The Demise of the Pit Traded Futures

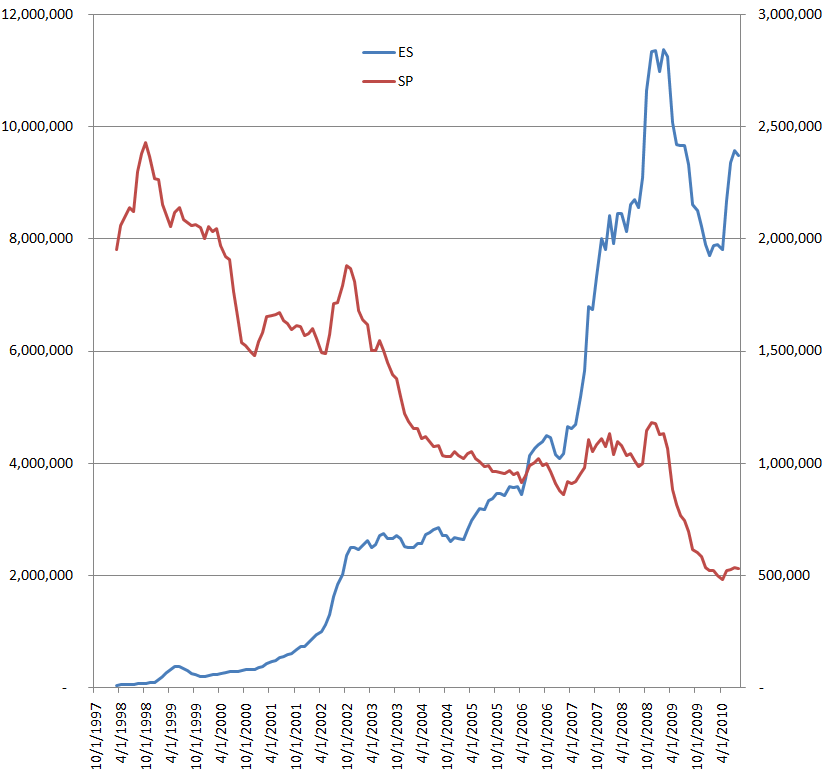

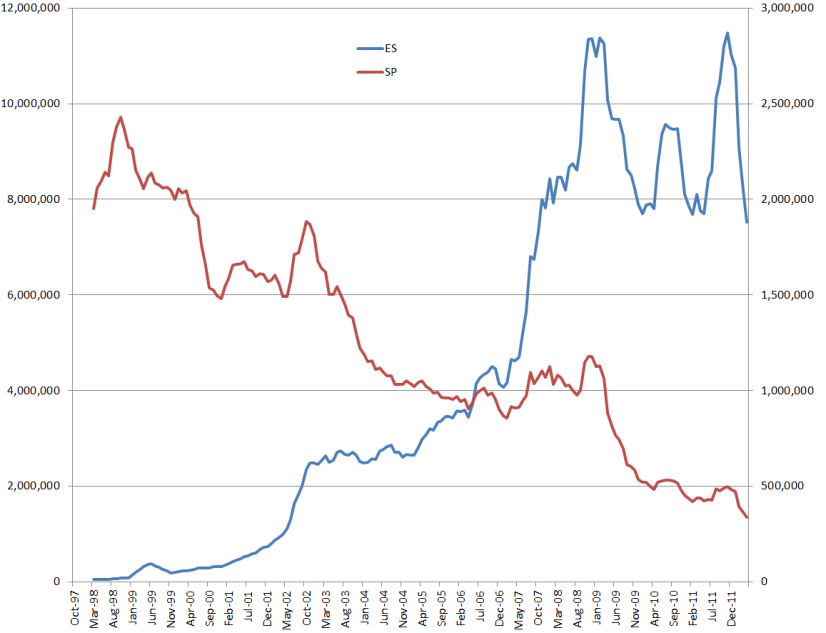

The following chart shows the monthly volume of the pit traded versus the electronic S&P500 futures contract. (I smoothed the monthly volume by taking the 6 month average.) Each line is represented on a different Y-axis. The electronic futures are on the left axis and the pit traded on the right. Also, I divided the number of contracts from the electronic future by 5 to make the value comparable to the pit traded future (i.e. 5 ES contracts = 1 SP contract).

My previous prediction was for the demise of the pit traded future between 2009 and 2013 (inclusive). We're now in this bracket and, in my opinion, it's still a valid range but it's getting close and I only have 3-years to go to be proved wrong or right.

What do you think? S&P500 pit traded futures here to stay or on its way out?

Also, why would anybody still trade the pit traded futures? The only reason I can think of is that they're a fund manager with a mandate that allows them to trade the SP but not the ES.

My previous prediction was for the demise of the pit traded future between 2009 and 2013 (inclusive). We're now in this bracket and, in my opinion, it's still a valid range but it's getting close and I only have 3-years to go to be proved wrong or right.

What do you think? S&P500 pit traded futures here to stay or on its way out?

Also, why would anybody still trade the pit traded futures? The only reason I can think of is that they're a fund manager with a mandate that allows them to trade the SP but not the ES.

Originally posted by day trading

Ah - I see what you're saying. Were MF trading for their own account? If not then the volume should now flow through another floor broker and in theory shouldn't be impacted by a broker dropping out.

Funny story there, well not so funny for GF account (empty bag) holders, but it turns out GF was actually prop trading their in-house trading account but were using individual account funds as collateral to back their positions. When that Italian Bond CDS blew up on them, they lost somewhere in the neighborhood of $1.3 Billion (USD) of customer account funds.

The segregation of customer accounts in a clearing firm is sacrosanct, and GF is a Fed Primary dealer no less. Curiously not so much as a peep so far from the Fed on this. If the cop on the street looks the other way when the old lady's purse is stolen, well we are all cooked. Lesson here for us regular folks is: keep your futures account balance at a minimum, any funds you need to live on or cannot afford to lose in a bankruptcy of your trading or futures clearing firm you should keep safe elsewhere.

Originally posted by day trading

Originally posted by luckytwelve

There are still benefits to holding a chair on the floor of an exchange.

What are those benefits?

Well the immediate benefit is for high volume traders. An exchange seat holder trades at the exchange member price (= 50 cents per contract on the CME), meaning members bypass all the retail level fees and costs to trade. For a trader with even a modest average weekly volume total the lease fee is quickly recoverable. Also, the seat owner can lease that seat to another trader or trading firm and collect a nice monthly income stream.

Aside from the illiquidity in the pit, the S&P500 has had its spell of whistle-blowing pieces within the last five years in regards to their pit traders' treatment of casual filling orders of retail and institution placements. One writer called them outright thugs. It's a shame because when and if the technology gives way in Globex the farmers in the midwest are out of business until they fashion their own markets. Every generation has their conservatives, but after X, Y & Z ruin it, I doubt the Devil's Bride will conjure it back up, or put one of these infantile alien hipsters in the Senate. Either way it's near over.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.