S&P 500 emini moving slow this morning

Can some one please answer this question for me:

Why is the S&P 500 emini moving so slow? Usually it moves very far very fast in the morning. But for the last few days its been moving very slow. Is it something I'm missing? Thanks in advance.

Why is the S&P 500 emini moving so slow? Usually it moves very far very fast in the morning. But for the last few days its been moving very slow. Is it something I'm missing? Thanks in advance.

Of the past 7 RTH sessions, it seems a good portion of the price action is very constricted (and low volume). Potentially a lot of the movement is taking place in the overnight sessions with influence of global/foreign markets. Notice all of the "gap opens" for RTH lately.

But there have been some dead zones when I was banging on my monitor thinking I'd disconnected from the datafeed. Peculiar activity for an October. I don't think I answered your Q Rookie.

But there have been some dead zones when I was banging on my monitor thinking I'd disconnected from the datafeed. Peculiar activity for an October. I don't think I answered your Q Rookie.

This has been unusual and peculiar market activity for October. Earnings season can bring sideways movement, add to that the uncertainty with Washington's current activity(health care and all) it isn't totally unexpected. However, in the past 10 yrs, or so, whenever the market trades slow for awhile, a major move follows.

Thanks you guys. I think I'm going to just watch from the sidelines until things get back to normal.

Well said MM, TI now is the time for patience, what we don't do can determine our seccess as much as what we do

I agree ST. Well said.

IMHO typical ES, YM bull market behavior. No dullness in the Pound/Yen, Pound/USD virtually straight up last three days.

Joe It kinda makes me sad you are trading forex now, I've learned a LOT from you & Kool Blue. Here is something I learned from Kool, AB-CD on the 240 min ch, if tomorrow is up, the pattern should complete on the dailys after tomorrows close. If completed the odds for a pull back & volotility expansion on increased volume should be greater next week. Short $ comes quick

Joe I read that you go fishing in Brevard, that's pretty close to me, my gf lived there til we hooked up. The fall colors are great there now! Good luck with fx

Joe I read that you go fishing in Brevard, that's pretty close to me, my gf lived there til we hooked up. The fall colors are great there now! Good luck with fx

COT shows institutions adding to short positions. Somethings gotta give. If your early your gonna lose a boatload.

Staylor,

I love fly fishing in the Davidson (not in the fall though to many leaves on the water, but it is beautiful)fishing for monster trout on tiny flies. We should hook up and do some guided fishing sometime.

I used to wonder what all the hype in FX was about, now I know. I actually have my ES, and NQ automated now and devote all my time to currency markets. I have always loved the Euro futures. But FX world is so much better for the trend trades then I have ever seen the ES. You now those days in the ES where it opens on the low level and goes up/down all day with minimal pull backs? and that only come once maybe twice a month, well it happens 95% of the time in FX.

http://finviz.com/forex_performance.ashx?v=22&o=-perfdaypct

Just buy the strongest and sell the weakest. I use RSI channels, MA's pullbacks, price pullbacks. Super simple stuff. Has always been my style in my stock swing trading buy the strongest sector sell the weakest. Another good thing is that the market never close's so moves get way exacerbated daily, because it currency moves with the sun from world bank to world bank. I used 1, 5, 30 min charts with the ES and now use 30min, 4hour, daily, weekly in Forex. I honestly never thought the day would come when I found something that....for the lack of a better word "replaced" the ES. I have made a lot of money in the ES, almost feel guilty trading forex and not looking at the ES any more, but its just the evolution of trader. I have learned so much about how money moves and how that affects bonds and the stocks.

I love fly fishing in the Davidson (not in the fall though to many leaves on the water, but it is beautiful)fishing for monster trout on tiny flies. We should hook up and do some guided fishing sometime.

I used to wonder what all the hype in FX was about, now I know. I actually have my ES, and NQ automated now and devote all my time to currency markets. I have always loved the Euro futures. But FX world is so much better for the trend trades then I have ever seen the ES. You now those days in the ES where it opens on the low level and goes up/down all day with minimal pull backs? and that only come once maybe twice a month, well it happens 95% of the time in FX.

http://finviz.com/forex_performance.ashx?v=22&o=-perfdaypct

Just buy the strongest and sell the weakest. I use RSI channels, MA's pullbacks, price pullbacks. Super simple stuff. Has always been my style in my stock swing trading buy the strongest sector sell the weakest. Another good thing is that the market never close's so moves get way exacerbated daily, because it currency moves with the sun from world bank to world bank. I used 1, 5, 30 min charts with the ES and now use 30min, 4hour, daily, weekly in Forex. I honestly never thought the day would come when I found something that....for the lack of a better word "replaced" the ES. I have made a lot of money in the ES, almost feel guilty trading forex and not looking at the ES any more, but its just the evolution of trader. I have learned so much about how money moves and how that affects bonds and the stocks.

quote:

Originally posted by staylor455

Here is something I learned from Kool, AB-CD on the 240 min ch, if tomorrow is up, the pattern should complete on the dailys after tomorrows close. If completed the odds for a pull back & volotility expansion on increased volume should be greater next week.

I don't quite understand your post. Do you construct BD equal to and parallel to AC?

Why do you say "the pattern should complete on the dailys after tomorrows close." Could not the pattern complete at anytime it reaches D?

How does a pattern complete "after a close?" are you saying it is only a valid completion if after hours trading completes it?

Thanks

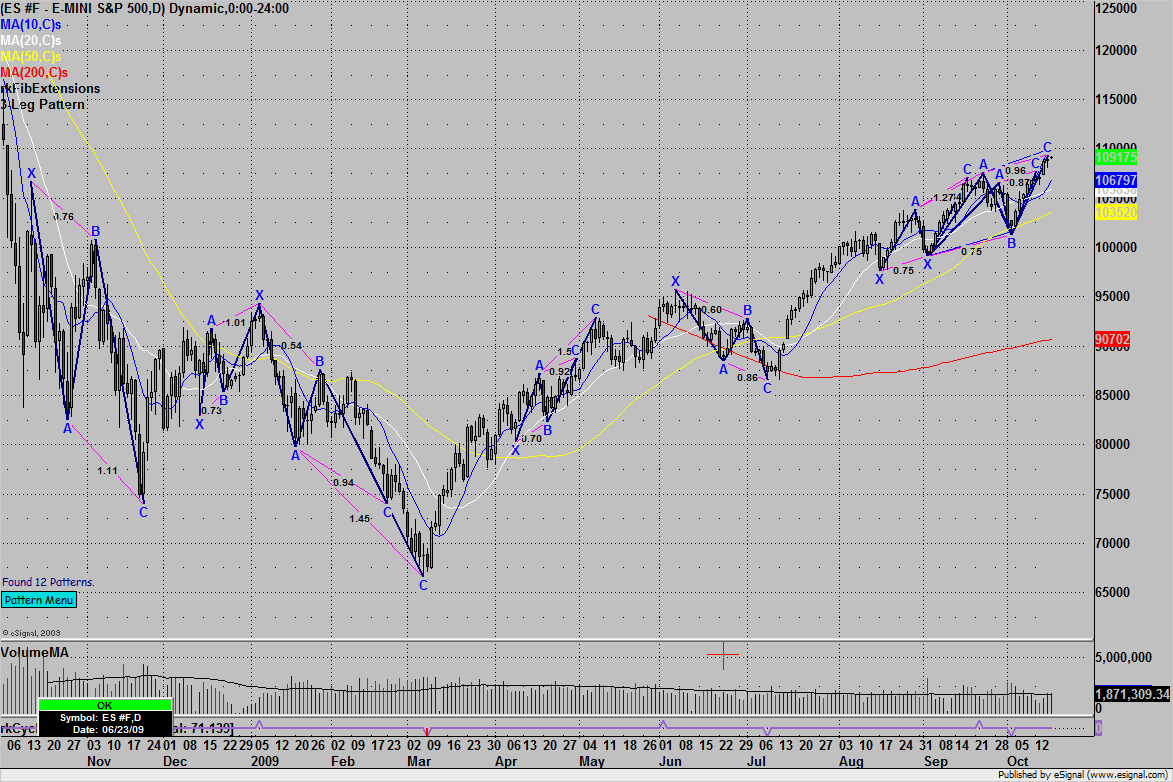

Daily ES with pattern recognition, the first chart was showing how close ES was to completing a harmonic AB CD pattern. They're fib ratios, not an exact science.

Kool Blue told me "if you want to know about AB CD, Gartelys & Butterflys" www.harmonictrader.com Download Scott's book, take his trial & you will learn.

Kool Blue told me "if you want to know about AB CD, Gartelys & Butterflys" www.harmonictrader.com Download Scott's book, take his trial & you will learn.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.