Trading the RTH Open

The RTH Open (9:30 EST) is an interesting point of entry. To make money we need 4 things 1. Time 2. Price 3. Volume 4. Direction. One benefit of trading the open is that the trader has a forced entry as the time, price and volume portion of entry is taken care of. Secondly you can chose to trade once only and keep yourself stress free for the rest of the day. So all we have to look for is a profitable direction. Now the question is whether to buy or sell the 9:30 Open. Various options are 1) Trade in the direction of previous day RTH close (4:15 EST)(Gap fill theory). 2) Trade towards the previous days RTH Open (Volume is the biggest magnet). Trade reverse of the 9:29 EST candle i.e. if it is a Red Candle Buy and if Green Sell or reverse i.e. SELL for Red and Buy for Green. I look forward to your inputs

quote:

Originally posted by ak1

What is a 3 bar reversal??

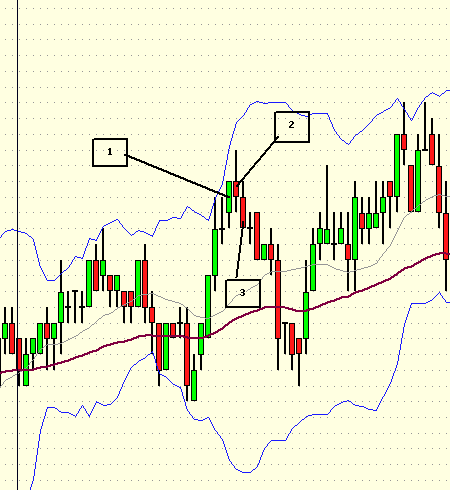

Here's a snapshot ak

Thanks everyone

heres one more from williams but I think they explain it well for you already

http://books.google.com/books?id=DYDSTEuElhIC&pg=PA16&lpg=PA16&dq=%22ringed%22+highs&source=bl&ots=Zf2IKo4FBJ&sig=4odRhVcB9kcWlor1NVA8AQO9obQ&hl=en&ei=P004SoPzFI_KlAfmpPXtDQ&sa=X&oi=book_result&ct=result&resnum=5

http://books.google.com/books?id=DYDSTEuElhIC&pg=PA16&lpg=PA16&dq=%22ringed%22+highs&source=bl&ots=Zf2IKo4FBJ&sig=4odRhVcB9kcWlor1NVA8AQO9obQ&hl=en&ei=P004SoPzFI_KlAfmpPXtDQ&sa=X&oi=book_result&ct=result&resnum=5

Beautiful trade

08:30:03 SELL_LIMIT 907.25

08:56:22 BUY_LIMIT 903.25

08:30:03 SELL_LIMIT 907.25

08:56:22 BUY_LIMIT 903.25

The market repeated the trade to the "T" again but this time with less resistance

I have the 9:29 EST as an up bar so in theory you would be long at the open print....we spoke about data difference already

No Bruce up meaning green bar right!! we go short.

On 26th May RHT Opened at 878.50 a level not retested so far. Thus 880-878 could be a possible target for the markets in the near future.

ak1. That's two in a row isn't it? Good deal. Very interesting.

Yes Rooki, no indicator mumbo jumbo.LOL!!! Give or take 4 points. Yesterday I tried a trailing stop and got stopped out making only 1.5 pts where as I could have made 4pts. So do it with an "IRON HEART". Here is yerterday's trade

08:30:04 SELL_LIMIT 923.50

08:41:10 BUY_STOP 922.00

08:30:04 SELL_LIMIT 923.50

08:41:10 BUY_STOP 922.00

thank you stockster.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.