ES short term trading 6-28-10

I just created a Market Profile using the RTH sessions for ES from last week, Monday through Friday. So the 1 week Value Areas are:

VAH=1102.00

POC=1075.50

VAL=1063.50

This week's Economic Events.

VAH=1102.00

POC=1075.50

VAL=1063.50

This week's Economic Events.

Piker, I was wrong on my initial exit near 76 this a.m as I mistook the volume near the open as part of the volume from the O/N thinking it was new O/N volume. This is for all the diehards that actually read this later. So not only is the high and low and midrange important but the peak volume price is probably most important from the O/N session...the ever changing colors of the markets...!!!

So the Volume POC from the O/N gets tested more than 85 % in my brief test but I'll watch as we go forward....

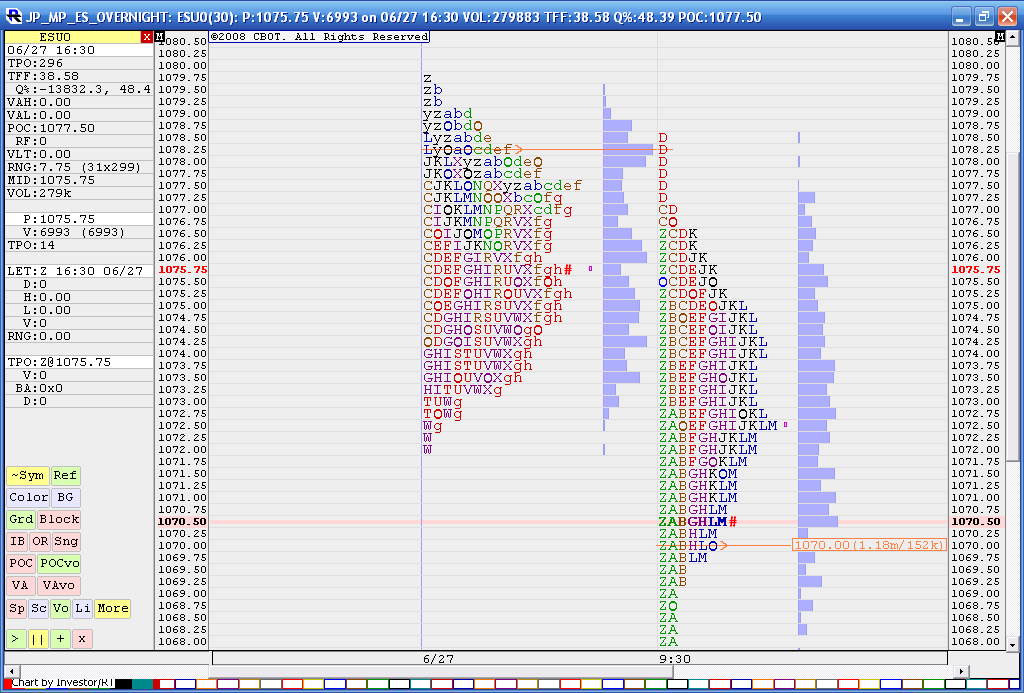

Here is today...on the left is the O/N sunday session...it has a 6/27 date...and has and orange > ( greater than sign) with a line through 1078.75.On the right is the day session it has a 9:30 label but it is 6/28 trade...note how period "D" goes up to test that 1078.75 from the O/N session.

What we never will know is WHEN it will do it's test..

So the Volume POC from the O/N gets tested more than 85 % in my brief test but I'll watch as we go forward....

Here is today...on the left is the O/N sunday session...it has a 6/27 date...and has and orange > ( greater than sign) with a line through 1078.75.On the right is the day session it has a 9:30 label but it is 6/28 trade...note how period "D" goes up to test that 1078.75 from the O/N session.

What we never will know is WHEN it will do it's test..

trying to get out on last at 73.75 print now....and will be flat...not waiting around for that 75 gap fill

damn u kool...LOL!! is your stuff gonna get in the way of filling in that 75 number??

NAAA, It probably gets filled later tonite.. i swear to God, Bruce ,this market is getting ready to blow ...bigtime! notice the last 2 days (Friday and Monday) the range (including overnite) has been 16.75 and 13.25 when the 5 and even 10 day avg is more like 20 handles... that means an explosion in range expansion is due ,and soon . I worry that its going to be down(1040 test?) since all the bloggers are generally looking for 1103-1131 ! looks like tomorrow could be very exiting as i have it as an important day!..Cant wait!

u read my mind Kool...I just finished some MP charts and posted on the exact same thing...we gotta watch tomorrow....I'm gonna be real careful on any open inside this tight range.......and careful on the fades

they are making these 75 gap fillers suffer now in O/N...so glad I exited instead of trying to wait on that...they do the same thing on triples sometimes....

they are making these 75 gap fillers suffer now in O/N...so glad I exited instead of trying to wait on that...they do the same thing on triples sometimes....

Originally posted by BruceM

here is VWAP from today but look at the gap at 75 even at 15:45

These are gaps that are easy to spot but for some reason I overlook them.

Just an observation guys. Yeah, there's the cycle of expansion and contraction of daily bar ranges (and the same on other time frames as well) ... but, look at the SPY chart and also the ES chart that includes all trading hours. The market is likely to have a decent magnitude move out of the current range ... my hope being that tonight's trading stays narrow and that Tuesday opens inside of this range bound activity. Then it's a matter of how ya play it ... directionally or tossing on straddle or strangle option contracts ... and even potentially legging out of them. Here's hoping for continued range constriction tonight and opening into tomorrow!!

Originally posted by MonkeyMeat

Just an observation guys. Yeah, there's the cycle of expansion and contraction of daily bar ranges (and the same on other time frames as well) ... but, look at the SPY chart and also the ES chart that includes all trading hours. The market is likely to have a decent magnitude move out of the current range ... my hope being that tonight's trading stays narrow and that Tuesday opens inside of this range bound activity. Then it's a matter of how ya play it ... directionally or tossing on straddle or strangle option contracts ... and even potentially legging out of them. Here's hoping for continued range constriction tonight and opening into tomorrow!!

Just curious MM,

Do you use front-month contracts when you put on straddles/strangles?

Yes, the front month unless there are only a few days to expiration. And I'm looking for immediacy in the move, up or down, of decent magnitude ... preferably within 1 to 2 (sometimes 3)days. And that's if I don't have a strong directional bias ... which I don't currently ... just a mild bias to the down side which comes primarily from how individual stocks have performed in the past couple of days and how their charts currently look "heavy" for lack of a better term.

Originally posted by Piker

Originally posted by MonkeyMeat

Just an observation guys. Yeah, there's the cycle of expansion and contraction of daily bar ranges (and the same on other time frames as well) ... but, look at the SPY chart and also the ES chart that includes all trading hours. The market is likely to have a decent magnitude move out of the current range ... my hope being that tonight's trading stays narrow and that Tuesday opens inside of this range bound activity. Then it's a matter of how ya play it ... directionally or tossing on straddle or strangle option contracts ... and even potentially legging out of them. Here's hoping for continued range constriction tonight and opening into tomorrow!!

Just curious MM,

Do you use front-month contracts when you put on straddles/strangles?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.