ES Wednesday 10-5-11

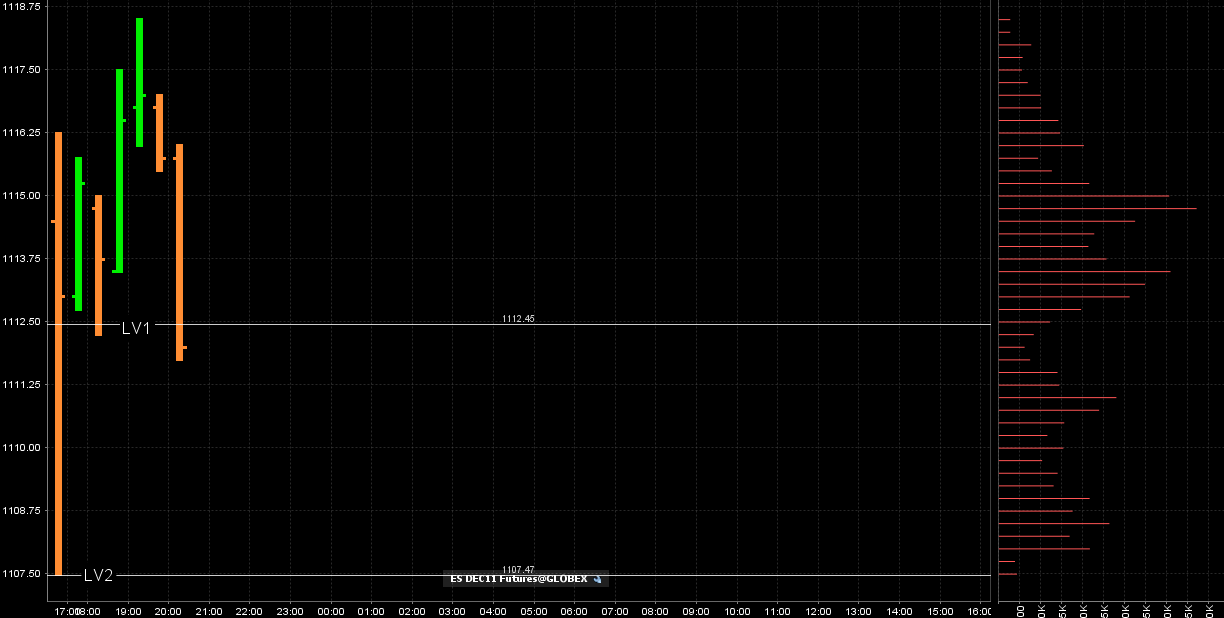

Very interesting finish today which hopefuly will helps us expand our knowledge of the bell curves. At the end of today we blew right through the high volume node of 1102.75 and then preceeded to blow through the low volume nodes ( LV1 and LV2 zones from yesterdays chart) that comprised the 1107.5- 1112.50 area. The market then stoped at our high volume area of 1120.

The rules as I have stated them say that we will come back to test LOW volume and that is why I choose to be more agressive in the low volume zones. They donot state that we will retest high volume and that is why I donot trade at those areas for retests once broken. Like all trading methods this has it's losses and trading at the end of the day is more prone to trend then in the morning. So if you were trading this afternoon it would have been most challenging but here is the interesting part. As soon as the Overnight opened the market dropped like a rock to come back down to test all the way down to our 1107.50 and retest the entire zone...like it should.

here is how the overnight looks as I type...the point of all this babble is that we can count on Low volume being tested but not so much the high volume nodes once broken.

The rules as I have stated them say that we will come back to test LOW volume and that is why I choose to be more agressive in the low volume zones. They donot state that we will retest high volume and that is why I donot trade at those areas for retests once broken. Like all trading methods this has it's losses and trading at the end of the day is more prone to trend then in the morning. So if you were trading this afternoon it would have been most challenging but here is the interesting part. As soon as the Overnight opened the market dropped like a rock to come back down to test all the way down to our 1107.50 and retest the entire zone...like it should.

here is how the overnight looks as I type...the point of all this babble is that we can count on Low volume being tested but not so much the high volume nodes once broken.

Bren.T. S/Rs are calculated mathematically from previous 3 days S/R levels, they are similar to the regular pivots but a bit more sophisticated to calculate.

Originally posted by brent.t

sandoxe, how do you calculate these S/R levels?

i would like to thank everyone for sharing how they see the market.i think i have finally put the cherry on the cake.

have a goood night

duck

have a goood night

duck

I also would like to thank all of the input here again today, it is a real credit that you share your knowledge and to watch your trades in 'real' time is the icing on the cake.

Cheers

Tony

Cheers

Tony

Here's a 3 minute follow up chart for the examples posted today.

Notice how the S/Rs with any value will have a Fibonacci extension or retrace. Notice in the chart how the price reacts in those areas.

S/Rs could be pivots, or previous day H/L Weekly H/L an so on. Just be careful no to have so many lines in the chart. It's only few lines that work. The rest is noise.

Anyhow, I hope this helps in some way!

Notice how the S/Rs with any value will have a Fibonacci extension or retrace. Notice in the chart how the price reacts in those areas.

S/Rs could be pivots, or previous day H/L Weekly H/L an so on. Just be careful no to have so many lines in the chart. It's only few lines that work. The rest is noise.

Anyhow, I hope this helps in some way!

Originally posted by sandoxe

ES hit my stop 1137.00. + 3pts It was fun.

ES now trading 1137.00 @ 15:48

Originally posted by sandoxe

Here's a 3 minute follow up chart for the examples posted today.

Notice how the S/Rs with any value will have a Fibonacci extension or retrace. Notice in the chart how the price reacts in those areas.

S/Rs could be pivots, or previous day H/L Weekly H/L an so on. Just be careful no to have so many lines in the chart. It's only few lines that work. The rest is noise.

Anyhow, I hope this helps in some way!

Originally posted by sandoxe

ES hit my stop 1137.00. + 3pts It was fun.

ES now trading 1137.00 @ 15:48

I go away on mini vacation and see nice charts by you. Thx for sharing them with notes.

YW Destiny. I'm glad you like it.

I almost did not post the chart, bc after I was done making it, I was looking at it and said: OMG!!! Is this the best I can do? This is embarrassing!!! --All this people are going to see this... said my ego--

Wow, look what I missed here, and I could have done much better over here, OMG!!! Looky there, I could have taking much more money......but, when you are in the middle of the battle you do the best you can and hopefully come out ahead of the game!

Making your own charts with your own trading is really an eye opener.

I almost did not post the chart, bc after I was done making it, I was looking at it and said: OMG!!! Is this the best I can do? This is embarrassing!!! --All this people are going to see this... said my ego--

Wow, look what I missed here, and I could have done much better over here, OMG!!! Looky there, I could have taking much more money......but, when you are in the middle of the battle you do the best you can and hopefully come out ahead of the game!

Making your own charts with your own trading is really an eye opener.

Originally posted by destiny

I go away on mini vacation and see nice charts by you. Thx for sharing them with notes.

Originally posted by sandoxe

Here's a 3 minute follow up chart for the examples posted today.

Notice how the S/Rs with any value will have a Fibonacci extension or retrace. Notice in the chart how the price reacts in those areas.

S/Rs could be pivots, or previous day H/L Weekly H/L an so on. Just be careful no to have so many lines in the chart. It's only few lines that work. The rest is noise.

Anyhow, I hope this helps in some way!

Originally posted by sandoxe

ES hit my stop 1137.00. + 3pts It was fun.

ES now trading 1137.00 @ 15:48

Thanks sandoxe, where would i find the formula to calculate these S/R levels??

can you explicity mention what swings you are using (like swing high and low) to come up with the fibonacci extensions...it is not really clear from your chart what is it that you are using thanks

Originally posted by sandoxe

YW Destiny. I'm glad you like it.

I almost did not post the chart, bc after I was done making it, I was looking at it and said: OMG!!! Is this the best I can do? This is embarrassing!!! --All this people are going to see this... said my ego--

Wow, look what I missed here, and I could have done much better over here, OMG!!! Looky there, I could have taking much more money......but, when you are in the middle of the battle you do the best you can and hopefully come out ahead of the game!

Making your own charts with your own trading is really an eye opener.

Originally posted by destiny

I go away on mini vacation and see nice charts by you. Thx for sharing them with notes.

Originally posted by sandoxe

Here's a 3 minute follow up chart for the examples posted today.

Notice how the S/Rs with any value will have a Fibonacci extension or retrace. Notice in the chart how the price reacts in those areas.

S/Rs could be pivots, or previous day H/L Weekly H/L an so on. Just be careful no to have so many lines in the chart. It's only few lines that work. The rest is noise.

Anyhow, I hope this helps in some way!

Originally posted by sandoxe

ES hit my stop 1137.00. + 3pts It was fun.

ES now trading 1137.00 @ 15:48

Brent.T. The formula is proprietary, no available to the public.

Originally posted by brent.t

Thanks sandoxe, where would i find the formula to calculate these S/R levels??

Thanks Sandoxe, I missed your reply & just found it when researching the posts, what formula would I use to calculate these previous 3 days S/R levels?

regards Brent.T

regards Brent.T

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.