Impossible to make a successful career trading

Starting a new thread at the recommendation of the moderator.

Hey MM...

Better tell Paul Rotter to stop while he's $60 Million per year ahead. If you're interested, just google his name. According to you - this guy is the luckiest SOB there is.

http://i-found-my-holygrail.blogspot.com/2005/09/worlds-most-successful-trader-paul.html

Better tell Paul Rotter to stop while he's $60 Million per year ahead. If you're interested, just google his name. According to you - this guy is the luckiest SOB there is.

http://i-found-my-holygrail.blogspot.com/2005/09/worlds-most-successful-trader-paul.html

Martinez... Here's another trader who has been successful at it for 20+ years.

Here's his Bio.

Al Brooks, 56, is a self taught/self made day trader who has traded for his own account for 20 years. He started out in medicine after attending the University of Chicago, where he also did his ophthalmology residency. The pull of trading was with him early, as during his entire stay in Chicago, he always wondered if he should drop out and work on the floor of the Chicago Mercantile Exchange. But he continued his medical career and taught for a year at the Emory University School of Medicine and then practiced in Los Angeles for about 10 years. During his academic years, he published more than 30 scientific papers and regularly presented his work at national ophthalmology meetings. In Los Angeles, he built one of the first Medicare-approved eye surgery centers in California and performed thousands of operations in his office OR.

After his twin girls were born, and then with three girls under the age of 15 months, Al decided to leave medicine. He sold his practice, moved to a small town outside of Sacramento, stayed home to raise his daughters, and started trading.

He says that as a scalper, he needs to focus intensely on every tick and doesn’t want distractions. As he describes his trading style: "My room is dimly lit, all of the shades are fully drawn, and I trade off my 17” HP notebook computer. I have another computer on my desk with two 21” monitors but I keep it off during the trading day and never use it for trading. I trade best when I have minimal distractions and only a single chart with no indicators (other than a 20 bar ema and volume, which I rarely watch) and no additional monitors. I use TradeStation for charting and place most of my trades through IB using their BookTrader price ladder. I find TradeStation too cumbersome for scalping but that may only be because I never spent much time learning the subtleties of their order entry. I tried Ninja Trader a few years ago but using it violated my fundamental principle of keeping my life as simple as possible. I am prone to making mistakes and that costs me money, so the simpler I can structure my life, the less I give back. I never watch TV while trading and have no interest in the results of economic reports. I also never read newspapers and get all of my news from the internet. I just trade the price action that comes from those reports, rarely ever finding out what the actual numbers were. Although I have a high IQ, I simply am not fast enough to process all of the ramifications of a report, read the 5 minute chart, and place my orders correctly. I believe that I am far more profitable when I only trade off the 5 minute chart in front of me and ignore all other input and opinions. I also don’t care where the market is going in the next year or even the next hour. All I want to know is whether I have an 80% chance of making a profit in the next 1 to 10 minutes with little risk. Since all of my entries are on stops, I consider myself a trend trader because I get swept into a trade by the market going in the direction I need it to go to make a profit. I prefer fading moves because the least stressful trades for me are the ones where I strongly believe that traders are suddenly trapped on the wrong side and have to get out. However, I also enter on pullbacks in a trend. If the trend is weak, there is a risk that I will be entering the pullback early. I find this more stressful than a quick fade where I usually scalp out with a profit within a couple of minutes and the market does not hesitate at all on its path to my profit target."

Al Brooks is an avid runner, weight lifter, fisherman, hiker, and skier who happily lives in Northern California.

YOu will have to sign up at the Futures I-Trade Show to see a presentation he made to the Futures Magazine event, Ir Buy his recently published book from Wiley "Reading Price Action Bar by Bar"

Here's his Bio.

Al Brooks, 56, is a self taught/self made day trader who has traded for his own account for 20 years. He started out in medicine after attending the University of Chicago, where he also did his ophthalmology residency. The pull of trading was with him early, as during his entire stay in Chicago, he always wondered if he should drop out and work on the floor of the Chicago Mercantile Exchange. But he continued his medical career and taught for a year at the Emory University School of Medicine and then practiced in Los Angeles for about 10 years. During his academic years, he published more than 30 scientific papers and regularly presented his work at national ophthalmology meetings. In Los Angeles, he built one of the first Medicare-approved eye surgery centers in California and performed thousands of operations in his office OR.

After his twin girls were born, and then with three girls under the age of 15 months, Al decided to leave medicine. He sold his practice, moved to a small town outside of Sacramento, stayed home to raise his daughters, and started trading.

He says that as a scalper, he needs to focus intensely on every tick and doesn’t want distractions. As he describes his trading style: "My room is dimly lit, all of the shades are fully drawn, and I trade off my 17” HP notebook computer. I have another computer on my desk with two 21” monitors but I keep it off during the trading day and never use it for trading. I trade best when I have minimal distractions and only a single chart with no indicators (other than a 20 bar ema and volume, which I rarely watch) and no additional monitors. I use TradeStation for charting and place most of my trades through IB using their BookTrader price ladder. I find TradeStation too cumbersome for scalping but that may only be because I never spent much time learning the subtleties of their order entry. I tried Ninja Trader a few years ago but using it violated my fundamental principle of keeping my life as simple as possible. I am prone to making mistakes and that costs me money, so the simpler I can structure my life, the less I give back. I never watch TV while trading and have no interest in the results of economic reports. I also never read newspapers and get all of my news from the internet. I just trade the price action that comes from those reports, rarely ever finding out what the actual numbers were. Although I have a high IQ, I simply am not fast enough to process all of the ramifications of a report, read the 5 minute chart, and place my orders correctly. I believe that I am far more profitable when I only trade off the 5 minute chart in front of me and ignore all other input and opinions. I also don’t care where the market is going in the next year or even the next hour. All I want to know is whether I have an 80% chance of making a profit in the next 1 to 10 minutes with little risk. Since all of my entries are on stops, I consider myself a trend trader because I get swept into a trade by the market going in the direction I need it to go to make a profit. I prefer fading moves because the least stressful trades for me are the ones where I strongly believe that traders are suddenly trapped on the wrong side and have to get out. However, I also enter on pullbacks in a trend. If the trend is weak, there is a risk that I will be entering the pullback early. I find this more stressful than a quick fade where I usually scalp out with a profit within a couple of minutes and the market does not hesitate at all on its path to my profit target."

Al Brooks is an avid runner, weight lifter, fisherman, hiker, and skier who happily lives in Northern California.

YOu will have to sign up at the Futures I-Trade Show to see a presentation he made to the Futures Magazine event, Ir Buy his recently published book from Wiley "Reading Price Action Bar by Bar"

This is another lucky trader from Japan. Traded online from his home and turned $13,000 into $150 million over a 8 year period.

http://onigirisensei.wordpress.com/2008/05/20/takashi-kotegawa-bnf-super-day-trader/

there are also videos on you tube his nick is BNF

http://onigirisensei.wordpress.com/2008/05/20/takashi-kotegawa-bnf-super-day-trader/

there are also videos on you tube his nick is BNF

You can't take these stories at face value. You have to research and verify them to determine their accuracy. I did that quite a bit a few years back, and found that many of the so-called success stories turned out to be false. In many cases, the traders had success in the beginning few years, but then gave it all back. However, the advertising and books and stories don't mention about giving it all back. You have to practice investigation journalism, for lack of a better phrase, in order to find out what really happened.

So when I read stories like above, I'm very skeptical.

So when I read stories like above, I'm very skeptical.

You know Martinez, in the end, everyone of us gives it all back.

well said bakrob...

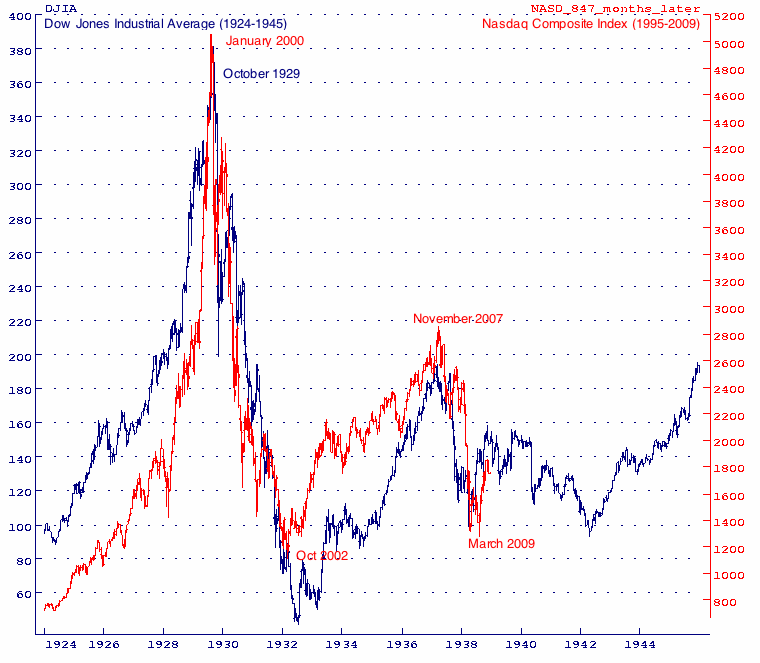

Okay ... now regarding the issue of Randomness... check out the Panic following the Bubble in 1929 compared to our Current Bubble and Panic which ensued from the 2001 Internet Frenzy.

On the attached Chart (courtesy MarketHistory.com) there is a very clear pattern to the price movement and the comparison is so close to our current pattern as to be a little freaky.

Martinez - if everything (human behaviour) is so Random, how do you explain the similarity?

On the attached Chart (courtesy MarketHistory.com) there is a very clear pattern to the price movement and the comparison is so close to our current pattern as to be a little freaky.

Martinez - if everything (human behaviour) is so Random, how do you explain the similarity?

bakrob,

the attachment didn't seem to come through. i don't know if it's my browser, or it just didn't come through, can you try it again

the attachment didn't seem to come through. i don't know if it's my browser, or it just didn't come through, can you try it again

quote:

Originally posted by bakrob99

Okay ... now regarding the issue of Randomness... check out the Panic following the Bubble in 1929 compared to our Current Bubble and Panic which ensued from the 2001 Internet Frenzy.

On the attached Chart (courtesy MarketHistory.com) there is a very clear pattern to the price movement and the comparison is so close to our current pattern as to be a little freaky.

Martinez - if everything (human behaviour) is so Random, how do you explain the similarity?

I can see it on, even on your post martinez.

Yeah that's right Martinez... nice try !! (PS.. login and you'll see it)

The same argument can be made for starting a business. Just a any regular business, not a trading business. How many are started every year? How many fail in the 1st year, 2 years, 5 years?

I don't know the number but it is a very high percentage >75%.

Of the ones that continue doing business, how many are highly profitable. That's even less of a percentage.

So people that want to try and say you can't do it in trading and if you do its all luck.....well, that same exact statement applies to starting any business. I started and ran a successful business, looking back so many things came down to timing and luck. Ask any successful business person and I'm sure they will agree.

Just like poker. Skill only gets you so far and puts you in a position to get lucky. You still have to get lucky to win. But the more skill you have the more your odds of getting lucky increase are.

I have pondered this topic quite extensively. Pretty much after most losing days. After my head gets clear, I always come back to the same thought.......Isn't this the same as running a business. Every day can't be good or great. There are plenty of bad days. Running a business....somedays you lose valuable employee....how much does that cost??? some days you lose sales deals....how much does that cost??? Some days you lose customers....how much does that cost???

So just like anything else that is worth doing. It's hard and can't be a straight line up. There is always a competing force that acts as resistance.

I don't know the number but it is a very high percentage >75%.

Of the ones that continue doing business, how many are highly profitable. That's even less of a percentage.

So people that want to try and say you can't do it in trading and if you do its all luck.....well, that same exact statement applies to starting any business. I started and ran a successful business, looking back so many things came down to timing and luck. Ask any successful business person and I'm sure they will agree.

Just like poker. Skill only gets you so far and puts you in a position to get lucky. You still have to get lucky to win. But the more skill you have the more your odds of getting lucky increase are.

I have pondered this topic quite extensively. Pretty much after most losing days. After my head gets clear, I always come back to the same thought.......Isn't this the same as running a business. Every day can't be good or great. There are plenty of bad days. Running a business....somedays you lose valuable employee....how much does that cost??? some days you lose sales deals....how much does that cost??? Some days you lose customers....how much does that cost???

So just like anything else that is worth doing. It's hard and can't be a straight line up. There is always a competing force that acts as resistance.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.