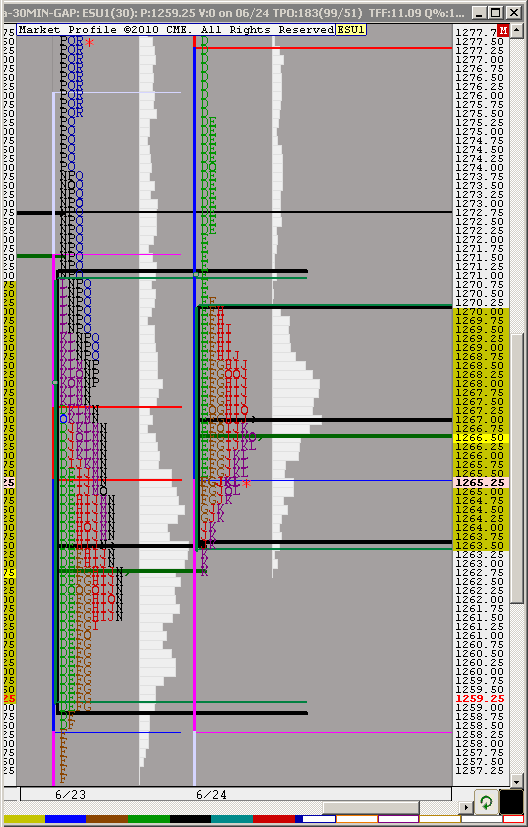

ES Fri 6- 24 -11

key resistance pre 8:30 reports is:

Low volume area from Wednesdays RTH trade at 1284.50

High Volume at 89 - 90

key support will be :

1273.75 - 1275 a low volume area Yesterday and

1266.50 - 1268.50 is the upper part of the "b" pattern yesterday and the aftrenonn lows. Below there we have the 1262.50 which is the peak volume from the bell curve.

lets see if the 8:30 reports change the confirmation of our numbers from the O/N session. So far they have respeceted the numbers generated from the day sessions.

Low volume area from Wednesdays RTH trade at 1284.50

High Volume at 89 - 90

key support will be :

1273.75 - 1275 a low volume area Yesterday and

1266.50 - 1268.50 is the upper part of the "b" pattern yesterday and the aftrenonn lows. Below there we have the 1262.50 which is the peak volume from the bell curve.

lets see if the 8:30 reports change the confirmation of our numbers from the O/N session. So far they have respeceted the numbers generated from the day sessions.

when I try to hold for longer term targets, I try to fiqure out which volume node they will push for. So today I'm thinking that if the low volume node up at the 84 area starts to fail then they will push for the 90 node. On the flip side of that we need to think that if the 68 area starts to give way then they will push for the 62 area.

The third scenario is that they chop it around in between the 92 and the 62 and develop a new high volume node in between those areas.

If we just use a crude idea then we can take the midpoint between the high volume nodes and come up with a POTENTIAL new volume node at the 50% mark in between 90 and 62. So that means that 1276-77 may be the new area where volume may build up.

We can use the open print and the O/N range to help us confirm or negate the directions.

so far the On range is shaping into a bell curve all its own with 80.50 as the peak volume and the center

The third scenario is that they chop it around in between the 92 and the 62 and develop a new high volume node in between those areas.

If we just use a crude idea then we can take the midpoint between the high volume nodes and come up with a POTENTIAL new volume node at the 50% mark in between 90 and 62. So that means that 1276-77 may be the new area where volume may build up.

We can use the open print and the O/N range to help us confirm or negate the directions.

so far the On range is shaping into a bell curve all its own with 80.50 as the peak volume and the center

with the O/N profile symetric my plan is to buy or sell based on the open price and the pitbull numbers using 1280 as the magnet to retrun to. The bggest risk is that they break an O/N range and keep going in that same direction . Without any 10 am reports to inspire the markets I think that risk is small. We also have some nice boundaries as the O/N range has fallen at our key zones.

had to take some off at the 77.75 print as that was pre market entry..and that was near 2.5 points off that low....with a key area at 74 - 75 and the minus 2.5 at 75.75 u had to be trying to buy into that area

if I had add ons at the minus 4 and lower then I would have targeted the opening minute low.....will look again if they run out the O/N lows

starting again at 74.25

not giving us any air to target ...YET !! looking to get initial target of 75.75 ////adding at 72.50

revising first target to 74.75....that is low volume

with an open print of 78.25 you can subtract and see where the key minus 4 - 5.5 zone came in. the purpose of posting my trades today is just to show how I incorporate the pitbull window. U will need to plan your own method if you like it.

secondary targets will be at 75.75 and 77.50 if real lucky...75.75 is 50% back on the current range

secondary targets will be at 75.75 and 77.50 if real lucky...75.75 is 50% back on the current range

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.