YMM1, (3, -1), profitable strategy, Stretch

Hi,

These past several months I've been posting this intra-day e-mini $5 Dow futures trading strategy in the Traders Lounge; and thought I would post the same in this room, for the purpose of identifying students of the markets who are interested to intra-day trade e-mini $5 Dow futures (YMM1).

Hi,

Trading from the 28 April settlement, 12708, and applying the (3, -1) formula to the Stretch calculation, and the Fibonacci of the Stretch calculations, the following price measurements printed before the end of the B trading session, this Friday afternoon:

28 April settlement = 12708

Stretch = 27

1.618% of the Stretch = 43

2.618% of the Stretch = 70

4.25% of the Stretch = 114 (108 = 29 April high - low = 12796-12688)

Pivot point = 12680 (never printed)

29 April high = 12796

29 April low = 12688

29 April settlment = 12794 + 86

12720- 27= 12700 (fading first intra-day counter trend = -1 of (3, -1)

12708 + 27 + 27 + 27 =12789 completing the trending move 3 of (3, -1)

12720 tested previous day's high (that's with the trend, up).

12720- 27 = 12693 =[12720 - Stretch calculation = 12693] (low=12688).

June e-mini $5 Dow rallied from the low, 12688 to unchanged, 12708, and rallied an additional three Stretch calculations, completing the 3 of (3, -1) formula basis trading the Stretch calculation from unchanged.

12708 opened and tested the 28 April high, 12724 (12:45PDT, which high failed in the last half hour (call it profit taking or ... evening up of positions going into the close.... whatever you want to call it, 12724 reversal trend from the high lower to the settlement, 12708). The 29 April A session soon lifted from 12708 to 12720, testing the previous day's high, 12724, failing 12720, decline to 12688 (28 April low = 12688). (12720 - 27 = 12693) From the low, 12688, prices rallied into the close, 12794 (12796 = high 29 April).

These past several months I've been posting this intra-day e-mini $5 Dow futures trading strategy in the Traders Lounge; and thought I would post the same in this room, for the purpose of identifying students of the markets who are interested to intra-day trade e-mini $5 Dow futures (YMM1).

Hi,

Trading from the 28 April settlement, 12708, and applying the (3, -1) formula to the Stretch calculation, and the Fibonacci of the Stretch calculations, the following price measurements printed before the end of the B trading session, this Friday afternoon:

28 April settlement = 12708

Stretch = 27

1.618% of the Stretch = 43

2.618% of the Stretch = 70

4.25% of the Stretch = 114 (108 = 29 April high - low = 12796-12688)

Pivot point = 12680 (never printed)

29 April high = 12796

29 April low = 12688

29 April settlment = 12794 + 86

12720- 27= 12700 (fading first intra-day counter trend = -1 of (3, -1)

12708 + 27 + 27 + 27 =12789 completing the trending move 3 of (3, -1)

12720 tested previous day's high (that's with the trend, up).

12720- 27 = 12693 =[12720 - Stretch calculation = 12693] (low=12688).

June e-mini $5 Dow rallied from the low, 12688 to unchanged, 12708, and rallied an additional three Stretch calculations, completing the 3 of (3, -1) formula basis trading the Stretch calculation from unchanged.

12708 opened and tested the 28 April high, 12724 (12:45PDT, which high failed in the last half hour (call it profit taking or ... evening up of positions going into the close.... whatever you want to call it, 12724 reversal trend from the high lower to the settlement, 12708). The 29 April A session soon lifted from 12708 to 12720, testing the previous day's high, 12724, failing 12720, decline to 12688 (28 April low = 12688). (12720 - 27 = 12693) From the low, 12688, prices rallied into the close, 12794 (12796 = high 29 April).

dont see a short entry yet, the pivot is 90 so will review

reaction to the 90 for sure. Will trade currencies for 10 pips but dont want to make my broker reach on fees for Dow. if we get a decent retest at 90 will consider short , but bias seems to be in favour of the bulls today.

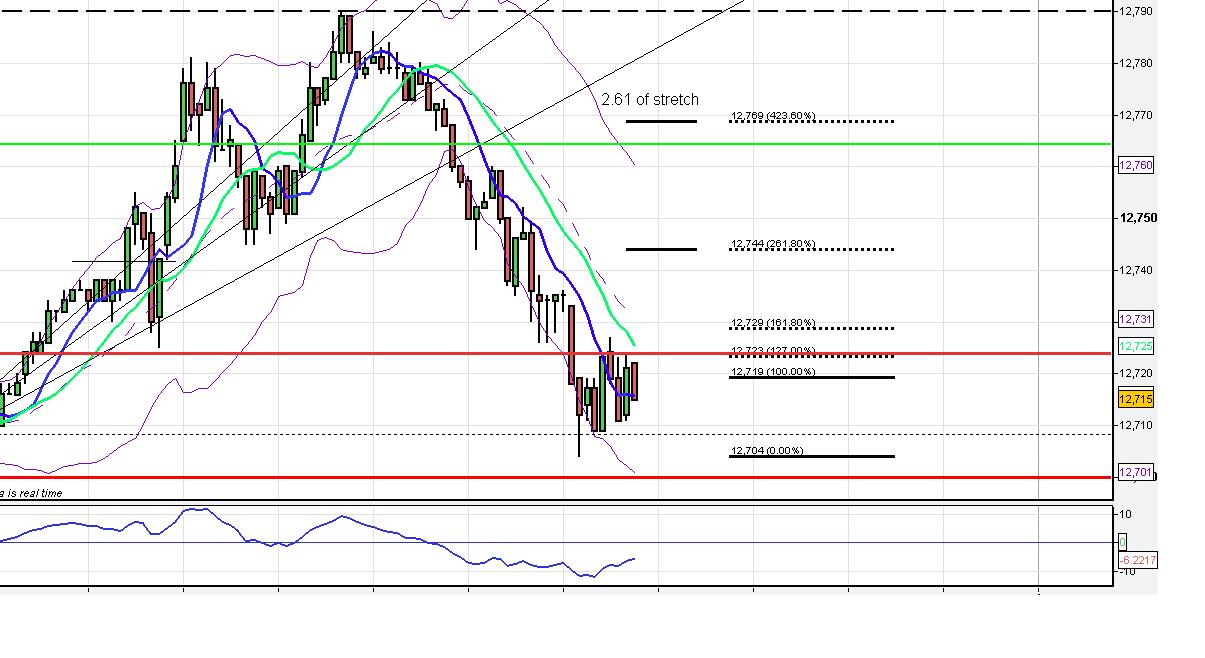

might be worth looking for a long here, tight stops, second black line is 2.61 of stretch for that move

the number was a bust, looks like its bottoming out, DX looks a bit toppy intraday

if this low holds, fib projection and stretch projection line up 12744 & 12769,

push!!!!!!!!!!!!

I think alot of people were looking at 1345 on S&P , should be some sort of bounce here

I think alot of people were looking at 1345 on S&P , should be some sort of bounce here

Hi,

Thanks for your replies.

BruceM, Yes, I've researched these strategies, and applied my money to these intra-day trading tools, with success. I've provided the reversal calculations, but not the charts.

Pull up your own e-mini $5 Dow futures charts and apply the price points (with the corrolating Stretch / Fibonacci of the Stretch calculations) that I have provided you.

No, it is not an academic exercise. This is not a dress rehearsal. Put you money at risk. You can never step into the same river twice. The markets are always changing. There is no "holy grail.'

I produced the price reversals, with the actual reversal prices. You can verify the price reversals, or not. You haven't read the previous posts supporting these strategies. I've learned these tools from other traders, who published these trading strategies during the past nearly two decades.

A physicist published the (3, -1) formula in a Trader's World (I think it was Trader's World.) in the Summer or Fall of 2003.

I've included three dozen posts (links provided at the bottom) which should serve to support the viability of these intra-day YM trading strategies. Until this month, I've posted in the "Traders Lounge," and not in the "Trading Strategies and Setups."

What is undeniable is a pattern that has repeated often enough to warrant posting. Before that, I'll explain a little, but not how to make a watch. Below are an e-mini $5 Dow futures intra-day trading post, not an inter-day strategies.

I've found the Stretch / Fibonacci of the Stretch to produce better results for entering into an intra-day YM trade than applying cross-overs of moving averages, oscillators, histograms.

The 'fade the first move by the Stretch / Fibonacci of the Stretch and apply it to the (3, -1) formula has produced profits. It is not a "Black Box," end-all-be-all golden egg. Corrolating targets, techniques and tradeable probabilities of technical analysis are important.

(Just a note: Ken Shaleen, Chartwatch, Inc., has three decades of data compiled in a Technical Analysis Characteristic Reliability Index. A few years ago the CBOT asked him to produce White Paper about the e-mini $5 Dow futures. He told them before accepting the 'job' that the equity index futures are one of the worst performing futures markets in the Technical Analysis Characteristic Reliabiity Index. I think he'll sell a current copy upon request. He made a special mention of the triangles.)

Rally failures are important, too. Early in this 4 May A session (previous settlement, 12749) the YMM1 futures fell eighteen points, reversed 1.618% of those eighteen points and failed that level, 12752 (17:05PDT), when no buyers were willing to pay three ticks above the previous settlement. The YMM1 futures fell to 12701 (12752 - 1.618% of the Stretch = 12752 - 43 = 12709. 12701 = low print (18:59PDT).

Since printing a low at 12701 ... and YMM1 prices have reversed to 12735 as of 22:17PDT. 51 points down followed by 36 points up is a 66% correction. Again, look for corrolating projections.

My target, and achieved exit, was 35 points. 1.618% of the 4 May Stretch calculation is 27 x 1.618% = 43. 35 points = $175 per contract, before fees and commissions. Depending on your broker imposed intra-day margin, ($672.50) $175 is a 26% profit per contract.

http://www.mypivots.com/calculators/day-trader-millionaire-calculator.aspx

Starting capital: $672.5

Capital base per contract traded: $672.5

One trade per day

$5 round turn commission

35 points profit per trade

$5 per tick

It will take you approximately 35 trading days (49 calendar days) to become a millionare. Your target date to have at least $Million in your trading account is 22-Jun-2011.

One of these techniques is to take one Stretch or 1.618% of the Stretch by measuring reversal price points.

Today's Facebook post: I sold YMM1 short at 12742 (15:00PDT). Rotation is down. The 2 May benchmark high, 12873, printed a rally failure, a Gravestone candlestick, volume change greater than 10%, and that prices printed a higher open and a lower close (consensus on every popular trading platform, except the exchange) . This defines a Minor Trend Reversal Indicator, which requires another day to confirm. 4 May is declining.

The fade the first move strategy has been one my intra-day trading tools since 1997. I post these trading strategies as one of the multiple possibilities that can produce consistent profits. It is not a tool that projects every range but rather indicates where reversals are projected to occur. Example: When an intra-day low reversal starts developing, target a Stretch calculation or a Fibonacci of the Stretch calculation that measures towards a 2/3 level of the previous decline. That Stretch calculation / Fibonacci of the Stretch measurement tends to corrolate to a Fibonacci retracement level of that intra-day decline, i.e., +1.618% of a 2.618% decline.

The 'fade the Stretch / Fibonacci of the Stretch' strategy serves as a price measurement tool that should be YM B session that targets a similar price level as that corrolating to the new A session level to be faded. Of course, pivot points are to be considered, thoughtfully.

The Stretch calculation / Fibonacci of the Stretch calculation is a tool for projecting price measurement reversals. Here's a few links that I have posted since December that'll provide additional credence to the strategy that fades the first move. The (3, -1) price measurement projection has happened often enough to share. The message herein suggests that reversals that corrolate with the Stretch calculation / Fibonacci of the Stretchcalculation have in recent months produced tradeable opportunities.

Low volatility days tend to complete a trading range that is approximately 4.25% of the Stretch calculation. Here's an example of how close a 4.25% of the Stretch calculation approaches one day's trading range, e.g., a day with little volatility.

http://www.mypivots.com/board/topic/6280/1/ymh1-tradeable-probability-rally-failure-4-25-stretch-failed-by-2-618-stretch

Price moves that are approximately 2.618% of the Stretch tend produce tradeable probabiliies, i.e., reverse. (Crisis in Egypty errupted and prices reversed at -2.618%, and rallied back to unchanged. That was good for approximately seventy points.)

http://www.mypivots.com/board/topic/6280/1/ymh1-tradeable-probability-rally-failure-4-25-stretch-failed-by-2-618-stretch

http://www.mypivots.com/board/topic/6318/1/ymh1-price-rotations-formula-3-1-trending

http://www.mypivots.com/board/topic/6328/1/ymh1-stretch-1-618-and-2-618-reversals

http://www.mypivots.com/board/topic/6330/1/12-jan-low4-25-of-stretch-1-pt-ltsettle

THIS TRADING DAY PRINTED A TWO-WAY TRADING RANGE THAT REVERSED AROUND THE STRETCH CALCULATION.http://www.mypivots.com/board/topic/6391/1/ymh1-price-rotation-stretch

http://www.mypivots.com/board/topic/6395/1/ymh1-stretch-3-1-price-reversal-formula

http://www.mypivots.com/board/topic/6415/1/ymh1-2-618-4-25-fib-stretch-reversals-error-3-pts-7-pts

http://www.mypivots.com/board/topic/6427/1/10-14-feb-fib-stretch-price-reversal-points-accuracy

http://www.mypivots.com/board/topic/6428/1/15-feb-1-618-stretch-reversal-fade-stretch

http://www.mypivots.com/board/topic/6440/1/ym-17-feb-3-1-fade-1-stretch-3-stretch

http://www.mypivots.com/board/topic/6445/1/ymh1-18-feb-stretch-3-1-price-rotations

http://www.mypivots.com/board/topic/6436/1/ymh1-15-16-feb-fib-stretch-4-25-2-618-price-reversals

http://www.mypivots.com/board/topic/6464/1/21-22-feb-fib-stretch-reversals-2-618-4-25

This post is a little 'wordy' but it's significance is the Fibonacci of the Stretc reversals.

http://www.mypivots.com/board/topic/6472/1/23-feb-ymh-stretch-3-1-price-reversals

http://www.mypivots.com/board/topic/6473/1/24-feb-ymh1-stretch-reversals

http://www.mypivots.com/board/topic/6474/1/25-feb-ymh1-stretch-3-1-formula-satisfied

http://www.mypivots.com/board/topic/6482/1/28-feb-ymh1-3-1-stretch-satisfied-parameters

http://www.mypivots.com/board/topic/6485/1/1-mar-ymh1-3-1-faded-2-618-of-stretch

http://www.mypivots.com/board/topic/6502/1/7-mar-ymh1-3-1-basis-stretch-achieved

http://www.mypivots.com/board/topic/6527/1/17-mar-ymm1-3-1-stretch-profitable-reversal-strategy

http://www.mypivots.com/board/topic/6530/1/17-18-mar-ymm-3-1-stretch-strategy-achieved

http://www.mypivots.com/board/topic/6536/1/18-mar-ymm1-4-25-stretch-5-trading-range

http://www.mypivots.com/board/topic/6551/1/23-mar-ymm1-profitable-3-1-stretch-strategy

http://www.mypivots.com/board/topic/6566/1/28-march-a-session-ymm1-profitable-fade-stretch-4x

http://www.mypivots.com/board/topic/6593/1/ymm1-profitable-formula-3-1-basis-stretch

http://www.mypivots.com/board/topic/6603/1/ymm1-profitable-strategy-2-618-stretch-price-reversals

http://www.mypivots.com/board/topic/6615/1/ymm1-profitable-strategy-3-1-fading-1-618-of-stretch

http://www.mypivots.com/board/topic/6625/1/ymm1-3-1-profitable-strategy-stretch-calculation

http://www.mypivots.com/board/topic/6630/1/ymm1-profitable-strategy-fade-1-618-of-stretch

http://www.mypivots.com/board/topic/6626/1/ymm1-3-1-profitable-strategy-1-618-of-stretch

http://www.mypivots.com/board/topic/6650/1/ymm1-3-1-open-short-offset-basis-stretch

http://www.mypivots.com/board/topic/6640/1/ymm1-3-1-profitable-strategy-faded-stretch

http://www.mypivots.com/board/topic/6643/1/ymm1-3-1-profitable-trade-fade-1st-stretch

http://www.mypivots.com/board/topic/6645/1/ymm1-3-1-one-entry-tool-explained

http://www.mypivots.com/board/topic/6647/1/ymm1-3-1-open-short-2300pdt-27-april

http://www.mypivots.com/board/topic/6653/1/ymm1-3-1-profitable-strategy-stretch

http://www.mypivots.com/board/topic/6650/1/ymm1-3-1-open-short-offset-basis-stretch

BruceM,... Again, I'm not intellectually lazy, and have posted trading strategies, with the price reversal points and how they are approximately corrolating with the Stretch and the Fibonacci of the Stretch calculation, as an addition to the trader's tool bag. These have been, are being (tonight's trade has already been offset), and will be applied, again.

Thanks for your replies.

BruceM, Yes, I've researched these strategies, and applied my money to these intra-day trading tools, with success. I've provided the reversal calculations, but not the charts.

Pull up your own e-mini $5 Dow futures charts and apply the price points (with the corrolating Stretch / Fibonacci of the Stretch calculations) that I have provided you.

No, it is not an academic exercise. This is not a dress rehearsal. Put you money at risk. You can never step into the same river twice. The markets are always changing. There is no "holy grail.'

I produced the price reversals, with the actual reversal prices. You can verify the price reversals, or not. You haven't read the previous posts supporting these strategies. I've learned these tools from other traders, who published these trading strategies during the past nearly two decades.

A physicist published the (3, -1) formula in a Trader's World (I think it was Trader's World.) in the Summer or Fall of 2003.

I've included three dozen posts (links provided at the bottom) which should serve to support the viability of these intra-day YM trading strategies. Until this month, I've posted in the "Traders Lounge," and not in the "Trading Strategies and Setups."

What is undeniable is a pattern that has repeated often enough to warrant posting. Before that, I'll explain a little, but not how to make a watch. Below are an e-mini $5 Dow futures intra-day trading post, not an inter-day strategies.

I've found the Stretch / Fibonacci of the Stretch to produce better results for entering into an intra-day YM trade than applying cross-overs of moving averages, oscillators, histograms.

The 'fade the first move by the Stretch / Fibonacci of the Stretch and apply it to the (3, -1) formula has produced profits. It is not a "Black Box," end-all-be-all golden egg. Corrolating targets, techniques and tradeable probabilities of technical analysis are important.

(Just a note: Ken Shaleen, Chartwatch, Inc., has three decades of data compiled in a Technical Analysis Characteristic Reliability Index. A few years ago the CBOT asked him to produce White Paper about the e-mini $5 Dow futures. He told them before accepting the 'job' that the equity index futures are one of the worst performing futures markets in the Technical Analysis Characteristic Reliabiity Index. I think he'll sell a current copy upon request. He made a special mention of the triangles.)

Rally failures are important, too. Early in this 4 May A session (previous settlement, 12749) the YMM1 futures fell eighteen points, reversed 1.618% of those eighteen points and failed that level, 12752 (17:05PDT), when no buyers were willing to pay three ticks above the previous settlement. The YMM1 futures fell to 12701 (12752 - 1.618% of the Stretch = 12752 - 43 = 12709. 12701 = low print (18:59PDT).

Since printing a low at 12701 ... and YMM1 prices have reversed to 12735 as of 22:17PDT. 51 points down followed by 36 points up is a 66% correction. Again, look for corrolating projections.

My target, and achieved exit, was 35 points. 1.618% of the 4 May Stretch calculation is 27 x 1.618% = 43. 35 points = $175 per contract, before fees and commissions. Depending on your broker imposed intra-day margin, ($672.50) $175 is a 26% profit per contract.

http://www.mypivots.com/calculators/day-trader-millionaire-calculator.aspx

Starting capital: $672.5

Capital base per contract traded: $672.5

One trade per day

$5 round turn commission

35 points profit per trade

$5 per tick

It will take you approximately 35 trading days (49 calendar days) to become a millionare. Your target date to have at least $Million in your trading account is 22-Jun-2011.

One of these techniques is to take one Stretch or 1.618% of the Stretch by measuring reversal price points.

Today's Facebook post: I sold YMM1 short at 12742 (15:00PDT). Rotation is down. The 2 May benchmark high, 12873, printed a rally failure, a Gravestone candlestick, volume change greater than 10%, and that prices printed a higher open and a lower close (consensus on every popular trading platform, except the exchange) . This defines a Minor Trend Reversal Indicator, which requires another day to confirm. 4 May is declining.

The fade the first move strategy has been one my intra-day trading tools since 1997. I post these trading strategies as one of the multiple possibilities that can produce consistent profits. It is not a tool that projects every range but rather indicates where reversals are projected to occur. Example: When an intra-day low reversal starts developing, target a Stretch calculation or a Fibonacci of the Stretch calculation that measures towards a 2/3 level of the previous decline. That Stretch calculation / Fibonacci of the Stretch measurement tends to corrolate to a Fibonacci retracement level of that intra-day decline, i.e., +1.618% of a 2.618% decline.

The 'fade the Stretch / Fibonacci of the Stretch' strategy serves as a price measurement tool that should be YM B session that targets a similar price level as that corrolating to the new A session level to be faded. Of course, pivot points are to be considered, thoughtfully.

The Stretch calculation / Fibonacci of the Stretch calculation is a tool for projecting price measurement reversals. Here's a few links that I have posted since December that'll provide additional credence to the strategy that fades the first move. The (3, -1) price measurement projection has happened often enough to share. The message herein suggests that reversals that corrolate with the Stretch calculation / Fibonacci of the Stretchcalculation have in recent months produced tradeable opportunities.

Low volatility days tend to complete a trading range that is approximately 4.25% of the Stretch calculation. Here's an example of how close a 4.25% of the Stretch calculation approaches one day's trading range, e.g., a day with little volatility.

http://www.mypivots.com/board/topic/6280/1/ymh1-tradeable-probability-rally-failure-4-25-stretch-failed-by-2-618-stretch

Price moves that are approximately 2.618% of the Stretch tend produce tradeable probabiliies, i.e., reverse. (Crisis in Egypty errupted and prices reversed at -2.618%, and rallied back to unchanged. That was good for approximately seventy points.)

http://www.mypivots.com/board/topic/6280/1/ymh1-tradeable-probability-rally-failure-4-25-stretch-failed-by-2-618-stretch

http://www.mypivots.com/board/topic/6318/1/ymh1-price-rotations-formula-3-1-trending

http://www.mypivots.com/board/topic/6328/1/ymh1-stretch-1-618-and-2-618-reversals

http://www.mypivots.com/board/topic/6330/1/12-jan-low4-25-of-stretch-1-pt-ltsettle

THIS TRADING DAY PRINTED A TWO-WAY TRADING RANGE THAT REVERSED AROUND THE STRETCH CALCULATION.http://www.mypivots.com/board/topic/6391/1/ymh1-price-rotation-stretch

http://www.mypivots.com/board/topic/6395/1/ymh1-stretch-3-1-price-reversal-formula

http://www.mypivots.com/board/topic/6415/1/ymh1-2-618-4-25-fib-stretch-reversals-error-3-pts-7-pts

http://www.mypivots.com/board/topic/6427/1/10-14-feb-fib-stretch-price-reversal-points-accuracy

http://www.mypivots.com/board/topic/6428/1/15-feb-1-618-stretch-reversal-fade-stretch

http://www.mypivots.com/board/topic/6440/1/ym-17-feb-3-1-fade-1-stretch-3-stretch

http://www.mypivots.com/board/topic/6445/1/ymh1-18-feb-stretch-3-1-price-rotations

http://www.mypivots.com/board/topic/6436/1/ymh1-15-16-feb-fib-stretch-4-25-2-618-price-reversals

http://www.mypivots.com/board/topic/6464/1/21-22-feb-fib-stretch-reversals-2-618-4-25

This post is a little 'wordy' but it's significance is the Fibonacci of the Stretc reversals.

http://www.mypivots.com/board/topic/6472/1/23-feb-ymh-stretch-3-1-price-reversals

http://www.mypivots.com/board/topic/6473/1/24-feb-ymh1-stretch-reversals

http://www.mypivots.com/board/topic/6474/1/25-feb-ymh1-stretch-3-1-formula-satisfied

http://www.mypivots.com/board/topic/6482/1/28-feb-ymh1-3-1-stretch-satisfied-parameters

http://www.mypivots.com/board/topic/6485/1/1-mar-ymh1-3-1-faded-2-618-of-stretch

http://www.mypivots.com/board/topic/6502/1/7-mar-ymh1-3-1-basis-stretch-achieved

http://www.mypivots.com/board/topic/6527/1/17-mar-ymm1-3-1-stretch-profitable-reversal-strategy

http://www.mypivots.com/board/topic/6530/1/17-18-mar-ymm-3-1-stretch-strategy-achieved

http://www.mypivots.com/board/topic/6536/1/18-mar-ymm1-4-25-stretch-5-trading-range

http://www.mypivots.com/board/topic/6551/1/23-mar-ymm1-profitable-3-1-stretch-strategy

http://www.mypivots.com/board/topic/6566/1/28-march-a-session-ymm1-profitable-fade-stretch-4x

http://www.mypivots.com/board/topic/6593/1/ymm1-profitable-formula-3-1-basis-stretch

http://www.mypivots.com/board/topic/6603/1/ymm1-profitable-strategy-2-618-stretch-price-reversals

http://www.mypivots.com/board/topic/6615/1/ymm1-profitable-strategy-3-1-fading-1-618-of-stretch

http://www.mypivots.com/board/topic/6625/1/ymm1-3-1-profitable-strategy-stretch-calculation

http://www.mypivots.com/board/topic/6630/1/ymm1-profitable-strategy-fade-1-618-of-stretch

http://www.mypivots.com/board/topic/6626/1/ymm1-3-1-profitable-strategy-1-618-of-stretch

http://www.mypivots.com/board/topic/6650/1/ymm1-3-1-open-short-offset-basis-stretch

http://www.mypivots.com/board/topic/6640/1/ymm1-3-1-profitable-strategy-faded-stretch

http://www.mypivots.com/board/topic/6643/1/ymm1-3-1-profitable-trade-fade-1st-stretch

http://www.mypivots.com/board/topic/6645/1/ymm1-3-1-one-entry-tool-explained

http://www.mypivots.com/board/topic/6647/1/ymm1-3-1-open-short-2300pdt-27-april

http://www.mypivots.com/board/topic/6653/1/ymm1-3-1-profitable-strategy-stretch

http://www.mypivots.com/board/topic/6650/1/ymm1-3-1-open-short-offset-basis-stretch

BruceM,... Again, I'm not intellectually lazy, and have posted trading strategies, with the price reversal points and how they are approximately corrolating with the Stretch and the Fibonacci of the Stretch calculation, as an addition to the trader's tool bag. These have been, are being (tonight's trade has already been offset), and will be applied, again.

SILVERHARP,

YOU GOT IT!!! $-)

YOU GOT IT!!! $-)

Hunter you put your method out there for people to review. Whats with this browbeating?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.