ES short term trading 6-28-10

I just created a Market Profile using the RTH sessions for ES from last week, Monday through Friday. So the 1 week Value Areas are:

VAH=1102.00

POC=1075.50

VAL=1063.50

This week's Economic Events.

VAH=1102.00

POC=1075.50

VAL=1063.50

This week's Economic Events.

Your method of trading has always interested me, Bruce, but try as i might i just cant seem to be wrong that much before im right. however one certainly cant argue with the obvious success you have ( and ive always felt the big boyz have a similar trading style)so i wont give up trying to emulate it, but its an ongoing work in progress.Currently my goal is to slowly go from my 2 es style to 4-6 contracts, eventually working my way back up to 10 lots with a syle similar to yours

Not sure ,but i think Charter joe and PTemini have a similar tecnique

by the way, current 5 min proj is 1077.00, but im hoping were close to making the break up that im hoping for!

Originally posted by BruceM

Piker, one last clue to my madness...you will find that some of my best add ons will come as the SECOND air pocket is forming...before the 5 minute bar closes......like today.....

I start with an initial position and then will all two more times....usually no more..

Well I noticed your first trade was also on the 3rd/4th 5min bar. You have stated that you like to see 5 5min bars and it is unusual to see more than 9 bars, so was the first trade premature for you typically?

Knowing when to hold 'em and when to fold 'em is what confuses me on some of your trades. For fade trades you allow much room for being right, while others you seem to prefer surgical strikes when it comes to entries. Some of your entries, as with Kool's, literally have no drawdown.

Originally posted by koolblue

Your method of trading has always interested me, Bruce, but try as i might i just cant seem to be wrong that much before im right. however one certainly cant argue with the obvious success you have ( and ive always felt the big boyz have a similar trading style)so i wont give up trying to emulate it, but its an ongoing work in progress.Currently my goal is to slowly go from my 2 es style to 4-6 contracts, eventually working my way back up to 10 lots with a syle similar to yours

The big boys trade like this because they have the funds to trade the forest versus the trees like us little guys.

Most I've done was 4 contracts on a fade trade (in the afternoon no less ), but normally it is 1, maybe 2, so I know what you mean.

So true Piker, so true! ... now if im right about a late day break up(which probably has already begun), im hoping the red avg on the 5 min (15 ema,currently 1073.50) holds any pullback on our way to the 1080's... as always time will tell!

wish i still had a runner on a long, just in case... anybody long here?

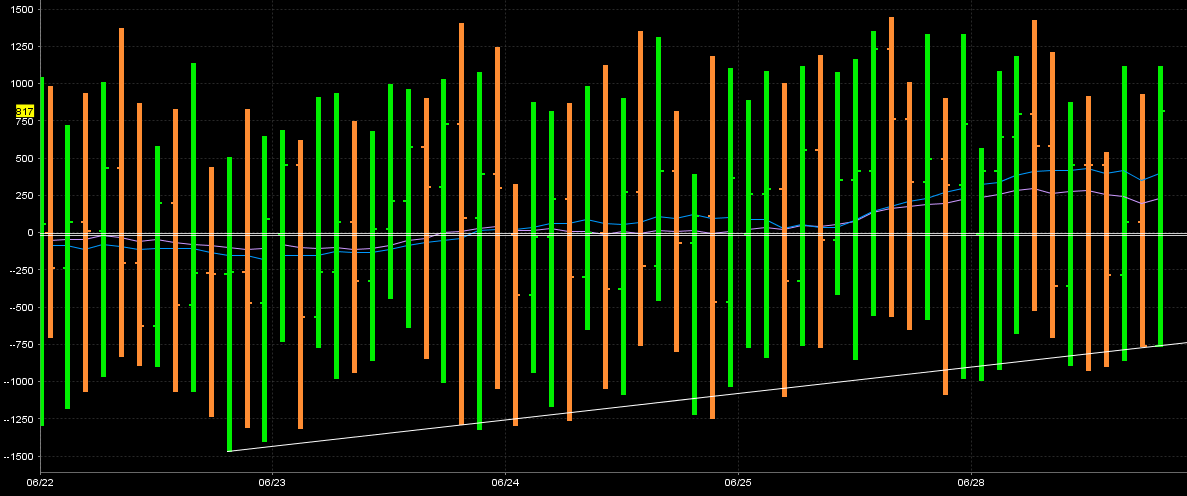

here is an update to the $ tick trend......if it holds we will have a nice spike high into the close.....if we get below that 70.50 area then we may start breaking down this trend line to test Fridays lows...nothing working as I can't trade this middle

Originally posted by koolblue

So true Piker, so true! ... now if im right about a late day break up(which probably has already begun), im hoping the red avg on the 5 min (15 ema,currently 1073.50) holds any pullback on our way to the 1080's... as always time will tell!

I hope so, I have been nursing a long at 73. Just waiting for something, anything, to happen.

thx, pal... i voted your chart and analysis up, and hold a similar outlook

Yes, the front month unless there are only a few days to expiration. And I'm looking for immediacy in the move, up or down, of decent magnitude ... preferably within 1 to 2 (sometimes 3)days. And that's if I don't have a strong directional bias ... which I don't currently ... just a mild bias to the down side which comes primarily from how individual stocks have performed in the past couple of days and how their charts currently look "heavy" for lack of a better term.

Originally posted by Piker

Originally posted by MonkeyMeat

Just an observation guys. Yeah, there's the cycle of expansion and contraction of daily bar ranges (and the same on other time frames as well) ... but, look at the SPY chart and also the ES chart that includes all trading hours. The market is likely to have a decent magnitude move out of the current range ... my hope being that tonight's trading stays narrow and that Tuesday opens inside of this range bound activity. Then it's a matter of how ya play it ... directionally or tossing on straddle or strangle option contracts ... and even potentially legging out of them. Here's hoping for continued range constriction tonight and opening into tomorrow!!

Just curious MM,

Do you use front-month contracts when you put on straddles/strangles?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.