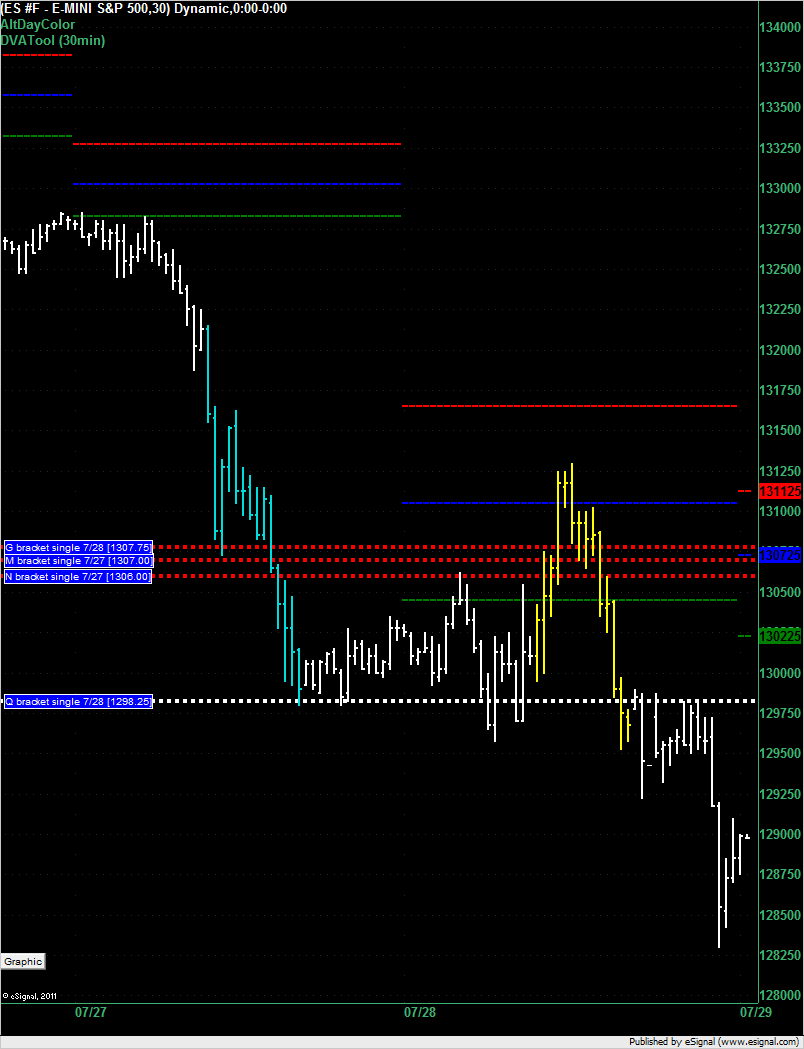

ES Fri 7-29-11

Weak market overnight so far at 12:30am. Given that the single print at 1298.25 provided support (and Wednesday's low) before it became a single print and has subsequently provided resistance since it became a single print I think that this price is a higher probability resistance point going forward.

1278 here we come?

1278.00 is the low of 6/28/11

honestly,

if the current headline generating fiasco in D.C. runs its course similar to other politcal parades of bull$@#!, then it will not be generating any bullish headline for today.

deadlines create headlines and the deadline (at least for current rationalizations) is Tuesday, August 2.

1278.00 is the low of 6/28/11

honestly,

if the current headline generating fiasco in D.C. runs its course similar to other politcal parades of bull$@#!, then it will not be generating any bullish headline for today.

deadlines create headlines and the deadline (at least for current rationalizations) is Tuesday, August 2.

great bounce from 1278.50 LOD.

next battleline is prior week's L (1291.25) and overnight mid pt 1290.50

good trading to all.

next battleline is prior week's L (1291.25) and overnight mid pt 1290.50

good trading to all.

Sub 1291 can keep on running if established as R level-see O/N dance at that line and Wed notes

1286.25 S/R level here

equal move down targets 1272

Reversal only would begin if 1291 and 1293 broken and held

Key levels above those are 1298 and 1303

lower highs and lower lows til broken

1286.25 S/R level here

equal move down targets 1272

Reversal only would begin if 1291 and 1293 broken and held

Key levels above those are 1298 and 1303

lower highs and lower lows til broken

I have old gap (June 27-28)at 1276.75. Anyone has a different number?

76.25 may not matter much today...but stranger things have happened

CNN: rumors are that a vote is possible today... Watching the Senate debate live... it is a circus..

If anyone is trading, INDU closed today's gap

Rep senator: "Reid's proposal does not reduce spending, it reduces the rate of spending." ... lol

1289.50 50%

1292.25 the 38%

1287 the 61.8%

the retrace levels from low to high

1294.50 level to break and hold here to me for higher and use it as absolute s/r level if it does

1291 in there somewhere too

end of month but not sure it matters here to fund managers

1292.25 the 38%

1287 the 61.8%

the retrace levels from low to high

1294.50 level to break and hold here to me for higher and use it as absolute s/r level if it does

1291 in there somewhere too

end of month but not sure it matters here to fund managers

from ZeroHedge...

Summarizing The Negotiations In D.C

Summarizing The Negotiations In D.C

The biggest challenge I have is to make a good entry. I trade Russell Futures and I do not like to have a top more than 2 points which is 200$, preferably lower if I can help it. If you wait for your candlestick confirmation pattern at VAH/VAL or any other support or resistance level you use then by the time the confirmation comes on a 5 minute chart, the trade has already slipped, and the stop becomes greater than 2 points. If on the other hand you pre-place the order then you are hoping your analysis is correct and more importantly precise.

I would appreciate if other traders can share their thoughts on how they neter their trades and where do they place stops(obvious stop points are swing highs and lows...)

Thank you

I would appreciate if other traders can share their thoughts on how they neter their trades and where do they place stops(obvious stop points are swing highs and lows...)

Thank you

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.