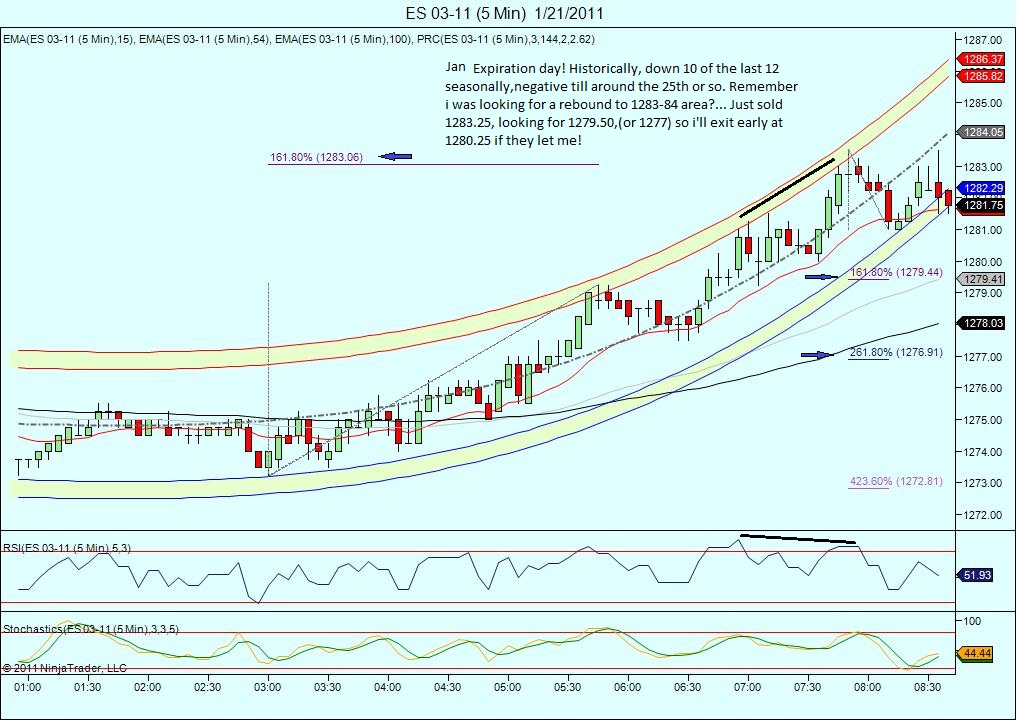

ES short term trading 1-21-11

Coming into the end of a down week , as expected. We are in the midst of a rally off of yesterdays low (as expected), but my bias is still negative for today....

Great trading today, by the way Bruce. You have such tremendous discipline! At the time i had just been stopped out and was thinking 1289, but you hung in there!

Even though this RTH move has all the classic signs of a directional move with lower lows and lower highs and prices staying under VWAP I'm a little suspicious because of one main thing.....euro strength.

One or the other needs to give way or maybe the correlation between the two is ending for now.

One or the other needs to give way or maybe the correlation between the two is ending for now.

Lorn, just an opinion, but the correlation is never 100%. for instance you also have good correlations with copper( which diverged a few days before the 1296.25 top) and crude.The one i like the best is the nas.

for instance... ever since the nov low , if s&p was up 1% the nas was up 1.2 % or something , always leading, untill right before the top! Ever since ,it is leading on the downside. like today..NASDAQ 2,697.31 -6.98

S&P 1,283.32 +3.06... when that relationship changes you will be at, or very near a bottom!

S&P 1,283.32 +3.06... when that relationship changes you will be at, or very near a bottom!

Feels like we are at the make or break point today. Above 1283.00 and we stabilize higher, below 1278.75 and we should have a nice afternoon sell-off.

Yes, you are right its never 100%. I like using the euro because it trades a bit more independently from equities.

Originally posted by koolblue

Lorn, just an opinion, but the correlation is never 100%. for instance you also have good correlations with copper( which diverged a few days before the 1296.25 top) and crude.The one i like the best is the nas.

There have been times when the euro's relationship was freakin uncanny! I just meant that i use it not on an intraday basis but more like a daily indicator, same as the nas. And especially ,i look for divergencies (new low in the s&p but not the nas, especially if that day the nas declined at less a percentage than the s&p ,etc) strongly would argue for a direction change!

Sure thing. I agree with you, intra day divergences between all the major markets shout loud and clear something is up.

Originally posted by koolblue

There have been times when the euro's relationship was freakin uncanny! I just meant that i use it not on an intraday basis but more like a daily indicator, same as the nas. And especially ,i look for divergencies (new low in the s&p but not the nas, especially if that day the nas declined at less a percentage than the s&p ,etc) strongly would argue for a direction change!

I think this is the one. I'm long at 1280.25. stop at 1278.75 with the objective at 1288.00, possibly 1291.00. Partial taking at 1284.75. Will see if it works.

ES trading 1281.50 @ 14:07

ES trading 1281.50 @ 14:07

Originally posted by BruceM

and while I'm thinking here...what happened to Paul and Phileo...? Just two of the many posters who have past through and moved on from the Mypivots day trading threads...

Last I remember Phileo was taking a JPJ trading room trial and then POOF.....he's gone !!

I see Phileo posting on Twitter now and then:

http://twitter.com/Phileo99

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.