ES Thu 8-11-11

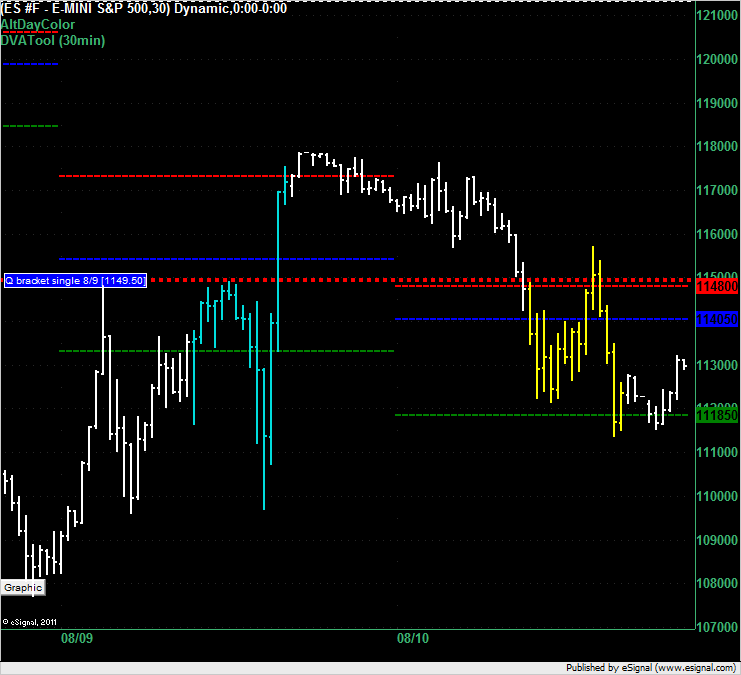

This is the ES at 8:30pm ET on Wednesday. On yesterday's ES topic I called a buy at 1148 or 1148.5 based on the single print and VAH but that call was nullified because we opened in the value area and the Initial Balance (IB) was formed inside the value area.

Market Profile theory looks for a day to be contained inside the value area when the IB is formed inside the value area. The market followed the theory and traded mostly inside in the value area and you will notice that the value area for today's trading is now, as a result, inside the previous day's value area.

Even though the market traded off the value areas it was, in my opinion, a truly scary market to trade off those lines with such fast markets and such a large range.

Have a look at the 5, 10, 20 and 40 day average ranges on this page:

http://www.mypivots.com/dailynotes/symbol/445/-1/e-mini-sp500-september-2011

We don't often see 70+ average ranges over 5 trading days.

Had you shorted the 1148 VAH on Wednesday you would have suffered through a 9 point draw down (or been stopped out) however the VAL target was only 1.5 points above the low of the day so you couldn't have wanted for a better target down there.

Market Profile theory looks for a day to be contained inside the value area when the IB is formed inside the value area. The market followed the theory and traded mostly inside in the value area and you will notice that the value area for today's trading is now, as a result, inside the previous day's value area.

Even though the market traded off the value areas it was, in my opinion, a truly scary market to trade off those lines with such fast markets and such a large range.

Have a look at the 5, 10, 20 and 40 day average ranges on this page:

http://www.mypivots.com/dailynotes/symbol/445/-1/e-mini-sp500-september-2011

We don't often see 70+ average ranges over 5 trading days.

Had you shorted the 1148 VAH on Wednesday you would have suffered through a 9 point draw down (or been stopped out) however the VAL target was only 1.5 points above the low of the day so you couldn't have wanted for a better target down there.

I didn't get a signal off the 58 area to go for the air pocket at 55.....I did get one just under 65 to go for that air that was created on the flush up......

typing fast ..let me know if that clears it up

typing fast ..let me know if that clears it up

65 was an area of Low volume from Tuesdays/wednesdays morning Overnight session !!

sorry, i meant why not target 55 (from 65) as that was the lvn created on the start of the move up

i did not have/see 58 as another low volume area, that is why i had nothing in between 65 and 55

i did not have/see 58 as another low volume area, that is why i had nothing in between 65 and 55

Originally posted by BruceM

I didn't get a signal off the 58 area to go for the air pocket at 55.....I did get one just under 65 to go for that air that was created on the flush up......

typing fast ..let me know if that clears it up

for those who haven't grabbed onto the histogram work you can use pervious days highs and lows and the Value area high and low....

think about it, if the Value area defines 70 % of the volume then being OUTSIDE those lines is the other 30% of volume.......so 15% above and 15 % below......so that automatically defines low volume... I still prefer the low areas as per the histogram

think about it, if the Value area defines 70 % of the volume then being OUTSIDE those lines is the other 30% of volume.......so 15% above and 15 % below......so that automatically defines low volume... I still prefer the low areas as per the histogram

and by signal you mean one of the first two items you described earlier today along with some air to play with below?

are you still factoring in cum delta dvg to jump into trades? i was looking up at 65 and there was none

are you still factoring in cum delta dvg to jump into trades? i was looking up at 65 and there was none

Originally posted by BruceM

I didn't get a signal off the 58 area to go for the air pocket at 55.....I did get one just under 65 to go for that air that was created on the flush up......

typing fast ..let me know if that clears it up

thanks

Originally posted by NickP

sorry, i meant why not target 55 (from 65) as that was the lvn created on the start of the move up

i did not have/see 58 as another low volume area, that is why i had nothing in between 65 and 55

Originally posted by BruceM

I didn't get a signal off the 58 area to go for the air pocket at 55.....I did get one just under 65 to go for that air that was created on the flush up......

typing fast ..let me know if that clears it up

we had wednesdays high in the way and I thought that might be support and a better area to target..best to get out early just in case..runners could have gone for that 55 though Nick....I'm trading smaller so I'm coming out faster than usual and a bit lighter.

Originally posted by NickP

sorry, i meant why not target 55 (from 65) as that was the lvn created on the start of the move up

i did not have/see 58 as another low volume area, that is why i had nothing in between 65 and 55

Originally posted by BruceM

I didn't get a signal off the 58 area to go for the air pocket at 55.....I did get one just under 65 to go for that air that was created on the flush up......

typing fast ..let me know if that clears it up

a signal Nick is my renko and delta/volume work...hopefully will get to post some later...

FYI .. I have the key support bell curve at

1155 and 1140 and 1148 as the center....for those looking to draw their own....

FYI .. I have the key support bell curve at

1155 and 1140 and 1148 as the center....for those looking to draw their own....

so I would look to get below the low volume of 1155 and then get a signal for the retest back up from under neath it...

I would also look for a signal once i see 55 print...

I won't buy into the high volume of the 48 node

why trade in a place where buyers and sellers agree on price ? That is what the POC represents and I spent many years trying to master that....no thank you anymore....

I would also look for a signal once i see 55 print...

I won't buy into the high volume of the 48 node

why trade in a place where buyers and sellers agree on price ? That is what the POC represents and I spent many years trying to master that....no thank you anymore....

I use cum delta but not just for divergences...I like the pure flips in regular delta at key prices...

80 is my last key number.....too late for me though

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.