ES Monday 10-3-11

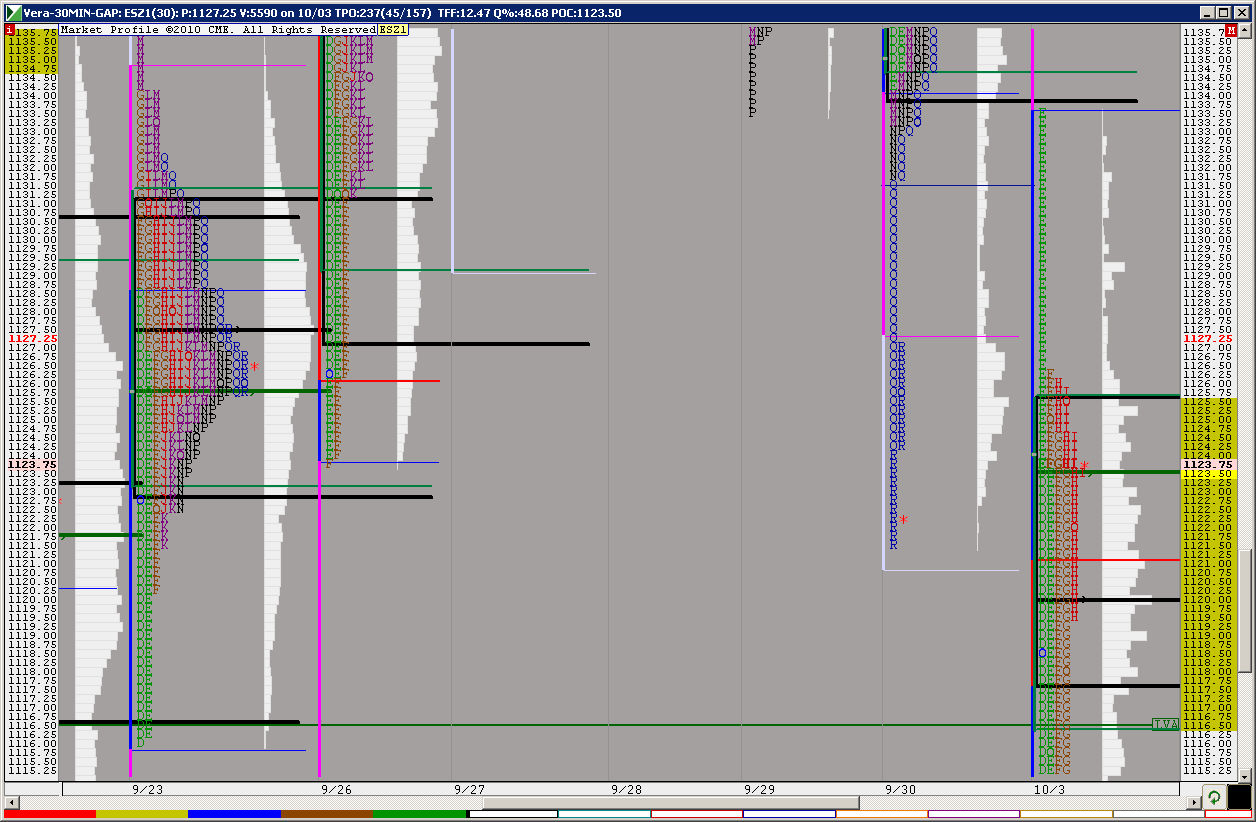

Here is how I have Fridays chart marked off...I have it on the one minute so some can see the price action at these points. A few things to keep in mind:

1) On friday the 47 - 48 low volume zone from Thursday held prices down. So even though I only have the 45.50 - 46 area marked off we still need to be aware of that entire zone from 45,50 - 48.75 as it is all really low volume.

2)Even though I have the 29.25 - 30.25 marked off we really have low volume up to 32.50 and then the histogram starts getting wider and volume starts to buldge

The traditional Market profile has the VA low at 35 and our secondary high volume number is 36.50 so that will be a point that I will not trade from due to that high volume.

The Va high comes in at 45 and we begin our low volume zone there so that will be a good number to trade from. The ideal trade up there would see them push through the 45 low volume zone and then find a short that will attempt to come back to fill in not only the 45 but come back down to the high volume magnet near 1143...!! Again using the high volume as targets instead of entry points.

Will forumulate a better trading plan once we see how the overnight does.

1) On friday the 47 - 48 low volume zone from Thursday held prices down. So even though I only have the 45.50 - 46 area marked off we still need to be aware of that entire zone from 45,50 - 48.75 as it is all really low volume.

2)Even though I have the 29.25 - 30.25 marked off we really have low volume up to 32.50 and then the histogram starts getting wider and volume starts to buldge

The traditional Market profile has the VA low at 35 and our secondary high volume number is 36.50 so that will be a point that I will not trade from due to that high volume.

The Va high comes in at 45 and we begin our low volume zone there so that will be a good number to trade from. The ideal trade up there would see them push through the 45 low volume zone and then find a short that will attempt to come back to fill in not only the 45 but come back down to the high volume magnet near 1143...!! Again using the high volume as targets instead of entry points.

Will forumulate a better trading plan once we see how the overnight does.

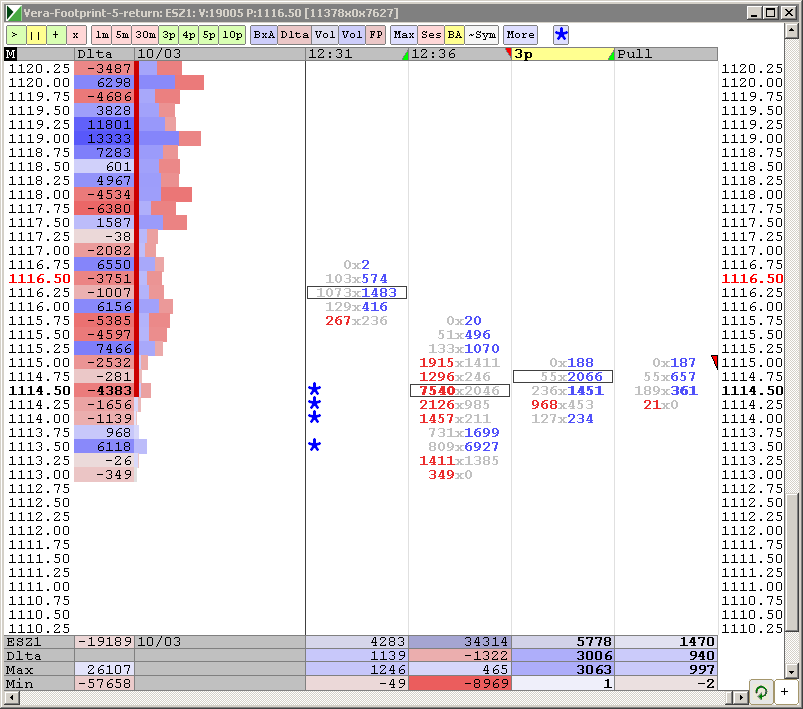

That is a damn strange looking formation on the lows as per 30 minute bars..peak volume sits at 1120...I will be real surprised if the new lows don't come...completely fooled is more like it !!

bruce i was looking at that before 19.00 and 20.00 thats the highest vol

glad u saw it Richard...sure is tricky after the first 90 minutes...much easier to trade areas that have developed from previous days then from the current days development...it is not often you see a ledge like we have down at 1115 area actually hold in the S&P....

that will keep me off any long set ups..seems like they wantto create a new bell curve with the 24 at the highs, the 1115 lows and the peak volume of 1120 right smack in the middle...so failure to push up will come back to the 20 first

that will keep me off any long set ups..seems like they wantto create a new bell curve with the 24 at the highs, the 1115 lows and the peak volume of 1120 right smack in the middle...so failure to push up will come back to the 20 first

I only have vol for today on my matrics with tradestation I have tpo from days back but I see what you mean

Thanks lisa big time

Will follow up on the 60 minute chart tonight.

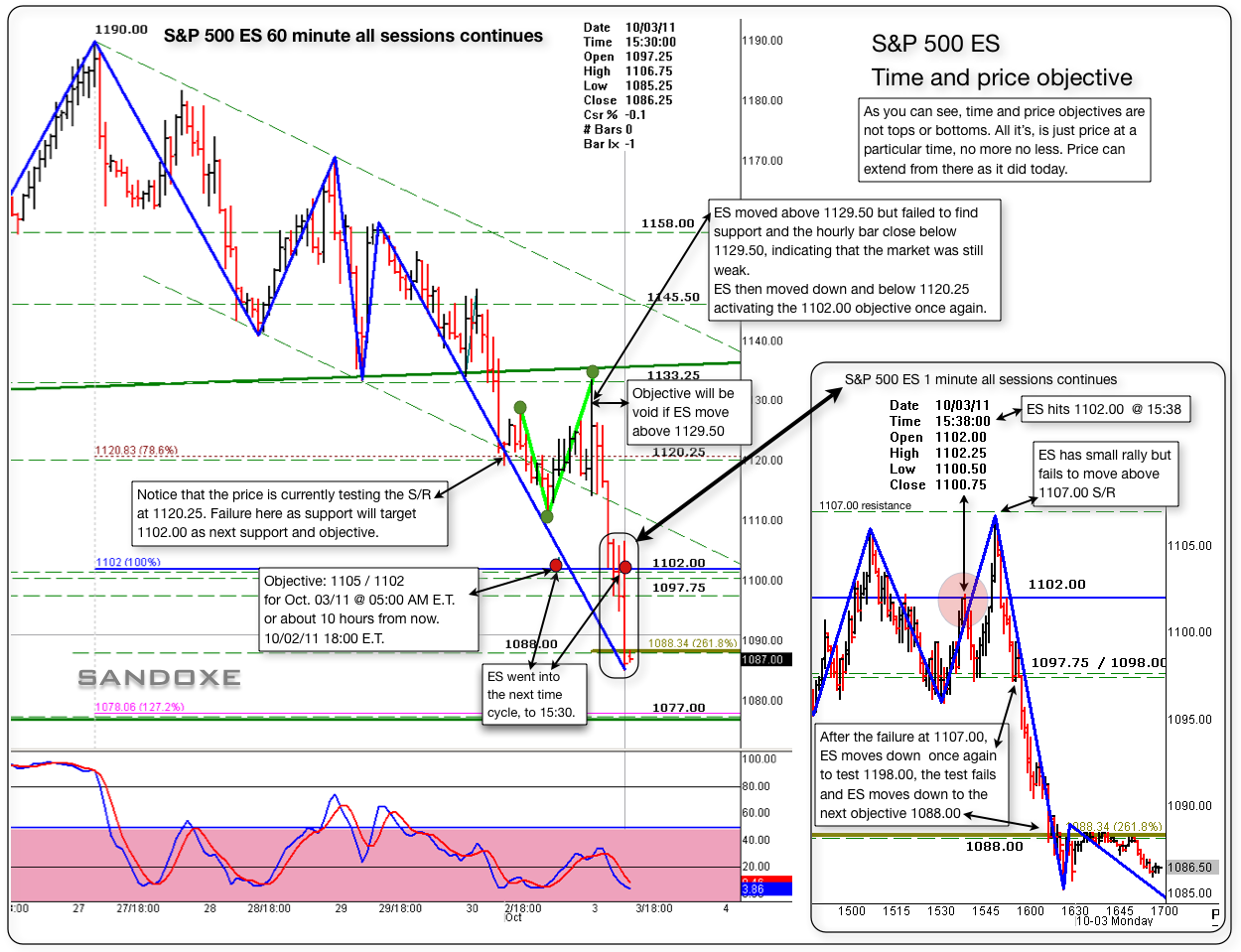

Interesting moves today. Is like it's fighting to move above 1120 but fails to do so. The pivot to change the down trend, is at 1129.50 (short term). Other than that? 1102.00 here we come, soon or latter. -- The price has all the time in the world to make it there. Next cycle time to 1102.00 is at 15:30 E.T.

ES now trading 1115.00 @ 12:33 E.T.

Will see, in due time the market will show us the way.

Interesting moves today. Is like it's fighting to move above 1120 but fails to do so. The pivot to change the down trend, is at 1129.50 (short term). Other than that? 1102.00 here we come, soon or latter. -- The price has all the time in the world to make it there. Next cycle time to 1102.00 is at 15:30 E.T.

ES now trading 1115.00 @ 12:33 E.T.

Will see, in due time the market will show us the way.

Originally posted by sandoxe

Here's a 60 minute chart with the objective for tomorrow AM.

Looks like a long shot, but what do I know?

Will see. The market always has the last word and in due time will show us the way.

I see for you the same I see for my self: Having the best of luck, fun, and awesome profitable trading day!!

Watching protests on Wall Street. They should protest across Securities Commission or the Fed. Nothing has been fixed from 2008

no one is in jail, except Madoff

Here's the 60 minute follow up chart. The chart is self explanatory, showing how I used and see s/rs.

The time and price objectives shown in this chart is about the same as the previous time and price chart posted some time ago, where the price hits the objective before the time and moves lower, but, returns to the price objective at or near the time cycle.

I hope this charts help in some way.

The time and price objectives shown in this chart is about the same as the previous time and price chart posted some time ago, where the price hits the objective before the time and moves lower, but, returns to the price objective at or near the time cycle.

I hope this charts help in some way.

Originally posted by sandoxe

ES moved down to 1098 s/r and found support. I think for the rest of the session the ES will try to base here between 1102/1098 then late session or tomorrow AM a small rally.

bellow 1098 will open the door for 1088. --

Gals and guys I'm using the numbers as reference, don't get stack on my words. Go by what you see in your charts. If you find that some of your s/rs and M/P model is congruent with some of the numbers posted by other people, maybe you got something to work from, a potential trade may unfold from that area.

Originally posted by sandoxe

ES hit 1102.50 objective at 13:18. Now some bouncing and testing, Notice that the price did zig-zag a bit in the 1107/8 area. (seeing in the 1M chart) That area is now a small s/r. I think MM had that S/R too.

Below 1102 will target 1088.00 with some support at 1098.00 s/r.

Will see what happens between now and closing.

ES now trading 1104.00 @ 13:26

Originally posted by sandoxe

Will follow up on the 60 minute chart tonight.

Interesting moves today. Is like it's fighting to move above 1120 but fails to do so. The pivot to change the down trend, is at 1129.50 (short term). Other than that? 1102.00 here we come, soon or latter. -- The price has all the time in the world to make it there. Next cycle time to 1102.00 is at 15:30 E.T.

ES now trading 1115.00 @ 12:33 E.T.

Will see, in due time the market will show us the way.

Originally posted by sandoxe

Here's a 60 minute chart with the objective for tomorrow AM.

Looks like a long shot, but what do I know?

Will see. The market always has the last word and in due time will show us the way.

I see for you the same I see for my self: Having the best of luck, fun, and awesome profitable trading day!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.