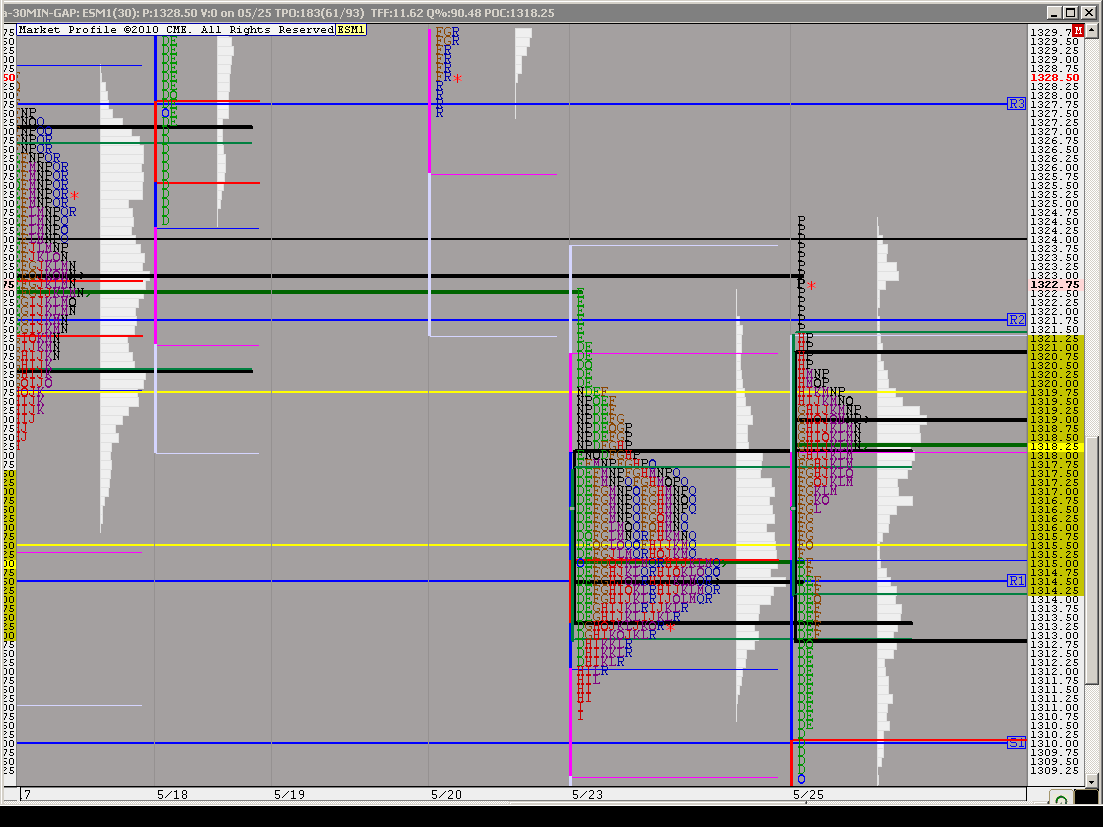

ES Day Trading 5-25-2011

Two vprofiles on this chart. Last weeks and the developing one for this week. Tight range so far this week and the bell curve shaped profile signaling a fight between bulls and bears. Interesting to note VPOC is below last weeks range.

you answered them all...the 18.75 seems pretty obvious now, should have looked at it before deliberately asking lol

once more, thank you

once more, thank you

U r being too hard on yourself....it's all ok...there are plenty of folks who read these forums that don't ask questions and that is ok too...I admire your interest in the work and asking questions is a great thing...pleae keep at it!!

Originally posted by TradeQueen

Note to self...

Rule #1

If I suggest something and the person with the 10+ years "experience" doesn't see it... DON'T QUESTION IT!

In fairness to myself... If I seem argumentative... I'm not intending to be. People outside can hear me screaming... "What am I missing?"

The positive side... What I thought I knew... re: open air... I am now much more clear.

Thanks again for being patient with me Bruce as well as everyone else in the forum.

Trade Queen

Tape reading on fills and volume weakness skills are key component to mastering timing. On the other hand, it could be a redundancy front-end application problem. I can name every data provider every charting solution that partners with them I've read reviews about except for one that filters ticks: Zen Fire.

Tighten that data and you might would have not seen it either.

Tape reading on fills and volume weakness skills are key component to mastering timing. On the other hand, it could be a redundancy front-end application problem. I can name every data provider every charting solution that partners with them I've read reviews about except for one that filters ticks: Zen Fire.

Tighten that data and you might would have not seen it either.

VPOC at 1323 hit

a great example of why post 2 pm trading is so much harder for us faders.......it's that switching of trading hats from fader to trend trader but some days that doesn't happen...too tricky for me...

congrats to those buyers who held...well done indeed..Trade queesn there is "air" at 21.25...much harder this late in the day so just pointing that out in case some are agressive in fading

congrats to those buyers who held...well done indeed..Trade queesn there is "air" at 21.25...much harder this late in the day so just pointing that out in case some are agressive in fading

and 5/18 low

That Island Reversal headfake took kids AND smart money to school.

This is the bear.

This is the bear.

I guess nobody was buying above Lorns OVB !! LOL!

There's divergence in this market. This is a 5 min (daily numbers: 1 SMA, 3 typical SMA, & 8 EMA. The 8's leveling off and the 1 and 3 are trying to drive prices lower. Some heavy chop swings coming down the pike.

Chop I says. 12, 16, 21, 35, 43 I says.

Chop I says. 12, 16, 21, 35, 43 I says.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.