Philosophical ramblings and blues notes

Hi Everyone,

I have decided to give a whirl at posting a trading journal.

In the journal I have asked everyone not to post questions or comments in my journal. I am not looking for feedback on the journal - at this time.

From some research on trading journals one of the items mentioned is the emotional and mental state at the time of the trade. One example was "you're late getting to the office because of taking the kids to school and traffic and are in a rush and don't have time for your regular daily preparation, the market's moving and you rush a trade giving a bad entry."

For myself, one of the factors that may effect my trades is current things on investing I am reading or new ideas I am working with. So I have started this thread for some of those factors.

On these more general or philosophical ideas I am receptive to hearing other peoples thoughts and that is why I started this thread in the Lounge.

I'll post an example.

I have decided to give a whirl at posting a trading journal.

In the journal I have asked everyone not to post questions or comments in my journal. I am not looking for feedback on the journal - at this time.

From some research on trading journals one of the items mentioned is the emotional and mental state at the time of the trade. One example was "you're late getting to the office because of taking the kids to school and traffic and are in a rush and don't have time for your regular daily preparation, the market's moving and you rush a trade giving a bad entry."

For myself, one of the factors that may effect my trades is current things on investing I am reading or new ideas I am working with. So I have started this thread for some of those factors.

On these more general or philosophical ideas I am receptive to hearing other peoples thoughts and that is why I started this thread in the Lounge.

I'll post an example.

There may be some who wonder why I am posting a journal without wanting feedback at this time.

There are several reasons

1. I hope the discipline of a posting journal will be helpful in bringing all the work of the last two years together - combining and crystallizing all the disparate threads of exploration.

2. It make be interesting (or possibly helpful) to someone else.

3. Trading is a lonely profession. It is not like having a office you go to with lots of co-workers with whom you can discuss your ideas, theories, struggles and successes. This is one of the functions of an investing board, like this. (If it becomes a negative or hostile place then I are unlikely to visit or post.) I realize that their are some people who love a good argument. Not me. It bothers me and drains my energy. And I need all the energy and focus I can muster to conquer this beast!

I have realized I do have a need to communicate with friends. Ergo this thread where friends can post there thoughts on the more general philosophical investing topics.

I am a Gemini Jupiter and need to communicate.

There are several reasons

1. I hope the discipline of a posting journal will be helpful in bringing all the work of the last two years together - combining and crystallizing all the disparate threads of exploration.

2. It make be interesting (or possibly helpful) to someone else.

3. Trading is a lonely profession. It is not like having a office you go to with lots of co-workers with whom you can discuss your ideas, theories, struggles and successes. This is one of the functions of an investing board, like this. (If it becomes a negative or hostile place then I are unlikely to visit or post.) I realize that their are some people who love a good argument. Not me. It bothers me and drains my energy. And I need all the energy and focus I can muster to conquer this beast!

I have realized I do have a need to communicate with friends. Ergo this thread where friends can post there thoughts on the more general philosophical investing topics.

I am a Gemini Jupiter and need to communicate.

On finding the big trades.

In this book "Sniper Trading" G Angell, states that many new traders think they can trade just one contract all the time with a preset percentage loss (e.g x% of one's account) and they will be profitable.

George argues that there are two reasons this theory does not work. One reason is that you may bat say 30%-70% loser/winners but if your winners are much bigger profit-wise than your losers you will still come out ahead. You can dictate to the market the size of the move - it will set the maximum point length of profit potential in that trade, but you can vary the size. (The other is about stop positioning to S/R not your entry price.)

If you feel really good about the trade you might start with larger size than your normal initial size and also you may add to your position while in the trade if the trade keeps confirming your setup/ trade hypotheses.

I refer to the process of increasing and reducing one's position size while in the trade as "dynamic weighting".

So this brings up 2 questions:

1. How to identify the big winners before trade entry?

2. How to create a successful "dynamic weighting" strategy as part of your successful money management strategy?

Any thoughts?

From his book:

In this book "Sniper Trading" G Angell, states that many new traders think they can trade just one contract all the time with a preset percentage loss (e.g x% of one's account) and they will be profitable.

George argues that there are two reasons this theory does not work. One reason is that you may bat say 30%-70% loser/winners but if your winners are much bigger profit-wise than your losers you will still come out ahead. You can dictate to the market the size of the move - it will set the maximum point length of profit potential in that trade, but you can vary the size. (The other is about stop positioning to S/R not your entry price.)

If you feel really good about the trade you might start with larger size than your normal initial size and also you may add to your position while in the trade if the trade keeps confirming your setup/ trade hypotheses.

I refer to the process of increasing and reducing one's position size while in the trade as "dynamic weighting".

So this brings up 2 questions:

1. How to identify the big winners before trade entry?

2. How to create a successful "dynamic weighting" strategy as part of your successful money management strategy?

Any thoughts?

From his book:

There are two questions to ask yourself if you are overextended in the market: Do you think about the money? Do you panic? As illogical as it sounds, this should be the litmus test that every trader must pass. I never found that my trading improved if I worried about the money day after day or if I found myself getting out on panic. The ultimate test, of course, is to ask yourself if you are enjoying your trading. If you dread to see the market open in the morning, it is probably better to find another occupation.

A trader cannot operate on what some textbook says is right or wrong. You have to trade according to your own game plan, taking intelligent risks and reaping, hopefully, your just rewards. That's when trading can be extremely satisfying-when you have and execute a plan according to wise strategies and your tolerance toward risk.

With this in mind, you want to approach the market with a specific game plan in mind. You want to be selective, yet aggressive, looking for classic opportunities and capitalizing on them to the best of your ability. Is this a realistic approach? You bet. The winning trader knows how to craft his own enthusiastic approach to the market, one grounded in sound trading techniques, but tailor-made for his own personality.

All traders face the same challenge: how to identify the optimal situation. Perhaps you have already decided to concentrate on short-term, aggressive trading in the high-flying S&P 500 futures market. Perhaps you plan to focus on time and price patterns and reliable trading formulas. A second consideration, which is equally important to your success, is money management. How will you manage your money? For most new traders, the market commitment is dictated by the size of their bankroll, making one-lots a necessity. But even the most cautious trader must occasionally take advantage of the exceptional opportunities. You don't want to be locked into a rule that says you can never go for the genuine opportunity. The downside, of course, is that you may get hammered. So you need to factor in the likelihood of some substantial losses.

FINDING THE "GO FOR BROKE" TRADES

In order to manage money intelligently, you must divide your trade selection into two categories: the run-of-the-mill trades and the go-for-broke trades. If you can find enough of the latter, your odds of coming out ahead are greatly improved. How to find them? We are going to explore some of the strategies in the pages ahead. But be assured the work is worth the payoff. One good go-for-broke winner will offset a half dozen losers. I am often asked questions about winning percentages versus losing percentages. My reply is always the same. Essentially, you can win on only ten percent of your trades and still make a lot of money-if the winners are big and the losses small. So the important question isn't one of winning versus losing percentages. How much money, on average, do you make on every trade, including winners and losers? ...

best way to find big winners is to study what preceeds the big moves.....most who like to have a lower win rate concentrate on low volatility as it usually leads to high volatility.

Depending on your market you might want to research low range bars and what happens when we break out from them......these can work on all time frames....

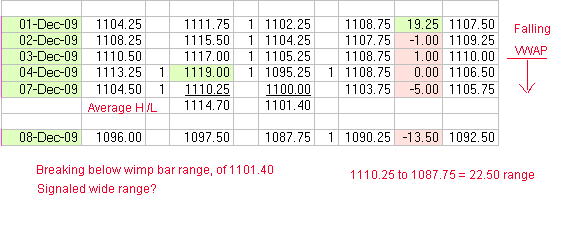

A vendor I learned from called these "wimp" bars and had statistical studies for range penetration on either side and the odds of breaking both sides of a wimp bar...just some quick thoughts...

Good luck with the journal...I wish more would take the time to post those

Bruce

Depending on your market you might want to research low range bars and what happens when we break out from them......these can work on all time frames....

A vendor I learned from called these "wimp" bars and had statistical studies for range penetration on either side and the odds of breaking both sides of a wimp bar...just some quick thoughts...

Good luck with the journal...I wish more would take the time to post those

Bruce

Thanks Bruce!

So your thought is you look at wimp bars and see if there are tell-tale signs on that data for the wide-range bars, especially a break-out from the wimp range?

So you might get say 3 small wimp bars more forming a three day consolidation pattern?

ps error in post I meant to have higher % of losers so 70% losers 30% winners - I guess you guys figured that out!!

So your thought is you look at wimp bars and see if there are tell-tale signs on that data for the wide-range bars, especially a break-out from the wimp range?

So you might get say 3 small wimp bars more forming a three day consolidation pattern?

ps error in post I meant to have higher % of losers so 70% losers 30% winners - I guess you guys figured that out!!

Blue thanks for sharing. I am going to attempt to do the same thing. I really believe it will help both of our trading by making ourselves accountable for bad trades and good trades throughout the day. This way I can't just forget about them. I will at the very least learn something from my mistakes.

I started a blog, and not to be cool or anything its more of a personal journal so I can recognize and go back and see what I did wrong.

I started a blog, and not to be cool or anything its more of a personal journal so I can recognize and go back and see what I did wrong.

mental stops Blue? Good way to insure all winners?

Originally posted by koolblue

mental stops Blue? Good way to insure all winners?

Hi KB,

I'm not quite sure of your question.

1. Are you referring to hard stops (entered orders) versus stop we compute and execute but not post?

2. Assure all winners? - What does this mean?

Hi Spliton,

All the best on your new journal!

Are all the posts on "Closed up shop" page for Wednesday, December 9, 2009?

Did you post your journal on the blog to avoid negative comments from board posters?

Thanks

All the best on your new journal!

Are all the posts on "Closed up shop" page for Wednesday, December 9, 2009?

Did you post your journal on the blog to avoid negative comments from board posters?

Thanks

Originally posted by spliton

Blue thanks for sharing. I am going to attempt to do the same thing. I really believe it will help both of our trading by making ourselves accountable for bad trades and good trades throughout the day. This way I can't just forget about them. I will at the very least learn something from my mistakes.

I started a blog, and not to be cool or anything its more of a personal journal so I can recognize and go back and see what I did wrong.

Originally posted by blue

Hi Spliton,

All the best on your new journal!

Are all the posts on "Closed up shop" page for Wednesday, December 9, 2009?

Did you post your journal on the blog to avoid negative comments from board posters?

Thanks

Thanks blue!

All the posts are made in real time based on what I am trading at the moment so each trade corresponds with the date and time it is posted. So everything under Wednesday, December 9th is for Wednesday, December 9th. As of now I only have two days because I just created this blog right after I read your post. I had only 1 posted trade for Tuesday as I didn't read your post till later in the day.

As for why I did it in a blog format I figured three things. 1) It would be something I haven't done before and thought maybe it would be fun. 2) I like how it auto archives my posts and has a readily available search feature(currently I have disabled) for when I reach x amount of trading days. It will be great for looking back on trades as a trade diary. 3) Yea to avoid negative feedback from people I do not know. I have my way of trading and I believe it works and I do not need to get in a heated argument or waste my time with a forum troll who thinks differently.

However I am not trying to avoid constructive criticism in anyway, if someone on this forum thinks that one of my trades was just off the wall or reckless that is completely welcome. I also greatly appreciate all the support I have received from KB, yourself, and Bruce!

Yes Blue,

I believe this site lists consolidation patterns (NR7, NR4 - research Raschke and Toby Crabels work)for various markets and gaps are usually very good for pointing out an intraday trend......

I believe this site lists consolidation patterns (NR7, NR4 - research Raschke and Toby Crabels work)for various markets and gaps are usually very good for pointing out an intraday trend......

Originally posted by blue

Thanks Bruce!

So your thought is you look at wimp bars and see if there are tell-tale signs on that data for the wide-range bars, especially a break-out from the wimp range?

So you might get say 3 small wimp bars more forming a three day consolidation pattern?

Many thanks Leob.

May God keep you and bless and your family.

May God keep you and bless and your family.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.