Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

Day's summary

CL new system : 1 win (+29-t)

Today's short win was probably the longest duration winning trade I ever took : 1h34, and I resisted all kind of temptations to mess it up ! I did a quick day-of-week analysis while in the trade though, as I was really wondering what performance Fridays have in store for this system ... well, the good news was it is #1 day for total P&L, and #2 for average P&L / trade ... that helped me stay quiet, but the market really tried to shake me out between 12:50pm and 2:05pm.

I spend the day working on performance improvements (really, the same topic as yesterday, from a better angle), and I found this morning that 1 of the 2 filters I have (since July 31) has actually NO benefit on P/F / expectancy, but cuts ~7% of overall P&L ... how could I let this go on for so long ? Needless to say, I turned it off right away, good thing as it would have filtered this afternoon winning trade...

Week's summary

I achieved my 2 primary goals for the week :

1) got the new system live

2) traded it all week w/o any manual intervention.

Net performance for the week : 2 win / 1 (max) loss ; net minus $45 ; and a lot of learning from all this. I would lie if I didn't mention how excited I am with this system !

CL new system : 1 win (+29-t)

Today's short win was probably the longest duration winning trade I ever took : 1h34, and I resisted all kind of temptations to mess it up ! I did a quick day-of-week analysis while in the trade though, as I was really wondering what performance Fridays have in store for this system ... well, the good news was it is #1 day for total P&L, and #2 for average P&L / trade ... that helped me stay quiet, but the market really tried to shake me out between 12:50pm and 2:05pm.

I spend the day working on performance improvements (really, the same topic as yesterday, from a better angle), and I found this morning that 1 of the 2 filters I have (since July 31) has actually NO benefit on P/F / expectancy, but cuts ~7% of overall P&L ... how could I let this go on for so long ? Needless to say, I turned it off right away, good thing as it would have filtered this afternoon winning trade...

Week's summary

I achieved my 2 primary goals for the week :

1) got the new system live

2) traded it all week w/o any manual intervention.

Net performance for the week : 2 win / 1 (max) loss ; net minus $45 ; and a lot of learning from all this. I would lie if I didn't mention how excited I am with this system !

Dom;

What kind of chair is that......I don't think my chair would

fit in the picture...

My desk has coffee cups and empty cashew nut cans on it..lol

What kind of chair is that......I don't think my chair would

fit in the picture...

My desk has coffee cups and empty cashew nut cans on it..lol

Dom, I think you need to upgrade your chair - assuming that you spend a fair amount of time in it. Otherwise I like your setup and am jealous at the amount of space that you have. Next time I relocate my workspace I'm going to do something very similar to what you have in that photo.

I agree with the other guys about the chair. Believe me I have had first hand experience with a crappy chair and a bad back.

Nice free feeling space though.

Cheers!

Nice free feeling space though.

Cheers!

That chair is a $65 Staples Depot 7-year old one, and I sit on it mostly like on a stool - lol

I'd like to post here the lyrics of one of my most favorite songs, this one by Supertramp, "Where there's a will, there's a way" ...

Where there's a will, there's a way

Or so they say

A friend in need is a friend indeed

He'll be there every day

And if it's trouble that's in store

You know they'll tell you even more

Where there's a will, there's a way

That's what they'll say

When the writing is on the wall

And if you could fall

When your best ain't good enough

And life's too tough

When the land of hope and dreams

Isn't always what it seems

Where there's a will, there's a way

They always say

You may be sorry, you may be sad, you may be blue

You think you'll never see the sun come breaking thru

You struggle morning noon and night

And you still can't get it right

But where there's a will, there's a way

Just say it every day

Well so much for trouble, so much for heartache

So much for pain

You just gotta get up, you just gotta reach out

You gotta try and try again

You think you'll never see it thru

But what the hell you gonna do

Where there's a will, there's a way

You've heard'em say

Well I don't know nothing 'bout this world, and all its wrongs

I can't tell you now, why we all can't get along

But after all is said and done

We gotta keep on, keepin' on

'Cos where there's a will, there's a ...

If you don't know by now, I don't know what to say

Thru all your sorrows, all your dreams, and all your joys

In times of sadness, in time of grief and even times that you enjoy

As your life you live it through

You know it all depends on you

And if there's a will, there's a way

You better get down and pray

From the cradle to the grave

You better say it every day

When the crime's above the law

When the plane's about to fall

When the mighty oceans roar

When tomorrow's at your door

Where there's a will, there's a way

That's what they'll say

I'd like to post here the lyrics of one of my most favorite songs, this one by Supertramp, "Where there's a will, there's a way" ...

Where there's a will, there's a way

Or so they say

A friend in need is a friend indeed

He'll be there every day

And if it's trouble that's in store

You know they'll tell you even more

Where there's a will, there's a way

That's what they'll say

When the writing is on the wall

And if you could fall

When your best ain't good enough

And life's too tough

When the land of hope and dreams

Isn't always what it seems

Where there's a will, there's a way

They always say

You may be sorry, you may be sad, you may be blue

You think you'll never see the sun come breaking thru

You struggle morning noon and night

And you still can't get it right

But where there's a will, there's a way

Just say it every day

Well so much for trouble, so much for heartache

So much for pain

You just gotta get up, you just gotta reach out

You gotta try and try again

You think you'll never see it thru

But what the hell you gonna do

Where there's a will, there's a way

You've heard'em say

Well I don't know nothing 'bout this world, and all its wrongs

I can't tell you now, why we all can't get along

But after all is said and done

We gotta keep on, keepin' on

'Cos where there's a will, there's a ...

If you don't know by now, I don't know what to say

Thru all your sorrows, all your dreams, and all your joys

In times of sadness, in time of grief and even times that you enjoy

As your life you live it through

You know it all depends on you

And if there's a will, there's a way

You better get down and pray

From the cradle to the grave

You better say it every day

When the crime's above the law

When the plane's about to fall

When the mighty oceans roar

When tomorrow's at your door

Where there's a will, there's a way

That's what they'll say

In this post I won't describe what the new system does, any further than to state that it looks for strong momentum situations, and enters in that direction in the 1st pullback.

But I will show the genesis of the system, at least from a performance point of view. The whole point here is to show that using the very same concept & technique of identifying a setup (strong momentum), there was a long road from the 1st attempts to the current version (and there remains some road ahead).

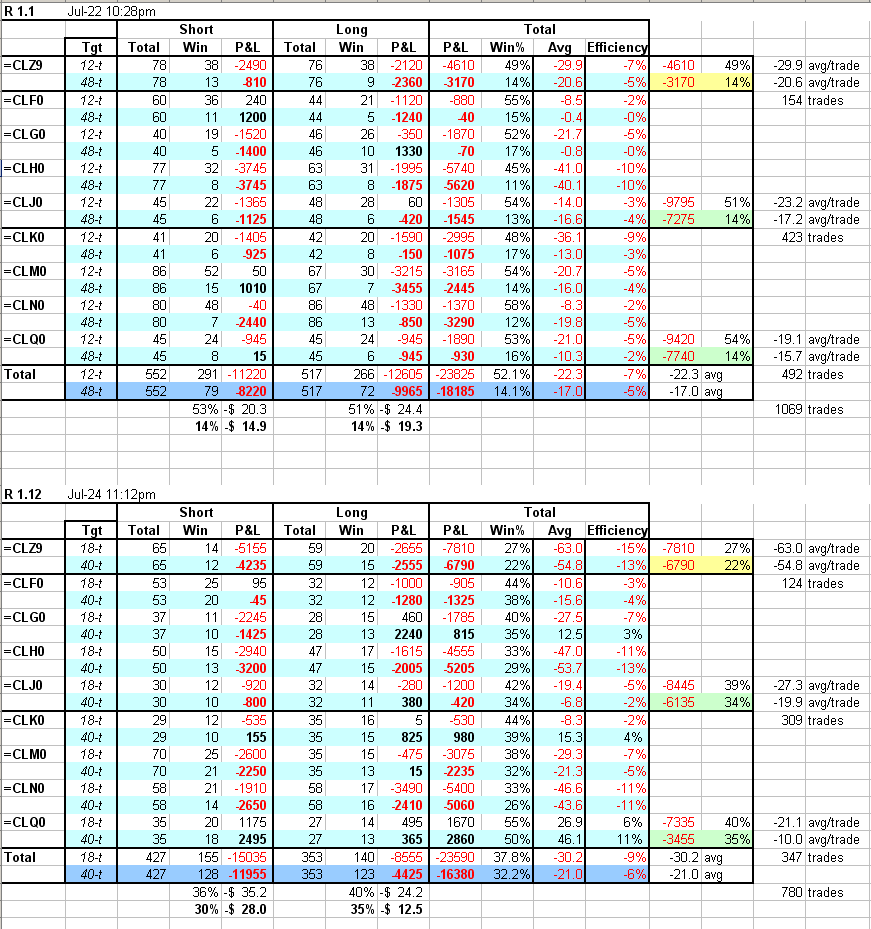

I started the system using reversal breakout entries, ie. using a STP entry once price retraced "enough". I worked 3 days on this basis, the following 2 "performance" reports depict the 1st and 12th (and last) version on this principle. BTW, "enough" was quantified using a pair of EMAs.

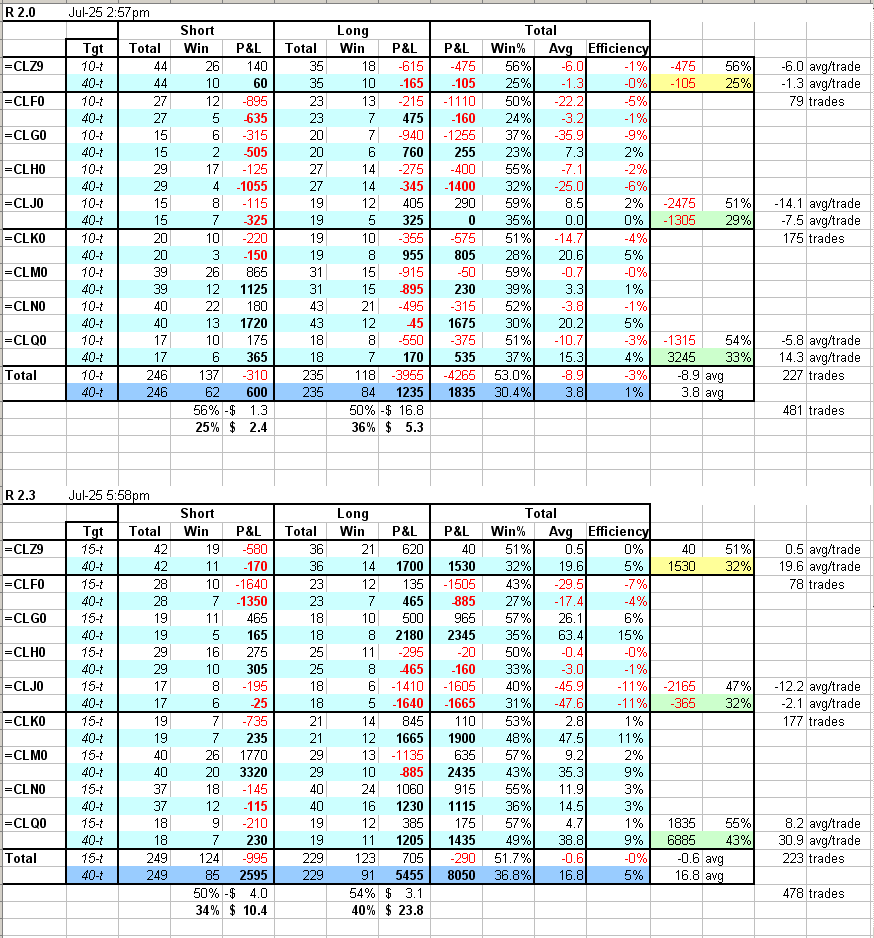

I decided to try another approach, this time calculating the entry level and using LMT entry. Even though the 1st try didn't look too good (except in comparison to R1), a couple hours later R2.3 was for me the incentive to keep pushing in that direction.

And by the time I went to bed, R2.7 confirmed that approach. See how R2.12 next day didn't improve things much, and really from R3 to R20 most of the work has been in fixing a large number of design shortcuts that were good in the beginning to quickly assess if the system concept was viable, but led too many bad trades - simply because oversimplification of price action analysis doesn't work.

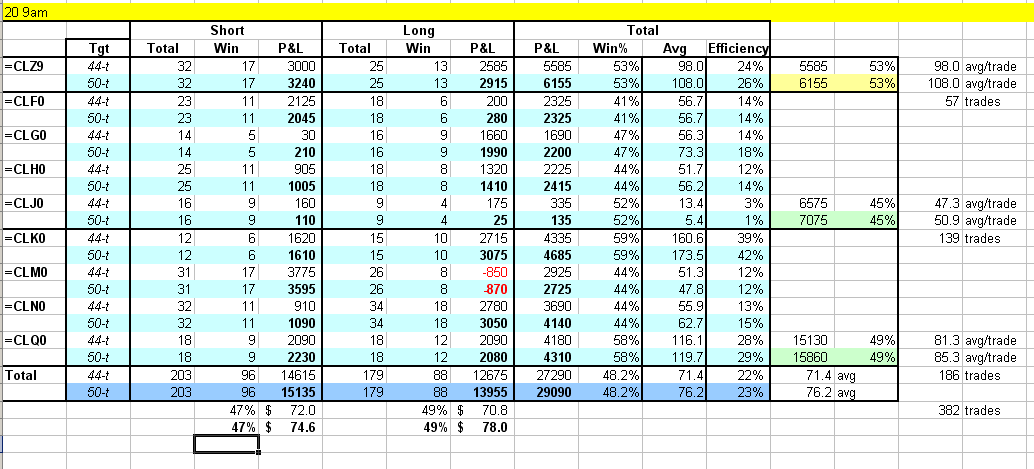

This next performance report is for the most recent "unfiltered" version ... by this I mean, it takes all trades, no filtering any

(actually, this is false, there was a filter in this version that cut ~20 trades & 7% of the P&L, removed since then).

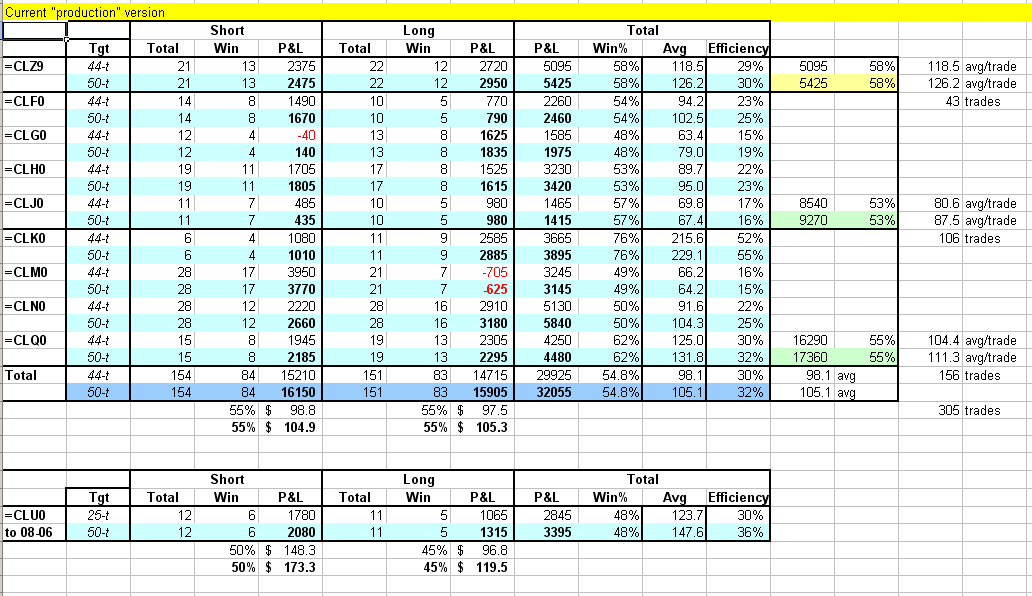

Most of my work since that version (ie. this week) has been trying to improve performance by looking at many things ... most ideas were garbage, and the 1 idea that evolved into a filter for the current production version was exactly the inverse of what the filter is (as often in trading I find, my thinking was 180° of what was really needed).

I have to admit I am a little scared by this filter, as I am the first to think filters are mainly over-optimization. But because of its nature (the filter is purely based on the initial stop size, which is calculated off price-action), I decided to use it for production.

That's it ... from -$20 / trade to +$105 / trade using exactly the same technique to identify strong momentum (which I believe, is the least important part of the system, and I will later try using other techniques to see how much of a difference that particular aspect makes).

Trade management is very simple for this system, a combination of "loose" trailing stop(s) to reduce much of the capital exposure once price moves by a certain amount in the direction of the trade, and a "tight" trailing stop used upon return of strong momentum. I am sure a lot better can be done, but that's what it is at the moment.

But I will show the genesis of the system, at least from a performance point of view. The whole point here is to show that using the very same concept & technique of identifying a setup (strong momentum), there was a long road from the 1st attempts to the current version (and there remains some road ahead).

I started the system using reversal breakout entries, ie. using a STP entry once price retraced "enough". I worked 3 days on this basis, the following 2 "performance" reports depict the 1st and 12th (and last) version on this principle. BTW, "enough" was quantified using a pair of EMAs.

I decided to try another approach, this time calculating the entry level and using LMT entry. Even though the 1st try didn't look too good (except in comparison to R1), a couple hours later R2.3 was for me the incentive to keep pushing in that direction.

And by the time I went to bed, R2.7 confirmed that approach. See how R2.12 next day didn't improve things much, and really from R3 to R20 most of the work has been in fixing a large number of design shortcuts that were good in the beginning to quickly assess if the system concept was viable, but led too many bad trades - simply because oversimplification of price action analysis doesn't work.

This next performance report is for the most recent "unfiltered" version ... by this I mean, it takes all trades, no filtering any

(actually, this is false, there was a filter in this version that cut ~20 trades & 7% of the P&L, removed since then).

Most of my work since that version (ie. this week) has been trying to improve performance by looking at many things ... most ideas were garbage, and the 1 idea that evolved into a filter for the current production version was exactly the inverse of what the filter is (as often in trading I find, my thinking was 180° of what was really needed).

I have to admit I am a little scared by this filter, as I am the first to think filters are mainly over-optimization. But because of its nature (the filter is purely based on the initial stop size, which is calculated off price-action), I decided to use it for production.

That's it ... from -$20 / trade to +$105 / trade using exactly the same technique to identify strong momentum (which I believe, is the least important part of the system, and I will later try using other techniques to see how much of a difference that particular aspect makes).

Trade management is very simple for this system, a combination of "loose" trailing stop(s) to reduce much of the capital exposure once price moves by a certain amount in the direction of the trade, and a "tight" trailing stop used upon return of strong momentum. I am sure a lot better can be done, but that's what it is at the moment.

Day's summary

CL new system : 1 loss (-22t)

I get another A on behavior today, although this one was easy, as I let the system run unattended all day ... I admit I would have had a very tough time if I was in front of the screen for that trade, as the system sold a retest of the pullback high after a marginal LL (ie., short after DB).

This trade falls into a category I was working on yesterday, ie. entry touched no fill ... the question being to void the setup or not in that situation. Statistical analysis done yesterday was showing that it is better to keep the setup alive (from a long-term performance point of view), but taking the stupidest loss today in that situation triggered some additional creativity.

CL new system : 1 loss (-22t)

I get another A on behavior today, although this one was easy, as I let the system run unattended all day ... I admit I would have had a very tough time if I was in front of the screen for that trade, as the system sold a retest of the pullback high after a marginal LL (ie., short after DB).

This trade falls into a category I was working on yesterday, ie. entry touched no fill ... the question being to void the setup or not in that situation. Statistical analysis done yesterday was showing that it is better to keep the setup alive (from a long-term performance point of view), but taking the stupidest loss today in that situation triggered some additional creativity.

Day's summary

CL new system : 1 loss (-9t)

I get an A+ on behavior today, not only did I respect my trade management rules on this trade, but I had to do it very manually, as I lost my charting datafeed seconds into the trade ... 3-ticks slippage on exit, I guess that's trading in August !

CL new system : 1 loss (-9t)

I get an A+ on behavior today, not only did I respect my trade management rules on this trade, but I had to do it very manually, as I lost my charting datafeed seconds into the trade ... 3-ticks slippage on exit, I guess that's trading in August !

Day's summary

CL new system : 1 win (+15t)

I behaved well again today, no temptation to mess with this trade, I did only cheer for it - not enough for it to get to the 50-t target it seems, but it would have make the reduced target (25-t) if I was trading 2 contracts (planning on adding a 2nd contract w/ reduced target after Labor day week-end).

CL new system : 1 win (+15t)

I behaved well again today, no temptation to mess with this trade, I did only cheer for it - not enough for it to get to the 50-t target it seems, but it would have make the reduced target (25-t) if I was trading 2 contracts (planning on adding a 2nd contract w/ reduced target after Labor day week-end).

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.