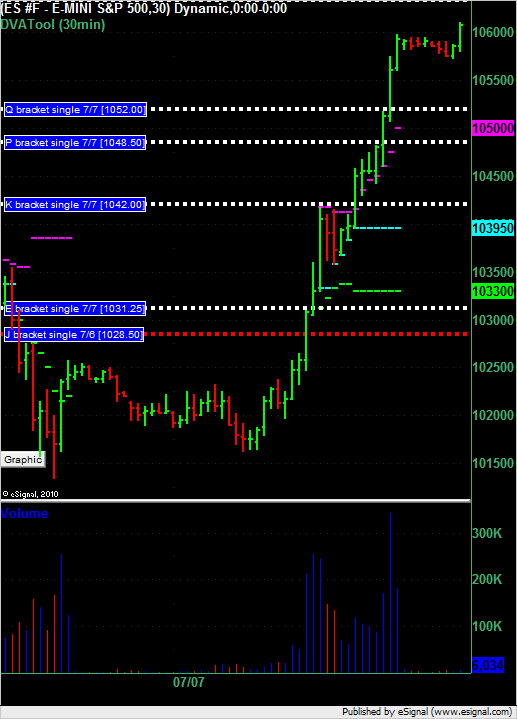

ES short term trading 7-8-10

Though it would be interesting to start Thursday off by looking at the chart that I posted at the end of yesterday's session showing the 4 single prints left behind.

Remember that today is a MATD.

For those interested in trading single prints as a strategy here are some links to some forward tests that we did 5 years ago that I believe are still relevant today:

http://www.mypivots.com/board/topic/132/1/single-prints-forward-test-may-2005

http://www.mypivots.com/board/topic/214/1/single-prints-forward-test-june-2005

http://www.mypivots.com/board/topic/312/1/single-prints-forward-test-july-2005

Remember that today is a MATD.

For those interested in trading single prints as a strategy here are some links to some forward tests that we did 5 years ago that I believe are still relevant today:

http://www.mypivots.com/board/topic/132/1/single-prints-forward-test-may-2005

http://www.mypivots.com/board/topic/214/1/single-prints-forward-test-june-2005

http://www.mypivots.com/board/topic/312/1/single-prints-forward-test-july-2005

and now the battle betwen the selling tail and buying tail for that hour range ..pefect print of open on that last 30 minute bar

had to scale some out at 61.50...still holding 6...next target is hour low and gap fill...I hope....great day to sell the rallies..

as long as we can hold back the 64 - 65 area we are good to go but long term targets will be hard as the still should chop it up and down

nice gaop fill...

nice gaop fill...

I guess everyones gone to skype.....that makes sense! afterall you can come back and read this stuff anytime but you'd have to record the skype session....I get it

Bruce, what are you talking about "gone to skype?"

On MATD's, after the choppiness is sorted through in the morning session, does the mid/afternoon session tend to eventually continue the previous day's trend?

I thought folks were going to skype as voice is better for many

Originally posted by PAUL9

Bruce, what are you talking about "gone to skype?"

Originally posted by BruceM

I thought folks were going to skype as voice is better for manyOriginally posted by PAUL9

Bruce, what are you talking about "gone to skype?"

I think that this forum is the "mother ship." Traders tend to drift off into small voice groups or chat rooms but they mostly return here, as Bruce pointed out.

I wish Bruce would skype and call the entries

Piker,

I have noticed that early afternoon (anywhere after "noon" upto like 2:00, a swing failure takes place and then price starts a move in the direction of the price direction of the trend day.

At least that has been the case for the 5 most recent market after trend days that I have looked at.

a swing failure for current market after UP trend day yesterday would mean a HL on the 5min.

I remember 3 out of the 5 I looked at had swing failure in the 12:30 to just before 2pm window of time.

I have noticed that early afternoon (anywhere after "noon" upto like 2:00, a swing failure takes place and then price starts a move in the direction of the price direction of the trend day.

At least that has been the case for the 5 most recent market after trend days that I have looked at.

a swing failure for current market after UP trend day yesterday would mean a HL on the 5min.

I remember 3 out of the 5 I looked at had swing failure in the 12:30 to just before 2pm window of time.

Originally posted by BruceM

that's the goal Paul...in fact I think it would be valuable to write up charts after the day ends as my typing is quick while trading and make mistakes...

I don't want anyone to think of this thread as a signal calling service as it is really more about market distinctions that repeat over time.......I believe that no two traders will really trade a like...I hope that the ideas we post help folks "look" at the market in new ways,,,,especially those who continue to buy and sell breakouts....I think most of us have made that crystal clear that fading is a better way to go over time....we let the trend guys hold us back for two or three days a month knowing we can crush them the next day !!!!Originally posted by PAUL9

I think Bruce wants you to learn how to do it yourself and not piggyback.

I completely agree with Bruce. This is not and should not be a "trade calling service." What Bruce is doing here is a million times more valuable than a trade calling service. Instead of giving you fish he is teaching you how to fish. (I know that's a corny and overused expression but it is perfectly appropriate here.)

What you should be doing is reading, questioning and understanding what Bruce and the other "vets" are saying. If he's using a term over and over that you don't understand then PM me and I'll get it defined in the dictionary and auto-link it from the forum.

Ultimately you should be able to look at a chart and say "I bet that Bruce is going to buy/sell at this point and target points x, y, and z because there are single prints over there and it's a MATD etc." At that point you don't need a trade calling service because you are already one step ahead of the market and when Bruce is on vacation you are still able to trade profitably.

end of rant

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.