Contract Rollover

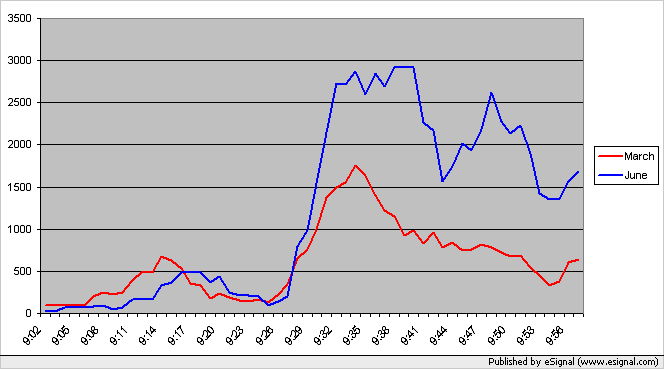

When does volume switch from one contract to another? The chart below shows the volume for the March and June 2005 contracts for the E-mini S&P500 between 09:00 and 10:00 EST. The volume for the old contract (March) dominates in the first 15 minutes and then again just before the open at 09:30 EST. Otherwise you can see that the volume in the new contract (June) have taken over. (The chart shows the 5 minute average volume for each minute. e.g. The volume on the 09:17 bar shows the average volume per minute from 09:15 to 09:19 inclusive.)

More information about rollover day can be found on this page: Rollover Days

More information about rollover day can be found on this page: Rollover Days

I know you are trying to confuse me with facts, I assure you, your plan will probably work.

It wasn't until later when the ES weighted open interest volume surpassed the bigs on a consistent basis. I think that is a better indication of the importance of the contract. This isn't an absolute, only a shift of importance to how participants adjust their trading over time.

It wasn't until later when the ES weighted open interest volume surpassed the bigs on a consistent basis. I think that is a better indication of the importance of the contract. This isn't an absolute, only a shift of importance to how participants adjust their trading over time.

Not trying to confuse anyone. Just trying to determine why we've seen this shift so that we can understand and move to the next contract at the best and most appropriate time. We want to keep everyone trading in the most liquid contract so they can get the best prices. By understanding why this rollover timing change has happened will help all of us understand the market a bit better.

Thanks for your helpful input beyondMP - appreciated!

Thanks for your helpful input beyondMP - appreciated!

"A well-developed sense of humor is the pole that adds balance to your steps as you walk the tightrope of life." ~William Arthur Ward

This is it. The year is over. Roll your contracts from December (Z contract) to March (H contract). It's rollover on 12/12/2013.

Rollover was on Thursday. We are now on the June (M contract). Some info from the CME:

CME Group Equity Index futures contracts users may roll their futures positions from one quarterly futures contract month (e.g.. June) to the next quarterly futures contract month (e.g.. September) at any time they choose.Source: http://www.cmegroup.com/trading/equity-index/rolldates.html

However, the trading floor convention is to roll the expiring quarterly futures contract month eight calendar days before the contract expires for most of our Equity Index futures contracts. This is known as the Rollover date. Note that Nikkei 225 contracts historically have a Rollover date of the Monday before expiration.

From the Rollover date on, it is customary to identify the second nearest expiration month as the “lead month” for the index futures. This is because the nearest expiring contract will terminate soon and will have a less liquid market than the new “lead month” contract

For certain contracts traded in open outcry and then traded electronically on CME Globex during the overnight (ETH) sessions, the Rollover date dictates which contract is listed for trading on CME Globex.

Note: The following contracts have only one contract listed at a time for trading during the overnight CME Globex session (these contracts are not available on CME Globex during the RTH session):

S&P 500

NASDAQ-100

S&P MidCap 400

S&P SmallCap 600 futures

For these, the Rollover date determines what contract month is listed for trading during the CME Globex session.

Example:

If the Rollover date is Thursday, December 13, 2012 for the S&P 500 futures contract, the CME Globex session beginning that evening (at 3:30 p.m. Chicago time /CT) will list the Mar 2013 contract for trading and the Dec 2012 contract would no longer be available to trade on CME Globex. On the trading floor, the Mar 2013 contract would become the lead month beginning at 8:30 a.m. on Thursday, December 13, 2012.

It's time for rollover. Move your contracts from June (M) to September (U).

Rollover is on Thursday, December 11, 2014.

Move contracts from Z14 to H15, i.e. from Dec 2014 to Mar 2015.

Move contracts from Z14 to H15, i.e. from Dec 2014 to Mar 2015.

This is rollover week.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.