ES Monday 10-17-11

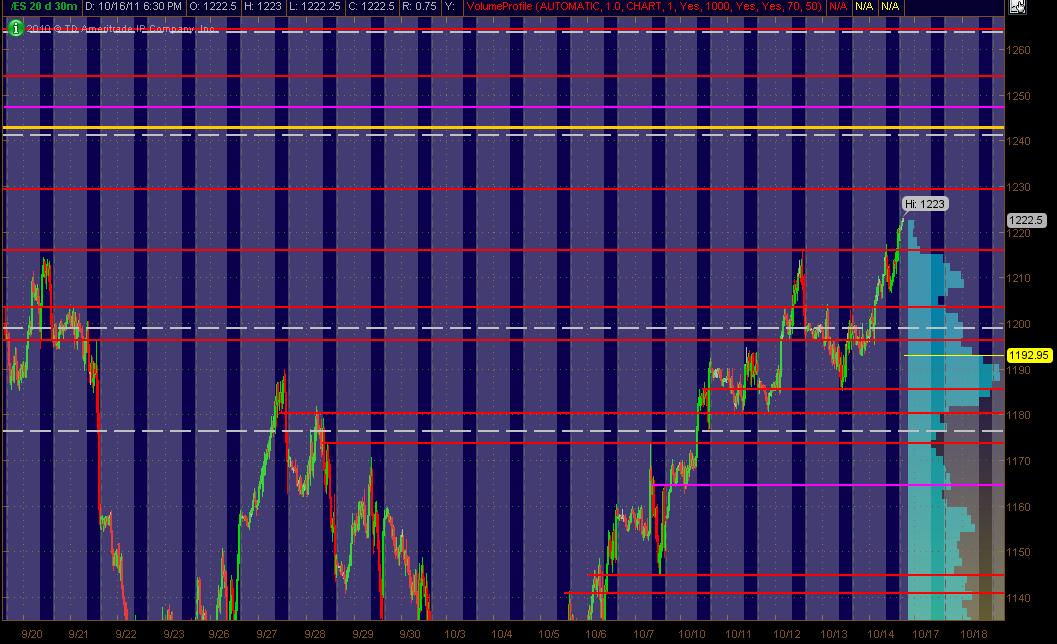

Here's what I've got in the way of a MAP for the ES coming into Monday's trading and the week. The Red Lines are potential significant PASR levels with any Magenta Lines as "semi" significant levels. White Dashed Lines are Wkly Pivots as per mypivots site. The Yellow line above the current market is a significant Fib Cluster fwiw.

The right vertical lighter Blue reflects 20 days of All Trading Hours Volume Profile. The Grayed out background is the non-RTH price activity. Hope this his helpful for some ... especially when incorporated with shorter term Volume Profile of the past 1 to several days ... looking at bell curves and more importantly, the High Volume Areas ... and the Low Volume Areas.

The right vertical lighter Blue reflects 20 days of All Trading Hours Volume Profile. The Grayed out background is the non-RTH price activity. Hope this his helpful for some ... especially when incorporated with shorter term Volume Profile of the past 1 to several days ... looking at bell curves and more importantly, the High Volume Areas ... and the Low Volume Areas.

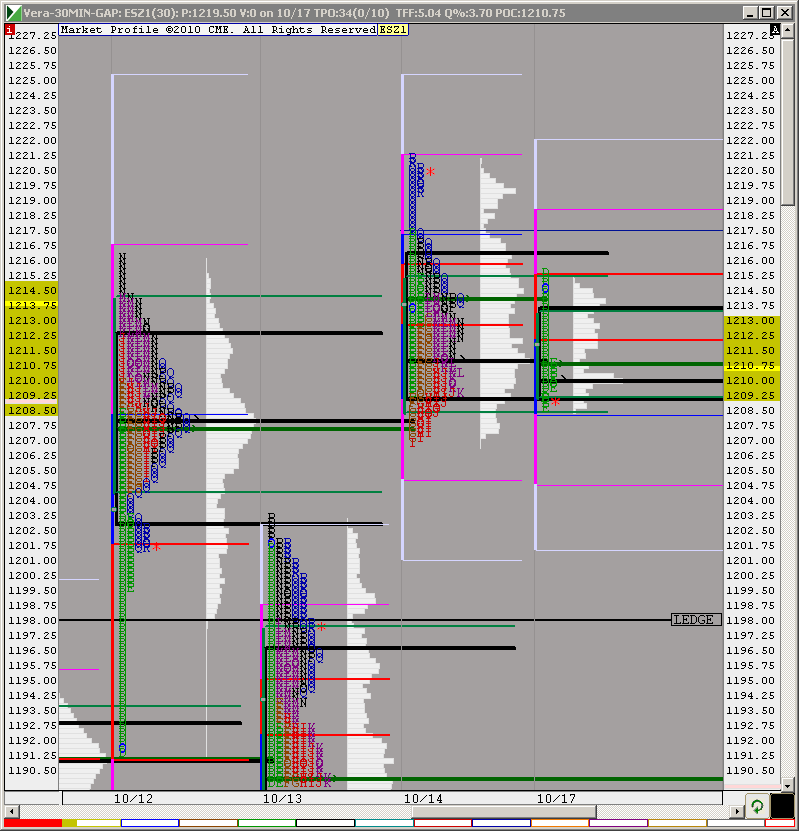

08.50 is my last line of low volume support form Friday...low volume today is still at 11.00.

My 2-cents worth contribution. IF bulls do not step up now, I expect that the low-density area below be filled

Also here is 30-min INDU chart. Two unfilled gaps below (blue lines)

Also here is 30-min INDU chart. Two unfilled gaps below (blue lines)

SO I am looking for the bulls to "make a mistake"

Looks like there going for the gap fill

Is this thing going to bounce at a print of 1206.75 (maybe one tick below)?

thanks for all the dentistry advice.

thanks for all the dentistry advice.

Sorry Della - which gap?

Thurday fri

Bruce are you showing LV at the 05.50 area from last wed?

sorry I mean 03.50

Thanks Della

it really cool that when we come back down or go up you can go to that day on the forum and look back a see what was going on that day

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.