Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

Some tidbits re. my trading plan.

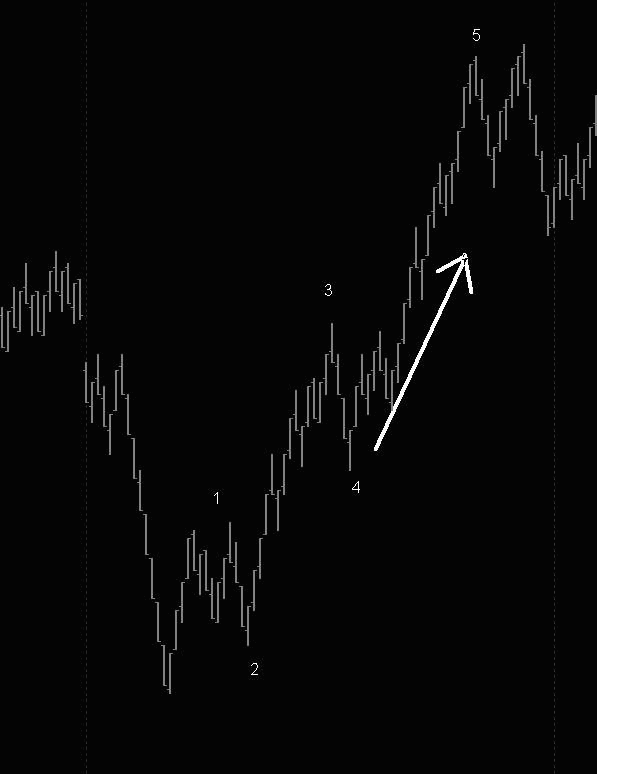

1) I have a "5th wave" trend setup that I fully automated and backtested (Oct 2008 to Jan 2010, ~550 trades), which I have been trading since January.

The essence of this setup is to find 123 wave-structures with strong enough wave 3 to believe a wave 5 will follow. I enter aggressively in wave 4 to ride wave 5.

I use 42-t (42 ticks) stop and 21-t/42-t targets. (the 21-t target on backtesting did show about 70% of the performance of the full target, with a reduced max drawdown ($3400 vs $5500).

I started trading this in January, trading only 1 contract on the larger target. Murphy's law in action, this larger target has been in mild drawdown from Jan to April, while the 1/2 target (which I wasn't trading at the beginning) was making more than in backtesting :(

I added a 2nd contract in March to also trade the 1/2 target, this helped globally get back to even, at which point I decided to temporarily park the system (the amount at risk on each trade for 2 contracts is too much for my psyche at this time).

Murphy's law again, since the fast crash the system is back to making money on both targets - but at this time, I only trade it manually, which means I miss all overnight setups, and also I pass on many trades during the day.

Note : in the past 3 years I have developped and backtested at least a dozen systems ... 3 of them were appealing enough to be taken live, but this one is the only one that I keep in my trading toolbox.

2) Most of my discretionary trading is trend-trades (scalps, really) - I always enter in pullbacks, using LMT entries. As stated in an earlier post, where to enter is the million dollar question. CL has a tendency to have many shallow pullbacks, with occasional deep pullbacks (or A/V reversals). I use a couple techniques aimed at shallow pullbacks (one for straight pullback, one for ABC pullback - when AB is created before reaching my LMT).

My backtesting results gave me 16 ticks as the optimal stop, and 10/15/25 ticks as optimal targets ... I currently only trade the 15-t target, I simply move stop to BE at +10.

On the 15-t target, the average trade duration is in the order of a couple minutes ... still too long for me, I manage to get undisciplined that fast :(

3) I occasionally do CT-trades ... only when I see good confluence of price projection levels. But even then, CT-trades on CL is highly risky business.

My CT-trades are mostly "standing in front of the train" type trades ... rarely will I get in on a pullback in opposition to the current trend.

4) Trend ... I define using wave structure and/or HHs/HLs LHs/LLs

5) Timeframes - I use a 9-tick range chart (R9) to identify the setups, but I also follow a number of other timeframes (mostly R4/R12/R27,R81/R127)using the same software, that gives me a view on waves structures of different magnitudes. I read volume on a 1min chart. CL volume analysis isn't as effective as for ES, but it still makes a lot of difference for me.

1) I have a "5th wave" trend setup that I fully automated and backtested (Oct 2008 to Jan 2010, ~550 trades), which I have been trading since January.

The essence of this setup is to find 123 wave-structures with strong enough wave 3 to believe a wave 5 will follow. I enter aggressively in wave 4 to ride wave 5.

I use 42-t (42 ticks) stop and 21-t/42-t targets. (the 21-t target on backtesting did show about 70% of the performance of the full target, with a reduced max drawdown ($3400 vs $5500).

I started trading this in January, trading only 1 contract on the larger target. Murphy's law in action, this larger target has been in mild drawdown from Jan to April, while the 1/2 target (which I wasn't trading at the beginning) was making more than in backtesting :(

I added a 2nd contract in March to also trade the 1/2 target, this helped globally get back to even, at which point I decided to temporarily park the system (the amount at risk on each trade for 2 contracts is too much for my psyche at this time).

Murphy's law again, since the fast crash the system is back to making money on both targets - but at this time, I only trade it manually, which means I miss all overnight setups, and also I pass on many trades during the day.

Note : in the past 3 years I have developped and backtested at least a dozen systems ... 3 of them were appealing enough to be taken live, but this one is the only one that I keep in my trading toolbox.

2) Most of my discretionary trading is trend-trades (scalps, really) - I always enter in pullbacks, using LMT entries. As stated in an earlier post, where to enter is the million dollar question. CL has a tendency to have many shallow pullbacks, with occasional deep pullbacks (or A/V reversals). I use a couple techniques aimed at shallow pullbacks (one for straight pullback, one for ABC pullback - when AB is created before reaching my LMT).

My backtesting results gave me 16 ticks as the optimal stop, and 10/15/25 ticks as optimal targets ... I currently only trade the 15-t target, I simply move stop to BE at +10.

On the 15-t target, the average trade duration is in the order of a couple minutes ... still too long for me, I manage to get undisciplined that fast :(

3) I occasionally do CT-trades ... only when I see good confluence of price projection levels. But even then, CT-trades on CL is highly risky business.

My CT-trades are mostly "standing in front of the train" type trades ... rarely will I get in on a pullback in opposition to the current trend.

4) Trend ... I define using wave structure and/or HHs/HLs LHs/LLs

5) Timeframes - I use a 9-tick range chart (R9) to identify the setups, but I also follow a number of other timeframes (mostly R4/R12/R27,R81/R127)using the same software, that gives me a view on waves structures of different magnitudes. I read volume on a 1min chart. CL volume analysis isn't as effective as for ES, but it still makes a lot of difference for me.

Who deleted my posts?

Originally posted by myptofvu

Who deleted my posts?

I did - it appeared to be a misunderstanding between the two of you so I cleaned it up. Did you think that there was value in leaving those posts up?

Crude Oil Futures

1. CL vs QM

CL is the "big" (Light Sweet) Crude Oil contract - its settlement is for physical delivery (1000 barrels)

CL trades in 1-cent increments (1-tick = $10 per contract), is "very" liquid (average daily volume for the front month contract > 250K), its bid/ask spread is consitenly 1-cent throughout the US session and most of the European session.

CL is traded on CME Globex AND in open-outcry (pit session : 8am-1:30pm CST) - I have no clue how the 2 interwork, but aside from much larger volume during the pit session I haven't noticed any impact.

I am only trading 1 or 2 CL contracts at this moment, I have experienced many "ET" fills (ET : Extreme Tick), ie. price goes to my LMT, does NOT trade through the LMT, but still gives me a fill. In comparison, it is quite rare that I don't get a fill on an ET. WRT stop slippage, I would say on average it is 1-tick ... I have had many stops filled w/o slippage, but also a number filled with 2 or 3 ticks slippage. My worst stop slippage was 8 ticks, one automated trading system got caught on the wrong side of the market on a 8:30am EST news release (unrelated to CL, but still had an immediate & significant impact).

QM is the "mini" (Light Sweet) Crude Oil contract - its settlement is financial only (contract unit : 500 barrels - 1/2 "big" contract)

QM trades in 2.5-cents increments (1-tick = $12.50 per contract), is ridiculously low volume (average daily volume for front-month about 10% of big contract volume), and its market is visibly made by arbitraging with the big contract. The bid/ask spread widens to 2-4 ticks (yep, 5-10-cents, sometimes even more) at the drop of a hat, and it rarely trades continuous ticks (ie., the bid/ask follows the big contract, without necessarily triggering any transaction). This makes it an inappropriate instrument for scalping, at best it can be used for swing-trading (understanding that you might have to give-up about 5 cents to get in and another 5 cents to get out).

If anything, QM provides an alternate "datafeed" for Crude Oil prices, totally independant from CL (so when CL datafeed goes down at the exchange, QM still provides good enough data at least to manage existing positions).

The front-month contract rolls every month for CL & QM, the last trading day for CL is most often the 20 of the month (see CME group / Energy / CL / Product Calendar for the exact dates), for QM it is 1-day before CL.

2. News releases and other price-movers

The one news release that affect CL/QM in a MAJOR way is the weekly Petroleum report on Wednesday 10:30am EST. It is very advisable to be flat going into the report, as price action right at the news release is always a nightmare (multiple spikes of 30+cents in a few seconds)

CL/QM is less affected by other economic news releases, with the exception of the monthly employment report (1st Friday of the month). In all case, price-action usually slows down a few minutes before the news release.

CL/QM is inversely correlated to the dollar index (dollar goes up, crude oil goes down) - but the correlation factor has a life of its own, so this is by no means a silver bullet (for me anyway).

3. Price Limits

Price limit mechanisms are precisely described in the Nymex Rulebook. For starters, the 1st price limit is +/- $10 vs prior-day settlement price, and triggers a 5min trading halt. After the 5min, trading resumes with slightly expanded limits (unsure by how much). Note that there are no limits in the last hour of the pit session.

1. CL vs QM

CL is the "big" (Light Sweet) Crude Oil contract - its settlement is for physical delivery (1000 barrels)

CL trades in 1-cent increments (1-tick = $10 per contract), is "very" liquid (average daily volume for the front month contract > 250K), its bid/ask spread is consitenly 1-cent throughout the US session and most of the European session.

CL is traded on CME Globex AND in open-outcry (pit session : 8am-1:30pm CST) - I have no clue how the 2 interwork, but aside from much larger volume during the pit session I haven't noticed any impact.

I am only trading 1 or 2 CL contracts at this moment, I have experienced many "ET" fills (ET : Extreme Tick), ie. price goes to my LMT, does NOT trade through the LMT, but still gives me a fill. In comparison, it is quite rare that I don't get a fill on an ET. WRT stop slippage, I would say on average it is 1-tick ... I have had many stops filled w/o slippage, but also a number filled with 2 or 3 ticks slippage. My worst stop slippage was 8 ticks, one automated trading system got caught on the wrong side of the market on a 8:30am EST news release (unrelated to CL, but still had an immediate & significant impact).

QM is the "mini" (Light Sweet) Crude Oil contract - its settlement is financial only (contract unit : 500 barrels - 1/2 "big" contract)

QM trades in 2.5-cents increments (1-tick = $12.50 per contract), is ridiculously low volume (average daily volume for front-month about 10% of big contract volume), and its market is visibly made by arbitraging with the big contract. The bid/ask spread widens to 2-4 ticks (yep, 5-10-cents, sometimes even more) at the drop of a hat, and it rarely trades continuous ticks (ie., the bid/ask follows the big contract, without necessarily triggering any transaction). This makes it an inappropriate instrument for scalping, at best it can be used for swing-trading (understanding that you might have to give-up about 5 cents to get in and another 5 cents to get out).

If anything, QM provides an alternate "datafeed" for Crude Oil prices, totally independant from CL (so when CL datafeed goes down at the exchange, QM still provides good enough data at least to manage existing positions).

The front-month contract rolls every month for CL & QM, the last trading day for CL is most often the 20 of the month (see CME group / Energy / CL / Product Calendar for the exact dates), for QM it is 1-day before CL.

2. News releases and other price-movers

The one news release that affect CL/QM in a MAJOR way is the weekly Petroleum report on Wednesday 10:30am EST. It is very advisable to be flat going into the report, as price action right at the news release is always a nightmare (multiple spikes of 30+cents in a few seconds)

CL/QM is less affected by other economic news releases, with the exception of the monthly employment report (1st Friday of the month). In all case, price-action usually slows down a few minutes before the news release.

CL/QM is inversely correlated to the dollar index (dollar goes up, crude oil goes down) - but the correlation factor has a life of its own, so this is by no means a silver bullet (for me anyway).

3. Price Limits

Price limit mechanisms are precisely described in the Nymex Rulebook. For starters, the 1st price limit is +/- $10 vs prior-day settlement price, and triggers a 5min trading halt. After the 5min, trading resumes with slightly expanded limits (unsure by how much). Note that there are no limits in the last hour of the pit session.

I spent a lot of time over the week browsing through various areas of the forum, looking for inspiration and remedies to my psyche issues (FEAR translating into lack of discipline, for both taking entries and trade management).

I found a large number of posts of interest, too many to highlight here, anyway my thanks to all who posted in these threads - I was eager to trade with discipline this morning :)

Day's summary

- The day started on a nice CT (counter-trend) opportunity right after the open, however I have a rule to NOT take CT-trades on Monday mornings

- 1st valid setup for a short in pullback after the LoD established around 9:45am EST ... I suspected a reversal right there, because that low was really a retest of an overnight break-out zone (plus it was Friday's low, but despite this being on my chart I didn't see it on the spot), but being eager to be discipline I took the trade.

7-t heat, moved stop to BE+1 at +6, stopped BE.

Turned out to be indeed a V-reversal

-2nd valid setup for long in pullback after the HoD made around 10:11am EST ... again I suspected a reversal right there, this time because ES was just teasing Friday late afternoon highs, and I anticipated a consolidation to form inside that current range, anyway I took that trade also by discipline.

8-t heat, moved stop to BE+1 at +5, stopped BE+1

Turned out in a stair-step reversal

- couple of no-fill shorts on the way down (not by much each time, how frustrating)

- passed on a short on pullback after the "marginal" LLoD (14-t range extension) - it really looked like a washout move, however a short there would have been a win (one example of being "right" and making no money)

- 3rd setup on the big bounce off the LoD - took a long in the pullback off the 11:46am EST high, aggressive entry (vs my "regular" entry) at a level I have a lot of trust in, and a shock - price went through my entry w/o stopping one sec., gave me another 7-t heat in a matter of a few seconds - I panicked and set my target to BE, was indeed bailed-out just to see CL run to my target w/o looking back :(

That was my "only" error of the day - I panicked for 7-t heat on an entry that I made aggressive - but I totally forgot that "detail" in the heat of the trade.

That "only" error cost me the only win for the day...

I find this type of scenario to be pretty consistent in my trading ... my errors are more often punished than rewarded ...

I found a large number of posts of interest, too many to highlight here, anyway my thanks to all who posted in these threads - I was eager to trade with discipline this morning :)

Day's summary

- The day started on a nice CT (counter-trend) opportunity right after the open, however I have a rule to NOT take CT-trades on Monday mornings

- 1st valid setup for a short in pullback after the LoD established around 9:45am EST ... I suspected a reversal right there, because that low was really a retest of an overnight break-out zone (plus it was Friday's low, but despite this being on my chart I didn't see it on the spot), but being eager to be discipline I took the trade.

7-t heat, moved stop to BE+1 at +6, stopped BE.

Turned out to be indeed a V-reversal

-2nd valid setup for long in pullback after the HoD made around 10:11am EST ... again I suspected a reversal right there, this time because ES was just teasing Friday late afternoon highs, and I anticipated a consolidation to form inside that current range, anyway I took that trade also by discipline.

8-t heat, moved stop to BE+1 at +5, stopped BE+1

Turned out in a stair-step reversal

- couple of no-fill shorts on the way down (not by much each time, how frustrating)

- passed on a short on pullback after the "marginal" LLoD (14-t range extension) - it really looked like a washout move, however a short there would have been a win (one example of being "right" and making no money)

- 3rd setup on the big bounce off the LoD - took a long in the pullback off the 11:46am EST high, aggressive entry (vs my "regular" entry) at a level I have a lot of trust in, and a shock - price went through my entry w/o stopping one sec., gave me another 7-t heat in a matter of a few seconds - I panicked and set my target to BE, was indeed bailed-out just to see CL run to my target w/o looking back :(

That was my "only" error of the day - I panicked for 7-t heat on an entry that I made aggressive - but I totally forgot that "detail" in the heat of the trade.

That "only" error cost me the only win for the day...

I find this type of scenario to be pretty consistent in my trading ... my errors are more often punished than rewarded ...

Day's summary

I have been pretty good on entries today (100%), but made 2 trade management errors (moving stop too far / too early) which cost me 2 wins.

4 no-fill / 3 BE / 1 loser ; down 11-t (+ comms). I lost 25-t in those 2 trade management errors.

Was discussing this with another trader over Skype, and I wrote : "once I realize and fully accept there is NOTHING that can save from a loss, and that doing anything is most likely to turn a win into regrets, then I will be consistently profitable". I am going to make this a mantra.

So here we go :

"NOTHING can save a trade from a LOSS, and ANYTHING OUTSIDE OF MY PLAN is most likely to turn a WIN into REGRETS".

I have been pretty good on entries today (100%), but made 2 trade management errors (moving stop too far / too early) which cost me 2 wins.

4 no-fill / 3 BE / 1 loser ; down 11-t (+ comms). I lost 25-t in those 2 trade management errors.

Was discussing this with another trader over Skype, and I wrote : "once I realize and fully accept there is NOTHING that can save from a loss, and that doing anything is most likely to turn a win into regrets, then I will be consistently profitable". I am going to make this a mantra.

So here we go :

"NOTHING can save a trade from a LOSS, and ANYTHING OUTSIDE OF MY PLAN is most likely to turn a WIN into REGRETS".

Day's summary

CL live : 2 no-fill / 1 passed on (error)

Not a good day for my trading tools. I passed on a long just after the open, really no justification (but would be no fill), then on the next little push up I passed again, this time because I felt this last push up was not enough. But I didn't realize that volume was really low in the ensuing pullback, that should have got me long.

The 2 short setups (just after the Petroleum news report then at 2pm after a spike reversal at HoD) were both no-fill.

Went back to sim in the afternoon on ES, 6 win / 1 loss - but really what good does this make ?

CL live : 2 no-fill / 1 passed on (error)

Not a good day for my trading tools. I passed on a long just after the open, really no justification (but would be no fill), then on the next little push up I passed again, this time because I felt this last push up was not enough. But I didn't realize that volume was really low in the ensuing pullback, that should have got me long.

The 2 short setups (just after the Petroleum news report then at 2pm after a spike reversal at HoD) were both no-fill.

Went back to sim in the afternoon on ES, 6 win / 1 loss - but really what good does this make ?

Day's summary

CL live : 1 win / 1 BE+ (trade management error - again !) / 2 no-fills / 2 entry-errors

It looks like the 1st win did more psychological damage than not ... although that trade was "perfect" (ET fill, ie. not a single tick of heat, 21-t target reached in 51 sec, out 1-t before it reversed), for whatever reason (*) I could not follow my plan in the following trade, and moved the target for a small win exit rather than just waiting for the normal target or my BE stop to be hit (that would have been a win).

I then got distracted and missed a 5th wave short setup (also a win). Finally, I passed on a long setup after the BkO reversal at 1:35pm, this time on plain and simple FEAR of taking a loss (but would also be a win).

Bottom line : +26-t, even discounting the missed 5th wave short setup, I lost $250 on the 2 other errors.

(*) honestly, the reason for moving my target begging for a small win exit is that, in the moment, it looked like it would pull-back to my BE stop (was 3-t from it, after printing +11-t) ... but I know CL needs some room, and this is why I only move my stop to BE after printing +10 ... so I should be prepared to see price come back towards my BE stop, and not sweat it !

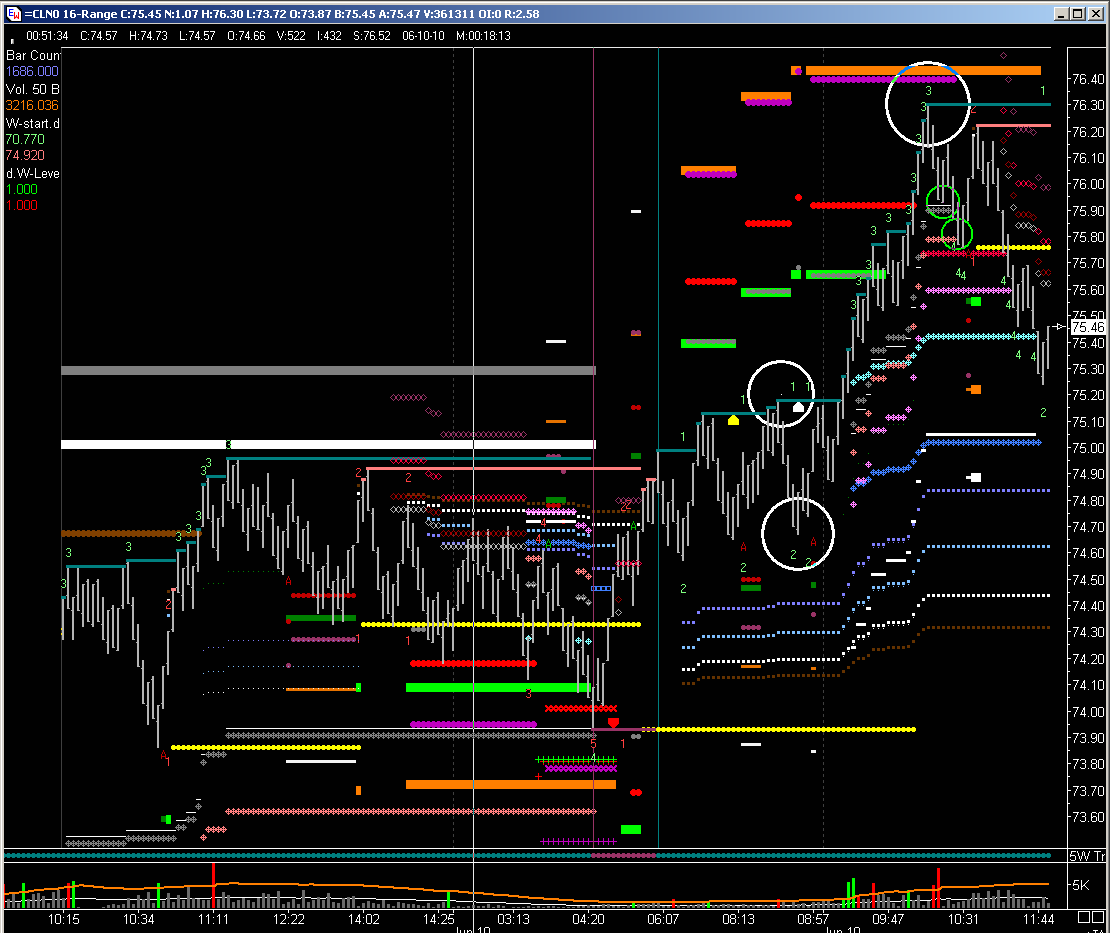

5th wave Long setup (on 16-t range chart, as pattern is too big to be viewed on 9-t range chart) :

Waves 1, 2, 3 are marked with white circles, the green circles are my 2 trade locations

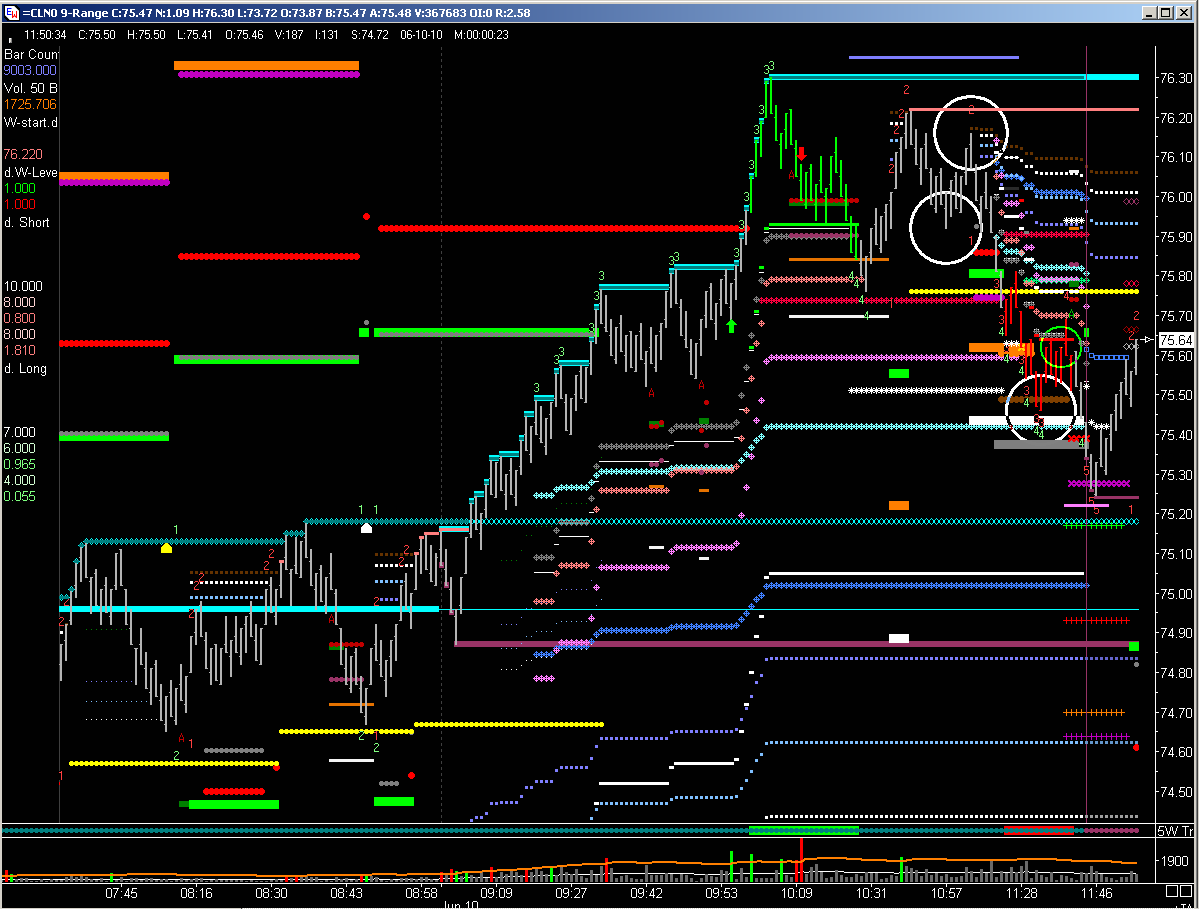

5th wave Short setup (on 9-t range chart) :

Waves 1, 2, 3 are marked with white circles, the green circle is where the corresponding trade location would be

As you guys can see, even though I don't use any bar-based indicator, my charts are quite busy ...

CL live : 1 win / 1 BE+ (trade management error - again !) / 2 no-fills / 2 entry-errors

It looks like the 1st win did more psychological damage than not ... although that trade was "perfect" (ET fill, ie. not a single tick of heat, 21-t target reached in 51 sec, out 1-t before it reversed), for whatever reason (*) I could not follow my plan in the following trade, and moved the target for a small win exit rather than just waiting for the normal target or my BE stop to be hit (that would have been a win).

I then got distracted and missed a 5th wave short setup (also a win). Finally, I passed on a long setup after the BkO reversal at 1:35pm, this time on plain and simple FEAR of taking a loss (but would also be a win).

Bottom line : +26-t, even discounting the missed 5th wave short setup, I lost $250 on the 2 other errors.

(*) honestly, the reason for moving my target begging for a small win exit is that, in the moment, it looked like it would pull-back to my BE stop (was 3-t from it, after printing +11-t) ... but I know CL needs some room, and this is why I only move my stop to BE after printing +10 ... so I should be prepared to see price come back towards my BE stop, and not sweat it !

5th wave Long setup (on 16-t range chart, as pattern is too big to be viewed on 9-t range chart) :

Waves 1, 2, 3 are marked with white circles, the green circles are my 2 trade locations

5th wave Short setup (on 9-t range chart) :

Waves 1, 2, 3 are marked with white circles, the green circle is where the corresponding trade location would be

As you guys can see, even though I don't use any bar-based indicator, my charts are quite busy ...

Day's summary

CL live : 1 no-fill right after the 8:30am news release, then there were only "low-rated" setups on which I passed - too bad, these were mostly winners despite being "low-rated".

I have noticed I tend to become ultra conservative towards the end of the day/week/month ... the drawback with this, is the lower the number of trades the less the greater the risk of deviating from the long-term expectancy.

CL live : 1 no-fill right after the 8:30am news release, then there were only "low-rated" setups on which I passed - too bad, these were mostly winners despite being "low-rated".

I have noticed I tend to become ultra conservative towards the end of the day/week/month ... the drawback with this, is the lower the number of trades the less the greater the risk of deviating from the long-term expectancy.

Day's summary

CL live : 1 win (+15-t) / 2 no-fill / 1 entry error

What a slow morning for CL !!! 1st opportunity at ~11:30am (EST), had all characteristics for an "ultra-aggressive" entry - but I was slow, too, and shy, also, so used my "standard" entry level and missed that trade (this is the entry error).

Then there were a couple of shorts / no-fill, and finally 1 short that turned out to be a lucky full win (ET fill on exit ... would have been stopped at +7 otherwise).

Here the good news is ... I finally managed ONE trade correctly (ie. per my plan) ... another 3599 to go and it will be a habit ?!

CL live : 1 win (+15-t) / 2 no-fill / 1 entry error

What a slow morning for CL !!! 1st opportunity at ~11:30am (EST), had all characteristics for an "ultra-aggressive" entry - but I was slow, too, and shy, also, so used my "standard" entry level and missed that trade (this is the entry error).

Then there were a couple of shorts / no-fill, and finally 1 short that turned out to be a lucky full win (ET fill on exit ... would have been stopped at +7 otherwise).

Here the good news is ... I finally managed ONE trade correctly (ie. per my plan) ... another 3599 to go and it will be a habit ?!

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.