eminiviper.com

I started this topic because some questions I asked and answers I got from cba33558 were getting lost in this rather extensive topic here:

http://www.mypivots.com/forum/topic.asp?TOPIC_ID=2300&whichpage=30

We started this discussion on page 30 of that thread, and I thought I'd move it here so we can continue it (since no one took me up on my offer to start this thread). I'll cut and paste the three posts made after cba33558 posted a chart about eminiviper.com

From 6/8/09:

jimkane: Hey, cba. I checked out that EminiViper.com page. Very impressive. Seems like they don't have any losing days, or even losing trades (or do they not post those?). Is that so? If not, how many stop outs or false signals are you seeing on an average day? It doesn't mean much to me to see winners, I am more interested in the losers I have to take to get those winners. Also, are you the owner of EminiViper.com, or do you work for them? If not, what is your association? If I don't ask, that will likely be the first question from everyone else. Thanks.

cba33558: Hey Jim -

Thanks for visiting the Web site and offering your constructive questions and feedback...

The videos are intended to show the NQ Emini trades that are triggered by the system each day. Currently the system is designed to issue trade signals only the Nasdaq Emini. In addition to the Viper indicator, the system uses a combination of guidance charts and a trading chart that very rarely has a losing trade. With all of these constraints, it should be noted however, that there are not many signals that trigger in any given trading day. Depending on the volatility - usually one or two trades may trigger - a busy day would be 3 trades.

The entire trading system is not shown in the videos; however, all of the details regarding these trade signals are shown in an eBook and training videos. The actual trade signals themselves are analyzed in real-time in the live Webinars. The entire goal of this system was accuracy - not catching every trade.

In answer to your other question, I have been a trader for a little over 12 years now, I am a partner in the firm; and was involved extensively in developing, actively trading and back-testing the Viper system over the past year and a half.

Once again, thank you for your input, and I look forward to opportunity of respectfully participating in your Forum...

jimkane: Thanks for the response, cba. Wow, those are some incredibly impressive stats. Given these are intraday trend trades, it's almost incomprehensible to me. My style is intraday trend trading, and with the 3 to 5 to 1 or sometimes higher reward/risk profiles I'm happy anywhere in the 30% to 50% winners range.

I have a few more questions. Is there a way to follow along and see live trade signals the moment they develop, on a trial basis? The web site mentions visiting a live webinar for a day. Would one see live signals in time to act, or only after they have started? What if no signals are generated that day, can someone try another day? It's very hard to evaluate a system with a one-day trial, especially one that generates only a few signals.

Next, what is the difference between live webinars and live trading room, as far as signals given in real-time? Also, if one signs on to your room and gets all that training, does that do any good without the software? What is the cost of the license, since the website doesn't specify this? I'd love to follow along real-time for a period and evaluate your system, but I'm not sure you have any provisions where I could do that without laying out money first. Again, if I don't ask all these questions, someone else will. Since I'm probably the longest-winded character at this forum, I figured I'd just get the ball rolling. It's not often I hear about a system that has almost no losers at all.

Lastly, if we go much further with this discussion it may be appropriate to move it from this thread to one you or someone else could create in Trading Advisory Services.

http://www.mypivots.com/forum/topic.asp?TOPIC_ID=2300&whichpage=30

We started this discussion on page 30 of that thread, and I thought I'd move it here so we can continue it (since no one took me up on my offer to start this thread). I'll cut and paste the three posts made after cba33558 posted a chart about eminiviper.com

From 6/8/09:

jimkane: Hey, cba. I checked out that EminiViper.com page. Very impressive. Seems like they don't have any losing days, or even losing trades (or do they not post those?). Is that so? If not, how many stop outs or false signals are you seeing on an average day? It doesn't mean much to me to see winners, I am more interested in the losers I have to take to get those winners. Also, are you the owner of EminiViper.com, or do you work for them? If not, what is your association? If I don't ask, that will likely be the first question from everyone else. Thanks.

cba33558: Hey Jim -

Thanks for visiting the Web site and offering your constructive questions and feedback...

The videos are intended to show the NQ Emini trades that are triggered by the system each day. Currently the system is designed to issue trade signals only the Nasdaq Emini. In addition to the Viper indicator, the system uses a combination of guidance charts and a trading chart that very rarely has a losing trade. With all of these constraints, it should be noted however, that there are not many signals that trigger in any given trading day. Depending on the volatility - usually one or two trades may trigger - a busy day would be 3 trades.

The entire trading system is not shown in the videos; however, all of the details regarding these trade signals are shown in an eBook and training videos. The actual trade signals themselves are analyzed in real-time in the live Webinars. The entire goal of this system was accuracy - not catching every trade.

In answer to your other question, I have been a trader for a little over 12 years now, I am a partner in the firm; and was involved extensively in developing, actively trading and back-testing the Viper system over the past year and a half.

Once again, thank you for your input, and I look forward to opportunity of respectfully participating in your Forum...

jimkane: Thanks for the response, cba. Wow, those are some incredibly impressive stats. Given these are intraday trend trades, it's almost incomprehensible to me. My style is intraday trend trading, and with the 3 to 5 to 1 or sometimes higher reward/risk profiles I'm happy anywhere in the 30% to 50% winners range.

I have a few more questions. Is there a way to follow along and see live trade signals the moment they develop, on a trial basis? The web site mentions visiting a live webinar for a day. Would one see live signals in time to act, or only after they have started? What if no signals are generated that day, can someone try another day? It's very hard to evaluate a system with a one-day trial, especially one that generates only a few signals.

Next, what is the difference between live webinars and live trading room, as far as signals given in real-time? Also, if one signs on to your room and gets all that training, does that do any good without the software? What is the cost of the license, since the website doesn't specify this? I'd love to follow along real-time for a period and evaluate your system, but I'm not sure you have any provisions where I could do that without laying out money first. Again, if I don't ask all these questions, someone else will. Since I'm probably the longest-winded character at this forum, I figured I'd just get the ball rolling. It's not often I hear about a system that has almost no losers at all.

Lastly, if we go much further with this discussion it may be appropriate to move it from this thread to one you or someone else could create in Trading Advisory Services.

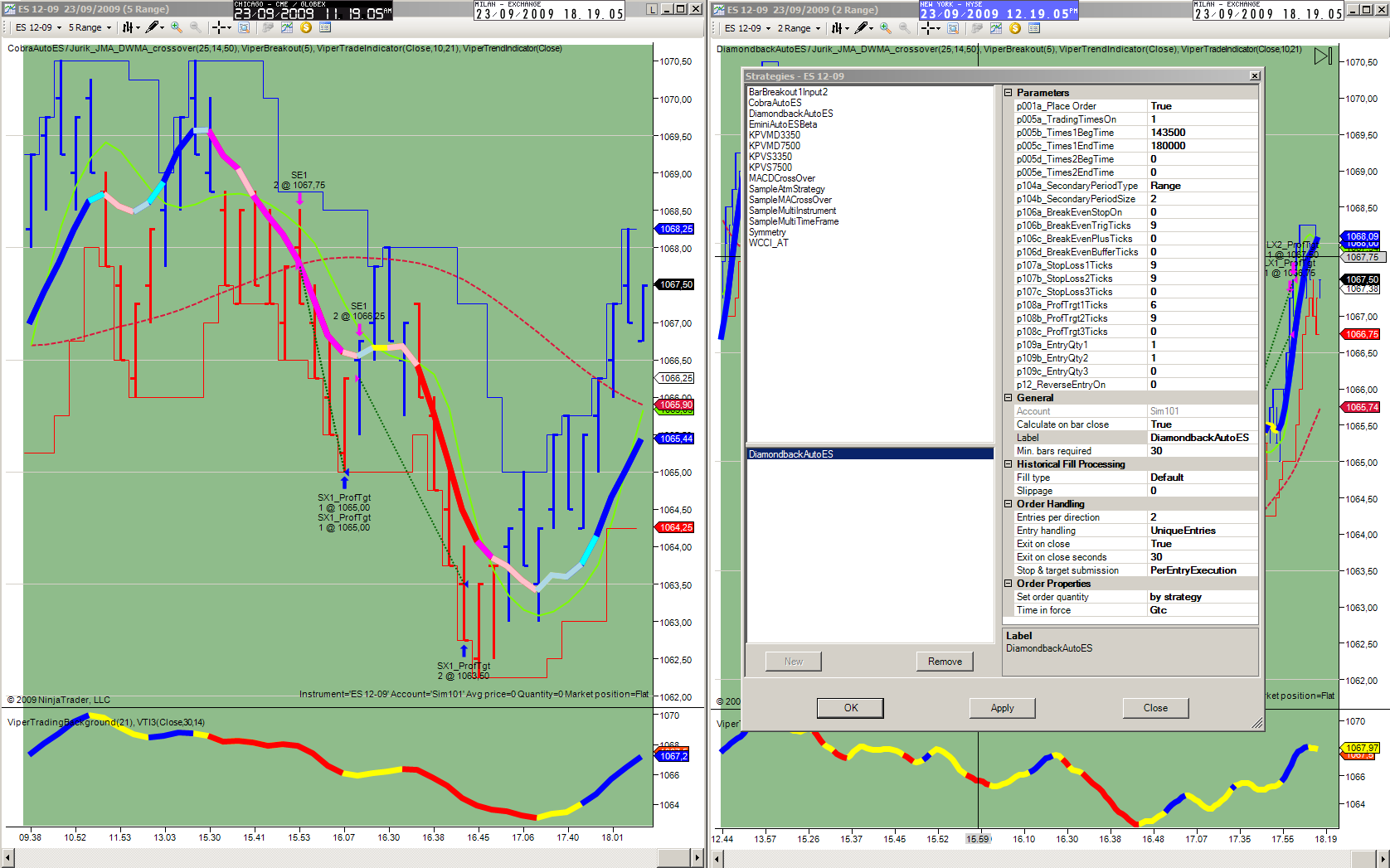

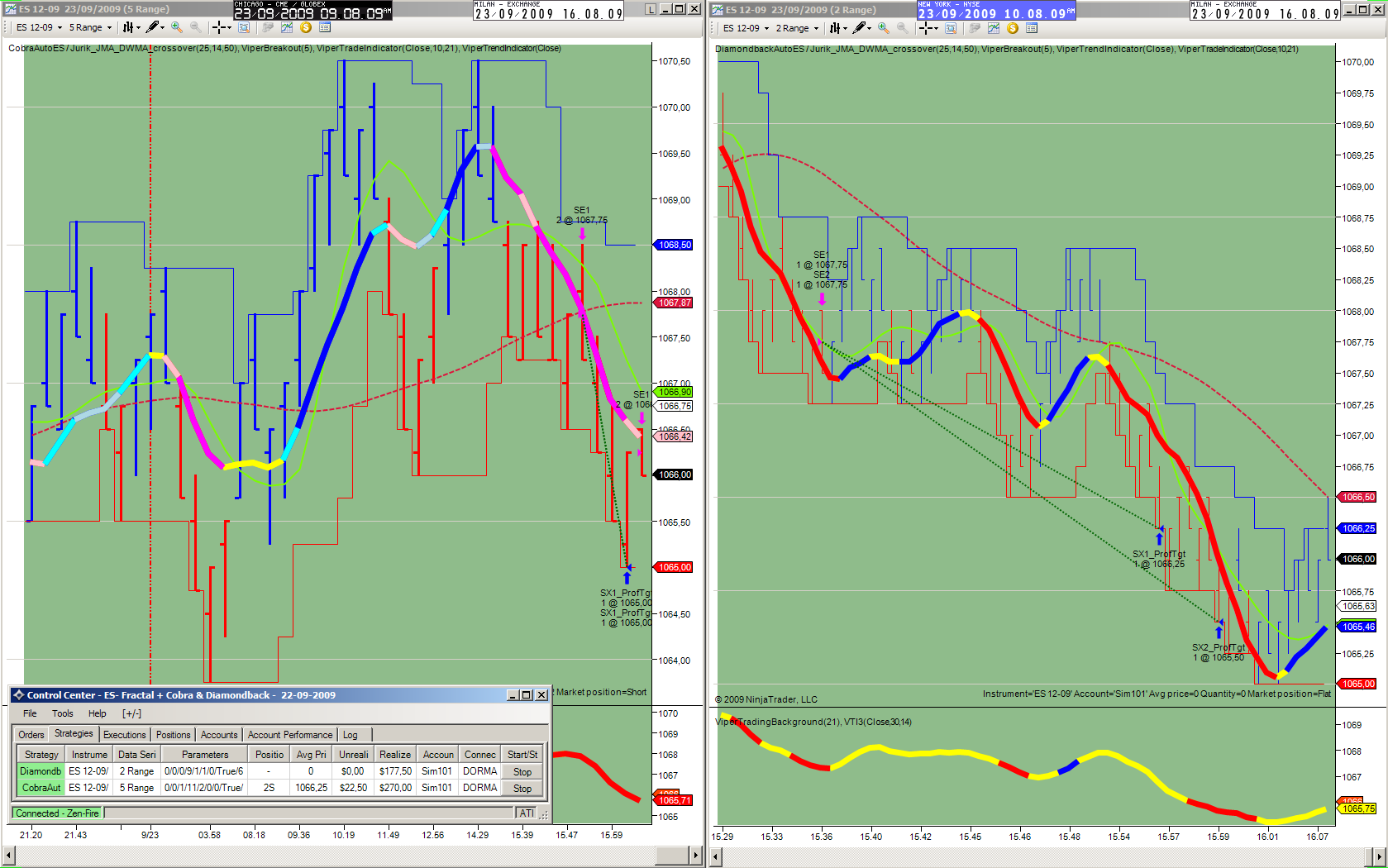

Here the results for today section as per the original settings of both strategies as received from developer :

this is Pc #3

please take note that time frame action is for Cobra from 5.35.00 am PST to 8.30.00 am PST

and

for DiamondBack is from 5.35.00 am PST and 9.00.00 am PST .

settings are as received .

will follow other info .

thanks

alinghy

this is Pc #3

please take note that time frame action is for Cobra from 5.35.00 am PST to 8.30.00 am PST

and

for DiamondBack is from 5.35.00 am PST and 9.00.00 am PST .

settings are as received .

will follow other info .

thanks

alinghy

x HotYogaMan

not brave inhaff to touch the sky but

lust good to get in one hour and 1/2

yeasterday more than what you get in 3

I say, 3 days .

the rest of the day was not good

but strating is what count at the end .....

cheers

Alinghy

not brave inhaff to touch the sky but

lust good to get in one hour and 1/2

yeasterday more than what you get in 3

I say, 3 days .

the rest of the day was not good

but strating is what count at the end .....

cheers

Alinghy

x HotYogaMan

at the end what I need to say is : I learn every every day

from You and from the other Colleagues as well .

this is the interesting and usefull reason this Forum I think

..............EXISTS !

thanks to All of you

Alinghy

at the end what I need to say is : I learn every every day

from You and from the other Colleagues as well .

this is the interesting and usefull reason this Forum I think

..............EXISTS !

thanks to All of you

Alinghy

Opss .. before I uploaded perhaps to many charts in one shot .

sorry for that .

Here the results for today section as per the original settings of both strategies as received from developer :

this is Pc #3

please take note that time frame action is for Cobra from 5.35.00 am PST to 8.30.00 am PST

and

for DiamondBack is from 5.35.00 am PST and 9.00.00 am PST .

settings are as received .

will follow other info .

thanks

alinghy

sorry for that .

Here the results for today section as per the original settings of both strategies as received from developer :

this is Pc #3

please take note that time frame action is for Cobra from 5.35.00 am PST to 8.30.00 am PST

and

for DiamondBack is from 5.35.00 am PST and 9.00.00 am PST .

settings are as received .

will follow other info .

thanks

alinghy

quote:

Originally posted by phantasmagoria

pt, you may want to refer to the AT instruction video.

http://www.vipertradingsystems.com/Autotrader.html

Well here is the dilemma. Using the default settings last week produced good results, a couple days last week achieved above a 70% win percentage. So, If we change the default settings on the viper system now, because it hit a rough patch for a couple of days this week, then it negates the results from all last week. Also, what settings would we change the viper to exactly ? Who is to say that the old settings from last week might not all of a sudden start working again tomorrow ? Do we then change the settings back in reaction to that turn of events ?

This is the problem with adjusting system parameters "on the fly" in reaction to the last trade result. Your never sure when the new set of curve fit parameters will "go bad" on you, and your never sure what the new set of curve fit parameters should be in advance, only in hindsight at the end of the day.

Back in the old days this was called a system stability problem. You can produce a 3-D map of the system parameter landscape, and what you want is a nice flat plataue indicating a low sensitivity of the system to the parameter settings. This means there is a wide margin of parameter settings that are profitable. I suspect, given the large number of parameters (degrees of freedom) built into viper, the 3-D map of viper is anything but stable. In which case, no amount of parameter curve fitting is going to solve this fundamental stability problem.

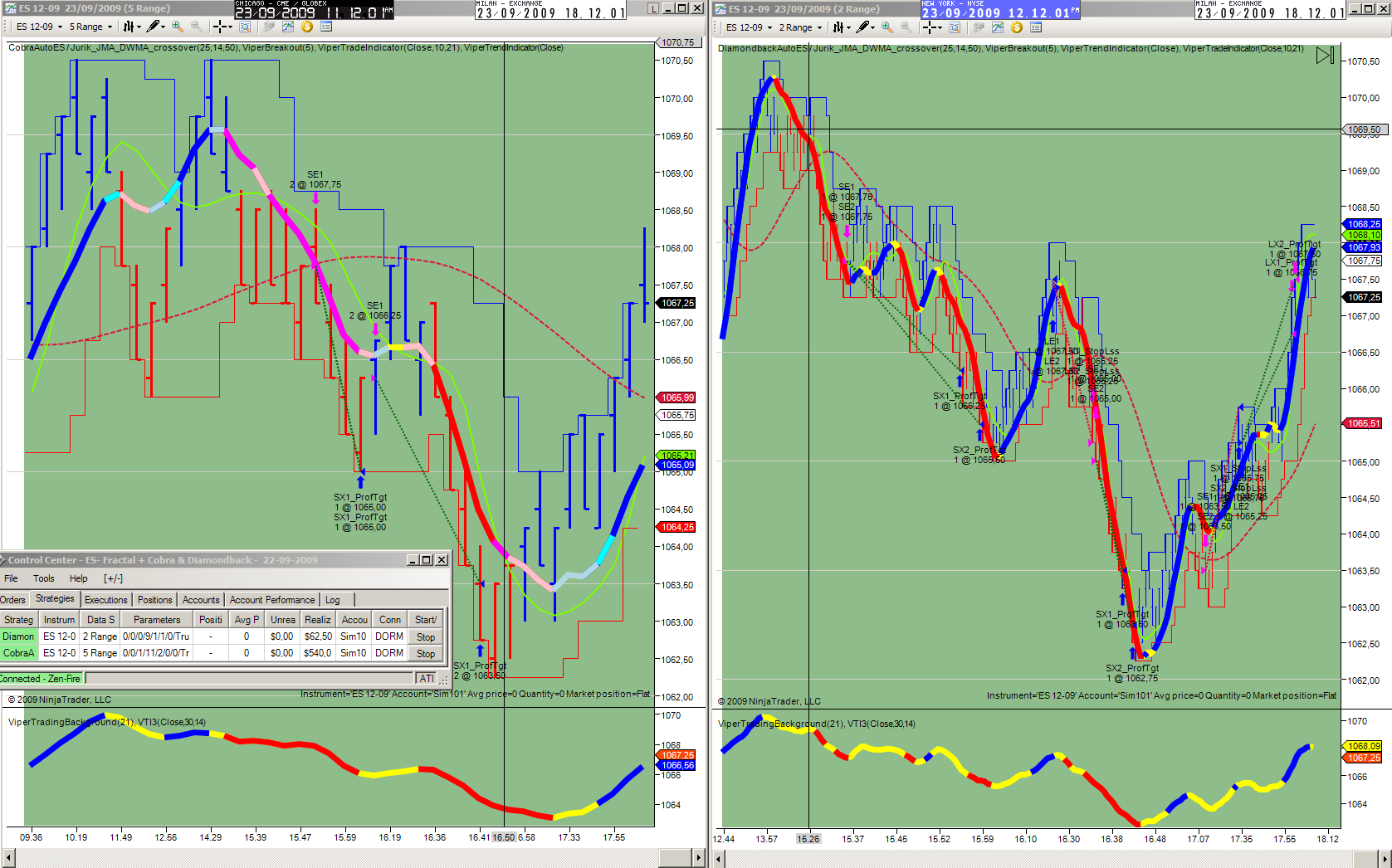

Hi All

final situation for DiamondBack today : please consider time frame

settled up was from 5.35.00 am PST to 12.45.00 am PST

I splitted the day story in 3 images because I am experimenting

troubbles after upload, today .

best

Alinghy

final situation for DiamondBack today : please consider time frame

settled up was from 5.35.00 am PST to 12.45.00 am PST

I splitted the day story in 3 images because I am experimenting

troubbles after upload, today .

best

Alinghy

quote:Hey, PT, good observations. Over the years I've tried to explain to many holy grail seeking newbies about moving average crossover 'systems'. They'd insist they were close to the grail, and I'd tell them they'd be better off spending their time actually working on learning how to trade. Anyway, the short version of what I told them was that for any given period, a day, a week, a month, a decade, there is pretty much always at least one setting for the averages that will have the system profitable, usually wildly profitable. The problem is, this setting is different for just about every lookback period. One has to choose from what might be hundreds or even thousands of settings to find the one, or the small group, that 'works'. In hindsight this can always be found, but for real trading today, how do you know which one to choose? You don't, and never will know. This is a paradoxical mathematical puzzle, and the grail seekers can't see this. It has no solution. Yet it still sucks in endless numbers of people who are determined that they can find the parameters. What you described above reminded me of this very same dilemma.

Originally posted by pt_emini

quote:

Originally posted by phantasmagoria

pt, you may want to refer to the AT instruction video.

http://www.vipertradingsystems.com/Autotrader.html

Well here is the dilemma. Using the default settings last week produced good results, a couple days last week achieved above a 70% win percentage. So, If we change the default settings on the viper system now, because it hit a rough patch for a couple of days this week, then it negates the results from all last week. Also, what settings would we change the viper to exactly ? Who is to say that the old settings from last week might not all of a sudden start working again tomorrow ? Do we then change the settings back in reaction to that turn of events ?

This is the problem with adjusting system parameters "on the fly" in reaction to the last trade result. Your never sure when the new set of curve fit parameters will "go bad" on you, and your never sure what the new set of curve fit parameters should be in advance, only in hindsight at the end of the day.

Back in the old days this was called a system stability problem. You can produce a 3-D map of the system parameter landscape, and what you want is a nice flat plataue indicating a low sensitivity of the system to the parameter settings. This means there is a wide margin of parameter settings that are profitable. I suspect, given the large number of parameters (degrees of freedom) built into viper, the 3-D map of viper is anything but stable. In which case, no amount of parameter curve fitting is going to solve this fundamental stability problem.

I'm trying not to jump into the fray on the Viper here, but let me make one general comment. This comment seems to go for nothing for most people, and I guess that's good, because that's what makes a market. When you see how many algos, programs, quants, computers, and so on are watching every tick of this market, is it possible to find any simply coded system that one would then offer to the public (meaning it can be reverse engineered quickly by the big money players), and it is actually going to print money for you? To me, that's ludicrous. I think, perhaps, the reason why so many continue to believe, and continue to work on this, is because at any given time there will be a 'system' that is just an absolute money machine. It's the siren song of that that keeps them coming, keeps them believing. In my experience and opinion, and that's all it is, there is only one thing that will ever allow one to be successful at trading over the long haul, and that is skill. Personal talent. That's the one thing the market can't defend against. And it doesn't need to, because very, very few will ever do what it takes to develop that talent, and even at that, that talent will allow a living, perhaps, but it surely won't let one 'suck the market dry'. Just some Jim-isms here for those that like to listen to my ramblings.

I wish I could be as diplomatic as Mr. Kane and pt, but that's not my style.

This system will never get traction for the irrefutable reasons pt states and I mentioned earlier in this thread. You cannot take garden variety lagging indicators and miraculously curve fit them to consistent success.

The manual Viper system was changed at least a half dozen times and still requires a whole lot of discretion on whether or not to take a trade.

Now the AT is being tested and it, too, (as I predicted)will be optomized and curve fitted ad nauseum to allow the Viper owners the opportunity to post inherently misleading videos on how great the system performed. Yesterday, it was trade it all day, today it's before lunch and tomorrow, it will be trade every other 18 minute cycles.

The Viper marketing method lacks any resemblance to ethical practices as witnesed by the testimonials written by the owners on the website (which have been subsequently removed after exposure in this thread).

This system will never get traction for the irrefutable reasons pt states and I mentioned earlier in this thread. You cannot take garden variety lagging indicators and miraculously curve fit them to consistent success.

The manual Viper system was changed at least a half dozen times and still requires a whole lot of discretion on whether or not to take a trade.

Now the AT is being tested and it, too, (as I predicted)will be optomized and curve fitted ad nauseum to allow the Viper owners the opportunity to post inherently misleading videos on how great the system performed. Yesterday, it was trade it all day, today it's before lunch and tomorrow, it will be trade every other 18 minute cycles.

The Viper marketing method lacks any resemblance to ethical practices as witnesed by the testimonials written by the owners on the website (which have been subsequently removed after exposure in this thread).

Hello moderators;

This page is BAD,

the charts are NEVER loaded.

I have tried to see this page at least fifteen times yesterday and today. No success.

The small square boxes representing the charts display that they were seen ZERO times.

You guys got to do something to fix it.

cheers....

This page is BAD,

the charts are NEVER loaded.

I have tried to see this page at least fifteen times yesterday and today. No success.

The small square boxes representing the charts display that they were seen ZERO times.

You guys got to do something to fix it.

cheers....

Hello Alinghy;

it appears that your charts are huge,

and this server cannot handle them.

Please consider to load only 2 charts per page, (as it has worked in the past),

OR

you may load the charts on your account at flickr.com (it takes only 1 minute to start an account - it is free)

and then post the link (URL) to the chart here,

like this:

cheers..

it appears that your charts are huge,

and this server cannot handle them.

Please consider to load only 2 charts per page, (as it has worked in the past),

OR

you may load the charts on your account at flickr.com (it takes only 1 minute to start an account - it is free)

and then post the link (URL) to the chart here,

like this:

cheers..

Sorry this reply is 2-years late but I just joined the forum.

I know from personal experience that GoToMeeting and GoToWebinar default to showing all users and all comments unless specifically disabled by the Host.

If they're saying what was reported that's a blatant lie.

I know from personal experience that GoToMeeting and GoToWebinar default to showing all users and all comments unless specifically disabled by the Host.

If they're saying what was reported that's a blatant lie.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.