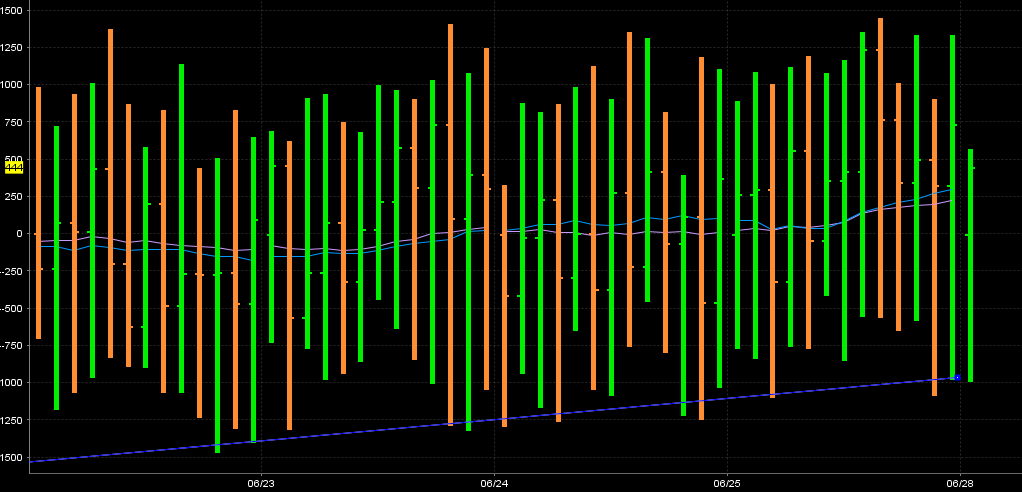

ES short term trading 6-28-10

I just created a Market Profile using the RTH sessions for ES from last week, Monday through Friday. So the 1 week Value Areas are:

VAH=1102.00

POC=1075.50

VAL=1063.50

This week's Economic Events.

VAH=1102.00

POC=1075.50

VAL=1063.50

This week's Economic Events.

airabove 74.25

as soon as it dropped below 1076 after the open, there was no re-trace, so I was not able to get short 1076 (unless i caught it on the way up)

no TICK extreme thus far, this could bleed down a little more before we see some buyers step in.....

no TICK extreme thus far, this could bleed down a little more before we see some buyers step in.....

added 69.50..15 minute break and official air pocket now

agree phileo...long term trendline in Ticks need sto help this out

last add at 67.25...need 71.25 to make this well....tough start air pockets above...trend will crush us!!

that is 6th down 5 minute bar...will it be 9 down today...hope not!!

officil airt pocket above 70.50 should get filled in soon,,,,tick trendline hit...let 's hope it's enough for a good low

trend down and now the consolidation...new daily lows will not be good now....hope for the retrace up!!!

we need to start thinking about the hour run out and which side it will come.....hopefully to the long side..gotta watch this 72.50....!!

Yes, the front month unless there are only a few days to expiration. And I'm looking for immediacy in the move, up or down, of decent magnitude ... preferably within 1 to 2 (sometimes 3)days. And that's if I don't have a strong directional bias ... which I don't currently ... just a mild bias to the down side which comes primarily from how individual stocks have performed in the past couple of days and how their charts currently look "heavy" for lack of a better term.

Originally posted by Piker

Originally posted by MonkeyMeat

Just an observation guys. Yeah, there's the cycle of expansion and contraction of daily bar ranges (and the same on other time frames as well) ... but, look at the SPY chart and also the ES chart that includes all trading hours. The market is likely to have a decent magnitude move out of the current range ... my hope being that tonight's trading stays narrow and that Tuesday opens inside of this range bound activity. Then it's a matter of how ya play it ... directionally or tossing on straddle or strangle option contracts ... and even potentially legging out of them. Here's hoping for continued range constriction tonight and opening into tomorrow!!

Just curious MM,

Do you use front-month contracts when you put on straddles/strangles?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.