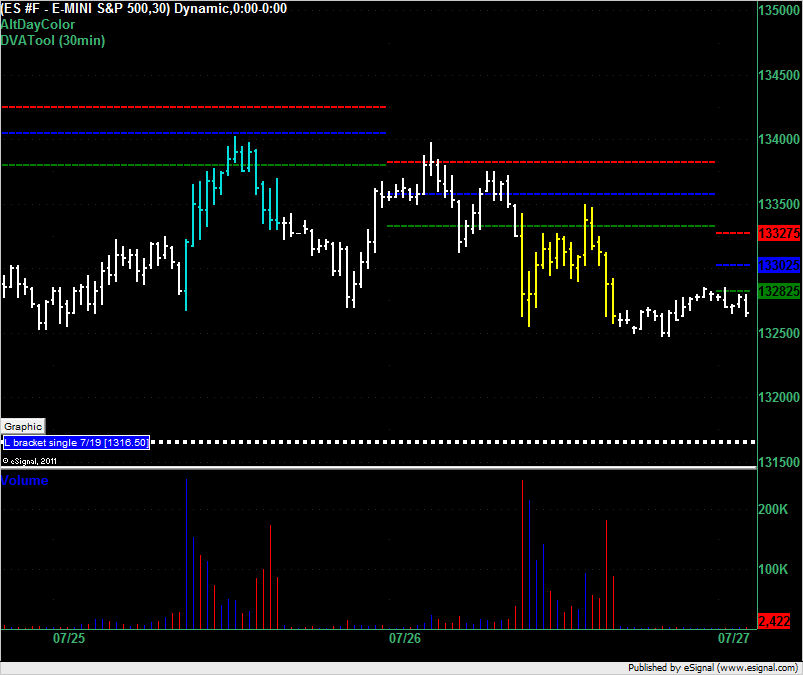

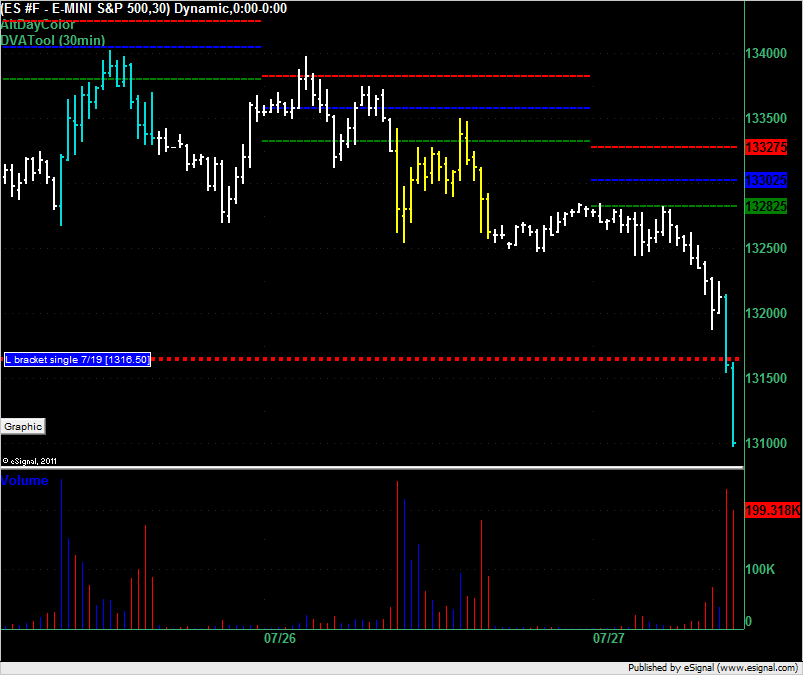

ES Wed 7-27-11

The VAL for the ES for trading on 27-July-2011 is at 1328.25. The overnight price has been hovering around here since this session started (white bars on right). Below us is the single print at 1316.50 from 7/19. Market Profile traders will be looking for longs at 1316.50 if we drop down there and if we open below the VAL will be looking to get short at 1328.25. If we open inside the value area we'll be looking for sideways trading but we have a very tight range of 4.5 points in the VA so we'd expect a breakout of that.

The Daily Notes page:

http://www.mypivots.com/dailynotes/symbol/445/-1/e-mini-sp500-september-2011

shows the average daily range to be between 17.00 and 19.50 points over the last 5 to 120 days so don't expect the price to stay inside the 4.5 point VA if it starts out in there.

The Daily Notes page:

http://www.mypivots.com/dailynotes/symbol/445/-1/e-mini-sp500-september-2011

shows the average daily range to be between 17.00 and 19.50 points over the last 5 to 120 days so don't expect the price to stay inside the 4.5 point VA if it starts out in there.

started new longs at 1311 ..looking to get back to 16 but air is first to be filled...in 15 area......will only add from here on footprint long signals

just a quick note here on printing a full extension down of Monday's range: That's all I got. I have not conducted any studies on reversals from a full extension down.

sorry (it only took me about 25 hours to review all the charts I did to come up with the print 618 down (RTH) will print 1.00 down RTH.

but that's all I was able to figure out. just that it should print, nothing about reversing or going further. sorry.

sorry (it only took me about 25 hours to review all the charts I did to come up with the print 618 down (RTH) will print 1.00 down RTH.

but that's all I was able to figure out. just that it should print, nothing about reversing or going further. sorry.

The Market Profile single print (from L bracket on 7/19) long at 1316.50 is obviously a failed trade and a loser.

trying 1308.25

long

long

geez, dt, I thought every single trade in the MP world worked (kidding, of course)

Unfilled gap below

I posted the unfilled gap numbers earlier

just tagging the upper edge can produce a small bounce.

Unfilled gap below

I posted the unfilled gap numbers earlier

just tagging the upper edge can produce a small bounce.

I wish they did!

Just trying to post the losers and winners to give a balanced view.

trying for +2.5 from 1308.25

1310.25 and 1311.5 above

1307.25 the 50% level between 1311.50 and 1303

1307.25 the 50% level between 1311.50 and 1303

Boehner might be holding a press conference soon. (cnbc notes that microphones are set up, but Boehner walked past them on his first pass

all my add ons are trying to get to low volume at 13.50 but will get out agressively at 12.50 print......I trade for the restests....

"what do others think of that idea?"

sounds fine to me,

in my "old school" view of the markets, right now, markets are weak due to uncertainty about the debt ceiling.

If a headline of resolution comes in, I would disregard taking shorts at 06 or 07 and expect a "buy the news" event. As shorts cover, squeezing other shorts who are slow on the trigger finger.

I would expect a minimum of a 16 print (because last week's RTH only 50% of the weekly range was 1317.25)

Headline of resolution can easily vault prices all the way to Bruce's 23-25.

1325 is weekly pivot point (based on last week's RTH PA)

but this kind of volatile PA can easily create spikes and reversals

sounds fine to me,

in my "old school" view of the markets, right now, markets are weak due to uncertainty about the debt ceiling.

If a headline of resolution comes in, I would disregard taking shorts at 06 or 07 and expect a "buy the news" event. As shorts cover, squeezing other shorts who are slow on the trigger finger.

I would expect a minimum of a 16 print (because last week's RTH only 50% of the weekly range was 1317.25)

Headline of resolution can easily vault prices all the way to Bruce's 23-25.

1325 is weekly pivot point (based on last week's RTH PA)

but this kind of volatile PA can easily create spikes and reversals

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.