ES Wednesday 1-11-12

Seeing that the Compx and the russel haven't taken over their late October highs should be a concern for the longs....Obvious keys will be the 89 high you Monkey mentioned , the 83 high and all this volume from the holiday trade in the 74 area.

I don't like when everyone talks about a certain pattern like this rising wedge in the S&P. It seems too obvious. I always assume that if my 10 year old can see it than everyone can see it. Now does that become a self fullfilling prophecy and because everyone sees it then it fuels buying or is the smart money selling out into the obvious public hands? Sure wish I had the answer

Lets see what the O/N does

I don't like when everyone talks about a certain pattern like this rising wedge in the S&P. It seems too obvious. I always assume that if my 10 year old can see it than everyone can see it. Now does that become a self fullfilling prophecy and because everyone sees it then it fuels buying or is the smart money selling out into the obvious public hands? Sure wish I had the answer

Lets see what the O/N does

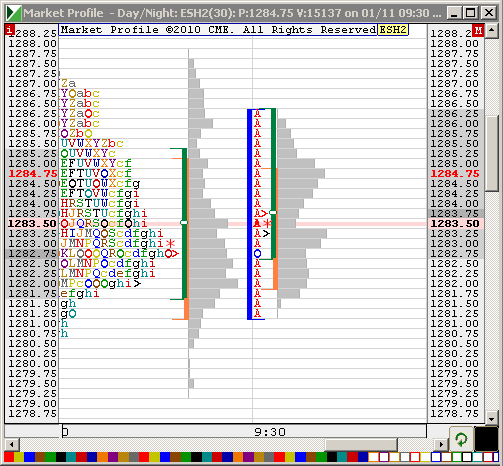

Ranges are tight so unfortunately all key areas are close to each other. heres what I'm using today...

1292 - 1295

1287 - 1289.50

1283 - 1284 *****

1279.50 - 1281

1274 - 1275

1292 - 1295

1287 - 1289.50

1283 - 1284 *****

1279.50 - 1281

1274 - 1275

The gap maybe be getting filled this morning to 86.00 closing price

damn these ranges are tight...no trades for me until I see 85 or higher or 80.50 or lower in the day session.....magnet price is 83.50 but we need to be real careful of 82 as all the volume from On is there....so buying under 80.50 needs to get agressive on exits in front of 82...

lets see what the pitbull says when we open...

lets see what the pitbull says when we open...

on 85.75..short

targeting Lv at 83.75

looks like they are trading off of euro mostly as there are no reports till 10.30

hit at 86..that overnight high vol 82 84 was the key vevel i think

if we can now stay outside the lows of yesterdays RTh range then we have a chance to go get the O/N lows down near the minus 4...in this volatility that could take all day...

trying to hold runner for minus 2.5 number at 80.50 ..problem is that without volume we may just fluctuate around that 83 area...

trying to hold runner for minus 2.5 number at 80.50 ..problem is that without volume we may just fluctuate around that 83 area...

flat at 81 ....just too close....the pitbull window was designed for the big S&P so we have to give some room for emini noise....no runners left

Hi Horse and welcome...I don't think it is the same thing but please keep us posted..there is lots of great work going on with probabilities and I'm sure most of us here would enjoy seeing some statistics on moves off the open.

Perhaps you can repost the ideas here on a daily basis if they will let you..

Perhaps you can repost the ideas here on a daily basis if they will let you..

Originally posted by horse43

Enjoy the great info everyday Bruce!

When you reference OR what timeframe is best to use? 5 minutes is the norm I believe.

Haven't seen much on +/-4 on these boards off the open before. But i think any +/- 4 handle move in the first 30 minutes is a significant event and gives some good clues the rest of the day especially when put into context. will definitely be looking more into a pitbull approach because there is definitely something there and i feel with all the imbalances at open, there is a lot of reversion back to open to find some balance.

I've have seen something about the +/-4 moves from another site. I found a site recently and have been following it that has a section devoted to this and whether they are a fade or a go with, think it's sort of based off the Crabel stuff too.

when doing some research on trading with probability i did a google search of trading probability and came up with it, its 6 links down on google, don't want to advertise this in anyway so if you want to search for it you can!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.