ES short term trading 2-08-11

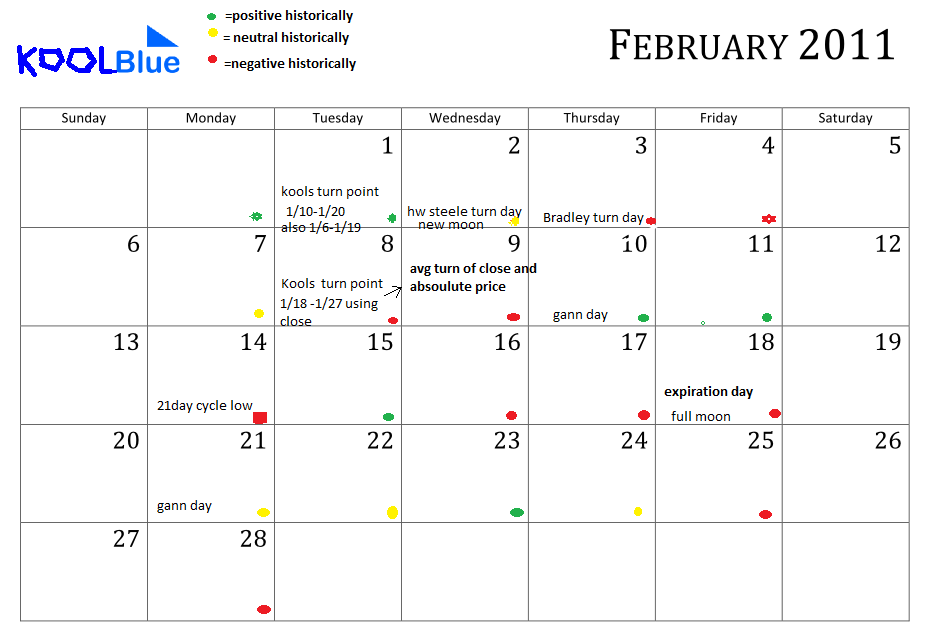

Good morning. Lots of bullish action recently. In fact , like many others ,im inclined to think we have much higher to go for an April or june top...BUT... i was looking as you know for an intermediate type correction, and we got about 37.Far less than i would have thought! Even with much higher prices ahead, i feel the market is still vulnerable to some type of consolidation before zooming straight up to the high 1300's or 1400's. This could start anytime ,(today or tomorrow in fact would be a perfect time frame) but i would think closer to 1329-30. As for the short term... support appears at 1313.25, 1311.50 and 1309.25. resistance may be found at 1326.50, and 1329.75...today or tomorrow could be a short term turning point of some sort...

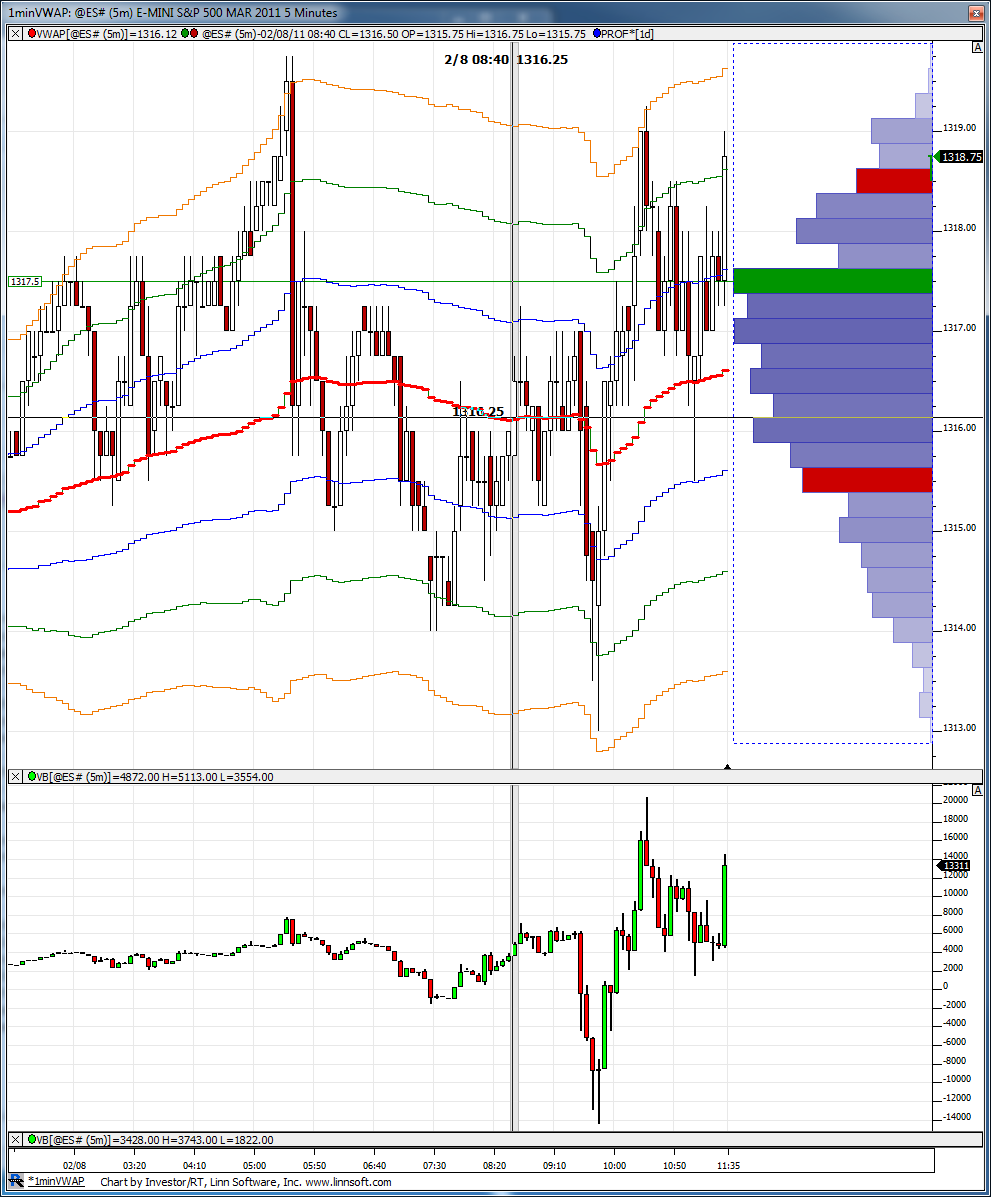

without some volume coming in this shouldn't push too far away....my estimate is 21 area at best but not expecting that...ultimate targets for me will be the triple run near 16 and that range air down near 15...

ya gotta love the edges..the three best edges are the O/N high and low, the RTH high and low and the 60 minute high and low....

If one has patience they could do well there...on fades..

Now we gotta get through the 17 number critical now and then we should retest that range air and the high of the highest volume bar today.....at 15 ....triples too....lots down there for targets...so far the day is as expected...

If one has patience they could do well there...on fades..

Now we gotta get through the 17 number critical now and then we should retest that range air and the high of the highest volume bar today.....at 15 ....triples too....lots down there for targets...so far the day is as expected...

I sold the 18 print but lighter now....we know they will eventually want to push a 60 minute high or low...volume is poor....they like to test the volume and that is still down near the 15 and untouched..

many times what you will see is NEW higher volume bars come in and then it won't return to those volume spikes...that hasn't happened yet today......so the 1315 can still be used as a target...

we are still stuck inside of all key ranges...so trying to buy or sell at extremes is still valid.....30 minute closes can't get outside any ranges

many times what you will see is NEW higher volume bars come in and then it won't return to those volume spikes...that hasn't happened yet today......so the 1315 can still be used as a target...

we are still stuck inside of all key ranges...so trying to buy or sell at extremes is still valid.....30 minute closes can't get outside any ranges

let me add a critical part to this....the reason you see me jump in ahead of those extremes quite often is beacuse it doesn't always push up or down as far as we would like it to.....so I'm trying to get something on AHEAD of those extremes in case they don't run out those extremes ........but I am always prepared to go in with a larger number of contracts if and when those xtremes get breached and especially in the first 90 minutes of trade

Originally posted by BruceM

ya gotta love the edges..the three best edges are the O/N high and low, the RTH high and low and the 60 minute high and low....

If one has patience they could do well there...on fades..

Now we gotta get through the 17 number critical now and then we should retest that range air and the high of the highest volume bar today.....at 15 ....triples too....lots down there for targets...so far the day is as expected...

I just close this last trade at 18.25..I don't like double tops on the 60 minute highs......will look for sells a bit higher ...above O/N high and YD RTH high

I'm officially declaring 1315 - 1315.50 as todays magnet zone...LOL....look at your one minute volume spikes and compare the areas with price

I'm watching to see if we get a one minute bar that has more than 15k volume...my IB volume is bundled supposedly but that is the level I'm watching...that would be higher than the two volume spikes we have down in the 1315 area and would then create a possibke new magnet price....

I still think the smart money is selling this rally here and I want to join them...using that filter as an exit and also the 30 minute close....lets see if the noon can close outside the O/N high and 60 minute high...hope not!!

I still think the smart money is selling this rally here and I want to join them...using that filter as an exit and also the 30 minute close....lets see if the noon can close outside the O/N high and 60 minute high...hope not!!

I'm looking to get short above 1319.50 then will re- evaluate at the 12:30 CLOSE

and while I'm multi- tasking....here is a good brief article from Dalton that mentions the key zone that was support earlier......

http://jamesdaltontrading.com/blog/20110208/sp/e-mini-sp-update-february-8-2011/?utm_source=Blog+Subscription&utm_campaign=14f8f41dbb-Blog_Post2_8_2011&utm_medium=email

Now Koolio had it for other reasons which always makes the area more powerful

The nice thing about the low volatility is it gives us the opportunity to try out some of our new deas that seem to work on paper with real money....hopefully without losing big when we are wrong...

and we can multi task without big risks......I'm actually watching my two year old play with "ELMO".....not bragging on any of this but I'm just trying to convey the looseness I'm attempting to bring to my trading

we really need to see the 12:30 close BELOW the 60 minute low, the O/N high and the high from yesterday just in case then decide to try to run stops up there...

16.75 is my first target on this short...we'll see

http://jamesdaltontrading.com/blog/20110208/sp/e-mini-sp-update-february-8-2011/?utm_source=Blog+Subscription&utm_campaign=14f8f41dbb-Blog_Post2_8_2011&utm_medium=email

Now Koolio had it for other reasons which always makes the area more powerful

The nice thing about the low volatility is it gives us the opportunity to try out some of our new deas that seem to work on paper with real money....hopefully without losing big when we are wrong...

and we can multi task without big risks......I'm actually watching my two year old play with "ELMO".....not bragging on any of this but I'm just trying to convey the looseness I'm attempting to bring to my trading

we really need to see the 12:30 close BELOW the 60 minute low, the O/N high and the high from yesterday just in case then decide to try to run stops up there...

16.75 is my first target on this short...we'll see

the 30 minute players will need to try once again to close and stay above the big 3 again....otherwise we will drift back again to the open print like before....

still haven't seen a one minute above 15 k so that is part of the clue up here

still haven't seen a one minute above 15 k so that is part of the clue up here

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.