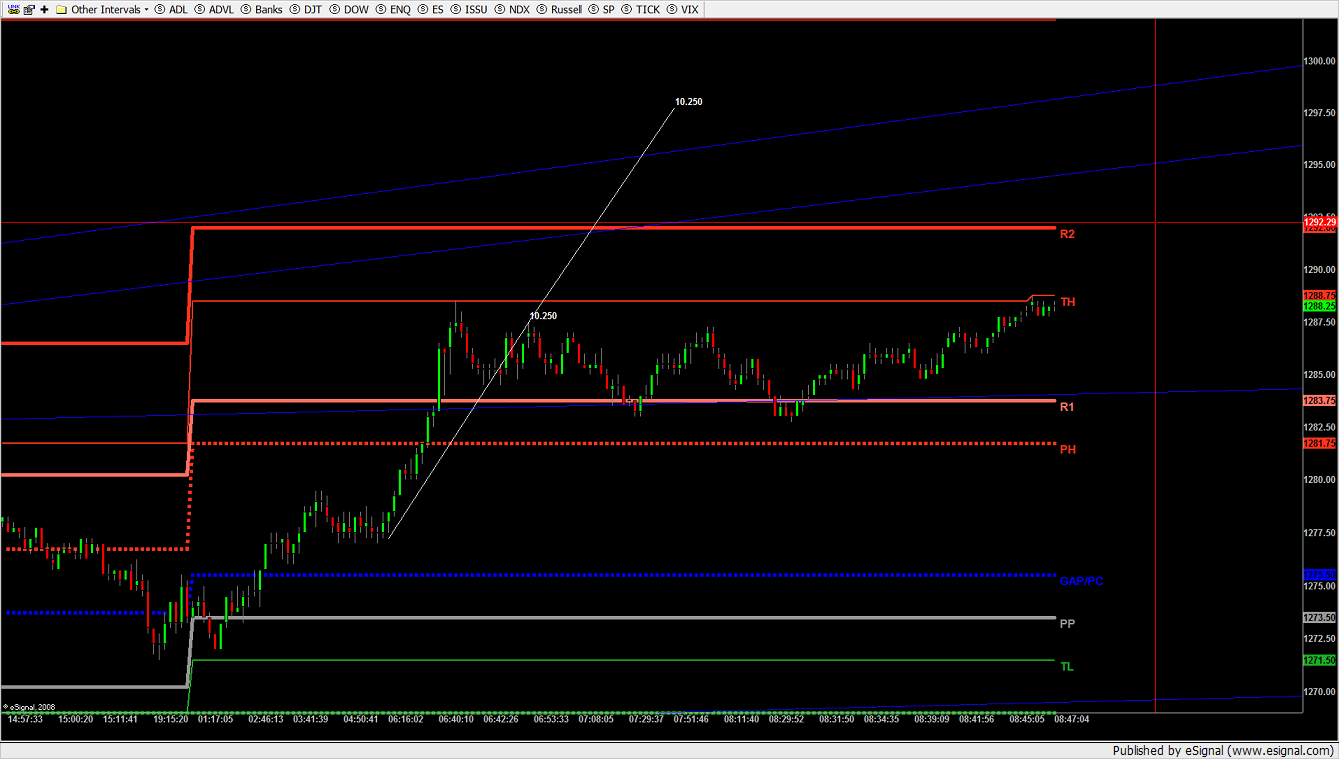

ES 8-22-08

Greener pastures? Maybe. I'm putting on the Ritz today and calling not only there not being a gap fill, at least in the morning session, but that we'll test and win 81.75 and see a high of at least 1285.75, and it'll be met at 12:45 PM.

A gap fill into the close seems likely in a certain weekend sell-off investors still learly and day traders principled.

Trading in Sunday's session in all probability will try to retrace to the upside starting the B wave and the opening range Monday will be decided from the bell selling was unfinished after letting bulls clean up bit; after which, a test and loss to this morning's low of 72 will jump start bulls to begin the bonafide third wave of the first impusle wherein 3 premium prices en route to correcting 1441 will ensue.

By Tuesday's afternoon session I expect to see prices near if not at the run's high. Third waves are fashioned by everyone already having shorted, short-covered, scalped, made their money driving prices to value and calling brothers to tell friends to call their brothers and friends to buy. It'll be on. Show up, and make some money.

{DISCLAIMER: None of The Above May Be True But May Be Permitted And Possible}

heh,heh

Good trading, all.

A gap fill into the close seems likely in a certain weekend sell-off investors still learly and day traders principled.

Trading in Sunday's session in all probability will try to retrace to the upside starting the B wave and the opening range Monday will be decided from the bell selling was unfinished after letting bulls clean up bit; after which, a test and loss to this morning's low of 72 will jump start bulls to begin the bonafide third wave of the first impusle wherein 3 premium prices en route to correcting 1441 will ensue.

By Tuesday's afternoon session I expect to see prices near if not at the run's high. Third waves are fashioned by everyone already having shorted, short-covered, scalped, made their money driving prices to value and calling brothers to tell friends to call their brothers and friends to buy. It'll be on. Show up, and make some money.

{DISCLAIMER: None of The Above May Be True But May Be Permitted And Possible}

heh,heh

Good trading, all.

The breakout level of the fourth wave has been breached already. A measured move would put price at 97.75. I suspect even it will be beaten but it's a conservative target.

selling 1292.00 if hit. buying 1285.25 if hit

kool why buy 85?

Bruce,

I noticed yesterday that the MP had 6 range extensions after the IB, and today we gap to the upside out of this bracketing market.....good call.

I noticed yesterday that the MP had 6 range extensions after the IB, and today we gap to the upside out of this bracketing market.....good call.

There's a gap to be filled 'round 78, the gap this morning was pretty small, those are usually filled.

thanks Joe...I get it right...sometimes.....lol...Dow trying to lead us out into the critical 90 - 92 zone..I reshorted 92.25 but don't like it...ticks showing no consistent low readings today.....this is a tricky spot for me

2 point stop. quick cover, if im lucky.

Excellent point Joe..consolidation leads to breakouts....so my fades are tougher today..so far it looks like a trend day but I'm still counting on them trying to fill in the 'b' a bit more...monitoring the 60 minute break is key today....especially if it comes from the obvious upside

quote:

Originally posted by CharterJoe

Bruce,

I noticed yesterday that the MP had 6 range extensions after the IB, and today we gap to the upside out of this bracketing market.....good call.

price projection popstocks, now negated (very short term)

could it be we close at that 1290.50 magnet?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.