ES Short Term Trading 8-18-2010

I guess if you don't have 89 - 90 on your radar you will be missing out...lets hope tomorrows reports do something so we can break away from this area....

Do the fib playes still want 1103 - 1105? Probably

do some of us want to see 1065 retested...yes....

but lets not get blinded and hopefully the gap and some volume will point the way..

I was watching a known vendor......and they were balbbing about 1130 last week and it never hit...awesome ending

cleaned up all the air and even that 87.50.......

Do the fib playes still want 1103 - 1105? Probably

do some of us want to see 1065 retested...yes....

but lets not get blinded and hopefully the gap and some volume will point the way..

I was watching a known vendor......and they were balbbing about 1130 last week and it never hit...awesome ending

cleaned up all the air and even that 87.50.......

good examples of why I can't trend trade the S&P...just too much back fill....

Rburns....

our 87.50.....wasn't working anything too!!

a critical point is that we can see and have a good "feeling" about low and high volume areas and triples, ledges etc but actually holding trades to full targets is very difficult...the one lot trader is unfortuantely at a hugh disadvantage unless they can be satisifed with watching the market continue in the direction they though without being on board..

Many days I feel like this:

When I'm wrong I have too many contracts on and when I am right I never have enough to get further targets.....

Probably the best lesson is to be happy with what we are able to take from the market

These comments aren't really meant for you specifically RB...just taking an opportunity to babble here before I go play with my kids

our 87.50.....wasn't working anything too!!

a critical point is that we can see and have a good "feeling" about low and high volume areas and triples, ledges etc but actually holding trades to full targets is very difficult...the one lot trader is unfortuantely at a hugh disadvantage unless they can be satisifed with watching the market continue in the direction they though without being on board..

Many days I feel like this:

When I'm wrong I have too many contracts on and when I am right I never have enough to get further targets.....

Probably the best lesson is to be happy with what we are able to take from the market

These comments aren't really meant for you specifically RB...just taking an opportunity to babble here before I go play with my kids

Fascinating read Bruce, thanks!

I would have never guessed that will happen this Friday...

I would have never guessed that will happen this Friday...

Originally posted by BruceM

LOL.....u have emailOriginally posted by Lorn

Friday's Wall street Journal wouldn't hurt....

Originally posted by BruceM

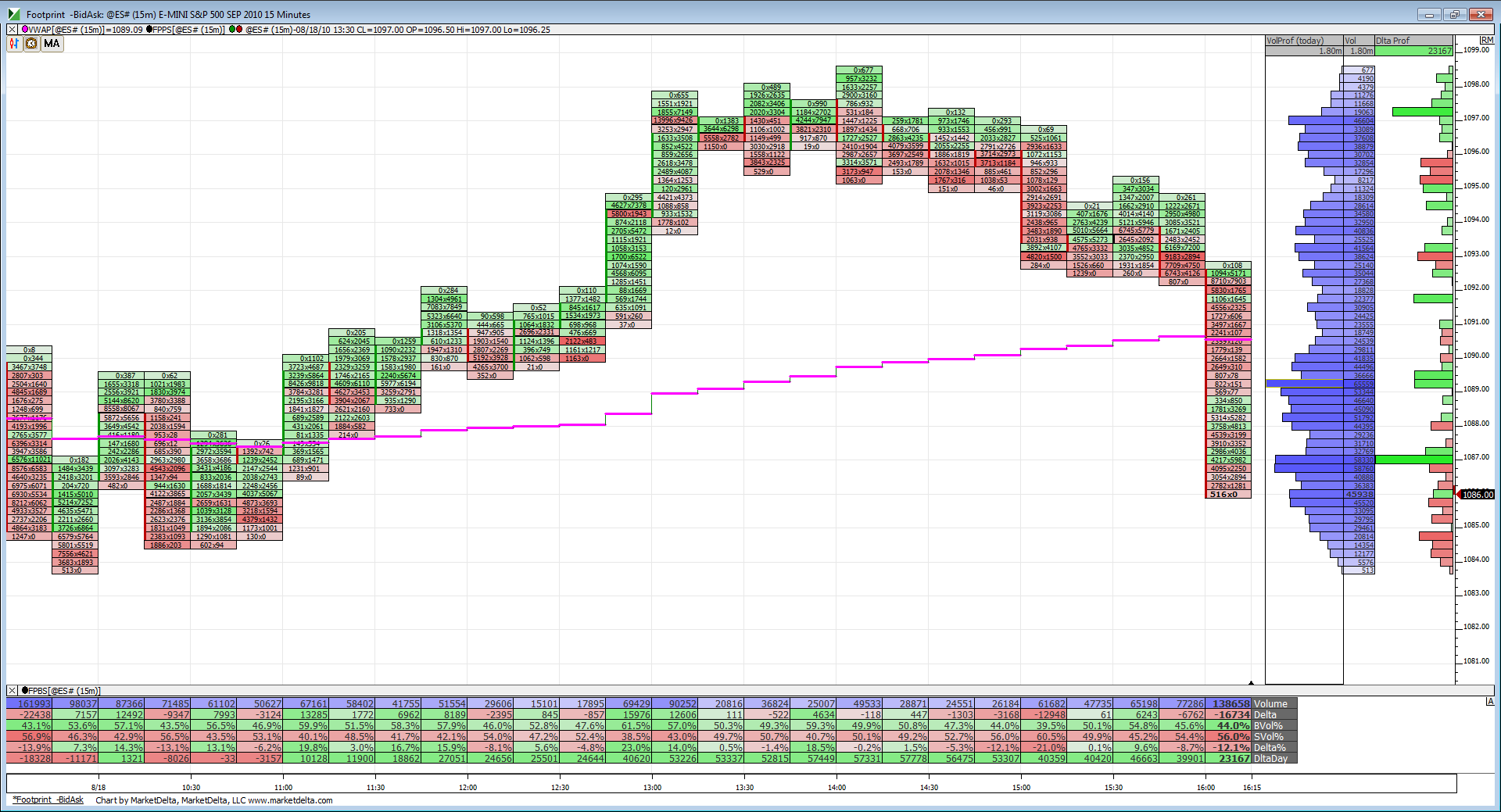

That chart is great though Lorn as it has lots of good info

1)Vwap ( I'd put the second standard deviation band on there too)

2)The peak volume prices

3)bid ask info

what more would we really need?

A look at the close. Interesting prices fell back to the 1087.00 node.

I did not trade today. I have a dinner party tonight and I was preparing food.

I do not like making real-time, all day long comments, I did it for years and years and grew to hate it. I do post here because I appreciate people like Bruce and Lorn (hey, where's Phileo? and I already know about koolblue), but I do offer some comments because there are technical conditions that are worth noticing and being aware of.

Here's one I think traders can benefit from if they want to remember it, and if you know how to read basic PA you might be able to make money.

Yesterday was a day when there was a large RTH gap that remained unfilled, BIG FLAG to me... check it out, Trade days following large unfilled gaps are often consolidation days, a consolidation day is a day when everyone in the short-term market is afraid of putting on a position for more than a short-term period of time because there's a gap in the price chart! Many day traders wait to see whether larger time-frame investors are stepping to the plate to produce a breakout of the RTH range created on the "no gap-fill" day.

Usually (unless there is a decisive breakout) the market expresses its uncertainty about the previous day's no-gap fill by testing the previous day's RTH Low and/or the previous day's RTH High.

I am offering you one of gems here (because it's August and there is hardly anyone reading these pages, LOL). This can be money if you watch for HH and HL and a break above the HH or if you see a LL, a LH and a break below the LL.

Large unfilled gap in the previous trade day often is followed by consolidation day, Just look at today's RTH prices...

today's RTH L was 83.75, yesterday's RTH Low was 83.25.

today's RTH High was 98.50, yesterday's RTH H was 98.50.

I really like this set-up, but you have to be able to read PA (As described above, bullish is a HH, a HL, and then a Break above the HH, or bearish is LL, LH, break LL).

I bothered to offer this because I appreciate the contributors who lay it on the line, but I also have to relate that I honestly do detest making real-time comments, I did it for years in a former career and I ultimately quit that job. SO, don't chastize me for making comments "after the fact," recognize that there is potential value in the observations I offer because honestly, I have written this crap so many times on so many trade days that I feel burned out just typing it.

watch PA after days of unfilled gaps.

I do not like making real-time, all day long comments, I did it for years and years and grew to hate it. I do post here because I appreciate people like Bruce and Lorn (hey, where's Phileo? and I already know about koolblue), but I do offer some comments because there are technical conditions that are worth noticing and being aware of.

Here's one I think traders can benefit from if they want to remember it, and if you know how to read basic PA you might be able to make money.

Yesterday was a day when there was a large RTH gap that remained unfilled, BIG FLAG to me... check it out, Trade days following large unfilled gaps are often consolidation days, a consolidation day is a day when everyone in the short-term market is afraid of putting on a position for more than a short-term period of time because there's a gap in the price chart! Many day traders wait to see whether larger time-frame investors are stepping to the plate to produce a breakout of the RTH range created on the "no gap-fill" day.

Usually (unless there is a decisive breakout) the market expresses its uncertainty about the previous day's no-gap fill by testing the previous day's RTH Low and/or the previous day's RTH High.

I am offering you one of gems here (because it's August and there is hardly anyone reading these pages, LOL). This can be money if you watch for HH and HL and a break above the HH or if you see a LL, a LH and a break below the LL.

Large unfilled gap in the previous trade day often is followed by consolidation day, Just look at today's RTH prices...

today's RTH L was 83.75, yesterday's RTH Low was 83.25.

today's RTH High was 98.50, yesterday's RTH H was 98.50.

I really like this set-up, but you have to be able to read PA (As described above, bullish is a HH, a HL, and then a Break above the HH, or bearish is LL, LH, break LL).

I bothered to offer this because I appreciate the contributors who lay it on the line, but I also have to relate that I honestly do detest making real-time comments, I did it for years in a former career and I ultimately quit that job. SO, don't chastize me for making comments "after the fact," recognize that there is potential value in the observations I offer because honestly, I have written this crap so many times on so many trade days that I feel burned out just typing it.

watch PA after days of unfilled gaps.

Thanks for the post Paul. Simple stuff that most traders simply overlook.

I totally understand your feelings to making real-time posts. For me personally it allows me to focus on my thoughts rather then get hijacked by the tick movement on my screen.

Cheers!

I totally understand your feelings to making real-time posts. For me personally it allows me to focus on my thoughts rather then get hijacked by the tick movement on my screen.

Cheers!

Good stuff Paul. I don't want anyone to feel they need to post while trading. In general its a stupid idea ! The only thing I hate is when folks come on here and tell us how long or short they are without any reasonable explainations. Those folks know who they are !

We certainly don't need anymore pressure while trading. For me it just evolved due to some "problems" I had with some vendors.

I've often thought about starting a "trading statements" thread so we could post a few years of statements to prove we actually trade but that wouldn't prove we trade the ideas we write/babble about. I'm also not sure that would resolve some of the wise ass comments and emails from the vendor crowd or the non-believers. Might be more trouble than it is worth.

Anyway, I too appreciate all the ideas that are shared here and none of us are TOO good that we can't get better. So please post whenever you feel you can and hope you enjoy that dinner!

We certainly don't need anymore pressure while trading. For me it just evolved due to some "problems" I had with some vendors.

I've often thought about starting a "trading statements" thread so we could post a few years of statements to prove we actually trade but that wouldn't prove we trade the ideas we write/babble about. I'm also not sure that would resolve some of the wise ass comments and emails from the vendor crowd or the non-believers. Might be more trouble than it is worth.

Anyway, I too appreciate all the ideas that are shared here and none of us are TOO good that we can't get better. So please post whenever you feel you can and hope you enjoy that dinner!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.