Trend Change or retracement?

I have a question I am looking for help on.

Has someone found a reliable indicator, or combination of indicators, or some other way, that from their personal trading experience can tell if an intra day direction change is a trend change as opposed to a retracement?

To explain my question further, some days the first leg is down, it retraces, and then the second leg is down, that is Leg2 is in the same direction as Leg1. On other days, the first leg is down and then it reverses trend and the remainder of the day is an uptrend.

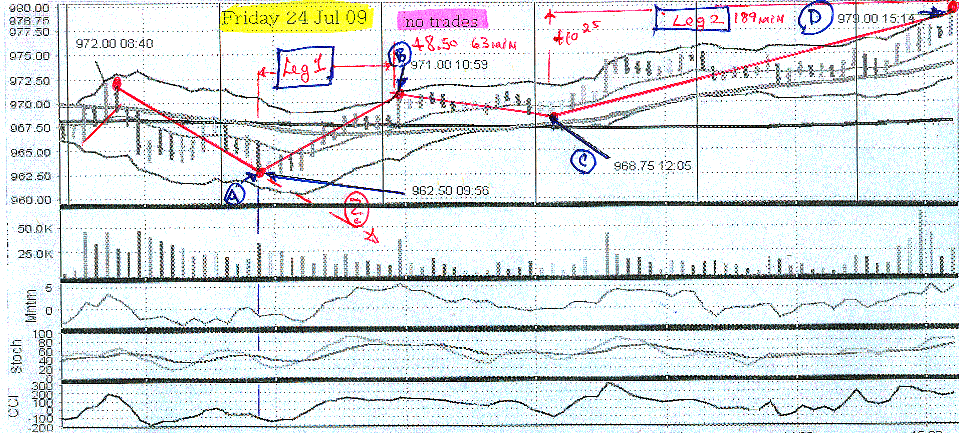

I have included a 5 min chart of Friday 24 July 2009 for the ESU9 (S&P emini Sep 09) contract, as an example (all times are CT).

From 972 at 8:40am it fell to 962.50 at 9:56 (marked point A). From A it rose to 971 at 10:59 or +8.5 pts in 63 min (point B). A to B I am calling Leg1.

Next it retrace to 968.75 at 12:05 or –2.25 pts in 66 mins (point C). Then it rises to 979 @ 15:14 or +10.25 in 189 mins (point D). From C to D I am calling Leg2.

In this example point A marks a Trend Change with the balance of the day now upward.

So in reference to this graph, my question is:

“At point A is there a way to tell that the balance of the day will be up?”

In other words:

“Is there a way to tell if point A will be marking the beginning of a retracement, that the next leg after the retracement will be down, that is in the same direction as 972 to 962.50, or is it a intra day trend change?”

I would note that one book waits until it has risen from A and it continues to rise beyond 61.8% or 968.25 and if it does then a trend change has taken place and the rise is not a retracement. (972-962.5 = 9.5*.618 = 5.75+962.5 =>968.25 = 61.8%.) I am looking for an answer at point A so this “if it retraces more than 61.8% it is a trend change” is not the answer I am looking for.

Thank-you to all.

Has someone found a reliable indicator, or combination of indicators, or some other way, that from their personal trading experience can tell if an intra day direction change is a trend change as opposed to a retracement?

To explain my question further, some days the first leg is down, it retraces, and then the second leg is down, that is Leg2 is in the same direction as Leg1. On other days, the first leg is down and then it reverses trend and the remainder of the day is an uptrend.

I have included a 5 min chart of Friday 24 July 2009 for the ESU9 (S&P emini Sep 09) contract, as an example (all times are CT).

From 972 at 8:40am it fell to 962.50 at 9:56 (marked point A). From A it rose to 971 at 10:59 or +8.5 pts in 63 min (point B). A to B I am calling Leg1.

Next it retrace to 968.75 at 12:05 or –2.25 pts in 66 mins (point C). Then it rises to 979 @ 15:14 or +10.25 in 189 mins (point D). From C to D I am calling Leg2.

In this example point A marks a Trend Change with the balance of the day now upward.

So in reference to this graph, my question is:

“At point A is there a way to tell that the balance of the day will be up?”

In other words:

“Is there a way to tell if point A will be marking the beginning of a retracement, that the next leg after the retracement will be down, that is in the same direction as 972 to 962.50, or is it a intra day trend change?”

I would note that one book waits until it has risen from A and it continues to rise beyond 61.8% or 968.25 and if it does then a trend change has taken place and the rise is not a retracement. (972-962.5 = 9.5*.618 = 5.75+962.5 =>968.25 = 61.8%.) I am looking for an answer at point A so this “if it retraces more than 61.8% it is a trend change” is not the answer I am looking for.

Thank-you to all.

quote:

Originally posted by BruceM

my shorter answer is that anyone who tells you they can tell it was an intraday trend change is a liar at point A...may make a great after the fact book but not in the real world...one thing I like to keep in mind is "where is the previous days high or low and which one are we farther from"..in other words how far do we need to travel to break the previous days range...certainly not perfect but it can help.....probably not the answer u r looking for but that's the only one I have

Thank-you Bruce,

I will have to work on intramarket divergences - a new area for me.

I do think the Yesterday's High and Low and how far we are from them is useful and I do use a variation of that. One of my problems is that when I plot in the estimated high zone and estimated low zone of the day I "lock in". That is I forget about other things.

I didn't have a "set" idea but I was thinking along the lines of:

Perhaps if A is a trend change the momentum will slow and reverse on both a longer term chart (30 min or 15 min) and on a shorter term chart (5 or 3 min), but at retracement beginning the longer term momentum doesn't only slows but not reverses.

OR perhaps a difference in action between the stocastics action is different?

etc.

Nison says 8 to 10 higher highs and we can start looking for a reversal. We close

to that on the daily.

to that on the daily.

quote:

Originally posted by CharterJoe

blue,

Check out 30min RSI, do away with the oversold lines and watch the #50 draw large channels, small channels and trendlines. It gives the best idea of what your asking that I know of...and that with MP is even better.

A good after the fact analysis as bruce called it is the ES now. The trend is up, RSI and the ES pulled back from 976.50 and if you draw a line from RSI low on Tues and low on wends you get the low on friday. And with the RSI being @50 that too was a good place for the bulls to resume. But like bruce said you can never know for sure.

Thanks Joe,

What is MP?

Ian

Hi Joe & Bruce,

Here's a 30 min with RSI (9) about 40 and looking flatlined

My "Sheet estimate" of the low is 967

Yesterday's low was 969.

My estimated .25sq low is 963.75

We have had 966 Low at 10:37 CT

So we've had a run of the stops (3 pt) of yesterday's low

and we have been in my "buy zone" 968 to 964.

But my gut and 5 min says they'll run the stops again say 966-2 =964.

What are your thoughts?

Is the low in place for the day?

Thanks

Here's a 30 min with RSI (9) about 40 and looking flatlined

My "Sheet estimate" of the low is 967

Yesterday's low was 969.

My estimated .25sq low is 963.75

We have had 966 Low at 10:37 CT

So we've had a run of the stops (3 pt) of yesterday's low

and we have been in my "buy zone" 968 to 964.

But my gut and 5 min says they'll run the stops again say 966-2 =964.

What are your thoughts?

Is the low in place for the day?

Thanks

blue,

I noticed you have posed the same question on the "Traders Laboratory" forum.

Were there any good responses from there?

I noticed you have posed the same question on the "Traders Laboratory" forum.

Were there any good responses from there?

Sorry for the delay here Blue....MP is market profile..Daltons book is "Mind over markets". Here is a link to somebody that is on the journey with MP and market delta....I suggest reading the opening types and open relative to value as a quick primer.

http://tradeorderflow.blogspot.com/2009/07/video-analysis-of-72009-es-market.html

As I mentioned in another thread, I am concentrating on trading for the probabilities here in summer which include overnight high and lows, previous days highs and lows, the 4 and 8 point increments ( the window)and hour ranges.....all good ones....

I don't use RSI so Joe will have to get to that one.....I would have expected lower lows yesterday and would have been wrong but the reality is that we were still inside the previous days range, the value area and the first 60 minutes of the current day so that on it's own implies that nothing has changed from the day before....in other words the perception of VALUE hasn't changed...hope that helps

Bruce

http://tradeorderflow.blogspot.com/2009/07/video-analysis-of-72009-es-market.html

As I mentioned in another thread, I am concentrating on trading for the probabilities here in summer which include overnight high and lows, previous days highs and lows, the 4 and 8 point increments ( the window)and hour ranges.....all good ones....

I don't use RSI so Joe will have to get to that one.....I would have expected lower lows yesterday and would have been wrong but the reality is that we were still inside the previous days range, the value area and the first 60 minutes of the current day so that on it's own implies that nothing has changed from the day before....in other words the perception of VALUE hasn't changed...hope that helps

Bruce

quote:

Originally posted by myptofvu

blue,

I noticed you have posed the same question on the "Traders Laboratory" forum.

Were there any good responses from there?

Well....

Firstly, I didn't realize it had "price action only" purists, so by posting the chart I did ( with indicators on it) it released a firestorm. Seems to be be an argumentative board.

But there are so many responses, and we are suffering from a heat wave where, I live that I haven't been able to sift through them all.

I am so busy with my collecting of data that I have little free time.

Bruces and Joe's are actually the only serious attempt to address it. Thanks to you both and to you to Rexspeed - though I have to get back to you for more clarification.

I printed off one that has potential and went to the air-conditioning of Starbucks to review it:

"Posted by: coderlen

On: 07-27-2009 07:30 PM

“At point A is there a way to tell that the balance of the day will be up?”

Your question is an interesting one. After all, what trader wouldn't want to know when a trend has changed? While I can't answer your question exactly, I think I can help you stay in a trade until the trend changes direction.

I have recently discovered some valuable indicators. Take a look at the attached .jpg file. Using StochasticFast (34,3) and DirectionalMovementIndex(5,2,2,5), you can get a very good idea of the strength of the trend. I will explain.

Use the following rules:

1) When FastK (Yellow) drops below FastD (Blue), and DI+ (Red) is below DI- (Green), and the ADX (Yellow) is rising, you have a strong Downtrend.

2) When FastK (Yellow) rises above FastD (Blue), and DI- (Green) is below DI+ (Red), and the ADX (Yellow) is rising, you have a strong Uptrend.

While I am still testing this combination of indicators, so far I have made a lot of "money" in my paper trading account.

I trade with thinkorswim, but these same indicators could be set up with other brokers, as long as they allow you to change the parameters on the indicators. Using StochasticFast with K period of 34 and D period of 3, and DirectionalMovementIndex with ATR length of 5, DI+ length of 2, DI- length of 2, and Wilders length of 5, you can duplicate the same results I get. Try it, and let us know if it works for you.

Had you followed these indicators on Friday, July 24th, and bought Puts and 9:45 AM and sold them at 10:15 AM, and then bought Calls at 12:15 PM and sold the Calls at Market Close, you would have made significant profit. The indicators help you to stay in a trade with confidence, as long as the ADX keeps rising. While the candlesticks will often drop down, that rising ADX keeps you in for big profits.

But make sure you don't jump the gun and get into a trade until all 3 of the elements of each rule are true, or you'll get into trouble. Yes, you'll miss some of the movement, but let these indicators tell you when the trend is strong and when to get in and get out, so you'll make money."

He has 1 hour bars so I think I'd work on that

you can learn at eminiaddict

quote:

Originally posted by blue

....

I didn't have a "set" idea but I was thinking along the lines of:

Perhaps if A is a trend change the momentum will slow and reverse on both a longer term chart (30 min or 15 min) and on a shorter term chart (5 or 3 min), but at retracement beginning the longer term momentum doesn't only slows but not reverses.

OR perhaps a difference in action between the stocastics is different?

etc.

A follow-up on this:

Today I listened to a webinar and guess what! He uses

momentum (MOM) and RSI across multiple timeframes!

(This guy has built a mechanical system and uses RSI together with MOM to determine if today is a trending day and when the trend changes and when it will exhaust.) He works for trade the market TTM and is selling this automated trading system.

In any case, I was pretty excited that the indicator MOM across multiple timeframes is what he chose to determine trend change after 10 years of building and testing different systems!

He uses RSI 60 cross down and 40 cross up to trigger entry and exit prices - Good work Joe!

http://www.tradethemarkets.com/public/department79.cfm

I don't see the recording posted yet. It was pretty poor presentation wise IMO. It would be with this guy and called Trading the Summer when they post it).

(John Clayburg has been a developer of trading systems for over 20 years.)

quote:

Originally posted by redsixspeed

Nison says 8 to 10 higher highs and we can start looking for a reversal. We close

to that on the daily.

Hi Rexspeed,

I'm not familiar with Nison. Do you have a link or book title you are referring to?

thanks,

Ian

quote:

Originally posted by zodei1

Any guesses on what his "squeeze indicator" is?

As I know its a MidRange Indkator with 5 Bars .....and the Average is also 5 or something like that

Thanks Zodei1,

I'm not clear on your reply.

What do you mean by a midrange indicator?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.