ES 7-5-2011

Reference Numbers to start the week.

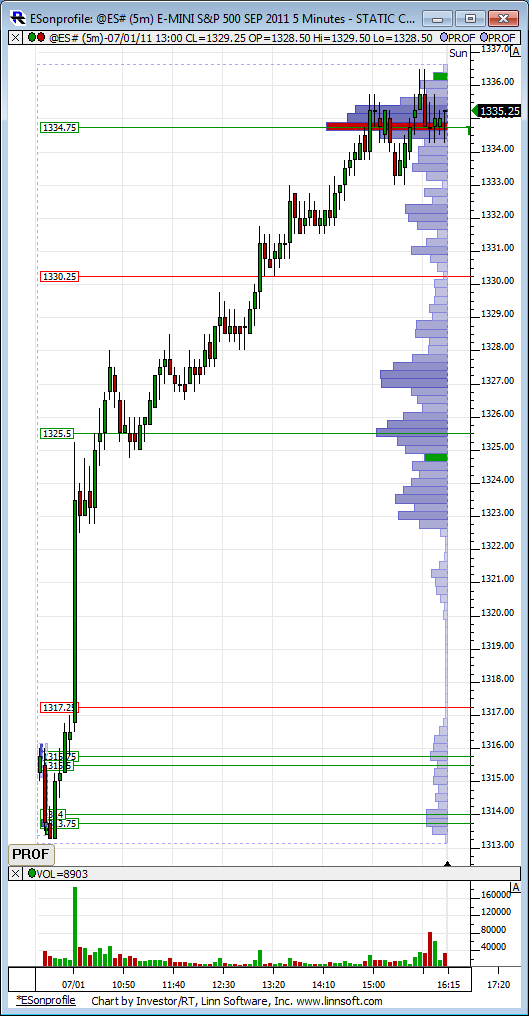

Weekly Close 1335.25 (4:15)

Weekly H/L 1336.5/1257 or 1336.5/1261.75 (RTH)

1339.00 Gap from 6-1

Single Prints 1330 and 1317.25

Currently the O/N MP Profile is showing a three TPO selling tail. Volume is above average so far so it should be interesting to see how RTH handles things.

Weekly Close 1335.25 (4:15)

Weekly H/L 1336.5/1257 or 1336.5/1261.75 (RTH)

1339.00 Gap from 6-1

Single Prints 1330 and 1317.25

Currently the O/N MP Profile is showing a three TPO selling tail. Volume is above average so far so it should be interesting to see how RTH handles things.

Lorn thank you

Originally posted by Lorn

Are you wanting to see the volume laid out in profile style (volume per price) or standard volume per time period?

Originally posted by della

good afternoon Lorn

can you put up a chart from last fri VOL where the VOL was big

standard volume per time period?

Hopefully this is what you are looking for. This is Fridays RTH session with a volume profile and standard volume on the bottom. Interesting contrast between volume views.

Originally posted by della

good afternoon Lorn

can you put up a chart from last fri VOL where the VOL was big

thanks Lorn alot

Thank you Lorn

32.to.27 there eas a drop the if I am seeing it rite

32.to.27 there eas a drop the if I am seeing it rite

tough trading today

(Reuters) - U.S. President Barack Obama will deliver remarks "on the status of efforts to find a balanced approach to deficit reduction" at 4:40 p.m. EDT (2040 GMT) on Tuesday, the White House said.

I was just thinking that... Too much information today(ON MY CHARTS!). Like trying to catch a super ball.

Thanks Lorn, Bruce and Lisa... On the good side... there is some great information put out today... Many many thanks as always.

Thanks Lorn, Bruce and Lisa... On the good side... there is some great information put out today... Many many thanks as always.

Originally posted by Lisa P

tough trading today

Feng, I did a thread on one minute volume spikes. I think Lorn covered all the key points though in his reply. I always look to see if we can get big $ticks on push outs of key ranges also to see if prolonged lower or higher readings prevail. Today we had higher lows in the $tick when we broke that hour low. That helps with the entry.

I began a research project about two months ago with the footprint charts that I look at after the market closes to help refine entries but so far that has been a worthless pursuit. I can't find an edge with that. As you know I add to trades so there is an element of "Gut feel" to some of this. My Market delta software has some cool volume with time functions that I have been messing with. To help show momentum or the lack of momentum.

For now I just take the trade as long as it is in proper context. I'm unafraid to add. Trust me when I tell you that I am working hard to remove the discretionary elements of my trading. Posting ideas to the forum helps me realize how hard it would be to "teach" certain elements of trading as I know it.

Many times you will not get that great mean reversion trade but often you will get the retest back to the 60 and 90 minute highs or lows after they break it out. I will add to trades expecting retest back. So often I am wrong on the first part of the campaign. hope that helps.

I began a research project about two months ago with the footprint charts that I look at after the market closes to help refine entries but so far that has been a worthless pursuit. I can't find an edge with that. As you know I add to trades so there is an element of "Gut feel" to some of this. My Market delta software has some cool volume with time functions that I have been messing with. To help show momentum or the lack of momentum.

For now I just take the trade as long as it is in proper context. I'm unafraid to add. Trust me when I tell you that I am working hard to remove the discretionary elements of my trading. Posting ideas to the forum helps me realize how hard it would be to "teach" certain elements of trading as I know it.

Many times you will not get that great mean reversion trade but often you will get the retest back to the 60 and 90 minute highs or lows after they break it out. I will add to trades expecting retest back. So often I am wrong on the first part of the campaign. hope that helps.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.