3 Hrs of Analysis on a Post-it-Note

Spent more than 3 hours going through equity charts for overall market components, sectors and lots o' daily/intraday stocks. The final list I distilled down to roughly 10 decent LONG picks, if memory serves, because I stuck the damn post-it in the left pocket of the shorts I just washed (and dried) ... poof - gone. So, went back thru charts for an hour and came up with these potential LONG stock picks for Monday ... as long as the overall market (SP-500) holds up or moves up. Either way, these are some key stocks with upward potential to keep an eye on for a day trade or two coming into Monday and Tuesday. I've got 4 that look good and 3 that I'd put one or two question marks beside ... and watch how things unfold.

LULU

DECK

NFLX

ILMN

(secondary)

FOSL

BIDU

APKT

There were about 3 or 4 others that disappeared into Tide-laden wash inside of a Whirlpool brand evil stock pick killer. The dryer cooked the rest beyond the salvage abilities of packs of scientists that noodled around with the "shroud of ... " Enough of that. Hope this might be helpful to some other crazy hillbillies out there like me!

LULU

DECK

NFLX

ILMN

(secondary)

FOSL

BIDU

APKT

There were about 3 or 4 others that disappeared into Tide-laden wash inside of a Whirlpool brand evil stock pick killer. The dryer cooked the rest beyond the salvage abilities of packs of scientists that noodled around with the "shroud of ... " Enough of that. Hope this might be helpful to some other crazy hillbillies out there like me!

Interested to know your logic/rationale behind NFLX?

MM;

I told a trader, when I want to remember something I call my phone and leave myself a message .. he said "LOL" ... BUT, it works for me .

I told a trader, when I want to remember something I call my phone and leave myself a message .. he said "LOL" ... BUT, it works for me .

Will do the best I can when I get a chance ... am under the weather currently, bleh.

Originally posted by day trading

Interested to know your logic/rationale behind NFLX?

Hey Red ... not a bad idea ... maybe I'll start texting myself. Will have to up the meds to prevent a psychotic break.

Originally posted by redsixspeed

MM;

I told a trader, when I want to remember something I call my phone and leave myself a message .. he said "LOL" ... BUT, it works for me .

If you answer your own message, you may want to talk to Dr. Phil or

Oprah

Oprah

Originally posted by day trading

Interested to know your logic/rationale behind NFLX?

NFLX My best pick of the year. Def a must buy I mean just look at the crazy amount of aggressive marketing this stock pulls off.

I'm looking for long stocks only. I consider "technicals" mostly but also would prefer some good fundamentals behind a pick (earnings growth). For fundamentals, I'll use IBD lists and scans with TC2000 and finviz.com to do the heavy lifting for me. I'm looking for consolidation type patterns or slight pullbacks in what are usually momentum stocks. I also heavily weigh Relative Strength by comparing a stock's daily chart with a chart of the overall market (SP-500). I'm looking at price activity in a stock to hold up better (or pull back less) than the SP in its recent price swings when comparing charts. I especially love a pullback day in the SP and to see a stock that held up well or moved up that same day. I'll then drill down to a multi-day 5-minute chart to again compare price action between the stock and the SP index for the past few days, and especially today. Again, I'm looking for strength in the stock ... higher highs, closes up stronger than SP, doesn't participate in a late day selloff in the SP etc. I'm wanting a stock that's displaying a good chance to have a decent magnitude move up tomorrow or in the next few days. This is often "allowed" by the SP moving up the next day ... or at least not moving down. Anyway, I also have a basic minimum price and minimum avg. volume scan I run on NYSE and NAZ and sort by % gain at the end of the day and scroll through most or all of the charts, visually evaluating them. While I do look at daily volume activity, I don't really give it much weight other than the stock not be too illiquid.

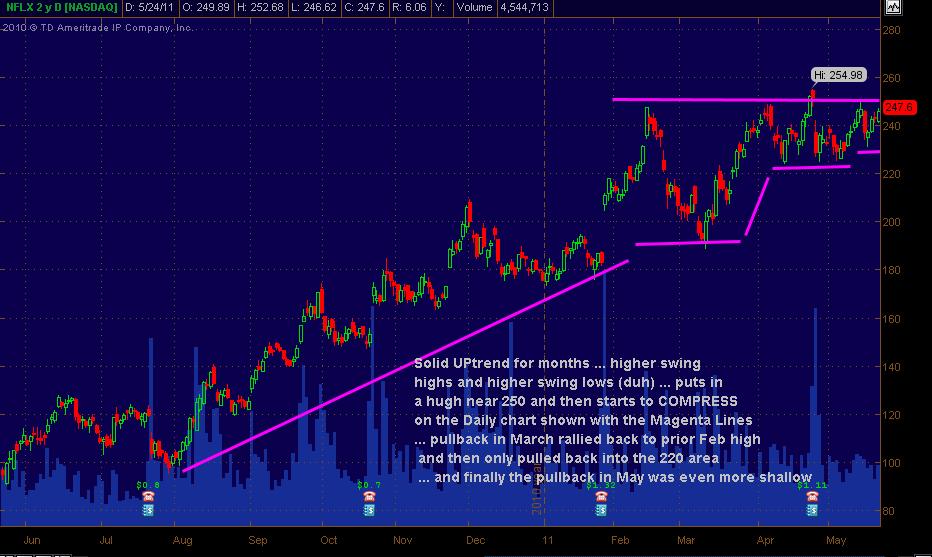

There's really nothing too exotic about it all I guess. But that's the process that brought NFLX up into my "short list." NFLX has been a consistent performer, making new high after new high and screened with good fundamentals. Just overlay a 5-minute chart of the SP (or SPY etc.) with NFLX and look at Thursday and ESPECIALLY Friday's price action. Then go back to its daily chart and see how it had pushes for the past few months up into the $250 area with pullbacks from that zone becoming shallower and shallower ... espec. on 5/16-5/17, creating an overall good looking bullish pattern on its own (also the 50 day sma was holding recent pullbacks - that's a plus too). NFLX had/has some serious buyers that want to pick up more shares. The market (and NFLX) gapped down Monday ... but the market didn't really sell off ... just kind of "held up" where it was. That gave an opportunity for buyers to go ahead and pick up shares of NFLX ... which they obviously did - aggressively too. It's always better if the SP starts a rally too after a gap down. This is a description and I know it'd make more sense and I could point out more specific details of what I was seeing that put it on my "short list" of I put up a chart or two. I'll try to get that posted here too. It just takes time to do it right since there's a lot of info (data points) being processed in the evaluation of any stock at any particular time, and some of it may be even harder to explain since it comes from just doing this for years. There's that subconscious thing at work that also pokes its head up and says "Hey, this 'un looks really good for tomorrow" when I'm flying through the stock charts. Hope this at least partly answers y'all's question as to "why NFLX." Will get some charts up when I can.

There's really nothing too exotic about it all I guess. But that's the process that brought NFLX up into my "short list." NFLX has been a consistent performer, making new high after new high and screened with good fundamentals. Just overlay a 5-minute chart of the SP (or SPY etc.) with NFLX and look at Thursday and ESPECIALLY Friday's price action. Then go back to its daily chart and see how it had pushes for the past few months up into the $250 area with pullbacks from that zone becoming shallower and shallower ... espec. on 5/16-5/17, creating an overall good looking bullish pattern on its own (also the 50 day sma was holding recent pullbacks - that's a plus too). NFLX had/has some serious buyers that want to pick up more shares. The market (and NFLX) gapped down Monday ... but the market didn't really sell off ... just kind of "held up" where it was. That gave an opportunity for buyers to go ahead and pick up shares of NFLX ... which they obviously did - aggressively too. It's always better if the SP starts a rally too after a gap down. This is a description and I know it'd make more sense and I could point out more specific details of what I was seeing that put it on my "short list" of I put up a chart or two. I'll try to get that posted here too. It just takes time to do it right since there's a lot of info (data points) being processed in the evaluation of any stock at any particular time, and some of it may be even harder to explain since it comes from just doing this for years. There's that subconscious thing at work that also pokes its head up and says "Hey, this 'un looks really good for tomorrow" when I'm flying through the stock charts. Hope this at least partly answers y'all's question as to "why NFLX." Will get some charts up when I can.

Here's the best I can do with the charts. Have NFLX and comparing it to the SPY on both a daily and also an intraday 5 minute chart ... annotated and the initial description in the prior 2-paragraph GIANT tome of explanation as best I could provide.

First the Daily charts:

First the Daily charts:

The intraday 5-minute charts for NFLX and the SPY:

Hope I've described this in a way that makes sense and can be understood and replicated by others!! If anyone's interested, I'll interrogate Bruce as to what worked for his video and can really do a full walk-through of everything I'm looking at and how I'll rule out or in stocks that are probably "ready" for a pop long the following session.

Peace Love and Wild Monkey Flips to All!

MM

Hope I've described this in a way that makes sense and can be understood and replicated by others!! If anyone's interested, I'll interrogate Bruce as to what worked for his video and can really do a full walk-through of everything I'm looking at and how I'll rule out or in stocks that are probably "ready" for a pop long the following session.

Peace Love and Wild Monkey Flips to All!

MM

Btw, look at the other long picks in the same way ... on the daily and intraday ... you'll see the same type of price patterns and R/S compared to the SP-500 for most of 'em. And most of the picks, not to forget, also have good fundamentals as described in the big description above. Again, use the the IBD 50 (was IBD 100) and IBD 200 Composite and a few other lists in their paper or online. And you can also create some IBD online screens that are similar ... and do the same with TC2000 ... and www.finviz.com has the same capabilities as well where you can move your mouse across the screened stocks and see the chart and get a good "visual" as to how it looks from a technical analysis and pattern (and R/S) perspective.

And always look to play 'em long if the SP holds up or moves up the next day ... even with a gap down ... that's what happened with NFLX.

The other picks didn't do much ... and NFLX went long trending intraday after the opening whipsawing (typical) ... but NO ... had no idea it'd run as far up as it did. It's about the probability of the patterns and R/S and the unfolding of the ES the following day as to how/when/where a trader might enter a stock pick long ... and also where/how the exit is planned. I'm all about scaling in and out sometimes too.

MM

And always look to play 'em long if the SP holds up or moves up the next day ... even with a gap down ... that's what happened with NFLX.

The other picks didn't do much ... and NFLX went long trending intraday after the opening whipsawing (typical) ... but NO ... had no idea it'd run as far up as it did. It's about the probability of the patterns and R/S and the unfolding of the ES the following day as to how/when/where a trader might enter a stock pick long ... and also where/how the exit is planned. I'm all about scaling in and out sometimes too.

MM

Awesome writeup about NFLX and your strategy MM! Thanks so much for taking the time to do that and do such a thorough job of it. Really appreciated that!

I recently read that 20% of peak time evening internet traffic is being used by NFLX customers:

http://news.cnet.com/8301-13506_3-20020434-17.html

I recently read that 20% of peak time evening internet traffic is being used by NFLX customers:

http://news.cnet.com/8301-13506_3-20020434-17.html

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.