the other three one can watch (along with many, many other videos) with a free 30 day trial to their room. That's what I did. And I'm not here to promote them

(ummmm ... ya just did ... promote them, that is)

I'm just speaking from what I see in his presentations. Rather than try to summarize it, and have people take my word for it, I'd encourage (if anyone's interested) people to judge for themselves, just looking at a couple of free webinars he has posted at traderkingdom.

(line sheep up nose to tail, smile and pat their heads, point toward open door to slaughter house)

Do you know what a shillpen is? Probably not because it's a new indicator that just popped into my head. It's the pen with which a shill spills "ink" subtly or overtly to promote a vendor. And it's pegging in oversold territory now. Some of its component measurements relate to length of posts, asking what/why someone thinks about a vendor ... then following up with your own praise for them in subsequent posts, certain verbiage used (ex. impressed, the real deal, etc.) among other things.

Btw, you write and communicate an awful lot like Jerry!

For anyone else out there who hasn't broken out in hives yet, here's some more comments/reviews to chew on:

http://traderopinions.com/indicators/advanced-trading-workshop-aka/

http://www.trade2win.com/boards/commercial-systems/36565-advanced-traders-workshop.html

First off, I'm not Jerry. I realize by pointing out their site I was promoting it; what I said was I wasn't here "to do that". My taking that pro-active stance, if you will, was only because you were commenting blind, lumping him in with every other vendor by mere fact that they were vendors. So I was pointing out why they aren't all the same. Okay, I was pointing out why THIS one wasn't the same, but I'd also say Dave Landry and Tim Morge, for similar reasons. Yes, I do seek out new info, perhaps too much and to my detriment. And I pointed people to the free videos bec. you wanted others to help judge whether the "stuff" was, as I had described, "very good" or not. Do you know of a better way? Me saying that it showed me the value of time cycles in the S&P and Gold, and helped me take a trader at x or y... Is that going to allow others to judge whether it was very good analysis or not, or is them watching him do it going to?

I was accused of being Al Brooks on another board, too (ET?) bec. I was a first-time poster at that time, simply saying what I had found of his. Ultimately, the guy who accused me apologized and said he loved Al's stuff. Personally, I'm not so keen on it, though at the time I hadn't concluded that yet. I was just helping other traders out by researching and sometimes archiving it. I'm in a free price action-based room, and that's what we do.

Thanks for the other board/thread link to ATW comments. And I'm not even countering what others have said here. Most (all?) of those comments were referencing the other half of ATW, and their daytrading part, which is mainly the other guy. That's why I specifically was asking about Simmons, and whether your experience was intraday or swing-based. Bec. (as I said at one point), I haven't seen Jerry and how he does intraday. I think I even said he may not be that good; I didn't know, and wanted your/others' opinions. I said what I was impressed with was his longer-term analysis.

Okay, enough time wasted (unfortunately, apparently) on this. FWIW, not having heard any concrete negatives on Simmons specifically, I went ahead and signed up for a month of his service, so I'll be able to post back with more specifics. To what end, though, I don't know, since you/others may not believe it, anyway. Good trading, Jack.

I was accused of being Al Brooks on another board, too (ET?) bec. I was a first-time poster at that time, simply saying what I had found of his. Ultimately, the guy who accused me apologized and said he loved Al's stuff. Personally, I'm not so keen on it, though at the time I hadn't concluded that yet. I was just helping other traders out by researching and sometimes archiving it. I'm in a free price action-based room, and that's what we do.

Thanks for the other board/thread link to ATW comments. And I'm not even countering what others have said here. Most (all?) of those comments were referencing the other half of ATW, and their daytrading part, which is mainly the other guy. That's why I specifically was asking about Simmons, and whether your experience was intraday or swing-based. Bec. (as I said at one point), I haven't seen Jerry and how he does intraday. I think I even said he may not be that good; I didn't know, and wanted your/others' opinions. I said what I was impressed with was his longer-term analysis.

Okay, enough time wasted (unfortunately, apparently) on this. FWIW, not having heard any concrete negatives on Simmons specifically, I went ahead and signed up for a month of his service, so I'll be able to post back with more specifics. To what end, though, I don't know, since you/others may not believe it, anyway. Good trading, Jack.

Agree with monkey meat and other bashers. I spent money on ATW and learned nothing of value. Andy is a true huckster and a jerk. Dont waste your money!

First off, as has been noted by others, I think you truly need to separate Andy from Jerry Simmons. I'm not denigrating Andy; just that they're very, very different, in many ways. Andy does daytrading whereas Simmons does swing trading, and the bigger analysis. And I'll only speak to Simmons, as I'm currently in his room.

I'd be curious when it was that the prior poster was with them, as they have changed over even the few months I've followed them. If I recall, when I first did a trial Jerry would only do morning prep sessions. Perhaps your level of experience is much greater than mine, but those sessions, along with the videos of Jerry demonstrating how he draws his levels and uses his tools, were very helpful to me. Perhaps they also didn't have those videos available when you were with them?

I went ahead and signed up for Simmons' swing trading service, and with that he does 2 sessions a week of 1 to 1.5 hours, and also does ones for all members twice a week at noon time, using his methods on shorter timeframes. Personally, I haven't come across anyone with the breadth of knowledge that he has. I know it sounds fawning, but it's the truth. Now that may partly be that many one might come across in this business have their "schtick" that they use to make them unique, and so you only see that. Simmons readily admits he isn't inventing the tools he uses and isn't doing anything new, yet his knowledge of the application of them is what stands out to me. Among those tools: horizontal S/R lines; waves, incl. measured moves and fibs; market geometry of wedges/triangles; trendlines and median lines; cyclical analysis; Drummond Lines, though only the very basic trendlines of it. For instance, I'm also in a trading room with other traders, many with a lot of experience, mainly using market structure, waves and geometry. But Simmons' knowledge - I think mainly from 30+ years of trading - of how to read waves, and when they're measured moves or not, and what it means, surpasses those traders in the other room. But his strength is combining all of the tools and using them appropriately, not relying on just one or two. And in addition to his analysis, he's also showing how he designs mechanical systems, and even shares the logic of some he's been using for years.

As for the trading part, Simmons is VERY conservative. His swing trading service, with calls, only started a few months ago, and though he had several profitable calls early on, the last two months there hadn't been any. Again, he's both conservative, and he was going for more major swings. So now he's adjusted that and is looking for shorter timeframe, and admittedly not quite as strong of calls, with smaller position sizes on them. Again, he's still tweaking his service, and just last week started having a room open throughout the day for the swing traders. It's not real active, but again, that's mainly the nature of swing trading. But he's available to answer questions, and there are a couple other knowledgeable traders posting, too.

As for trades since he made that adjustment (just last week), he had a long trade on ZB last week which was profitable, though I don't recall the result. And on Monday (through Wed.) he had a gold trade that, with 2 contracts, made $2200 (long at 1129.50; Profit Target 1 at 1141.00 hit, stopped out on other contract after moving stop to 1140). He had copper on a watchlist for a short, but it triggered last night over night so that wasn't taken/given out.

To sum up, for daytrading his info can certainly help, but it's not likely what a daytrader would be looking for. One can use Simmons' S/R lines, as they do work very well. But they are bigger term, and hence the "how to trade" the info, esp. in leveraged futures, is the hard part (like so much of daytrading). But otherwise, one won't get many trades from him; again, it is a swing trading service, though.

Personally, the knowledge I'm getting is invaluable, and I've no doubt that if not now, at some point the few hundred dollars ($225 per month) will be more than made up for. I was only able to buy Calls on the GLD ETF for the gold trade, so didn't do as well (couldn't risk holding overnight without a stop, so I had to close at EOD). But still made enough from that to pay for it this month. I've actually made more in SPY Calls/Puts using his info, but I can't give him direct credit as it wasn't his service calls. But his levels combined with his view of what's likely to happen made me money.

I've no doubt that people will flame me for heaping so much praise, but that's fine. I've no vested interest in this. Just trying to share what I know to help other traders. Again, if someone truly were interested, they'd at least watch the videos I noted earlier and judge for themselves. I just wanted to put in my .02 based on what I know from my actual experience, since some comments were based solely on the fact that he's a vendor, not any specific knowledge of him. That's fine if one wants to hold that opinion, but it should be made clear that the opinion is based solely on that. That lack of clarity is what generated the confusion in my first few posts/responses with MM. Good trading, Jack.

I'd be curious when it was that the prior poster was with them, as they have changed over even the few months I've followed them. If I recall, when I first did a trial Jerry would only do morning prep sessions. Perhaps your level of experience is much greater than mine, but those sessions, along with the videos of Jerry demonstrating how he draws his levels and uses his tools, were very helpful to me. Perhaps they also didn't have those videos available when you were with them?

I went ahead and signed up for Simmons' swing trading service, and with that he does 2 sessions a week of 1 to 1.5 hours, and also does ones for all members twice a week at noon time, using his methods on shorter timeframes. Personally, I haven't come across anyone with the breadth of knowledge that he has. I know it sounds fawning, but it's the truth. Now that may partly be that many one might come across in this business have their "schtick" that they use to make them unique, and so you only see that. Simmons readily admits he isn't inventing the tools he uses and isn't doing anything new, yet his knowledge of the application of them is what stands out to me. Among those tools: horizontal S/R lines; waves, incl. measured moves and fibs; market geometry of wedges/triangles; trendlines and median lines; cyclical analysis; Drummond Lines, though only the very basic trendlines of it. For instance, I'm also in a trading room with other traders, many with a lot of experience, mainly using market structure, waves and geometry. But Simmons' knowledge - I think mainly from 30+ years of trading - of how to read waves, and when they're measured moves or not, and what it means, surpasses those traders in the other room. But his strength is combining all of the tools and using them appropriately, not relying on just one or two. And in addition to his analysis, he's also showing how he designs mechanical systems, and even shares the logic of some he's been using for years.

As for the trading part, Simmons is VERY conservative. His swing trading service, with calls, only started a few months ago, and though he had several profitable calls early on, the last two months there hadn't been any. Again, he's both conservative, and he was going for more major swings. So now he's adjusted that and is looking for shorter timeframe, and admittedly not quite as strong of calls, with smaller position sizes on them. Again, he's still tweaking his service, and just last week started having a room open throughout the day for the swing traders. It's not real active, but again, that's mainly the nature of swing trading. But he's available to answer questions, and there are a couple other knowledgeable traders posting, too.

As for trades since he made that adjustment (just last week), he had a long trade on ZB last week which was profitable, though I don't recall the result. And on Monday (through Wed.) he had a gold trade that, with 2 contracts, made $2200 (long at 1129.50; Profit Target 1 at 1141.00 hit, stopped out on other contract after moving stop to 1140). He had copper on a watchlist for a short, but it triggered last night over night so that wasn't taken/given out.

To sum up, for daytrading his info can certainly help, but it's not likely what a daytrader would be looking for. One can use Simmons' S/R lines, as they do work very well. But they are bigger term, and hence the "how to trade" the info, esp. in leveraged futures, is the hard part (like so much of daytrading). But otherwise, one won't get many trades from him; again, it is a swing trading service, though.

Personally, the knowledge I'm getting is invaluable, and I've no doubt that if not now, at some point the few hundred dollars ($225 per month) will be more than made up for. I was only able to buy Calls on the GLD ETF for the gold trade, so didn't do as well (couldn't risk holding overnight without a stop, so I had to close at EOD). But still made enough from that to pay for it this month. I've actually made more in SPY Calls/Puts using his info, but I can't give him direct credit as it wasn't his service calls. But his levels combined with his view of what's likely to happen made me money.

I've no doubt that people will flame me for heaping so much praise, but that's fine. I've no vested interest in this. Just trying to share what I know to help other traders. Again, if someone truly were interested, they'd at least watch the videos I noted earlier and judge for themselves. I just wanted to put in my .02 based on what I know from my actual experience, since some comments were based solely on the fact that he's a vendor, not any specific knowledge of him. That's fine if one wants to hold that opinion, but it should be made clear that the opinion is based solely on that. That lack of clarity is what generated the confusion in my first few posts/responses with MM. Good trading, Jack.

Jack,

Yo yo yo dawg dawg listen ... you're makin' it real, man. Flame you? No way dude. That epic lovefest story I just read brought a tear to my eye (sadness actually). And yeah, he's still using pretty much the same s#!t you alluded to.

But hey, if it works fer ya, then conflatulations! That'd likely make you the first non money losing feller who's dealt with that prevaricating motor scooter. Just keepin' it real, dawg!

Yo yo yo dawg dawg listen ... you're makin' it real, man. Flame you? No way dude. That epic lovefest story I just read brought a tear to my eye (sadness actually). And yeah, he's still using pretty much the same s#!t you alluded to.

But hey, if it works fer ya, then conflatulations! That'd likely make you the first non money losing feller who's dealt with that prevaricating motor scooter. Just keepin' it real, dawg!

I have spent some time with ATW. I agree Andy is quite a sales man but if you get hood winked into buying somthing you should look at your self for being a sucker as much as the guy who is doing the sucking. They give a 30 day free trial take the free trial and pass at the rest. I personally believe that Jerry is telling the truth in whatever he states. I am not saying his level of accuracey is 100% but I have found him to be fairly correct on most occassions.

The big thing that I noticed was the level of greed involved in the trading. There is a lot of flashing lights and bells and sounds that would want to get you into a trade before you knew what happened. Bad move for over trading. The indicator packages are a bit overpriced for what they are and the instructions on how to use them don't seem to exist. But you have to think about this if an indicator existed that made millions it has been flogged to death on it's first outing. I personally spent over $5000 and have no regrets. I found Jerry's level of accuracey and honesty to be of a high standard. Andy is a salesman and my credit card is still getting over the trauma.

In my opinion the biggest problem is the amount of money that you start trading with. The guys encourage $10,000 per futures contract which is the correct amount. That means you are starting out with a $30,000 acc as a begginner. You are dreaming if you think you can get through your trading career without blowing up your acc. Livermore went broke how many times. Gann just got sick of losing and stopped trading, then went and got an education. If you truly are a begginner then start small. You may only be making $30 or $40 dollars a day and you will only be losing $30 or $40 a day. When your consisitencey gets up there your account will grow and when you get out of bed one day and find your account has had no draw downs in 3 months then start adding extra funds.

I personally have taken a liking to Jerrys Edge Trading system. I took the methodology Jerry has taught and have been trading it for over 6 months. I can say for sure we have more up days then down but how it goes into the future is anybodies guess. I don't trade a black box or indicator system blindly so I get better tyhen the system. If you don't take the time to check out ATW you could be doing your self out of a good education. My trading account has done nothing but grow since I got into the ATW. I had a high level of experience before but getting the help to automate my trading has made my life so much easier. I don't get flogged like the good old days. The Edge signals the trades and I add to the position or cancel it out. i had built a very similar system before going to the ATW but Jerrys level of programming experience really paid off.

To summerize watch your credit card but don't be ignorant, these guys have some good education and trading techniques. Just don't be a mug. Pay your money and demand the service. Get onto Andy at the begining and make him work for his money.

Raef Mackay.

Australia.

The big thing that I noticed was the level of greed involved in the trading. There is a lot of flashing lights and bells and sounds that would want to get you into a trade before you knew what happened. Bad move for over trading. The indicator packages are a bit overpriced for what they are and the instructions on how to use them don't seem to exist. But you have to think about this if an indicator existed that made millions it has been flogged to death on it's first outing. I personally spent over $5000 and have no regrets. I found Jerry's level of accuracey and honesty to be of a high standard. Andy is a salesman and my credit card is still getting over the trauma.

In my opinion the biggest problem is the amount of money that you start trading with. The guys encourage $10,000 per futures contract which is the correct amount. That means you are starting out with a $30,000 acc as a begginner. You are dreaming if you think you can get through your trading career without blowing up your acc. Livermore went broke how many times. Gann just got sick of losing and stopped trading, then went and got an education. If you truly are a begginner then start small. You may only be making $30 or $40 dollars a day and you will only be losing $30 or $40 a day. When your consisitencey gets up there your account will grow and when you get out of bed one day and find your account has had no draw downs in 3 months then start adding extra funds.

I personally have taken a liking to Jerrys Edge Trading system. I took the methodology Jerry has taught and have been trading it for over 6 months. I can say for sure we have more up days then down but how it goes into the future is anybodies guess. I don't trade a black box or indicator system blindly so I get better tyhen the system. If you don't take the time to check out ATW you could be doing your self out of a good education. My trading account has done nothing but grow since I got into the ATW. I had a high level of experience before but getting the help to automate my trading has made my life so much easier. I don't get flogged like the good old days. The Edge signals the trades and I add to the position or cancel it out. i had built a very similar system before going to the ATW but Jerrys level of programming experience really paid off.

To summerize watch your credit card but don't be ignorant, these guys have some good education and trading techniques. Just don't be a mug. Pay your money and demand the service. Get onto Andy at the begining and make him work for his money.

Raef Mackay.

Australia.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.