The Demise of the Pit Traded Futures

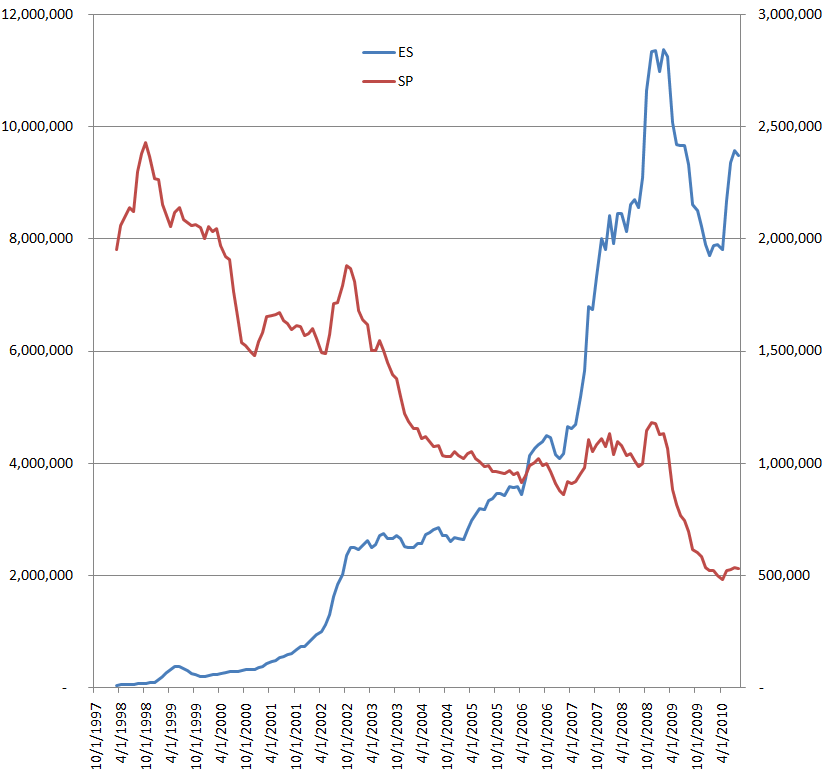

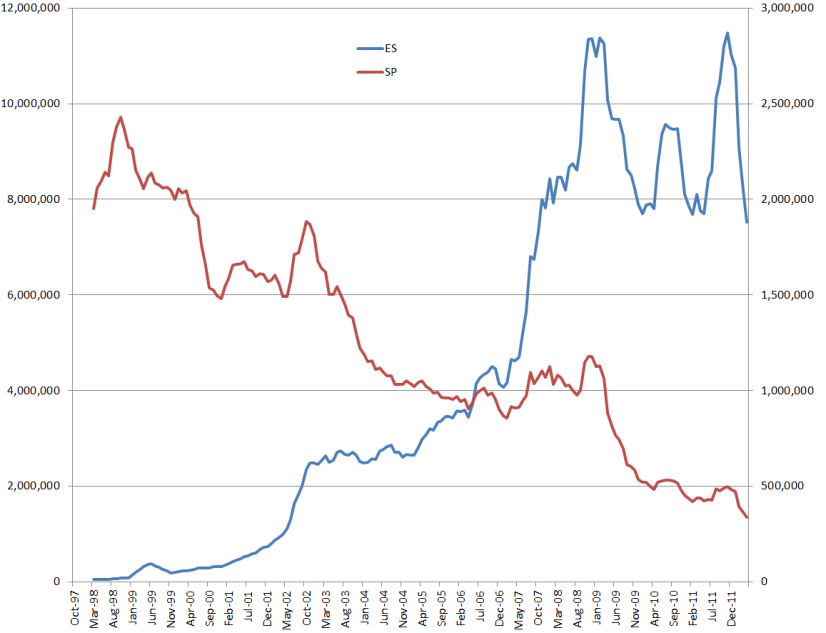

The following chart shows the monthly volume of the pit traded versus the electronic S&P500 futures contract. (I smoothed the monthly volume by taking the 6 month average.) Each line is represented on a different Y-axis. The electronic futures are on the left axis and the pit traded on the right. Also, I divided the number of contracts from the electronic future by 5 to make the value comparable to the pit traded future (i.e. 5 ES contracts = 1 SP contract).

My previous prediction was for the demise of the pit traded future between 2009 and 2013 (inclusive). We're now in this bracket and, in my opinion, it's still a valid range but it's getting close and I only have 3-years to go to be proved wrong or right.

What do you think? S&P500 pit traded futures here to stay or on its way out?

Also, why would anybody still trade the pit traded futures? The only reason I can think of is that they're a fund manager with a mandate that allows them to trade the SP but not the ES.

My previous prediction was for the demise of the pit traded future between 2009 and 2013 (inclusive). We're now in this bracket and, in my opinion, it's still a valid range but it's getting close and I only have 3-years to go to be proved wrong or right.

What do you think? S&P500 pit traded futures here to stay or on its way out?

Also, why would anybody still trade the pit traded futures? The only reason I can think of is that they're a fund manager with a mandate that allows them to trade the SP but not the ES.

The only thing I could see where the pit traded contract survives is if we go through an even larger liquidity crisis where deflation actually takes hold. Then I could see margin requirements going up for everything which would squeeze out the small players in the ES and allow the big contract to become the dominant one.

Thanks for posting the chart, very interesting.

Thanks for posting the chart, very interesting.

There are still benefits to holding a chair on the floor of an exchange.

Originally posted by luckytwelve

There are still benefits to holding a chair on the floor of an exchange.

What are those benefits?

I'll give you my 1/2 cent....When we place an order from our trading chair we don't see the other side. Where someone standing in the Gold pit and you see GDS or several other desks selling large lots when ever the market makes a new high you know they have large sell orders that cannot be filled instantly. And they will eventually bring gold down if there is no new fresh buying. You get to watch vets that have been in the pit for 10 years plus trade their real money which in itself is not much help but it pays to watch and learn from others who are more experienced.

Have you ever been to the Pits? and actually felt the price action it feels like a real thing...like a massive action....the auctioneer moves the price to where the money is (noise is). And you can hear it. Also I believe humans during times of "flash crash" are more capable of keeping capitalism alive look at the S&P compared to the ES on may 6th, or Feb 27 2007 or in 1987 when the brokers stopped picking up the phone and taking sell orders any larger than 10 contracts. The ES would probably have traded in the teens given how effective the electronic exchange is.

Electronic trading via cme or cbot has advantages the pit can never have...bring the exchange to the masses. I think they both belong in capitalism. pit traders who execute very large orders at what they believe is the best price and can actually think compared to a computer...where it just takes the best price at the moment and doesn't take into effect any news or where we have been if the last few seconds<days. And electronic trading so the public can make their own decisions at whats the best price.

Have you ever been to the Pits? and actually felt the price action it feels like a real thing...like a massive action....the auctioneer moves the price to where the money is (noise is). And you can hear it. Also I believe humans during times of "flash crash" are more capable of keeping capitalism alive look at the S&P compared to the ES on may 6th, or Feb 27 2007 or in 1987 when the brokers stopped picking up the phone and taking sell orders any larger than 10 contracts. The ES would probably have traded in the teens given how effective the electronic exchange is.

Electronic trading via cme or cbot has advantages the pit can never have...bring the exchange to the masses. I think they both belong in capitalism. pit traders who execute very large orders at what they believe is the best price and can actually think compared to a computer...where it just takes the best price at the moment and doesn't take into effect any news or where we have been if the last few seconds<days. And electronic trading so the public can make their own decisions at whats the best price.

Well said Joe. I unfortunately have never been to the pits but intend to change that.

Originally posted by Lorn

Well said Joe. I unfortunately have never been to the pits but intend to change that.

Don't wait too long, as you can see I'm convinced that they'll soon be gone.

MF Global is helping bring about the demise ...

How would MF Global's bankruptcy help bring about the demise of the pit?

A trader I know who has ties with pit traders here said the the pit is about 1/3 what it was prior to the MF thing ..

Ah - I see what you're saying. Were MF trading for their own account? If not then the volume should now flow through another floor broker and in theory shouldn't be impacted by a broker dropping out.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.