YMM1, (3, -1), profitable strategy, Stretch

Hi,

These past several months I've been posting this intra-day e-mini $5 Dow futures trading strategy in the Traders Lounge; and thought I would post the same in this room, for the purpose of identifying students of the markets who are interested to intra-day trade e-mini $5 Dow futures (YMM1).

Hi,

Trading from the 28 April settlement, 12708, and applying the (3, -1) formula to the Stretch calculation, and the Fibonacci of the Stretch calculations, the following price measurements printed before the end of the B trading session, this Friday afternoon:

28 April settlement = 12708

Stretch = 27

1.618% of the Stretch = 43

2.618% of the Stretch = 70

4.25% of the Stretch = 114 (108 = 29 April high - low = 12796-12688)

Pivot point = 12680 (never printed)

29 April high = 12796

29 April low = 12688

29 April settlment = 12794 + 86

12720- 27= 12700 (fading first intra-day counter trend = -1 of (3, -1)

12708 + 27 + 27 + 27 =12789 completing the trending move 3 of (3, -1)

12720 tested previous day's high (that's with the trend, up).

12720- 27 = 12693 =[12720 - Stretch calculation = 12693] (low=12688).

June e-mini $5 Dow rallied from the low, 12688 to unchanged, 12708, and rallied an additional three Stretch calculations, completing the 3 of (3, -1) formula basis trading the Stretch calculation from unchanged.

12708 opened and tested the 28 April high, 12724 (12:45PDT, which high failed in the last half hour (call it profit taking or ... evening up of positions going into the close.... whatever you want to call it, 12724 reversal trend from the high lower to the settlement, 12708). The 29 April A session soon lifted from 12708 to 12720, testing the previous day's high, 12724, failing 12720, decline to 12688 (28 April low = 12688). (12720 - 27 = 12693) From the low, 12688, prices rallied into the close, 12794 (12796 = high 29 April).

These past several months I've been posting this intra-day e-mini $5 Dow futures trading strategy in the Traders Lounge; and thought I would post the same in this room, for the purpose of identifying students of the markets who are interested to intra-day trade e-mini $5 Dow futures (YMM1).

Hi,

Trading from the 28 April settlement, 12708, and applying the (3, -1) formula to the Stretch calculation, and the Fibonacci of the Stretch calculations, the following price measurements printed before the end of the B trading session, this Friday afternoon:

28 April settlement = 12708

Stretch = 27

1.618% of the Stretch = 43

2.618% of the Stretch = 70

4.25% of the Stretch = 114 (108 = 29 April high - low = 12796-12688)

Pivot point = 12680 (never printed)

29 April high = 12796

29 April low = 12688

29 April settlment = 12794 + 86

12720- 27= 12700 (fading first intra-day counter trend = -1 of (3, -1)

12708 + 27 + 27 + 27 =12789 completing the trending move 3 of (3, -1)

12720 tested previous day's high (that's with the trend, up).

12720- 27 = 12693 =[12720 - Stretch calculation = 12693] (low=12688).

June e-mini $5 Dow rallied from the low, 12688 to unchanged, 12708, and rallied an additional three Stretch calculations, completing the 3 of (3, -1) formula basis trading the Stretch calculation from unchanged.

12708 opened and tested the 28 April high, 12724 (12:45PDT, which high failed in the last half hour (call it profit taking or ... evening up of positions going into the close.... whatever you want to call it, 12724 reversal trend from the high lower to the settlement, 12708). The 29 April A session soon lifted from 12708 to 12720, testing the previous day's high, 12724, failing 12720, decline to 12688 (28 April low = 12688). (12720 - 27 = 12693) From the low, 12688, prices rallied into the close, 12794 (12796 = high 29 April).

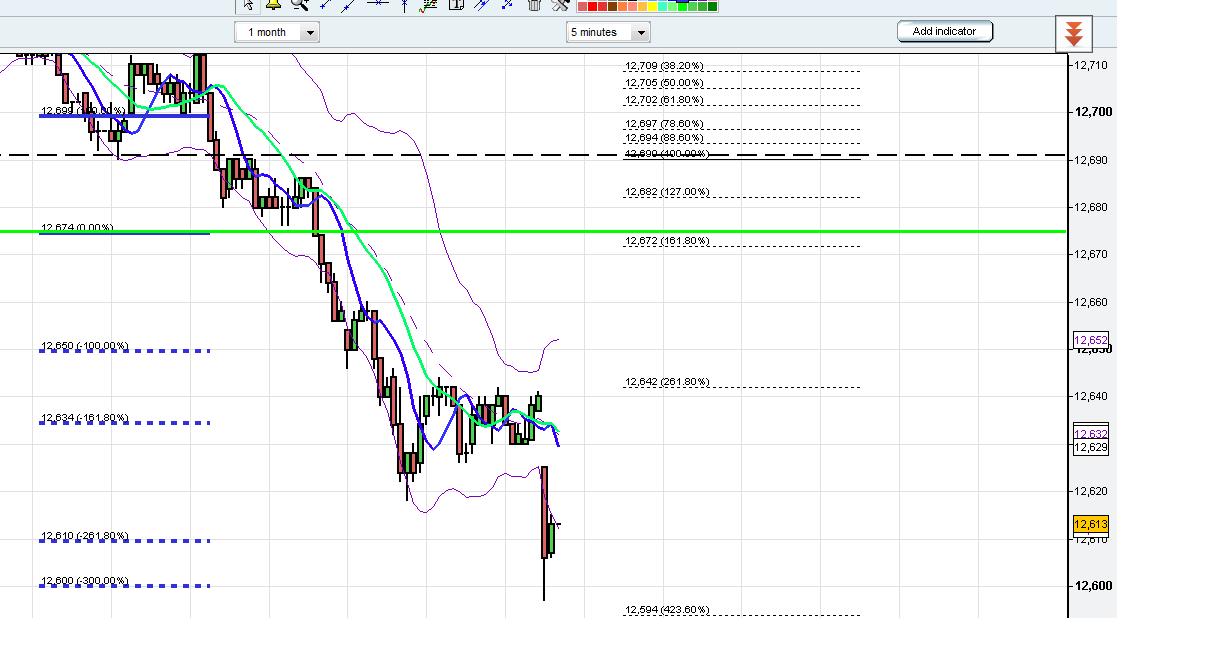

just closed position based on Fib161 , and there was a stretch number near 12640.

open close and profit below

12708 12643 325.00

open close and profit below

12708 12643 325.00

see what happened after , down to lower Stretch and fib target, happy enough with the meat in the middle

Hi,

Oh yee of little faith, those who claim that the (3, -1) is meerly an academic exercise. Seek you corrolating price projections, and exercise that gristle between your ears. Beef is on the menu boys.

Basis YMM1 ... the set up for this short, besides fading the first move at the 1.618% of today's Stretch calcuation (25 x 1.618% = 38) is a short strategy at 63% correction up in a short term down trend. The 63% bounce from the range defined as the decline, 4 May 01:56PDT high at 12777 to the 4 May low print,p 12621 (4 May 09:52) ... measuring 156 points, and bouncing 99 points to 12720 (63%)

Trading from the previous settlement,... 12672 + 38 = 12710 (12672 + 1.618% of today's Stretch calculation = 12710). The 5 May high, so far, = 12720.

12672 + 38 = 12710

12710 - 38 - 38 - 38 = 12606 (current low, 12583 printed at 07:33PDT)

or ...

12672 + 38 = 12710

12672 - 38 - 38 - 38 = 12558 (current low, 12583 printed at 07:33PDT).

The later count trading from unchanged may yet be achieved. The former has been achieved.

Oh yee of little faith, those who claim that the (3, -1) is meerly an academic exercise. Seek you corrolating price projections, and exercise that gristle between your ears. Beef is on the menu boys.

Basis YMM1 ... the set up for this short, besides fading the first move at the 1.618% of today's Stretch calcuation (25 x 1.618% = 38) is a short strategy at 63% correction up in a short term down trend. The 63% bounce from the range defined as the decline, 4 May 01:56PDT high at 12777 to the 4 May low print,p 12621 (4 May 09:52) ... measuring 156 points, and bouncing 99 points to 12720 (63%)

Trading from the previous settlement,... 12672 + 38 = 12710 (12672 + 1.618% of today's Stretch calculation = 12710). The 5 May high, so far, = 12720.

12672 + 38 = 12710

12710 - 38 - 38 - 38 = 12606 (current low, 12583 printed at 07:33PDT)

or ...

12672 + 38 = 12710

12672 - 38 - 38 - 38 = 12558 (current low, 12583 printed at 07:33PDT).

The later count trading from unchanged may yet be achieved. The former has been achieved.

12550 is x3 1.618 of stretch

+10.00 05/05/11 16:09:32 12563 12606 430.00 18097.92

05/05/11 16:42:07 7259824 Trade Receivable WALL STREET - Daily Rolling Future +10.00 05/05/11 16:16:34 12559 12606 470.00

profit highlighted

05/05/11 16:42:07 7259824 Trade Receivable WALL STREET - Daily Rolling Future +10.00 05/05/11 16:16:34 12559 12606 470.00

profit highlighted

Hunter you put your method out there for people to review. Whats with this browbeating?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.