Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

A slow - but profitable - start of the year for my other system, 1 win ; net +695 (1 contract).

Looking back at 2011 (and prior years, too), none of my price-action based systems did survive the test of time (my "other system" is not price-action based). I am still puzzled as to how this can be the case, and I will not admit defeat until I move my reversal system to 1-min charts and take a look at its performance on that timeframe (it is currently operating off 200-contracts volume-bar chart). But it would appear I am far from an isolated case, at least if I trust Rishi K. Narang, co-founder of Tradeworx, and author of "Inside the black box". Here is what he wrote in Chapter 9 - Research, p. 129:

"There are many attempts of quants working closely with successful discretionary traders, in an attempt to codify aspects of the latter's behavior into a trading system. Not all are necessarily bound for success. (...) Many quant funds have come (and mostly gone) that have attempted to recreate such patterns into systematic trading rules. This could be because the idea itself is not based upon valid theory, or it might be because the human version was ultimately less rule based, as one might like to believe, condemning a truly systematic implementation to be unsuccessful."

As a result, I am planning on researching other avenues this year.

Looking back at 2011 (and prior years, too), none of my price-action based systems did survive the test of time (my "other system" is not price-action based). I am still puzzled as to how this can be the case, and I will not admit defeat until I move my reversal system to 1-min charts and take a look at its performance on that timeframe (it is currently operating off 200-contracts volume-bar chart). But it would appear I am far from an isolated case, at least if I trust Rishi K. Narang, co-founder of Tradeworx, and author of "Inside the black box". Here is what he wrote in Chapter 9 - Research, p. 129:

"There are many attempts of quants working closely with successful discretionary traders, in an attempt to codify aspects of the latter's behavior into a trading system. Not all are necessarily bound for success. (...) Many quant funds have come (and mostly gone) that have attempted to recreate such patterns into systematic trading rules. This could be because the idea itself is not based upon valid theory, or it might be because the human version was ultimately less rule based, as one might like to believe, condemning a truly systematic implementation to be unsuccessful."

As a result, I am planning on researching other avenues this year.

Good luck, keep us appraised of your progress and feel free to use us as a sounding bound.

A choppy week for my other system: 2 wins / 2 losses ; net +310 on the week.

I have been fighting a bad cold for a couple weeks, and the most part of this week has been really bad, so I didn't do a lot. The only R&D work in progress is actually on my other system, I have been looking at 3 different filters, 1 of them does a great job in 2011 but is slightly negative on the other years - I decided to park it for now. The second one seems to be marginally better on 2009-2010, and significantly better in 2011. It is a candidate to stay. The 3rd one is definitively improving all years (about +10% on P&L across the 3+ years). At this point, I am finishing the detailed backtesting (tick by tick replay of the market from October 2008 to Dec 2011 ... that takes about 4 days to complete on 1 PC for that system), and after ensuring the "real time" results are correct (ie., match what I see on the chart) I will use that software version for trading a 2nd contract on that system, once I reach that point (1st contract will stay on current software version) (I am not a fan of filtering setups, even with a strong market psychology rationale for the filter, because the number of trades impacted is almost never statistically significant).

Also to be mentioned, that 2nd contract will use a way bigger target ... I currently use 70-ticks for target-1, target-2 will be 210-ticks, for an additional +10% P&L across the board, at the expense of more volatility in the P&L curve (meaning, larger drawdowns).

I have been fighting a bad cold for a couple weeks, and the most part of this week has been really bad, so I didn't do a lot. The only R&D work in progress is actually on my other system, I have been looking at 3 different filters, 1 of them does a great job in 2011 but is slightly negative on the other years - I decided to park it for now. The second one seems to be marginally better on 2009-2010, and significantly better in 2011. It is a candidate to stay. The 3rd one is definitively improving all years (about +10% on P&L across the 3+ years). At this point, I am finishing the detailed backtesting (tick by tick replay of the market from October 2008 to Dec 2011 ... that takes about 4 days to complete on 1 PC for that system), and after ensuring the "real time" results are correct (ie., match what I see on the chart) I will use that software version for trading a 2nd contract on that system, once I reach that point (1st contract will stay on current software version) (I am not a fan of filtering setups, even with a strong market psychology rationale for the filter, because the number of trades impacted is almost never statistically significant).

Also to be mentioned, that 2nd contract will use a way bigger target ... I currently use 70-ticks for target-1, target-2 will be 210-ticks, for an additional +10% P&L across the board, at the expense of more volatility in the P&L curve (meaning, larger drawdowns).

Disappointing week for my other system, 2 losses ; net -770 on the week.

I restarted working on the reversal system, I spotted a good improvement, changed a few things which did not make a lot of sense (but that only degraded the overall performance by the amount I had just gained). But all in all, it is broken since mid-August 2011.

I may have found something today though, as I started to look at the performance of that setup for various sizes of prior trend ; what I found so far is that for prior trend of a decent size (say, > 1pt) the setup performance hasn't suffered much (but that represents only ~30% of the setups). But for smaller prior trend, the performance has been much degraded, which basically means moves have had way more chop in their early & mid development since mid-August 2011. I'll keep looking in that direction next week.

Dom - you may have answered this elsewhere but after doing a search I couldn't find anything.

What do you use to do your back testing?

What do you use to do your back testing?

I use Ensign Windows for my backtesting & live automated trading. Over the years I developed a reasonably solid infrastructure to that effect (the backtesting automation, the interface to Bracket Trader & a trade simulator are written in ESPL, nowadays all my trading strategies are build using DYOs only (often a lot of them), I have another trade simulator in DYOs which I use for quick evaluation of the strategies on "static" charts).

The main limitation of this infrastructure is the amount of data I can load in a single chart for strategy evaluation - with a max of 65500 bars per chart, I find myself limited to about 1 month of data per chart (at least for the timeframes I use for intraday trading), so evaluating a strategy on 2 years means loading 24 charts, applying the template on the 24 charts & then recording in an Excel spreadsheet the results month by month.

I am not sure if Ensign 10 has made any progress on that front (max number of bars per chart), and since DYOs are plain different in Ensign 10, I have not spend any time yet looking into it - or any other option.

Another disappointing week for my other system: 2 (small) wins / 1 (max) loss ; net -555 on the week.

I realize there have to be drawdown periods, and the disappointment is just for been in drawdown at this time instead of making new equity peaks. Aside from that, the system keeps working as it should, and I have been pretty good at letting it manage the trades 100%. I made only 1 discipline error in December (that is, taking over the management of a trade), and none in January :)

On the R&D front I am working again full-time on the reversal system ... I investigated a few ideas in the 1st half of the week, making no headway :( Then from Wednesday I worked on the pivots identification, and made progressively some significant progress (+16% on total P&L for 27-months backtesting, 523 trades vs 497, 166 avg/trade for 2 contracts vs 150 avg/trade), with a big impact on last 4 months drawdown (reduced by about 75%). I am certainly not at a point where I am feeling confident to trade it again, though...

Just a quick note on pivots identification ... I was originally using 5/5 pivots (mandating 5 bars on each side of the pivot), with the added requirement of a minimum price bounce on the right side, and that no 2 opposite pivots be in the same 1min bar (this system uses a 200-vol chart). The significant improvement did come from 2 things:

1) reducing the left side to 3-bars (I tested all the way to 0-bars, there isn't much degradation from 3-bars to 0-bars, but 3-bars appears to be "best"). This came as a surprise in the beginning, but then I realized that many pullbacks do start by a fast move backwards, making the pullback pivot much closer to the leg pivot than I thought.

2) varying the right side from 4 to 6 bars, ensuring that the right side lasts at least 2min from the pivot. I tested the upper boundary from 6 to 8 bars, 6 & 7 were pretty close.

The challenge in pivots identification is to pick those pivots that are "visible" to most traders ... from those using 1min charts to those using volume charts & range charts. I believe I made some key progress in this area this week!

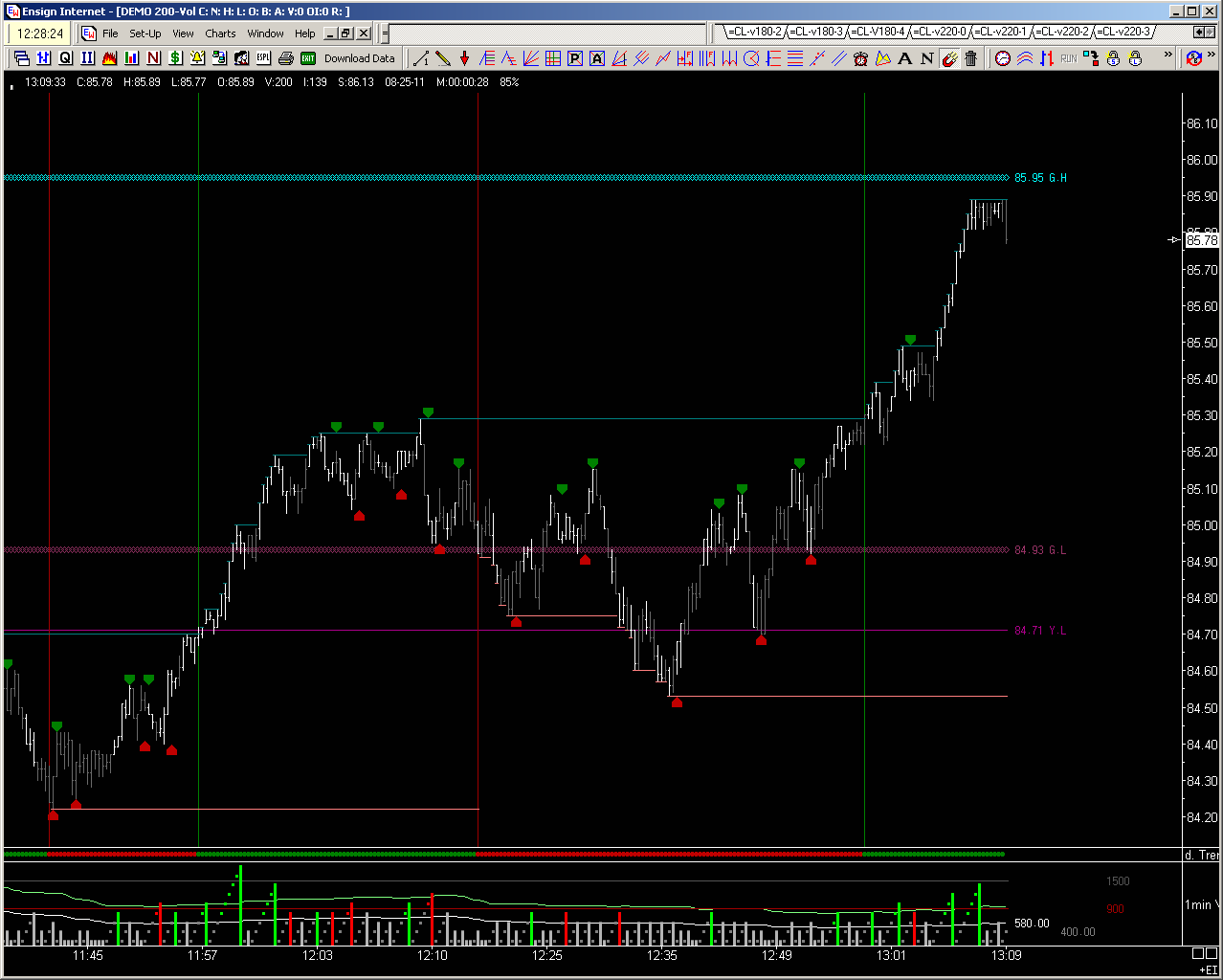

A random display of pivots ... trend changes are identified by green/red vertical lines. The bottom panel displays 1min equivalent volume.

I realize there have to be drawdown periods, and the disappointment is just for been in drawdown at this time instead of making new equity peaks. Aside from that, the system keeps working as it should, and I have been pretty good at letting it manage the trades 100%. I made only 1 discipline error in December (that is, taking over the management of a trade), and none in January :)

On the R&D front I am working again full-time on the reversal system ... I investigated a few ideas in the 1st half of the week, making no headway :( Then from Wednesday I worked on the pivots identification, and made progressively some significant progress (+16% on total P&L for 27-months backtesting, 523 trades vs 497, 166 avg/trade for 2 contracts vs 150 avg/trade), with a big impact on last 4 months drawdown (reduced by about 75%). I am certainly not at a point where I am feeling confident to trade it again, though...

Just a quick note on pivots identification ... I was originally using 5/5 pivots (mandating 5 bars on each side of the pivot), with the added requirement of a minimum price bounce on the right side, and that no 2 opposite pivots be in the same 1min bar (this system uses a 200-vol chart). The significant improvement did come from 2 things:

1) reducing the left side to 3-bars (I tested all the way to 0-bars, there isn't much degradation from 3-bars to 0-bars, but 3-bars appears to be "best"). This came as a surprise in the beginning, but then I realized that many pullbacks do start by a fast move backwards, making the pullback pivot much closer to the leg pivot than I thought.

2) varying the right side from 4 to 6 bars, ensuring that the right side lasts at least 2min from the pivot. I tested the upper boundary from 6 to 8 bars, 6 & 7 were pretty close.

The challenge in pivots identification is to pick those pivots that are "visible" to most traders ... from those using 1min charts to those using volume charts & range charts. I believe I made some key progress in this area this week!

A random display of pivots ... trend changes are identified by green/red vertical lines. The bottom panel displays 1min equivalent volume.

This week wasn't the best for my other system, but it ends positive on the week: 2 wins / 2 losses ; net +390 on the week.

I spent all the week improving the pivot identification software of the reversal system - the net result (in terms of P&L) is negligible compared to last week (~ +1% for -19 trades), but these pivots now always make sense on a 1min chart. This doesn't solve the last 4 months performance issue, but as it is now it could very much be a normal drawdown, although a very irritating one (BTW, only 1 of those 4 months is really red, 2 are a little less than BE, and 1 is green - not great but much better than BE).

On the plus side, performance for CLH12 (not part of my backtesting) is pretty reasonable so far: 13 trades, 6 target-1 wins, 6 target-2 wins, net +3130 for 2 contracts. Win rate for target-1 is below average, but all these target-1 wins had follow-through, making the target-2 win rate slightly above average.

I spotted 2 possible changes in the trend-change detection mechanism which I will evaluate next week. I also identified a situation in which I void the reversal setup but could later reactivate it.

An unusual week for my other system, at least compared to the last year ... 1 win / 1 loss / 2BE ; net +110 on the week. None of those trades was big either way (+315 / -205 / +95 / -95).

On the R&D front (reversal system), the 1st idea re. trend change modification turned out to be a real poor one (according to backtesting), the second one evolved into a filter candidate, for which I am now evaluating various settings. I also fixed a bug I had not noticed before (it impacted 3 trades out of the 500). It will probably take me most of next week to finish on this filter candidate then address the setup reactivation idea.

Reversal system current performance on CLH12 : 19 trades / 10 target-1 win / 9 target-2 wins ; net +3660 (this is "backtesting" performance, I have not resumed trading this system yet).

A pretty small week for my other system, 1 win / 1 loss ; net +220 (+335 / -115).

Reversal system performance on CLH12 : 24 trades / 14 win target-1 / 10 win target-2 ; net +3620 (this is from 19-jan to 16-feb ... usually I move to the next month at the close 2 business days before the last trading day of the contract, but when 1 of those 2 days is a reduced-session I move at the close 3 business days before the last trading day, and sure enough 2/3 of the volume today was on CLJ12).

On the R&D front (reversal system), I ended-up throwing that filter candidate ... depending on the settings, it was filtering up to 33 trades (out of 500 total), but really only the tightest setting was doing a good job, on 4 trades ... the other 29 trades did average the same P&L / trade as the system global performance, no matter where I was setting the filter threshold. And those 4 trades on the tightest settings are really not statistically significant.

I am a bit disappointed by the amount of energy "wasted" on this, however it is yet another proof that it is easy to spot a pattern that "seem" to work, when in fact it doesn't.

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.