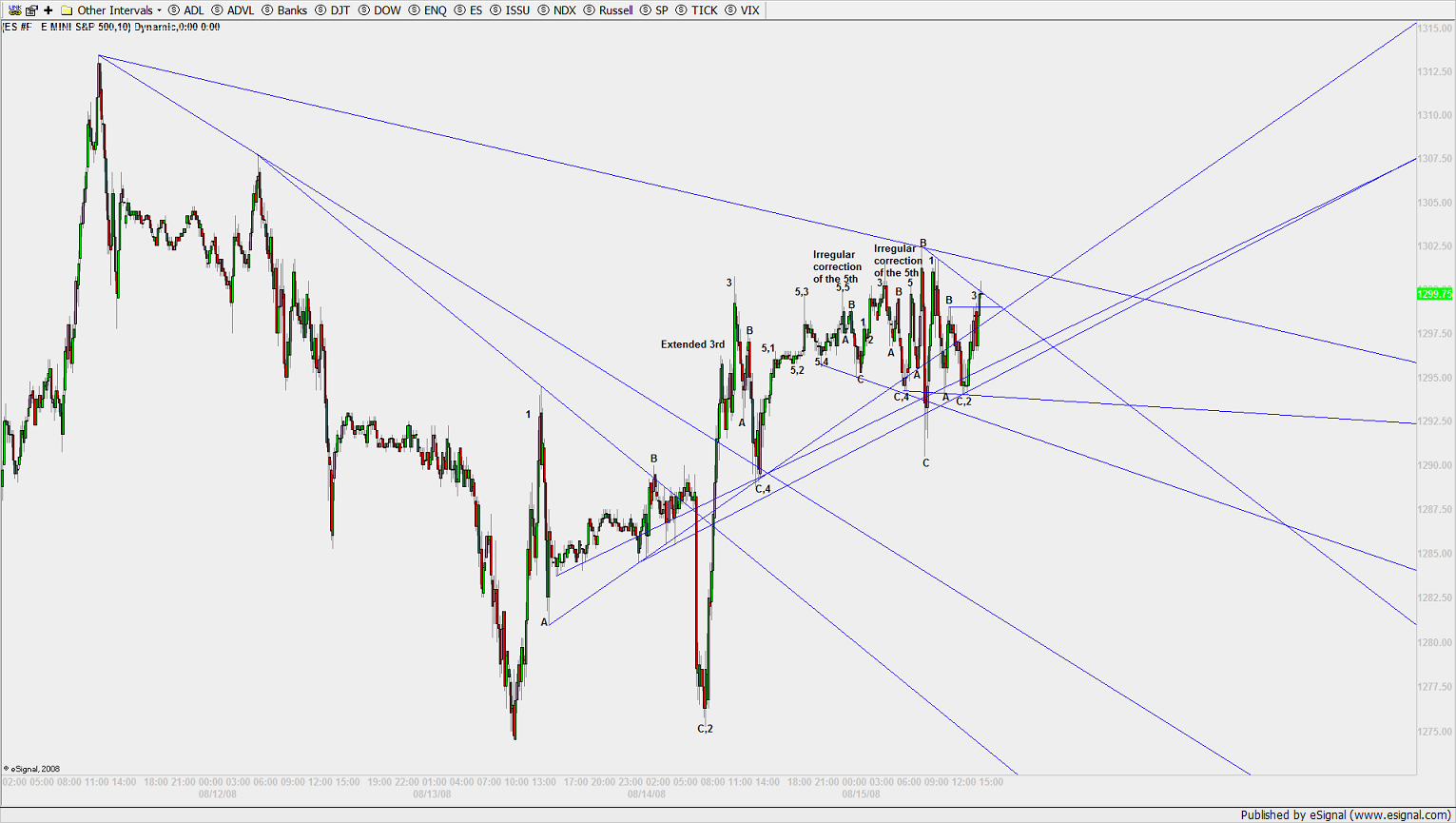

ES Ascending Triangle (Bear Flag) Correction

..False breakout confirmed.

At the open in this evening's international session we will move into the 4th wave of a failed 3rd in the 5th initiating the continuation of the bear impulse market.

I'll post targets in this thread before the open.

At the open in this evening's international session we will move into the 4th wave of a failed 3rd in the 5th initiating the continuation of the bear impulse market.

I'll post targets in this thread before the open.

That's some "heavy" stuff SPQR ! Reminds me of the lazer light shows ( zeppelin and Pink Floyd)

I use to go see in the late 70's. Seriously though, I think we are due for some downside also. I 'd like to see them

run out the "ledge" above your #1 point when the overnight session opens. I think the 80 - 82 area is coming soon. Perhaps that

is a flashback again in time for me and not a price point on the chart...lol. I look forward to your targets.

I use to go see in the late 70's. Seriously though, I think we are due for some downside also. I 'd like to see them

run out the "ledge" above your #1 point when the overnight session opens. I think the 80 - 82 area is coming soon. Perhaps that

is a flashback again in time for me and not a price point on the chart...lol. I look forward to your targets.

By the time I was old enough to venture to concerts the light shows lost their appeal and tried to rekindle in Gen X. I toured with the Dead in '91 before Jerry died, then Phish. It was its own genre then, the crowd more dark than what you would have known. Floyd's older stuff rocked, still rocks, but I wasn't about to see Gilmore, for all his greatness, dook his pants forgetting his geritol huggies. hahaha

Targets in a few.

Targets in a few.

Volatility obviously dwindled considerabley, which makes longer term targets questionable forecasting until it picks up. StDev presently is 2.6874253%. If 1302.50 is the peak to 1313.50's correction, then a conservative target would be 1267.50. The way it works is that just as soon as a move is oversold or overbought, it'll pull-back. It's the second to the last pull-back before a measured move correction. At the trough where the StDev pulls back, though, is where you can forecast the peak of its continued trend direction if there is to be one.

It just so happens that despite the dried up volatility we know that a measured move from the last leg down from 1313.50 at 93 is 1260ish. As is StDev from there. However volatility began decreasing from 1274.50 so I'ld target anywhere from 1263-1261 as a bottom due for a correction.

What's difficult from there is still not knowing whether or not bulls will try to correct 1441. The lines say it's over, but a decided move is a decided move. There's no stopping it. I'ld reasses in the early 60s.

As already mentioned elsewhere, DT, Bruce, Joe and others are more conversant in MP for intraday targets than I so if Bruce calls 80ish immediate term, if you're not accustomed to the swing, maybe his and others' targets would better suit.

I likewise reasses at their called MP #s validating an existing setup I'm in or working on.

It just so happens that despite the dried up volatility we know that a measured move from the last leg down from 1313.50 at 93 is 1260ish. As is StDev from there. However volatility began decreasing from 1274.50 so I'ld target anywhere from 1263-1261 as a bottom due for a correction.

What's difficult from there is still not knowing whether or not bulls will try to correct 1441. The lines say it's over, but a decided move is a decided move. There's no stopping it. I'ld reasses in the early 60s.

As already mentioned elsewhere, DT, Bruce, Joe and others are more conversant in MP for intraday targets than I so if Bruce calls 80ish immediate term, if you're not accustomed to the swing, maybe his and others' targets would better suit.

I likewise reasses at their called MP #s validating an existing setup I'm in or working on.

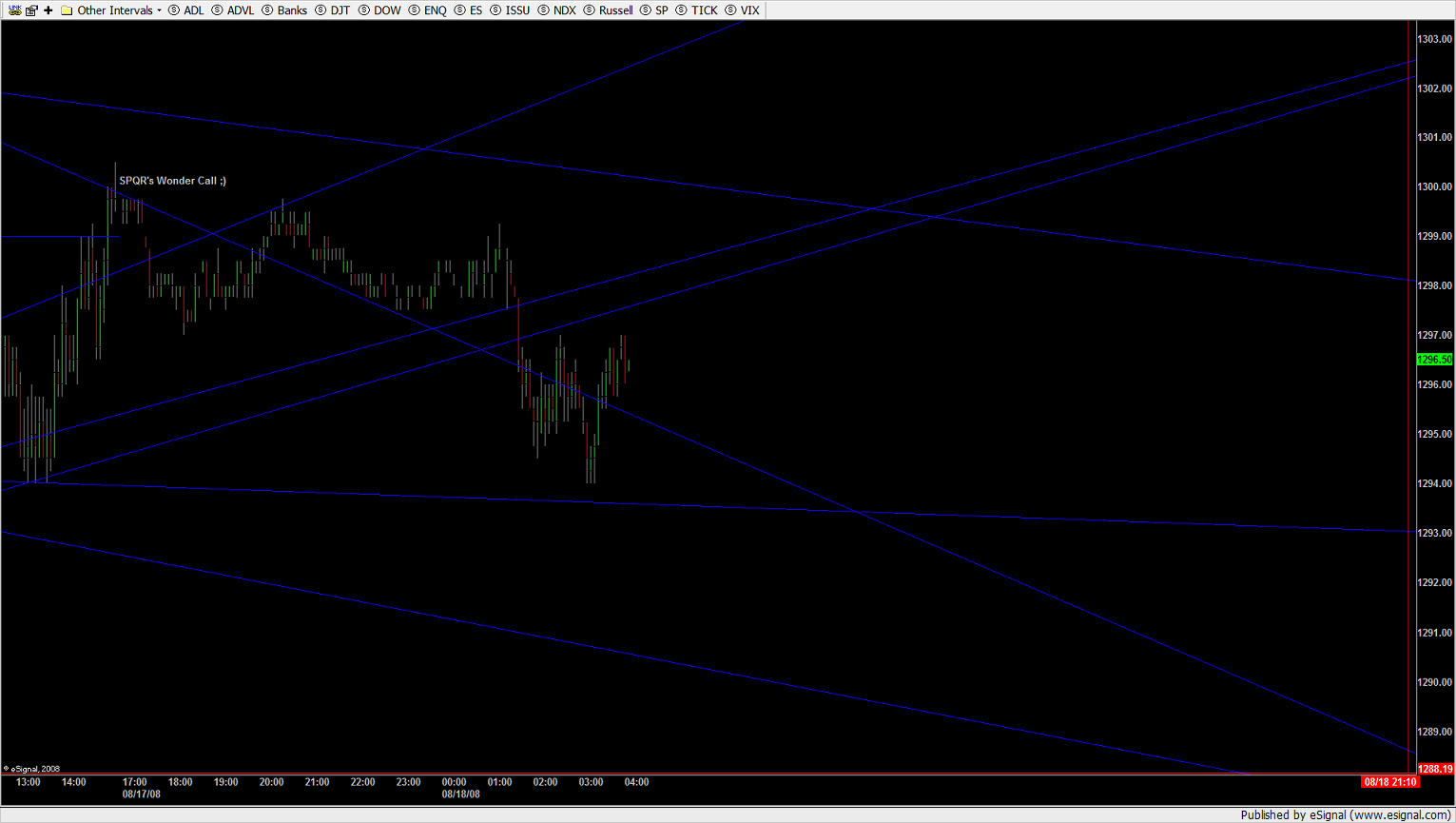

LOL. Someone put up a brick at price for short. No bids, no beating around the bush. It could be window dressing but I didn't see a tick more out of the last move it was hung up so well. Obviously he thought so too. It doesn't seem to be rattling cages long though. The 5S chart shows Friday's session having ended in the first advance to the downside. A propulsion scalp play short to 95, long 98, decidedly down from 98 seems to me likely. I want to see the line hold at 99.75 though. Thing is the opening move will probably hit 95 in a hurry if it does. A 3 point scalp to 98 on a failed recover retrace I'll move on though. Even if the line is broken, it'll be a false breakout.

It's like watching paint dry but I'm up 2 handles from 99.75 targeting 96 even.

Then I'm off to bed.

There's nothing like a fresh cup of bean and charts before bakers bang their wives. haha Sorry.

As always, count on my calling it like I see it.

Then I'm off to bed.

There's nothing like a fresh cup of bean and charts before bakers bang their wives. haha Sorry.

As always, count on my calling it like I see it.

buy order 2 baby spoos at 1295.00 limit.I concur with your chart and analysis but get projections (5min chart) to 1294.75.one point stop, hoping for 2points.Mywork still allows for one more thrust up to wash out remaining bears . good luck 2 all and see you tomorrow.ps. ... just got filled!

exit 1 at 1296, hold the other, if im not stopped out. nite all.keeping stop 1 point from projection at 1293.75.

wow, camedown to 1294, rebounded to 1296(so far). 1 min projection to 1297.25.Still not filled at 1296! holding 2, stop remains 1293.75

finally filled at1296. holding 1 till 1297.25. Gotta sleep ...wish me luck!

'Morn', Kool..

I think you may be right, though buyers despite having a large degree of edge at this point, seem to have run into resistance at their own 144 EMA at 96.62.

There's no way to tell where this will go now. Two things are certain though: the chop will continue and volatility will increase. Much money will be lost today.

Damage control, conservative momentum scalping is my tentative plan today, and I'm sticking to it.

I think you may be right, though buyers despite having a large degree of edge at this point, seem to have run into resistance at their own 144 EMA at 96.62.

There's no way to tell where this will go now. Two things are certain though: the chop will continue and volatility will increase. Much money will be lost today.

Damage control, conservative momentum scalping is my tentative plan today, and I'm sticking to it.

Man, all that work and "yes, sir" Quants in the pockets of BSD maneuvered around every single blasted bull trap made in two sessions. The FED bails out weak companies, the government bails out what the FED can't afford to be seen bailing out, the government then crafts tentative laws where prices of corps are fixed until enough worthless money is pumped back into the markets to account for all of the losses. People short the hell out financials, they don't budge, and now the men who own the politicians rig the set.

It's Corporate Fascism. Not to mention going against everything this Country's tenets stand for, without letting weak companies fail and allowing competitors assume their business the deflationary cycles only get worse.

Buy it if you want to. Line your pockets! But know it's a sham and part and parcel of destroying what little is relevant of the U.S. Constitution!

It's Corporate Fascism. Not to mention going against everything this Country's tenets stand for, without letting weak companies fail and allowing competitors assume their business the deflationary cycles only get worse.

Buy it if you want to. Line your pockets! But know it's a sham and part and parcel of destroying what little is relevant of the U.S. Constitution!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.