ES short term trading 5-10-10

just checked the CME website, lock limit up is +5% during overnight GLOBEX, which is about 1162 for ES.

However, note that the limit up rule is removed once RTH starts.

However, note that the limit up rule is removed once RTH starts.

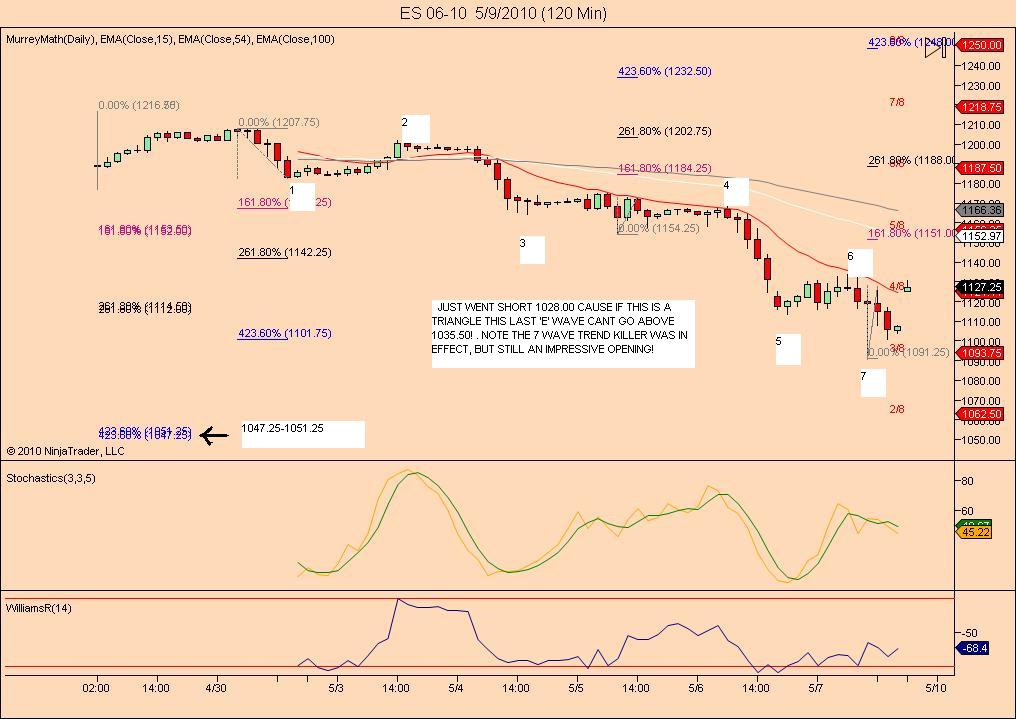

covered last at 51.25...here is the initial chart with the 51 area that I was using as a bias...look at the low area in the volume histogram on the right..

Some may also look how deep that retracement was the first time we went up into the 61 area and sold off...that was biggest correction in ON

Some may also look how deep that retracement was the first time we went up into the 61 area and sold off...that was biggest correction in ON

WEEKLY volume at price

Last week, (I think it was Thurs morning pre-RTH), I pointed out that price had moved below the Low of the previous month (1166) and that when similar PA occurs in daily trade, if L of previous day turns into resistance, well...

Now, today price is coming back up to test that area. (For Thursday's PA, RTH breakdown highs 64.50-65.00)

I have looked at volume at price chart: 30 minute bars for the RTH only, for the past 5 trade days:

the biggest aggregate "volume at price" for the past week is at 1169.75

1166-1170 is a "monthly" resistance level. I usually expect first tests to be rejected.

1137.50-1136 looks like the closest smallest volume at price area(based on an entire week of RTH volume)

I don't know whether 1166-1170 will be tested today, nor do I know what the PA will look like if this level is tested but it's an area of prices that will compel me to pay closer attention to PA especially since in the current pre-opening market there is a DT 61.75 & 62.00 highs, these prices carry the possibility that price can make an upthrust to run short stops (and maybe print 66+ handle).

Last week, (I think it was Thurs morning pre-RTH), I pointed out that price had moved below the Low of the previous month (1166) and that when similar PA occurs in daily trade, if L of previous day turns into resistance, well...

Now, today price is coming back up to test that area. (For Thursday's PA, RTH breakdown highs 64.50-65.00)

I have looked at volume at price chart: 30 minute bars for the RTH only, for the past 5 trade days:

the biggest aggregate "volume at price" for the past week is at 1169.75

1166-1170 is a "monthly" resistance level. I usually expect first tests to be rejected.

1137.50-1136 looks like the closest smallest volume at price area(based on an entire week of RTH volume)

I don't know whether 1166-1170 will be tested today, nor do I know what the PA will look like if this level is tested but it's an area of prices that will compel me to pay closer attention to PA especially since in the current pre-opening market there is a DT 61.75 & 62.00 highs, these prices carry the possibility that price can make an upthrust to run short stops (and maybe print 66+ handle).

new HV price now in O/N at 53...so we have the 53 and 59 drawing a lot of attention...in ON

other dowside is 47.50 and 41 ( O/N midpoint here too)

I'll be watching that huge YM volume if we get down there..and we should

On upside is the obvious current O/N high and then the 70 - 75 zone as big volume and key number up there...then 88 - 92

Good luck today, I'm trading lighter due to volatility

keeping Monday and the open price in mind as per Phileo and mutual funds. My bias is to the downside but it may be too obvious...every newbie in the world will be trying to sell this huge gap up..

other dowside is 47.50 and 41 ( O/N midpoint here too)

I'll be watching that huge YM volume if we get down there..and we should

On upside is the obvious current O/N high and then the 70 - 75 zone as big volume and key number up there...then 88 - 92

Good luck today, I'm trading lighter due to volatility

keeping Monday and the open price in mind as per Phileo and mutual funds. My bias is to the downside but it may be too obvious...every newbie in the world will be trying to sell this huge gap up..

so 53 is ending up being the top dog of O/N volume so that is the battle line in early trade..a break down of that and hold below will target the 47.50 and 41 - 42

and obvious break above will go to the 59 and the O/N high

failed buys and sell will use that 53 as the magnet......your results may vary...LOL

edit: that's my way of saying all magnets will either repel or attract price...good luck today

and obvious break above will go to the 59 and the O/N high

failed buys and sell will use that 53 as the magnet......your results may vary...LOL

edit: that's my way of saying all magnets will either repel or attract price...good luck today

trying short from 58.50

hopefully 56.25 will get worked on.......wow...volatile and won't be adding a second time today...plus 8 - 10 in minutes of trade...yikes

air pocket and key 53 retested...YM led that out...could be a tough hold for 47.50 and 41.50...but we'll try...

hoping they don't go for the 57.50 fill in from underneath at 53....this 53 a strong force so far..

so far we can't hold the overnight high and the YM is trying to lead out with two tries higher...now all we need to do is overtake this damn 53 and we are good to go I think.......down!! 47.50 and 41.50

clearing chart off my desktop.....here is why I thought that 650 YM was a magnet....LOOK at that volume in O/N......that test became the RTH low on Monday.....and they are jerking it around there in current overnight for Tuesday..

Originally posted by BruceM

what's up with that 10650 volume on the YM...hopefully not a data issue and hopefully a strong magnet

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.