ES 6-8-2011

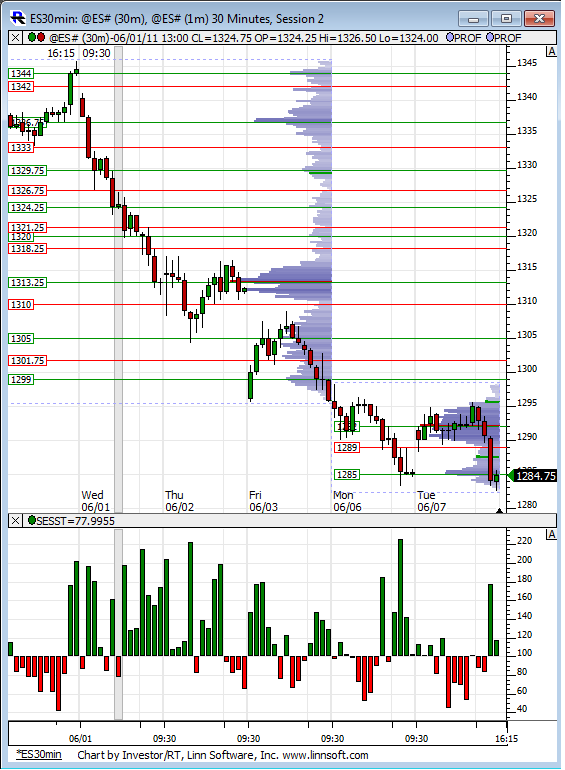

From the perspective of the RTH session only as on this chart, you can see that Monday/Tuesday have been a big consolidation from last weeks down move. Are we seeing a break of the range to the downside here in the O/N? The only clue on this chart is down moves have come on surging volume, up moves on decreasing volume.

Low from 3-23 of 1279 has now been breached and if you look at a daily all session chart there is a gap in the data from the open on 3-18 of 1268.50 to the low on 3-21 of 1274.75.

Low from 3-23 of 1279 has now been breached and if you look at a daily all session chart there is a gap in the data from the open on 3-18 of 1268.50 to the low on 3-21 of 1274.75.

March 23rd LOD is acting like a support. 1279.00

Yes, this will be the big number for today.

Originally posted by johnpr2010

March 23rd LOD is acting like a support. 1279.00

Thanks for citing the unfilled gap, Lorn.

gap up 3-18, partial fill 3-23 still open 1279-1274.25, this was 50% filled in the overnight today.

the 79-70 area is ripe for a rebound. Will it be retested today is my big question. (hope so)

Yesterday RTH L was 82.50, Low from Monday was 83.25, close yesterday 84.75,

I view them as immediate resistance: 82.50 through 84.75

Big round number DJIA 12,000 if tested, big money might run to its defence. (don't ask me why, but the round numbers fascinate players)

gap up 3-18, partial fill 3-23 still open 1279-1274.25, this was 50% filled in the overnight today.

the 79-70 area is ripe for a rebound. Will it be retested today is my big question. (hope so)

Yesterday RTH L was 82.50, Low from Monday was 83.25, close yesterday 84.75,

I view them as immediate resistance: 82.50 through 84.75

Big round number DJIA 12,000 if tested, big money might run to its defence. (don't ask me why, but the round numbers fascinate players)

paul, just one quick correction, yesterday's rth low was 83.25 and not 82.5; 82.5 was printed after 4pm...still i think the resistance area should be the one you mentioned.

Originally posted by PAUL9

Thanks for citing the unfilled gap, Lorn.

gap up 3-18, partial fill 3-23 still open 1279-1274.25, this was 50% filled in the overnight today.

the 79-70 area is ripe for a rebound. Will it be retested today is my big question. (hope so)

Yesterday RTH L was 82.50, Low from Monday was 83.25, close yesterday 84.75,

I view them as immediate resistance: 82.50 through 84.75

Big round number DJIA 12,000 if tested, big money might run to its defence. (don't ask me why, but the round numbers fascinate players)

Thanks, I run a day sheet that prints out prices as of the 4:15 close. Your point is well taken, helps focus the resistance at 83.50 to 84.00 (4:00 Close)

But a shot to the upside early might just be a short-term fakeout

The following I can absolutely guarantee you... I don't know what will happen. LOL

But a shot to the upside early might just be a short-term fakeout

The following I can absolutely guarantee you... I don't know what will happen. LOL

1279.5 hit in O/N (the equidistant move down)

1276.75 the low for me

I'd pay attention to both of these for extension but realize a reversal(even for a correction), possible here.

1291 key level now R

nothing but lower highs and lower lows since my wed note of last week

watching those 2 levels, can we see 1300 again the question here

1276.75 the low for me

I'd pay attention to both of these for extension but realize a reversal(even for a correction), possible here.

1291 key level now R

nothing but lower highs and lower lows since my wed note of last week

watching those 2 levels, can we see 1300 again the question here

would not be surprised if we visit the overnight lows

I'm looking to buy below the minus 2.5 , ideally below 80.....lots of low volume to re-enter up top.....will lean on 76 area if needed...that would be after the report hits

this 15 minute candle just formed is one ugly guy

Originally posted by NickP

i thought the same thing when i looked at my screen after 4.30pm but then i noticed dtn-iq had rolled over to sep; don't know why, jun is still good till tomorrow afternoon, volume wise

My research shows that volume switches to the new contract at 9:30am tomorrow morning:

http://www.mypivots.com/articles/articles.aspx?artnum=10&page=5

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.