11 July 2005 (Monday)

Session Start: Mon Jul 11 05:53:19 2005

Session Ident: #t1

[09:23:38] <guy> Pre-market ER2 chart

[09:23:45] <signal>

[09:23:49] <guy> shows us about to open well above the VAH

[09:24:24] <guy> Same chart for the ES

[09:24:33] <guy> shows us at VAH for the open ATM

[09:24:35] <signal>

[09:25:01] <guy> 5 minutes to open

[09:29:01] <guy> 1 minute to open

[09:29:33] <guy> Today's market comment

[09:29:38] <guy> Basically that comment points out that anybody who is short the ER2 (i.e. all open interest short in ER2) is losing money atm

[11:02:12] <guy> Monthly chart for russell 2000 cash index

[11:02:20] <signal>

[11:02:43] <guy> shows that russell 2000 cash is at record highs

[11:02:54] <guy> Monthly chart for s&p500 cash index:

[11:02:57] <signal>

[11:03:08] <guy> shows that we are still well off records for S&P500

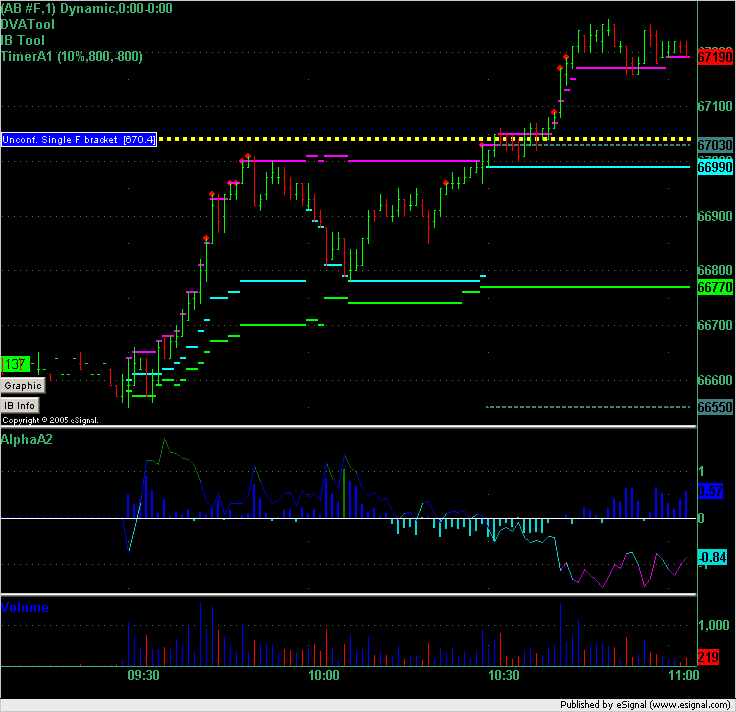

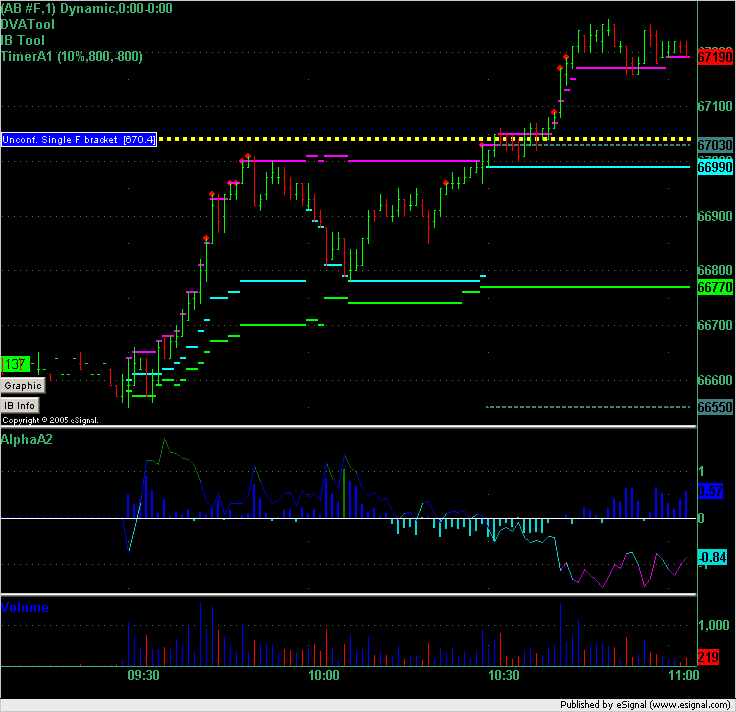

[11:04:16] <guy> Here is my 1min ER2 chart to now:

[11:04:25] <signal>

[11:04:36] <guy> I would have like to have bought the market at the 10am dip when alpha signaled a buy

[11:04:52] <guy> but i had technical/chart problems until then

[11:05:03] <guy> until now

[11:16:13] <guy> on ER2 we're coming up do DIBH here...

[11:19:25] <guy> Shorts ER2 @ 675.1

[11:19:39] <guy> exit stop set ER2 @ 676.1

[11:22:22] <guy> Covered all Short ER2 at 675 --> + 0.1

[11:23:26] <guy> I said in my morning market commentary that my bias is long

[11:24:05] <guy> and that DIBH short was a trade I wanted instant gratification on because we are still in a massive short squeeze

[11:24:23] <guy> remember that at the HOD - all shorts of the ER2 Sep contract are losing money

[11:24:41] <guy> that's why (IMO) the dips are safer to be bought

[11:26:03] <guy> each time the market dips you've got people doing what i've just done - buying the dip to get out of a short position or take early profits on a short from a bit higher

[11:26:16] <guy> and you've got the new entrants that want to get onto this bull

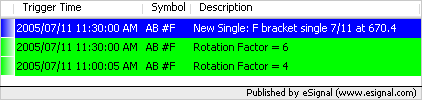

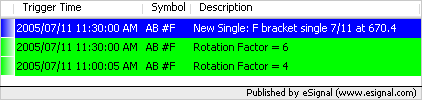

[11:42:31] <guy> Rotation Factors and new single print

[11:42:39] <signal>

[11:50:22] <guy> Innerworth: Self-Control: A Limited Resource

[12:04:55] <guy> .

[12:05:16] <guy> There is/was a bug in DVATool that I fixed this morning if anybody has a problem with it

[12:05:18] <guy> Indicators

[12:05:32] <guy> You can download latest version from there

[12:58:34] <guy> There was a single print long a few minutes ago at 12:51 ET at 672.8

[12:59:04] <guy> stop is 671.8

[13:07:10] <guy> single print stopped out

[14:30:01] <guy> Oil Futures closed

[14:43:27] <guy> Shorts ER2 @ 674.5

[14:44:35] <guy> exit stop set ER2 @ 675.5

[15:00:01] <guy> Bond Futures closed

[15:05:24] <guy> Covered 1/2 Short ER2 at 672.0 --> + 2.5

[15:05:38] <guy> exit stop moved to breakeven ER2 @ 674.5

[15:21:26] <guy> single print long at 15:20 at 670.5

[15:21:36] <guy> i'm still short

[15:24:30] <guy> exit stop lowered ER2 @ 673.1

[15:25:54] <mikee> i have very strong signal for tonight/o/n and it's down

[15:26:19] <guy> thanks mike

[15:26:28] <mikee> sure

[15:26:32] <guy> is it oscillator based?

[15:26:37] <guy> or fib?

[15:27:13] <mikee> it's ssame as it was on friday, but opposite,- just remember it's basically short term signal

[15:27:57] <mikee> no guy, we discussed it long time ago, it based on bonds/yield

[15:28:33] <mikee> so i'll short close

[15:28:57] <guy> thanks mike

[15:29:26] <mikee> sure, probability somewhere around 60-65%

[15:32:50] <guy> Covered remainder Short ER2 at 672.5 --> + 2

[15:33:48] <guy> single print takes +2 at 672.5 and moves stop to b/e

[15:56:09] <borisfen> Guy would you please post your chart again

[15:58:19] <guy> ER2 now:

[15:58:36] <signal>

[15:59:12] <borisfen> thank you guy

[15:59:36] <guy> y/w

[16:00:18] <borisfen> do i need to have esignal in order to run your indikators?

[16:01:09] <guy> yes borisfen

[16:01:50] <guy> Here is the download page: Download

[16:02:12] <guy> If you don't have eSignal then you can get a free trial and try the indicators at the same time

[16:02:32] <borisfen> il definitely try

[16:02:45] <guy> eSignal Free Trial

[16:02:59] <guy> If you take the free trial through that link

[16:03:23] <borisfen> im in your room about one year and you start trading er2 lately

[16:03:27] <guy> then the referal credit that esignal give me i pass back to you in free use of the indicators to the value of the referal fee

[16:03:34] <borisfen> but you trade es before

[16:03:57] <guy> yes - i've moved to ER2 because a lot of traders that I have a lot of respect for have moved to ER2

[16:04:14] <guy> and I have found it to be what ES used to be

[16:04:28] <guy> to be a day trader you need volatility

[16:04:33] <borisfen> nice site by the way

[16:04:35] <guy> and the volatility is higher in the ER2 than ES

[16:04:39] <guy> thanks borisfen

[16:04:41] <borisfen> agree

[16:05:14] <guy> if you look at Daily Notes and looks at Range % then you can compare volatility across all the symbols

[16:05:45] <mikee> gn

[16:05:52] <guy> gn mikee

[16:05:53] <guy> Daily Notes

[16:06:22] <borisfen> guy i see you making no more then 3-4 trades a day

[16:06:33] <borisfen> very impressive

[16:07:10] <guy> Instrument ES NQ YM ER2

[16:07:10] <guy> RANGE % 1.4% 2.3% 1.6% 2.3%

[16:07:39] <guy> So yo can see that ES is the least volatile of the 4 index futures

[16:07:48] <guy> and the ER2 is most volatile

[16:08:10] <guy> yes borisfen - trying to only take high probability setups

[16:08:21] <guy> haven't been doing well over last few weeks though

[16:11:42] <guy> other single print contract taken off at 674.0

[16:12:01] <guy> which is what i believe the traded price at or after 16:00:00 was

[16:12:36] <guy> no - it was 674.1

[16:15:11] <guy> gn all

[16:17:16] * Disconnected

Session Close: Mon Jul 11 16:17:19 2005

Session Ident: #t1

[09:23:38] <guy> Pre-market ER2 chart

[09:23:45] <signal>

[09:23:49] <guy> shows us about to open well above the VAH

[09:24:24] <guy> Same chart for the ES

[09:24:33] <guy> shows us at VAH for the open ATM

[09:24:35] <signal>

[09:25:01] <guy> 5 minutes to open

[09:29:01] <guy> 1 minute to open

[09:29:33] <guy> Today's market comment

[09:29:38] <guy> Basically that comment points out that anybody who is short the ER2 (i.e. all open interest short in ER2) is losing money atm

[11:02:12] <guy> Monthly chart for russell 2000 cash index

[11:02:20] <signal>

[11:02:43] <guy> shows that russell 2000 cash is at record highs

[11:02:54] <guy> Monthly chart for s&p500 cash index:

[11:02:57] <signal>

[11:03:08] <guy> shows that we are still well off records for S&P500

[11:04:16] <guy> Here is my 1min ER2 chart to now:

[11:04:25] <signal>

[11:04:36] <guy> I would have like to have bought the market at the 10am dip when alpha signaled a buy

[11:04:52] <guy> but i had technical/chart problems until then

[11:05:03] <guy> until now

[11:16:13] <guy> on ER2 we're coming up do DIBH here...

[11:19:25] <guy> Shorts ER2 @ 675.1

[11:19:39] <guy> exit stop set ER2 @ 676.1

[11:22:22] <guy> Covered all Short ER2 at 675 --> + 0.1

[11:23:26] <guy> I said in my morning market commentary that my bias is long

[11:24:05] <guy> and that DIBH short was a trade I wanted instant gratification on because we are still in a massive short squeeze

[11:24:23] <guy> remember that at the HOD - all shorts of the ER2 Sep contract are losing money

[11:24:41] <guy> that's why (IMO) the dips are safer to be bought

[11:26:03] <guy> each time the market dips you've got people doing what i've just done - buying the dip to get out of a short position or take early profits on a short from a bit higher

[11:26:16] <guy> and you've got the new entrants that want to get onto this bull

[11:42:31] <guy> Rotation Factors and new single print

[11:42:39] <signal>

[11:50:22] <guy> Innerworth: Self-Control: A Limited Resource

[12:04:55] <guy> .

[12:05:16] <guy> There is/was a bug in DVATool that I fixed this morning if anybody has a problem with it

[12:05:18] <guy> Indicators

[12:05:32] <guy> You can download latest version from there

[12:58:34] <guy> There was a single print long a few minutes ago at 12:51 ET at 672.8

[12:59:04] <guy> stop is 671.8

[13:07:10] <guy> single print stopped out

[14:30:01] <guy> Oil Futures closed

[14:43:27] <guy> Shorts ER2 @ 674.5

[14:44:35] <guy> exit stop set ER2 @ 675.5

[15:00:01] <guy> Bond Futures closed

[15:05:24] <guy> Covered 1/2 Short ER2 at 672.0 --> + 2.5

[15:05:38] <guy> exit stop moved to breakeven ER2 @ 674.5

[15:21:26] <guy> single print long at 15:20 at 670.5

[15:21:36] <guy> i'm still short

[15:24:30] <guy> exit stop lowered ER2 @ 673.1

[15:25:54] <mikee> i have very strong signal for tonight/o/n and it's down

[15:26:19] <guy> thanks mike

[15:26:28] <mikee> sure

[15:26:32] <guy> is it oscillator based?

[15:26:37] <guy> or fib?

[15:27:13] <mikee> it's ssame as it was on friday, but opposite,- just remember it's basically short term signal

[15:27:57] <mikee> no guy, we discussed it long time ago, it based on bonds/yield

[15:28:33] <mikee> so i'll short close

[15:28:57] <guy> thanks mike

[15:29:26] <mikee> sure, probability somewhere around 60-65%

[15:32:50] <guy> Covered remainder Short ER2 at 672.5 --> + 2

[15:33:48] <guy> single print takes +2 at 672.5 and moves stop to b/e

[15:56:09] <borisfen> Guy would you please post your chart again

[15:58:19] <guy> ER2 now:

[15:58:36] <signal>

[15:59:12] <borisfen> thank you guy

[15:59:36] <guy> y/w

[16:00:18] <borisfen> do i need to have esignal in order to run your indikators?

[16:01:09] <guy> yes borisfen

[16:01:50] <guy> Here is the download page: Download

[16:02:12] <guy> If you don't have eSignal then you can get a free trial and try the indicators at the same time

[16:02:32] <borisfen> il definitely try

[16:02:45] <guy> eSignal Free Trial

[16:02:59] <guy> If you take the free trial through that link

[16:03:23] <borisfen> im in your room about one year and you start trading er2 lately

[16:03:27] <guy> then the referal credit that esignal give me i pass back to you in free use of the indicators to the value of the referal fee

[16:03:34] <borisfen> but you trade es before

[16:03:57] <guy> yes - i've moved to ER2 because a lot of traders that I have a lot of respect for have moved to ER2

[16:04:14] <guy> and I have found it to be what ES used to be

[16:04:28] <guy> to be a day trader you need volatility

[16:04:33] <borisfen> nice site by the way

[16:04:35] <guy> and the volatility is higher in the ER2 than ES

[16:04:39] <guy> thanks borisfen

[16:04:41] <borisfen> agree

[16:05:14] <guy> if you look at Daily Notes and looks at Range % then you can compare volatility across all the symbols

[16:05:45] <mikee> gn

[16:05:52] <guy> gn mikee

[16:05:53] <guy> Daily Notes

[16:06:22] <borisfen> guy i see you making no more then 3-4 trades a day

[16:06:33] <borisfen> very impressive

[16:07:10] <guy> Instrument ES NQ YM ER2

[16:07:10] <guy> RANGE % 1.4% 2.3% 1.6% 2.3%

[16:07:39] <guy> So yo can see that ES is the least volatile of the 4 index futures

[16:07:48] <guy> and the ER2 is most volatile

[16:08:10] <guy> yes borisfen - trying to only take high probability setups

[16:08:21] <guy> haven't been doing well over last few weeks though

[16:11:42] <guy> other single print contract taken off at 674.0

[16:12:01] <guy> which is what i believe the traded price at or after 16:00:00 was

[16:12:36] <guy> no - it was 674.1

[16:15:11] <guy> gn all

[16:17:16] * Disconnected

Session Close: Mon Jul 11 16:17:19 2005

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.