ES Friday 10-28-2011

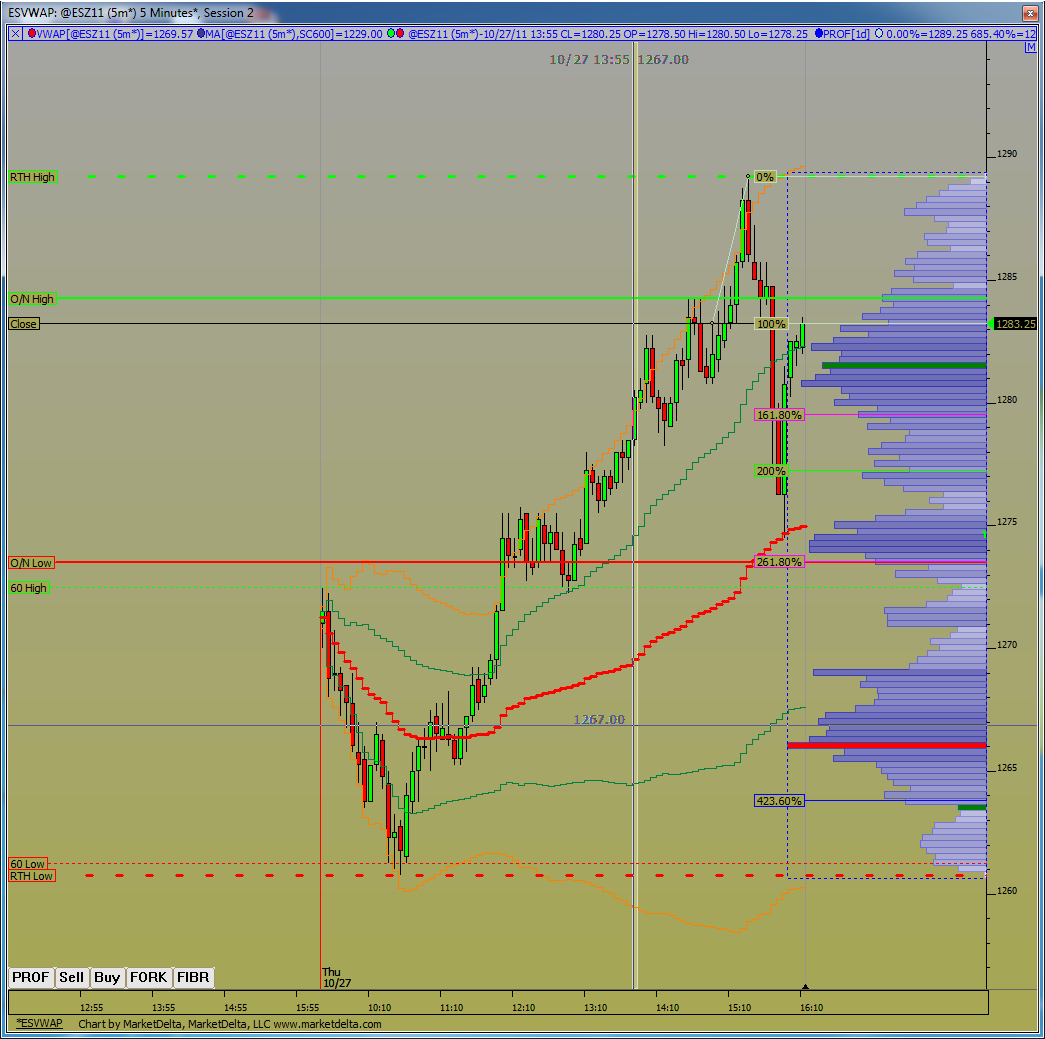

Yesterday's profile with a fib projection pointing down. I'll add that projections down from the O/N high and the secondary high at 1282.25 both have zones in the 1272.50 area which is lining up nicely with that important LVN at that level.

Good Morning lorn

looks good Lorn...my plan is to be a buyer down near 71 - 72 as per your chart and where the current Overnight low is....

for some reason I think they will want to fill in the entire area of 69 - 78 today...especially if we eliminate the high volume at 74...then that entire area becomes low volume....

sells will be best above 82.50 with 85 being the key price to fade

tricky volume picture from yesterday..IMHO

for some reason I think they will want to fill in the entire area of 69 - 78 today...especially if we eliminate the high volume at 74...then that entire area becomes low volume....

sells will be best above 82.50 with 85 being the key price to fade

tricky volume picture from yesterday..IMHO

this may be a stretch for some to see who are new to volume but this area ( the white lines)represents a bigger low volume area...rounding this out will make a much bigger bell curve...look at the low area on the histogram on the right

many are using that afternoon pull back low as a key price for s/r too....probably a good idea but I'm going to wait

many are using that afternoon pull back low as a key price for s/r too....probably a good idea but I'm going to wait

so it seems that so far they are using the 74 as a magnet price so we need to think about sells above and buys under for returns back to the 74...with that in mind the buys down near 71 seem attractive to me ..the closer we can take the trade to 69 then the better off we will be......that would be an EVEN steven off the 74 area to the current days highs...

09:55 AM Consumer Sentiment

chop with 2 1tic of the lows so far

we opened inside YD range and multiple trades through the open...not the day to be trying to hold for big trends...especially after yesterdays trend in the afternoon....fading strategies should do well

Absolutely Bruce. One must learn to know when to adjust holding targets. Its still early in the day, things will develop as the day marches onward.

Originally posted by BruceM

we opened inside YD range and multiple trades through the open...not the day to be trying to hold for big trends...especially after yesterdays trend in the afternoon....fading strategies should do well

the 30 minute chart is attempting to form a double bottom...still 15 minutes to close but that in general is not the best way to form a bottom especially given all the context for todays trading I already mentioned ....gonna run it out

In the "good old days" (before rampant volatility) a consolidation day often followed a huge directional day.

TV: best month on S&P since 1974

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.