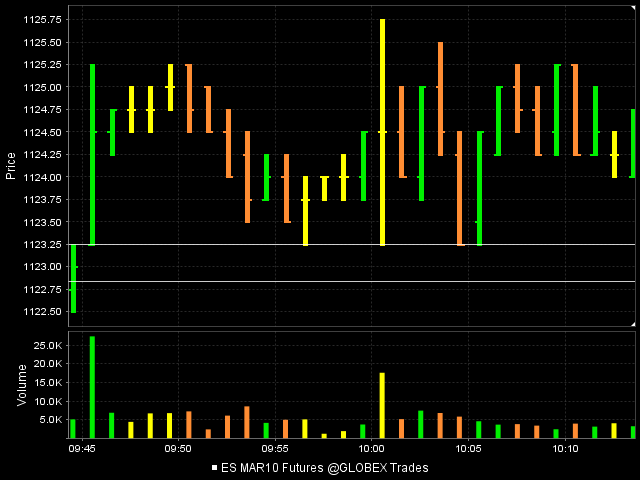

Chart of the day

Here is a gap and triples so up here at 1227 is my sell...look at the gap in between the white lines...just couldn't hold long with that looming

Thanks Jim for the link

Bruce could you clearify:

"We all remember how much the market plays with that line at the hour highs and the previous days highs don't we? See what happened once they took out the triples?"

I am kind of a naive on this. Hour high/low meaning RTH first hour high/low (9.30est to 10.30 est)

Also:

"yes, but best to use the triples as targets especially if they DON"T fall near the highs and lows of the day"

What about them if they form at the high and low?

Do we disregard them?

Also:

If the fourth or later bar breaks through the triple high/low and the market trades away is the formation still valid.

"We all remember how much the market plays with that line at the hour highs and the previous days highs don't we? See what happened once they took out the triples?"

I am kind of a naive on this. Hour high/low meaning RTH first hour high/low (9.30est to 10.30 est)

Also:

"yes, but best to use the triples as targets especially if they DON"T fall near the highs and lows of the day"

What about them if they form at the high and low?

Do we disregard them?

Also:

If the fourth or later bar breaks through the triple high/low and the market trades away is the formation still valid.

The hour highs and lows of the RTH is always critical to me...The market profile players will also key off it and it is known in that circle as the initial balance , the I.B. They'll also take that range and multiply it by 1.5 and 2 to create targets and potential fade points. I'm constantly monitoring the I. B for a fail breakout of the highs or lows. The hour highs or lows also get tested a very high percent of the time.

I don't like triples that form near the highs or the lows because we run the risk of them actually being a REAL triple top or bottom. Triples usually form in low volume trade and ones that form inside the range are preferred as targets. Like everything else, they aren't perfect but they have a good sucess rate of being run out. I beleive Blue on this forum was testing the overnight triples but I haven't heard anything yet...

Thanks Bruce, if the triples are formed inside the days range on high volume will they be considered valid.Like the ones at 1006.5 on Friday. Also if we can't find triples in a 5 min. chart, is it OK to consider the 1 min chart then or do we go loking for them from 4min to 3min to 2min and then 1 min.i.e scale down.

Also what do you consider as the end of overnight trading, is it at 9:30est or like me at 8.30est.

I don't think the volume is an issue but it is just something I have observed. I personally would not look at 1 - 4 minute etc..you'd drive yourself crazy and find too many areas of consolidation. For me it's on the 5 minute or else I don't look for them.

Obviously they are not perfect and you can see 5 (5 minute bars) in a row down near the 988 area that have held.....those folks got rewarded but most times the triples give folks the false impression of being rewarded only to get run out later.

There are some who think that the floor or larger traders don't gun for stops.....while they may not gun for my SPECIFIC order I beleive they do know that folks are taught to keep stops just below or above swing points and consolidation areas, like the triples. This is why I am a fader and like things like previous highs and lows and volume areas. We just don't trend enough and spend a huge amount of time consolidating...

Bring up a 5 minute chart of the ES and see how often we get a trend away from a price without going back to fill in the breakout area later.....look for my thread called "Price bar overlap" soon. The RTH session begins for me at 9:30 e.s.t and ends at 4:15 . Everything outside of that time is considered the overnight session for me.

Obviously they are not perfect and you can see 5 (5 minute bars) in a row down near the 988 area that have held.....those folks got rewarded but most times the triples give folks the false impression of being rewarded only to get run out later.

There are some who think that the floor or larger traders don't gun for stops.....while they may not gun for my SPECIFIC order I beleive they do know that folks are taught to keep stops just below or above swing points and consolidation areas, like the triples. This is why I am a fader and like things like previous highs and lows and volume areas. We just don't trend enough and spend a huge amount of time consolidating...

Bring up a 5 minute chart of the ES and see how often we get a trend away from a price without going back to fill in the breakout area later.....look for my thread called "Price bar overlap" soon. The RTH session begins for me at 9:30 e.s.t and ends at 4:15 . Everything outside of that time is considered the overnight session for me.

Originally posted by ak1

Thanks Bruce, if the triples are formed inside the days range on high volume will they be considered valid.Like the ones at 1006.5 on Friday. Also if we can't find triples in a 5 min. chart, is it OK to consider the 1 min chart then or do we go loking for them from 4min to 3min to 2min and then 1 min.i.e scale down.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.