Lookin' Mixed to Even Nasty

Went thru the Daily charts of the SP-500 ... and ain't much to write home to mom about. In fact, many that have been "performing" are individually showing toppy chart activity and appearance. Also, ran my other scans and just didn't see much that looked good as potential LONG equity picks.

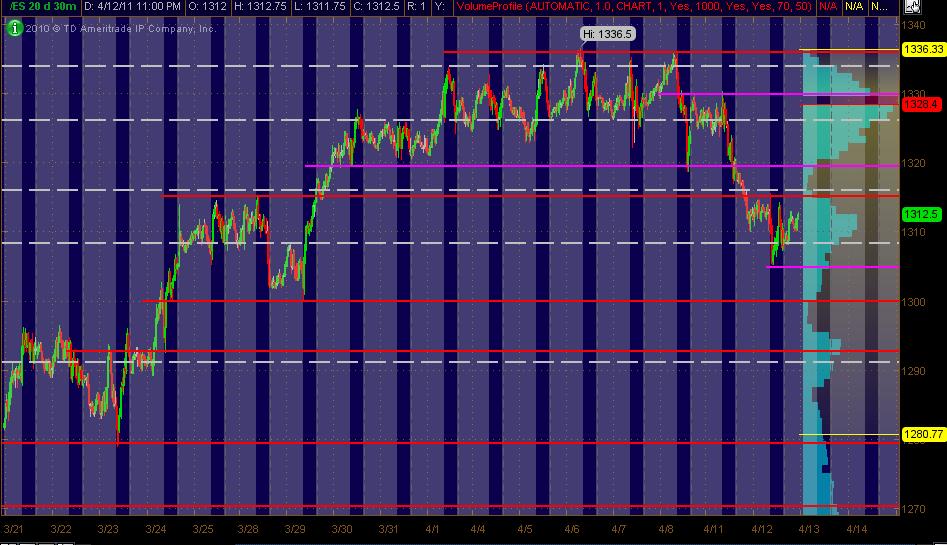

Obviously, there's the Double Toppy looking thing going on with the ES fwiw ... as we pushed up into that resistance and hit a brick wall for now. Anyway, here are the stocks that I plucked out of about a 1000 I viewed on both their Daily as well as their 5min intraday chart "look" and price action ... as it relates to long type setups/patterns and with heavy emphasis on R/S (strong) compared to the ES activity yday and the past few days/weeks:

PCLN

OPEN

APKT

CEVA

JAZZ

HUM

TZOO (this one's a mut&#! Focher)

Tossing these out as potential equity LONG plays if the market holds up and/or moves UP. But to revisit what I've continued to try and hammer out here ... is that this long pick group can function collectively as an INDICATOR for what the overall market is gonna do intraday ... at least for the first few hours ... and often the session. If they don't show any strength, show erratic bobble-head up/down price action ... or just fall off a cliff. Well, that's telling. Even with just 7 to work off of for Wednesday ... if the majority act like a bipolar etch-a-sketch jonesing for a vat of lithium ... then it's usually (not always, but usually) worth paying attention to. I'd encourage all to do the same with your own set of good long setups too. It really can be a read of MARKET INTERNALS.

And of course, we're coming into option expiration this week (which others have alluded to) that usually creates weird and unexpected cross-currents of noise on the ES and in stocks.

Hope these long picks and INDICATOR approach/idea is helpful to some folks out there!

Blathered so much that my Crown and Coke needs a straw for me to suck up the last nectar of the god's fumes at this point. Means a REFILL! Btw, if all of the "observers" out there that aren't comfortable posting yet, well POST in the ES daily room. Bruce, Paul, Lorn, PT, BeyondMP etc. and some new great poster inputs offer some seriously incredible calls and detailed education that I've not seen anywhere else on the internet free or for-fee!

I'm MonkeyMeat and I approve this message

Obviously, there's the Double Toppy looking thing going on with the ES fwiw ... as we pushed up into that resistance and hit a brick wall for now. Anyway, here are the stocks that I plucked out of about a 1000 I viewed on both their Daily as well as their 5min intraday chart "look" and price action ... as it relates to long type setups/patterns and with heavy emphasis on R/S (strong) compared to the ES activity yday and the past few days/weeks:

PCLN

OPEN

APKT

CEVA

JAZZ

HUM

TZOO (this one's a mut&#! Focher)

Tossing these out as potential equity LONG plays if the market holds up and/or moves UP. But to revisit what I've continued to try and hammer out here ... is that this long pick group can function collectively as an INDICATOR for what the overall market is gonna do intraday ... at least for the first few hours ... and often the session. If they don't show any strength, show erratic bobble-head up/down price action ... or just fall off a cliff. Well, that's telling. Even with just 7 to work off of for Wednesday ... if the majority act like a bipolar etch-a-sketch jonesing for a vat of lithium ... then it's usually (not always, but usually) worth paying attention to. I'd encourage all to do the same with your own set of good long setups too. It really can be a read of MARKET INTERNALS.

And of course, we're coming into option expiration this week (which others have alluded to) that usually creates weird and unexpected cross-currents of noise on the ES and in stocks.

Hope these long picks and INDICATOR approach/idea is helpful to some folks out there!

Blathered so much that my Crown and Coke needs a straw for me to suck up the last nectar of the god's fumes at this point. Means a REFILL! Btw, if all of the "observers" out there that aren't comfortable posting yet, well POST in the ES daily room. Bruce, Paul, Lorn, PT, BeyondMP etc. and some new great poster inputs offer some seriously incredible calls and detailed education that I've not seen anywhere else on the internet free or for-fee!

I'm MonkeyMeat and I approve this message

Thought I'd go ahead and post my ES PASR MAP ... 30min chart of 20 days of trading. The right vertical shows Volume at Price. The Red lines are potential significant S/R with Magenta as semi-significant. The White dashed lines are the Weekly Pivots. Hope it's helpful as a MAP for Wednesday's trading and into the end of the week.

And if anyone's wondering where I get my high-end trading analysis, methodology and strategeries ... wonder no more. I don this contraption every time I review the market and charts:

Have several in storage ... I heard Gann wore one of these. 3 bucks each ... first come, first serve. Beard and birth control glasses not included.

Have several in storage ... I heard Gann wore one of these. 3 bucks each ... first come, first serve. Beard and birth control glasses not included.

Thanks for the notes MM. I've always followed certain stocks as underlying strength/weakness for the overall market. I watch which sectors are leading then pick the hot stocks from them to use as "indicators".

Its much like when comparing the equity indexes to one another. Divergence between them, ie. S&P making new highs on the day but NQ isn't often is warning signs something isn't quite right.

Sometimes its the simplest things as you point out here, but take a bit of effort to follow that yield some great edges.

Cheers.

Its much like when comparing the equity indexes to one another. Divergence between them, ie. S&P making new highs on the day but NQ isn't often is warning signs something isn't quite right.

Sometimes its the simplest things as you point out here, but take a bit of effort to follow that yield some great edges.

Cheers.

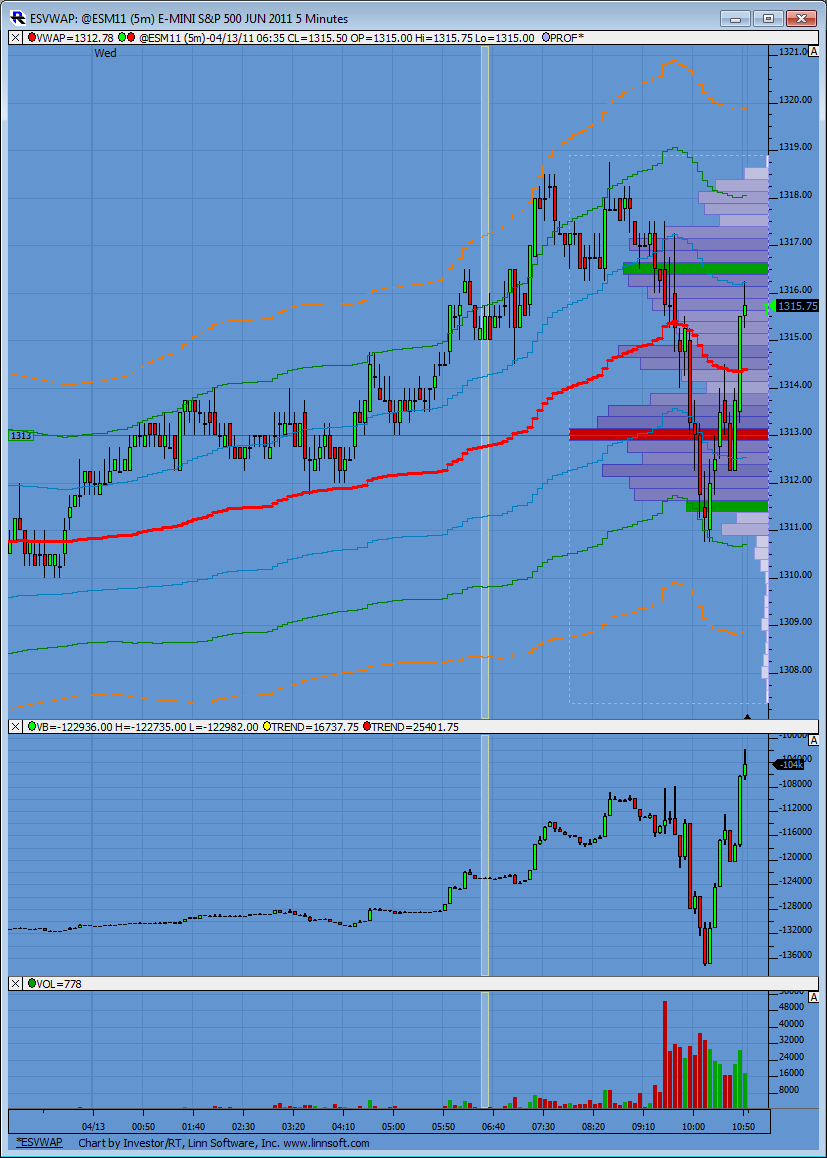

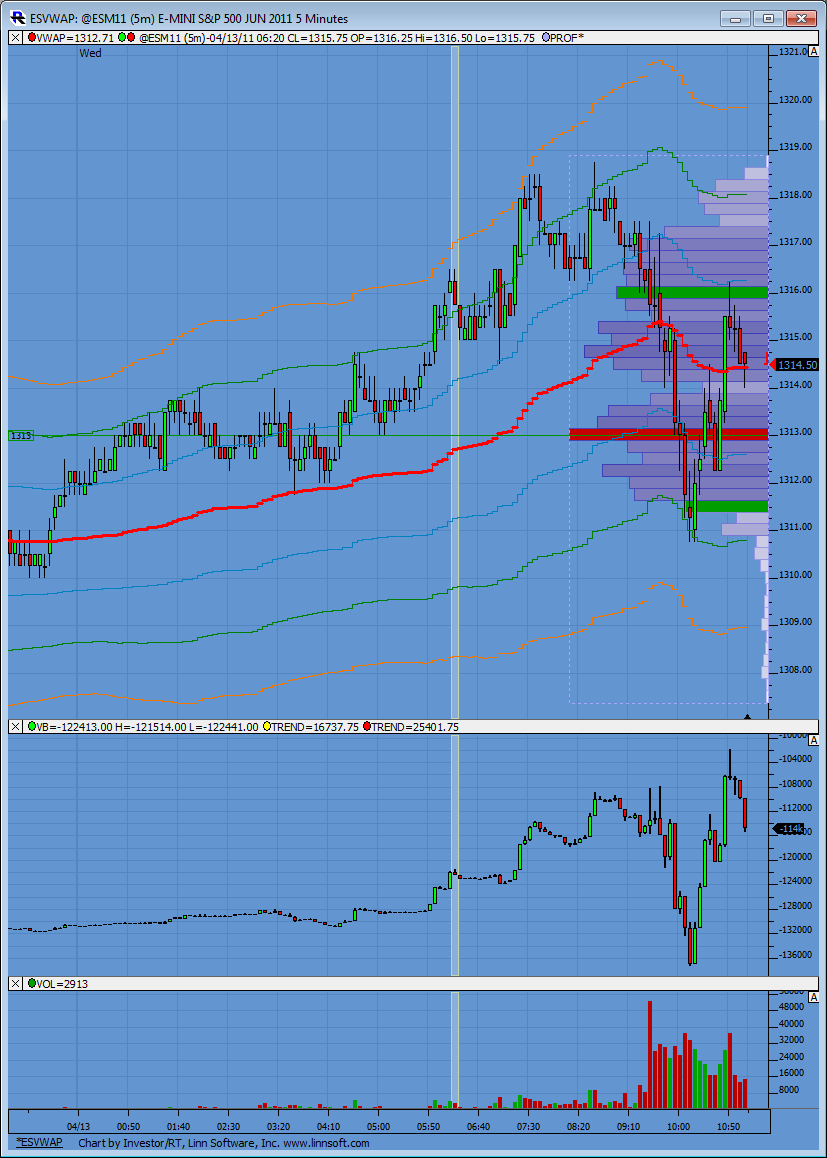

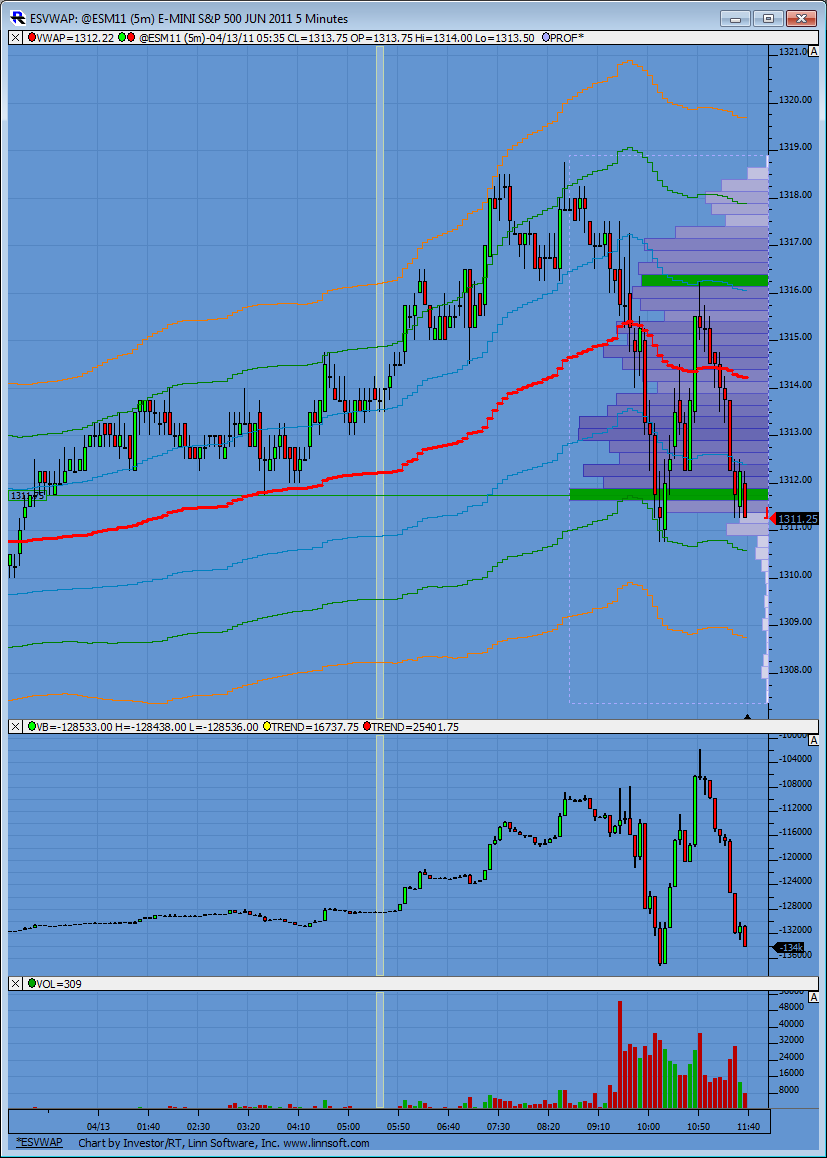

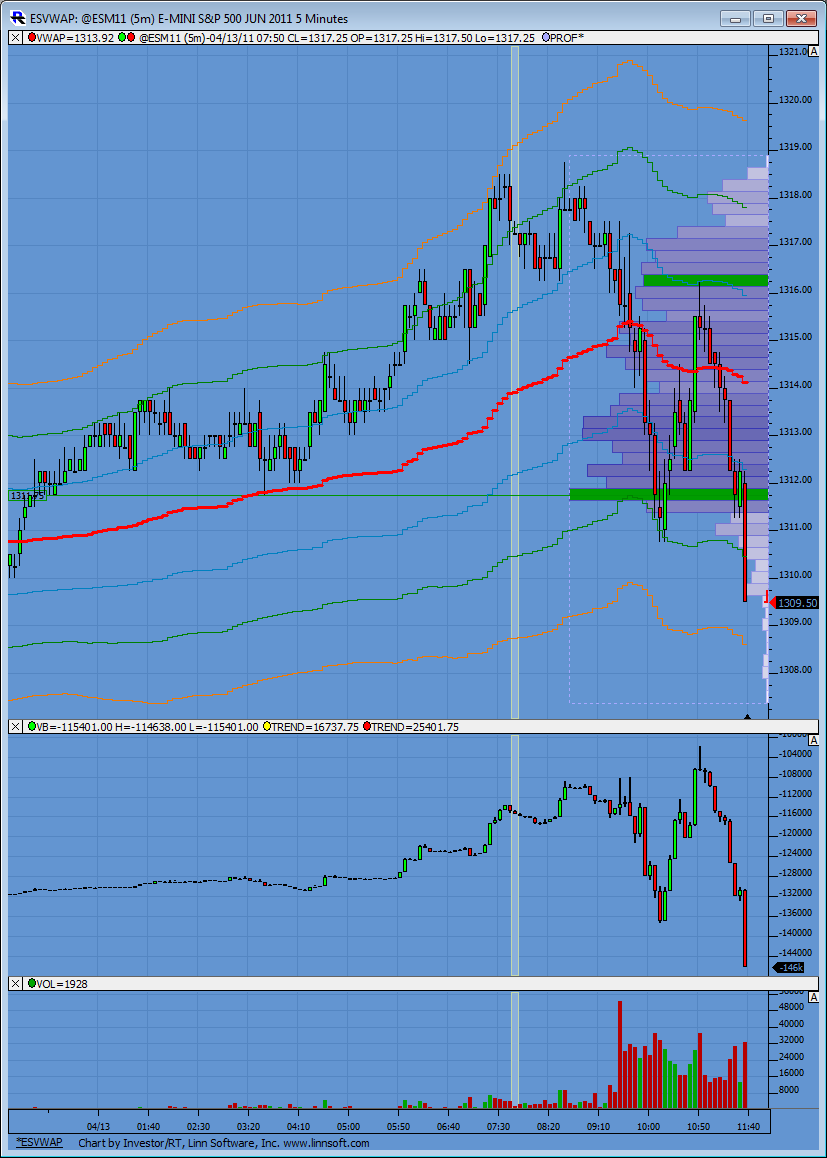

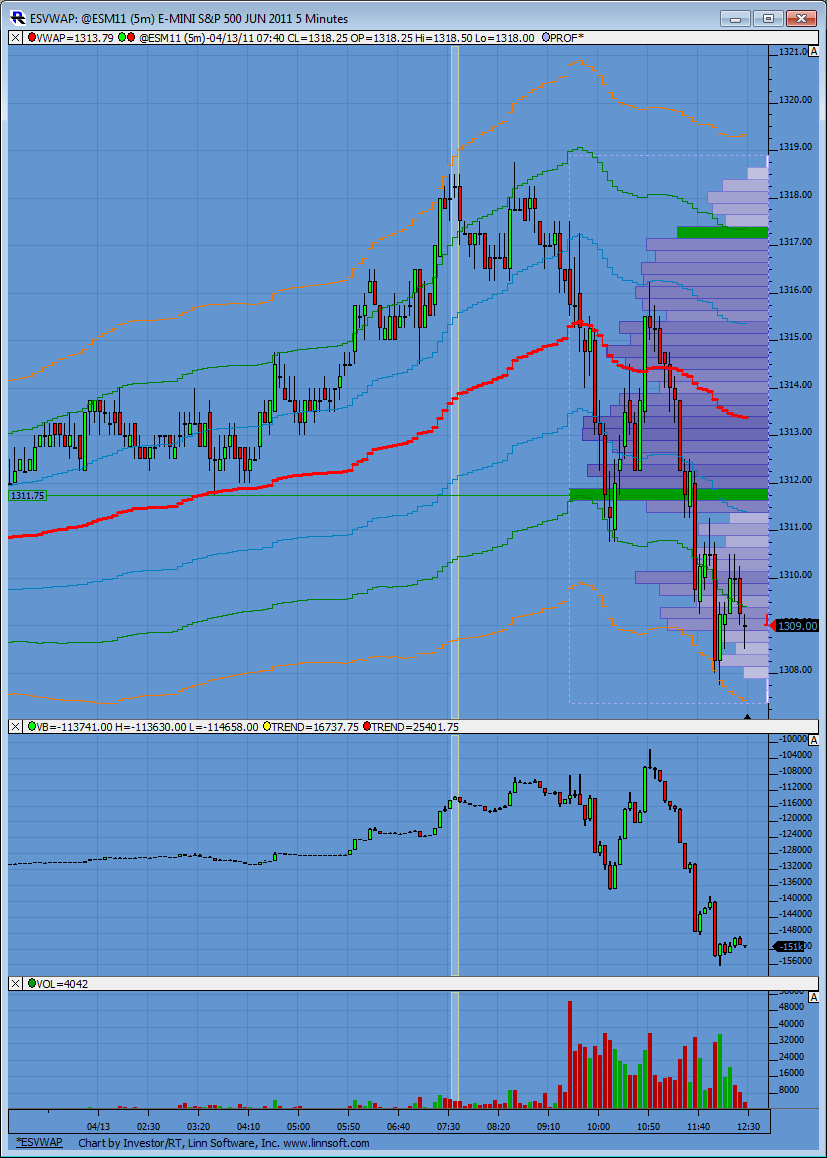

Quite an interesting day so far. You can see as per CD that selling pushed below the levels of CD in O/N session of 1310 but as prices pivoted up from 1311 those sellers quickly covered. Now we have a similar situation but in reverse. The question is will the buyers have to cover here or will prices continue heavenward.

nice extra effort with the charts today Lorn...thank you....

I'm waiting to see how this plays out now that the peak volume from Yesterday at 1308.50 has been tested

A/d line is just about flat now but Up volume is almost 2 to 1 over down...

I won't be surprised to see yet another test up into 11.25 number from here but gonna pass....

I'm waiting to see how this plays out now that the peak volume from Yesterday at 1308.50 has been tested

A/d line is just about flat now but Up volume is almost 2 to 1 over down...

I won't be surprised to see yet another test up into 11.25 number from here but gonna pass....

thanks for all those charts lorn !

One more for good measure. Notice on each rebound in price the CD bar is small/tight while all the declining bars are long and taking out the previous low.

In the midst of a bounce off yesterday's close and the O/N low.

In the midst of a bounce off yesterday's close and the O/N low.

Most of the 7 equity picks did decently (although erratically on a few) from the LONG side. And the ES ended up selling down. I know I've talked about the LONG PICKS as an "indicator." Some days they don't necessarily show as "internals" what the market's propensity for direction on the session is. But that's more uncommon than not. If anyone nabbed a decent one for a semi-decent stock trade ... then that's a good thang. But ... well, HELL! To get into the nuances of when and where to get into a stock isn't the place here. I can only trust that the group of 7 long picks didn't jig anyone out of a decent ES trade. At the same time, almost all of those Motor Scooters are still showing some great Daily AND 5min intraday action long. BUT ... as I've always alluded to when it comes to probabilities, the SP should "behave" ... in other words, not sell off like it did today. The fact that these stocks held up well in a weak market (expiry week factored in) ... may be xome serious great trades long if the overall market (ES) decides to bounce/rally.

Just a Monkey following up on the prior posts and explanations.

Hooot!

Just a Monkey following up on the prior posts and explanations.

Hooot!

Originally posted by MonkeyMeat

Went thru the Daily charts of the SP-500 ... and ain't much to write home to mom about. In fact, many that have been "performing" are individually showing toppy chart activity and appearance. Also, ran my other scans and just didn't see much that looked good as potential LONG equity picks.

Obviously, there's the Double Toppy looking thing going on with the ES fwiw ... as we pushed up into that resistance and hit a brick wall for now. Anyway, here are the stocks that I plucked out of about a 1000 I viewed on both their Daily as well as their 5min intraday chart "look" and price action ... as it relates to long type setups/patterns and with heavy emphasis on R/S (strong) compared to the ES activity yday and the past few days/weeks:

PCLN

OPEN

APKT

CEVA

JAZZ

HUM

TZOO (this one's a mut&#! Focher)

Tossing these out as potential equity LONG plays if the market holds up and/or moves UP. But to revisit what I've continued to try and hammer out here ... is that this long pick group can function collectively as an INDICATOR for what the overall market is gonna do intraday ... at least for the first few hours ... and often the session. If they don't show any strength, show erratic bobble-head up/down price action ... or just fall off a cliff. Well, that's telling. Even with just 7 to work off of for Wednesday ... if the majority act like a bipolar etch-a-sketch jonesing for a vat of lithium ... then it's usually (not always, but usually) worth paying attention to. I'd encourage all to do the same with your own set of good long setups too. It really can be a read of MARKET INTERNALS.

And of course, we're coming into option expiration this week (which others have alluded to) that usually creates weird and unexpected cross-currents of noise on the ES and in stocks.

Hope these long picks and INDICATOR approach/idea is helpful to some folks out there!

Blathered so much that my Crown and Coke needs a straw for me to suck up the last nectar of the god's fumes at this point. Means a REFILL! Btw, if all of the "observers" out there that aren't comfortable posting yet, well POST in the ES daily room. Bruce, Paul, Lorn, PT, BeyondMP etc. and some new great poster inputs offer some seriously incredible calls and detailed education that I've not seen anywhere else on the internet free or for-fee!

I'm MonkeyMeat and I approve this message

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.