Entries for present volatility.

I have found that with present movements is best "for me" to enter with a smaller amount and add to it when it starts going my way. Than going all in at once. Any thoughts?

This is the main principal discussed in Phantom of the Pits. In Rule Two Phantom of the Pits states PRESS YOUR WINNERS CORRECTLY WITHOUT EXCEPTION.

cool, I will read the whole thing, thanks.

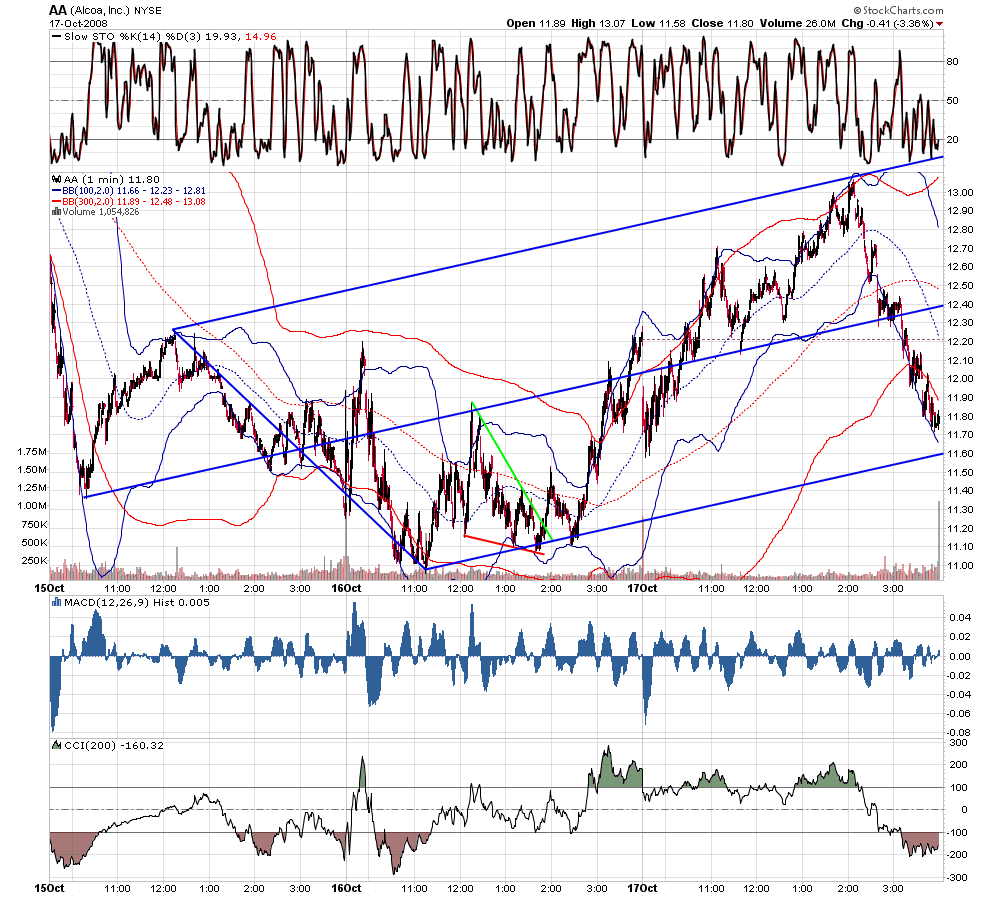

though the floor i trade on is backed by GS,in recent day the etf's have been unavailable to short leaving me at the mercy of the inverse etf's.. not my choice... my solution has been to find beaten down issues that still mirror the indexes...there i can still trade in size, logically using a ten cent stop, and still capture the almost 20% swings...a few examples. in both cases entries on retest of line , a common medianline technique.. note... i am not a fuures trader by choice.. i know that if i traded futures i would never sleep..

i should have been more exact.. i like to trade issues ican be long or short without any problem... thus the entries shown were longs the reversals at top were short AA and a reversal via etf in other...still a scramble..

quote:

Originally posted by roofer

though the floor i trade on is backed by GS.....

What does one have to do to trade on a GS floor? Are you a hedge fund trader?

trade on small floor that is backed by GS... they hold the money and provide shares to lend... just a private trader..

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.