ES 6-28-2011

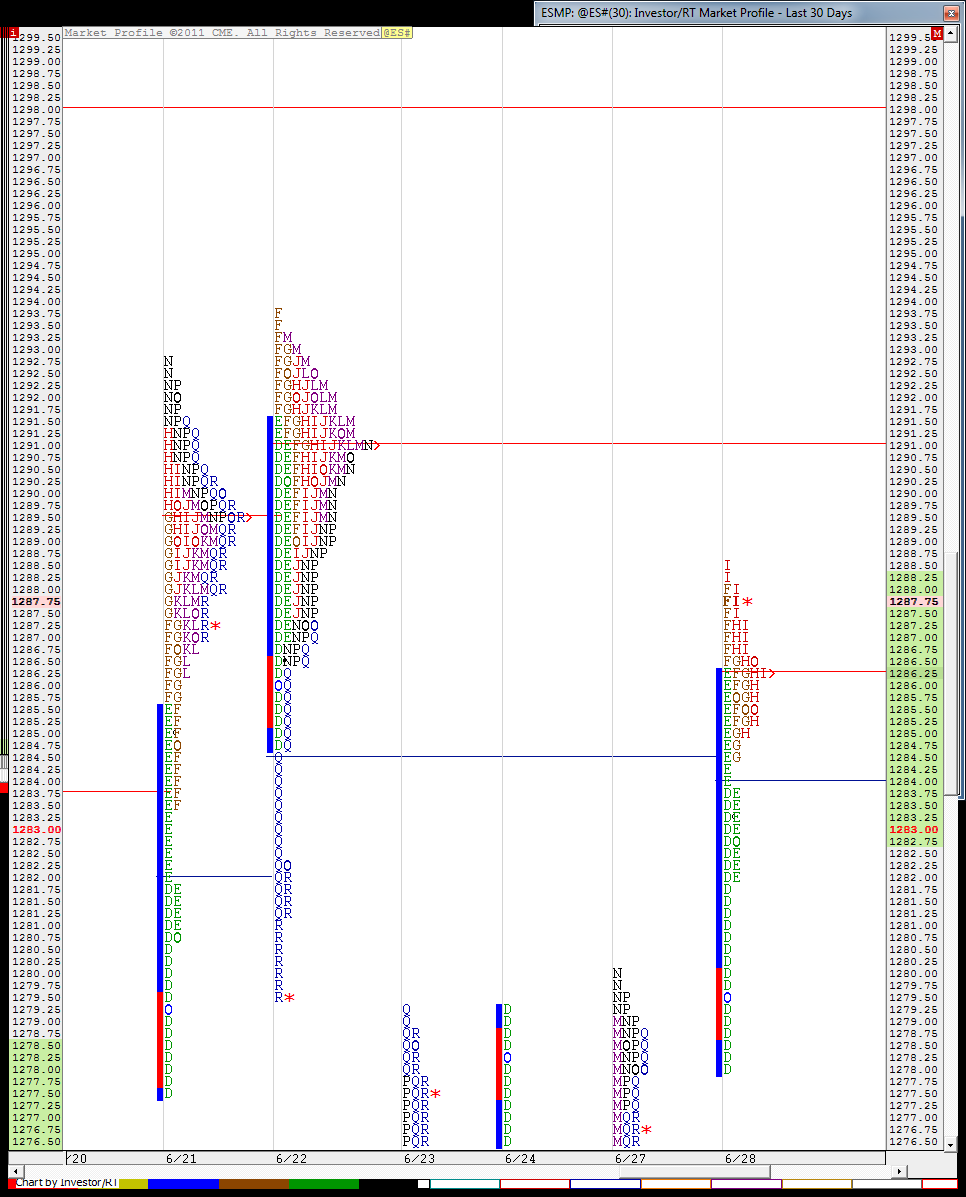

Two charts. O/N Volume Profile and O/N TPO profile. Whats interesting is the two are pretty much opposite looking. Volume entered the market at the lows of the O/N and quickly drove prices north.

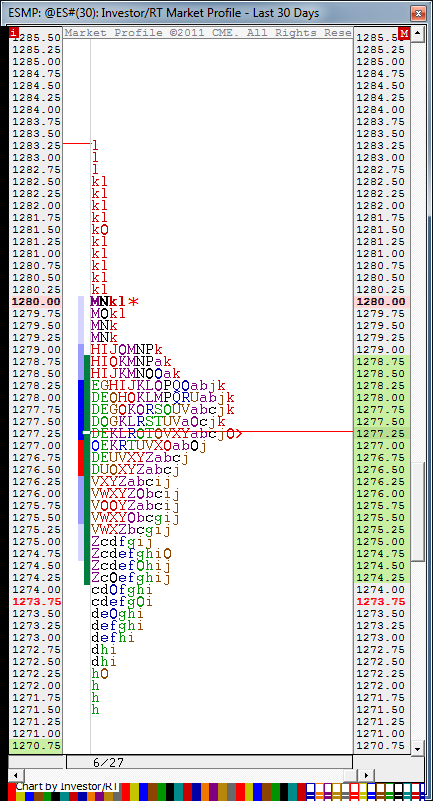

Also, price is currently sitting on YD RTH high of 1280. If opening here, we will be above YD value and above YD range, per Dalton, range potential is unlimited in either direction.

Also, price is currently sitting on YD RTH high of 1280. If opening here, we will be above YD value and above YD range, per Dalton, range potential is unlimited in either direction.

So everyone can see what Bruce is looking at. Singles down in that E period. Interesting though G period found its support on the single from 6-22.

that is the concern Lorn...like yesterday...all low volume became support on Monday...a very cool day to study

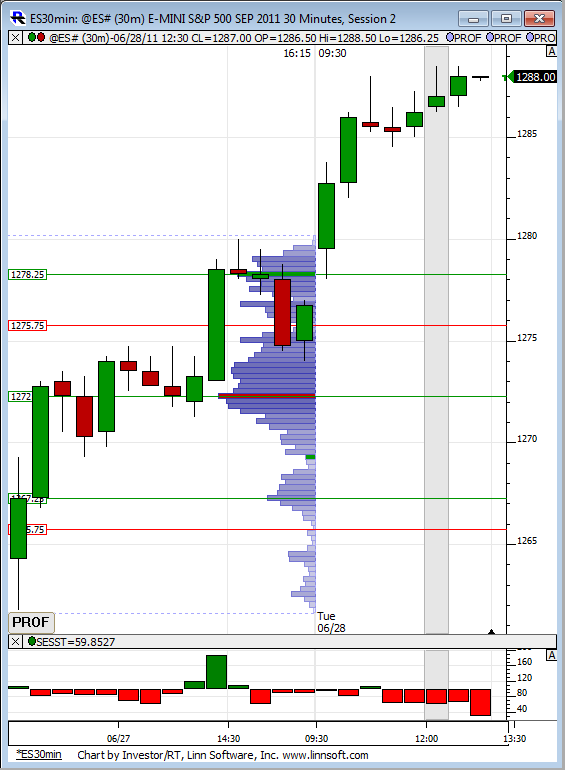

initially I'm trying for 86 which is 50% of this upper distribution

Here is something I find curious...I have a relative strength stat of volume on the bottom pane where it compares the last 200 days to its respective time zone...100 being equal. Look at the rally on WEAK volume...

flat at 87.75..don't like that top...will try again higher

trying on elast time from 88.75...Ticks still diverging

trying for 86.75 first..that is 50% of distribution IF and may be a big if this high holds

thanks for the charts Lorn and LisaP

Ifeel compelled to re-state dsomething I have mentioned in the past...

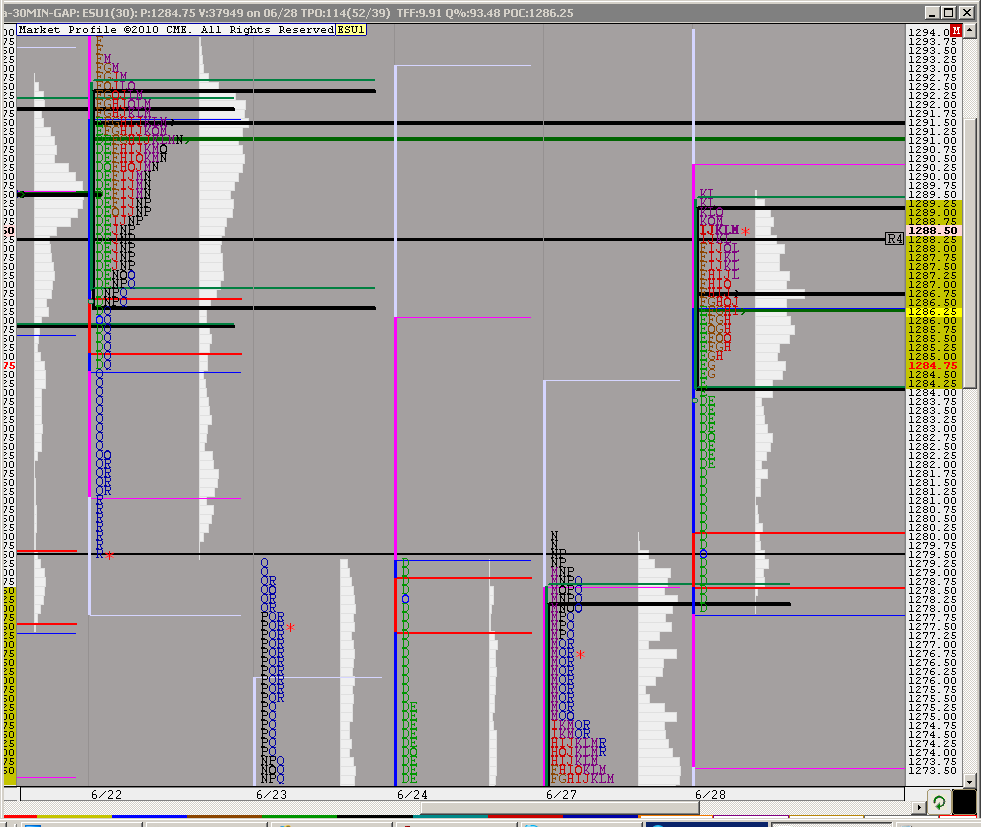

"618 and full extension of Monday's range

"

UP .618 = 1291.25, if it prints before Monday's Close, 8 in 10 odds that full extension of Monday's range will unfold, meaning a print of 1298.25

"

that 1291.25 level. I have a friend who shorts it when it prints, he scalps for 2 points.

the reality is that often, price will back away, retrace. test immediate support before attempting a move to the full extension.

best chances (even though historically it is about 8 in 10) best chances the way I view it is that MOnday's H (1280.00) acts like support.

Even better is if retracement from .618 extension runs only roughly 50% of the distance from the HOD (that prints 91.25) and the H of yesterday,

just based on a print of 91.25, that would be 11.25 diff , half of that is 5.62 subtract that from 91.25 = 85.75

I was in the midst of writing this when the ES prionted the .618 extension.

Ifeel compelled to re-state dsomething I have mentioned in the past...

"618 and full extension of Monday's range

"

UP .618 = 1291.25, if it prints before Monday's Close, 8 in 10 odds that full extension of Monday's range will unfold, meaning a print of 1298.25

"

that 1291.25 level. I have a friend who shorts it when it prints, he scalps for 2 points.

the reality is that often, price will back away, retrace. test immediate support before attempting a move to the full extension.

best chances (even though historically it is about 8 in 10) best chances the way I view it is that MOnday's H (1280.00) acts like support.

Even better is if retracement from .618 extension runs only roughly 50% of the distance from the HOD (that prints 91.25) and the H of yesterday,

just based on a print of 91.25, that would be 11.25 diff , half of that is 5.62 subtract that from 91.25 = 85.75

I was in the midst of writing this when the ES prionted the .618 extension.

Well, we've printed Paul's .618 extension at 91.25 ... thanks for the further detailed description of what to look for Mister.

End of quarter stuff..buying only

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.