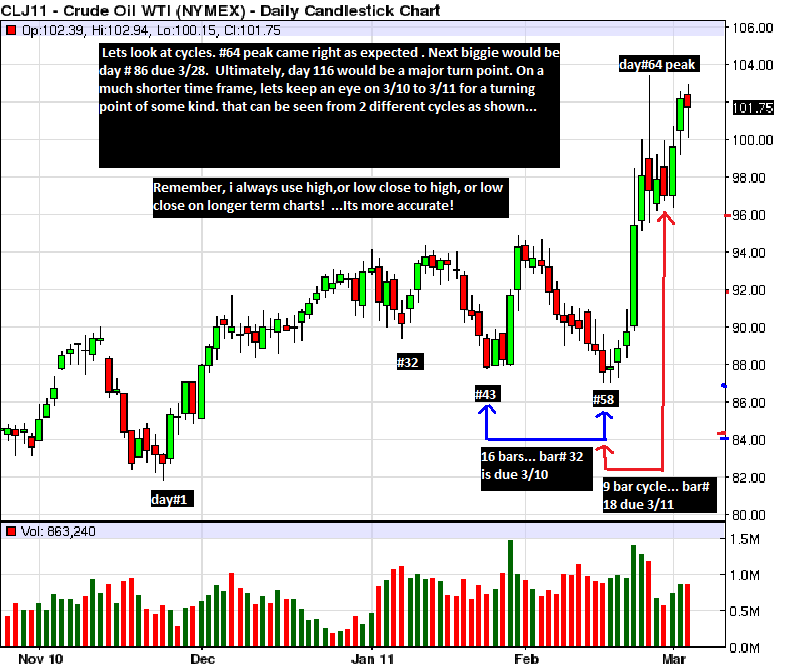

CL April crude oil

Originally posted by prestwickdrive

10106-10089 >>> 10078 initial and 10061 full

that failed but 10016-10102 >>> 10079 full that hit

Originally posted by prestwickdriveyup...hence my long ,hoping for 100.90 exit,expecting 100.97

Originally posted by prestwickdrive

10106-10089 >>> 10078 initial and 10061 full

that failed but 10016-10102 >>> 10079 full that hit

wow! freakin bingo again! i should play the lottery today!

Originally posted by koolblue

wow! freakin bingo again! i should play the lottery today!

nah ... just trade crude. great trade!

personally i think the rebound i predicted continues,possibly all the way to the 101.80 area, then the final leg of the decline to the 99.20 area for completion of the correction, longer term....then up to 103.20 area

Your 10141 hit KB. I was tempted to SS there but I am in my self imposed no-trade zone. I have given up too much $ during this time period to consistently make it worthwhile.

Originally posted by prestwickdriveyeah ,i almost sold there also, but because its late , like you, i passed... just watching the rest of the day...

Your 10141 hit KB. I was tempted to SS there but I am in my self imposed no-trade zone. I have given up too much $ during this time period to consistently make it worthwhile.

Just wondering what kind of stops you are using, KB and PWD? Thanks.

Bingo on 10320 KB. The recent high for this contract is 10341.

Einstein - re stops, because of the volatility I play my stops by feel. I do not recommend it as a tactic for others. I just find that I get whipped around a lot if I use a fixed approach and crude, at least to me, seems to behave differently at different times and different price points and when different geo-politial and economic news comes out so I adjust my approach based on what I am seeing and feeling. Sorry I can't be more specific.

Einstein - re stops, because of the volatility I play my stops by feel. I do not recommend it as a tactic for others. I just find that I get whipped around a lot if I use a fixed approach and crude, at least to me, seems to behave differently at different times and different price points and when different geo-politial and economic news comes out so I adjust my approach based on what I am seeing and feeling. Sorry I can't be more specific.

On the "Here goes" thread it was mentioned how dangerous the CL is to trade and I couldn't agree more. With more risk comes potential for greater rewards but one has to stay alive by prudently and aggressively managing risk in order to live long enough to capture the reward.

Everything with the CL moves faster and farther than an instrument like the ES. The following is an example of what I mean from last week with the CLJ contract which was the front month then. This first chart shows a typical ascending wedge.

Because the underlying trend of the market was up one could reasonably expect an up breakout. On top of that they "usual" ascending wedge continuation pattern is up and the following is what happened in the next eleven minutes after the above picture was taken:

The extent of the berakout was way more than one would usually expect from an instrument like the ES or NQ as it moved 80 cents in 11 minutes. That is $800 per contract or the equivalent of 16 ES points. What compounded the situation was the breakout point was the round number of $101. When stop losses at $101 got hit for those who were short it got really nasty. Even shorts with stops at $101 likely got hurt more than they expected because the market is so thin and their stop market orders likely got very poor fills. Those with stop limit orders just above $101 likely did not get fills at all.

The point of this is to point out the volatility of the crude oil contract and the need to be well capitilized to trade it and to really protect one's capital.

Everything with the CL moves faster and farther than an instrument like the ES. The following is an example of what I mean from last week with the CLJ contract which was the front month then. This first chart shows a typical ascending wedge.

Because the underlying trend of the market was up one could reasonably expect an up breakout. On top of that they "usual" ascending wedge continuation pattern is up and the following is what happened in the next eleven minutes after the above picture was taken:

The extent of the berakout was way more than one would usually expect from an instrument like the ES or NQ as it moved 80 cents in 11 minutes. That is $800 per contract or the equivalent of 16 ES points. What compounded the situation was the breakout point was the round number of $101. When stop losses at $101 got hit for those who were short it got really nasty. Even shorts with stops at $101 likely got hurt more than they expected because the market is so thin and their stop market orders likely got very poor fills. Those with stop limit orders just above $101 likely did not get fills at all.

The point of this is to point out the volatility of the crude oil contract and the need to be well capitilized to trade it and to really protect one's capital.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.